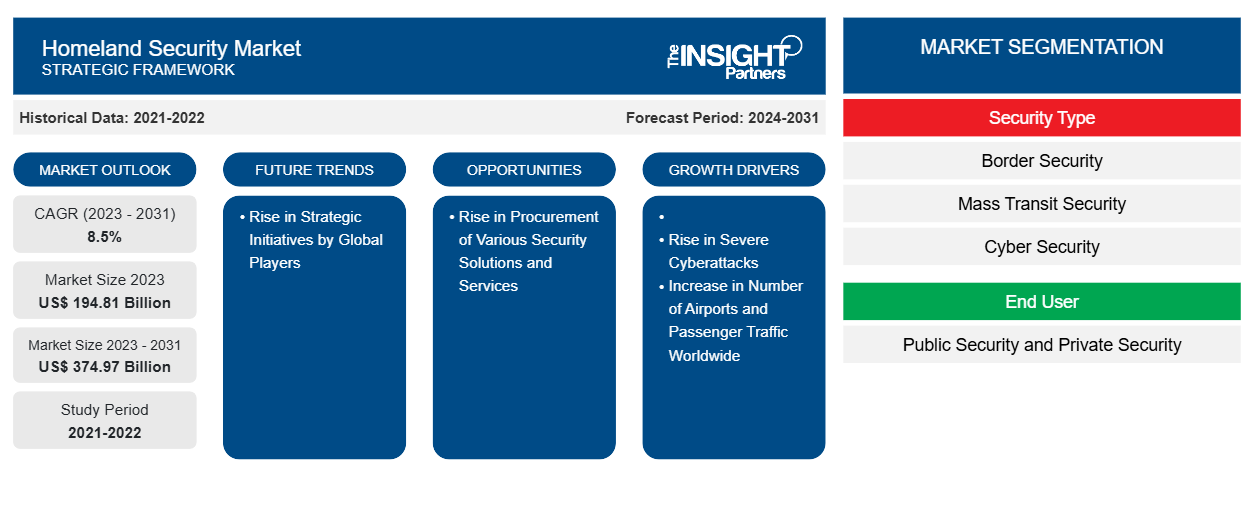

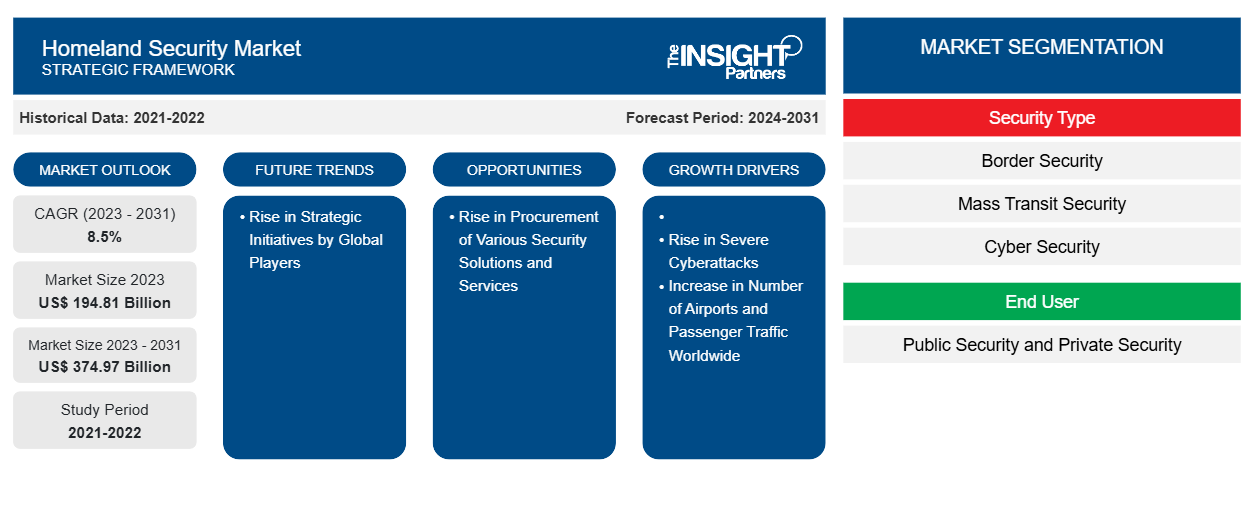

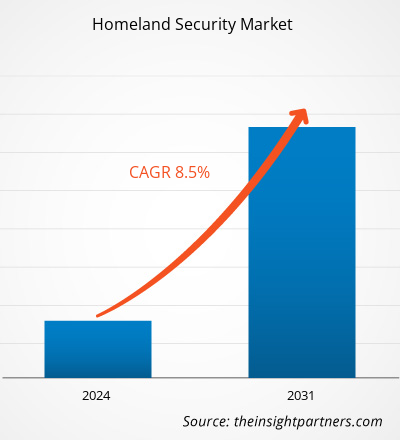

The homeland security market size is projected to reach US$ 374.97 billion by 2031 from US$ 194.81 billion in 2023. The market is expected to register a CAGR of 8.5% during 2023–2031. Rise in procurement of various security solutions and services is likely to remain a key trend in the market.

Homeland Security Market Analysis

The homeland security service providers offer security services to both private and public enterprises. The services are offered for cyber security, aviation security, maritime or border security, and critical infrastructure security, among others. Major service providers include AT&T, Accenture, and Perspecta Engineering Inc. The end-users of the global homeland security market include governing bodies and private organizations carrying out business to offer safety across airports, coastlines, and borders. The rise in homeland security expenditure by developed and developing nations and their increased investments to ensure the safety of their population and critical infrastructure from factors like drug trafficking, terror, and undocumented immigrants is also propelling the market growth.

Homeland Security Market Overview

The major stakeholders in the global homeland security market ecosystem include component manufacturers, homeland security solution providers, homeland security service providers, and end users. A homeland security system is made up of various components which are procured by the system manufacturers from a huge base of component manufacturers. These component manufacturers supply the base parts to the global homeland security market players. The homeland security solution providers are the companies engaged in manufacturing and developing the final system and solution after integrating each component. Major players operating in the market include Elbit Systems Ltd., Thales Group, IBM Corp., Lockheed Martin Corporation, and Northrop Grumman Corporation.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Homeland Security Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Homeland Security Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Homeland Security Market Drivers and Opportunities

Increase in Number of Airports and Passenger Traffic Worldwide

The growing number of airports and air passenger traffic globally is influencing the demand for aviation security solutions. According to International Civil Aviation Organization (ICAO), the number of air passengers traveling between January to April 2022 showcased an increase of 65% compared to the same period in 2021. The total flight departures also increased by 30% across the globe. The analysis by the organization also states that the total seating capacity offered by the airline also increased by 20% in the same time frame. Rising purchasing power of the global population, increasing trend of global tourism, and surging business travel are among the major reasons contributing to the growth of air traffic across the globe. The rise in air traffic is directly influencing the need for more efficient aviation security solutions to ensure safety across all airports. Moreover, stringent government regulations on airport security to ensure proper checks of all individuals entering and leaving the nation are also enhancing the demand for aviation security solutions.

Rise in Procurement of Various Security Solutions and Services

There is a rise in investment by various regional homeland security agencies to procure advanced solutions for ensuring safety across several applications such as border security, mass transit security, cyber security, critical infrastructure security, aviation security, and maritime security. Some of the prominent procurement contracts are highlighted below:

- In July 2022, Swish Data Corporation (Swish) received a contract from the Department of Homeland Security (DHS) Continuous Diagnostics and Mitigations (CDM) program to supply advanced security information and event management (SIEM) to the US Coast Guard department.

- The US Department of Homeland Security (DHS) awarded a contract to North-eastern University worth US$ 36 million to develop surveillance systems for protecting the country's schools, churches, and stadiums in November 2021.

- In May 2021, AT&T received a homeland security contract from the US Department of Homeland Security to upgrade the nation's telecommunication infrastructure and IP-based networking services.

Homeland Security Market Report Segmentation Analysis

Key segments that contributed to the derivation of the homeland security market analysis are security type and end user.

- Based on security type, the homeland security market is divided into border security, mass transit security, cyber security, critical infrastructure security, aviation security, maritime security, and others. The cyber security segment held a larger market share in 2023.

- Based on end user, the homeland security market is segmented into public security and private security. The public security segment held a larger market share in 2023.

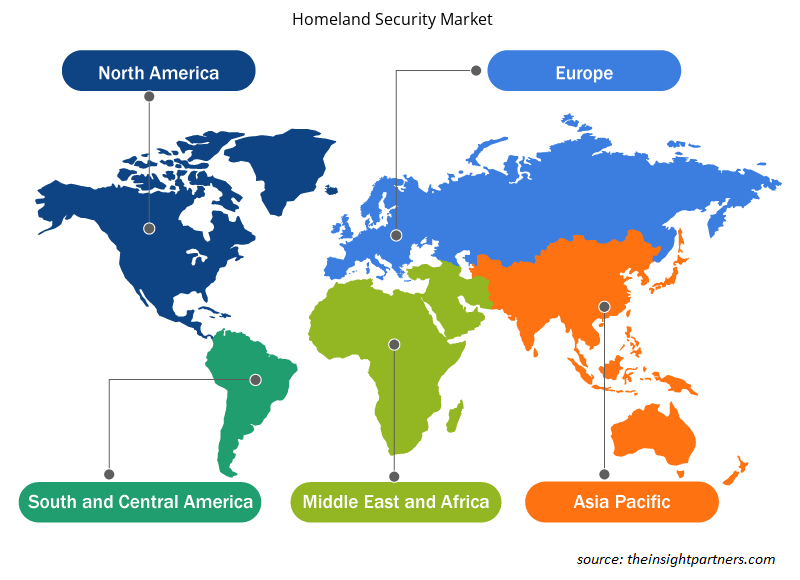

Homeland Security Market Share Analysis by Geography

The geographic scope of the homeland security market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific. Further, Asia Pacific is likely to witness highest CAGR in the coming years. The increasing investment by the region in the development of critical infrastructures such as schools, colleges, and stadiums are influencing the rise in the need for security solutions across the premises. Additionally, the region is also experiencing heavy investment in developing new airports across countries such as China, Australia, India, and South Korea. This is further influencing the demand for aviation security solutions across the region. Moreover, the rising adoption of automated solutions for both land and marine border protection by the APAC countries is further augmenting the demand for advanced security and surveillance solutions. Thus, the factors mentioned above are contributing to the growth of the APAC homeland security market.

Homeland Security Market Regional Insights

The regional trends and factors influencing the Homeland Security Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Homeland Security Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Homeland Security Market

Homeland Security Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 194.81 Billion |

| Market Size by 2031 | US$ 374.97 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Security Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

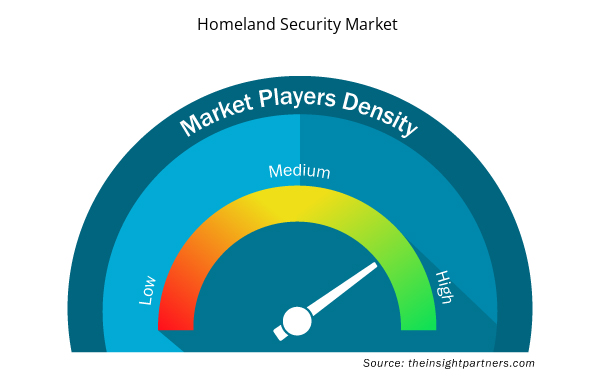

Homeland Security Market Players Density: Understanding Its Impact on Business Dynamics

The Homeland Security Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Homeland Security Market are:

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Thales Group

- Northrop Grumman Corporation

- Textron Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Homeland Security Market top key players overview

Homeland Security Market News and Recent Developments

The homeland security market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the homeland security market are listed below:

Teledyne FLIR Defense announced today at SOFIC 2022 the official launch of SeaFLIR 240 and TacFLIR 240, the latest additions to its line of high-definition, multi-spectral surveillance systems developed for a variety of maritime and land-based operations. (Source: Teledyne FLIR LLC, Press Release, Mar 2022)

- Excella, a pioneer in Agile technology solutions, announced it has been selected as part of the Department of Homeland Security US Immigration and Customs Enforcement contract. Under the contract, Excella will provide Agile software delivery, full-stack development, and cloud support. (Source: Excella, Press Release, Jan 2022)

Homeland Security Market Report Coverage and Deliverables

The “Homeland Security Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Homeland security market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Homeland security market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Homeland security market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the homeland security market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft Wire and Cable Market

- Terahertz Technology Market

- Biopharmaceutical Tubing Market

- Biopharmaceutical Contract Manufacturing Market

- Virtual Pipeline Systems Market

- Glycomics Market

- Industrial Inkjet Printers Market

- Passport Reader Market

- Helicopters Market

- Water Pipeline Leak Detection System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

End User, and Security Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the homeland security market in 2023.

Rise in severe cyberattacks and increase in number of airports and passenger traffic worldwide are some of the factors driving the growth for homeland security market.

Rise in procurement of various security solutions and services is one of the major trends of the market.

Elbit Systems, IBM Corporation, Leidos, Thales Group, Teledyne Flir LLC, Northrop Grumman Corporation, Raytheon Technologies Corporation, Textron Systems, and General Dynamics Information Technology Inc are some of the key players profiled under the report.

The estimated value of the homeland security market by 2031 would be around US$ 374.97 billion.

The homeland security market is likely to register of 8.5% during 2023-2031.

Get Free Sample For

Get Free Sample For