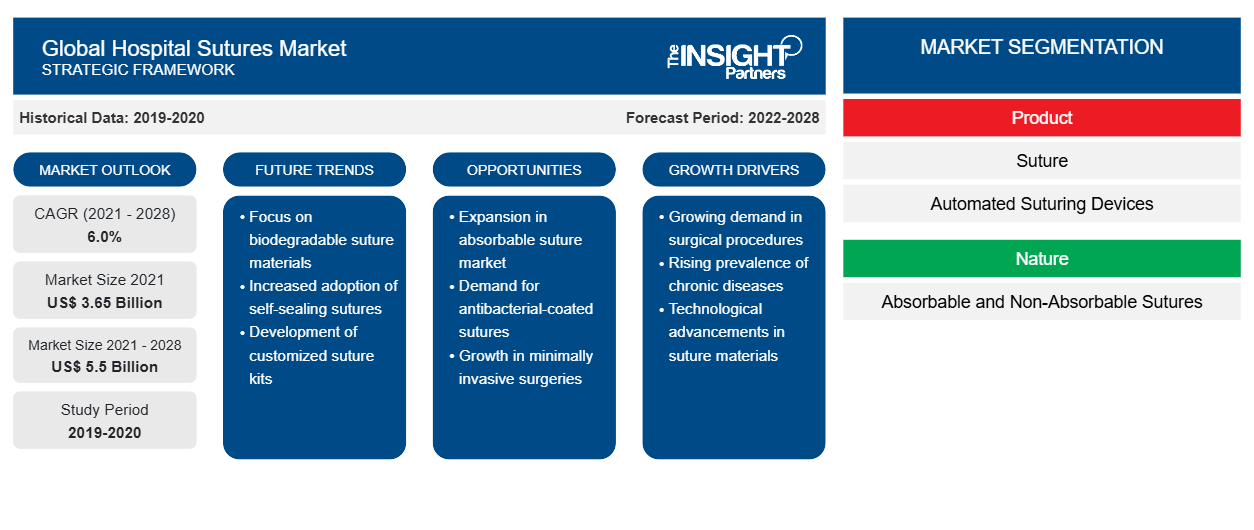

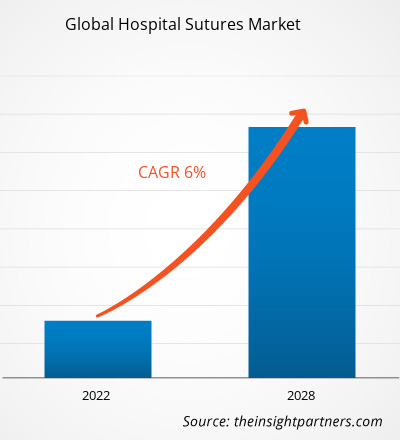

The global hospital sutures market garnered US$ 3,649.02 million in 2021 and is forecasted to hit US$ 5,495.74 million by 2028, expanding at a CAGR of 6.0% during 2021-2028.

The technological advancements in sutures and increasing cases of chronic wounds and surgeries are the key elements catalyzing the market growth. On the contrary, the availability of non-invasive alternatives to stitches impedes the expansion of global hospital sutures market.

Sutures close incisions and wounds on the skin or other tissues after surgical procedures. It is attached to a needle or anchor to stitch or close a wound. Various suture materials are available in the market as per the wound type. Key players in the global hospital sutures market have been enhancing the growth and strengthening their market position with several organic and inorganic business strategies.

Regionally, North America occupied the largest share of the global hospital sutures market and is likely to retain its dominance over the forecast period. Asia Pacific is speculated to spur with the highest CAGR throughout the forecast period.

COVID-19 Impact

Delays and Postponement of the Elective Surgeries Ceased the Global Hospital Sutures Market Growth

The global COVID-19 pandemic had fluctuating consequences observed in healthcare systems worldwide. In North America, the utility of hospital resources increased with the postponement of non-urgent cardiac surgeries. The frequency of routine clinical visits decreased and the rate of elective surgeries performed every week also declined drastically, stifling the expansion of regional hospital sutures market. In Asia-Pacific, the halt in supply chain of medical devices and the massive demand for quick and efficient treatments put the healthcare industry in an unpredictable situation. The severity and urgency of surgeries, availability of the clinical staff, number of backlogged patients, and pending elective procedures were all aspects under review during the pandemic. The lack of beds and operating room capacity caused a delay in non-urgent and semi-elective surgical operations. Since COVID-19 had no visible orthopedic manifestation, it influenced the orthopedic practices in Asia Pacific due to sudden heavy demand on healthcare systems.

Future Trends

Smart Surgical Sutures

Researchers have been developing smart surgical sutures due to challenges observed in the utilization of conventional ones. The National University of Singapore developed a smart suture that can monitor surgical wounds post-surgery to prevent infection, wound separation, and other complications. The design of smart surgical sutures incorporates electronic sensors to monitor wound integrity, gastric leakage, and tissue’s micro motion. They provide healing outcomes equivalent to conventional medical-grade sutures. Being an alert tool, smart suture notifies doctors about the complications that can be prevented from turning fatal. They lower re-operation rates, accelerate the recovery process, and improve patient outcomes. The numerous benefits these tools offer can potentially catalyze the global hospital sutures market in the future.

Drivers

Advancements in Sutures

Sutures serve the postoperative wound closure and promote natural healing. Technologically advanced sutures have transformed the wound care process alleviating major challenges. Winter Innovations Inc. introduced EasyWhip, an advanced suture for quick and easy stitching to heal orthopedic injuries. The development of absorbable and biodegradable sutures offering faster healing led to a substantial evolution in suturing techniques. These sutures eliminate the need for stitch removal, turning out to be utmost helpful for treating pediatric and elderly patients. Automated suturing devices are safer, quicker, and more precise than manual ones. They lower the risk of tissue trauma and scars by optimizing the needle force and size for efficient suturing. The robotic and endoscopic suturing devices ensure better access to hard-to-reach areas in the subject’s body.

Increasing Cases of Chronic Wounds and Surgeries

The American College of Surgeons stated that around 1–2% of the global population suffer from chronic wound stances at least once in a lifetime. According to the estimates of Centers for Disease Control and Prevention (CDC), over 385,000 sharp injuries occur among healthcare workers in the US every year. Moreover, poor working conditions are among the major causes of rising injuries and chronic wounds. As per the International Labor Organization, approximately 2.3 million people face work-related accidents every year. The rising burden of chronic injuries underlines the need for advanced wound care management. Several countries are spending huge on the treatment of injuries and the elimination of associated risks. The US healthcare system spends close to US$ 25 billion on wound care management and relevant complications every year. The immense requirement for treating wounds and injuries is likely to bolster the global hospital sutures market.

Restraints

Non-Invasive Alternatives to Stitches

Technologically advanced and non-invasive alternatives have been introduced that are easy to apply, less painful, and needleless. Zippers or ZipStitches are alternatives to stitches. It comprises two adhesive strips placed on either side of the wound. When the zipper is closed, it pulls the skin’s edges together and is removed without causing any pain to the patient. Zippers are FDA-approved surgical-quality wound care products, often suitable for treating the wounds of obese patients and children. Since 2014, they have been used in many operating and emergency rooms worldwide. In several cases, it has been observed that the demand for zippers is more than sutures due to benefits such as needle wound closure, skin puncturing, ease of handling and control, ability to adjust and customize the stretch according to the length of a wound. In addition to this, skin adhesives, hemostatic sealing agents, stapling devices, ligating clips, wound closure strips, and extracellular matrix are some of the miscellaneous alternatives curtailing the growth of global hospital sutures market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Global Hospital Sutures Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Global Hospital Sutures Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Segmentation

By Product

Integral Requirements Across a Wide Range of Surgeries Spurred the Segmental Growth

The global hospital sutures market, by product, is split into sutures, automated suturing devices, and others. The sutures segment held the largest market share in 2021 and is anticipated to record the highest CAGR for the projection period. Cardiovascular, gynecological, ophthalmic, and general surgeries require sutural incisions to be made to treat the conditions. Sutures are used to treat deep wounds, surgical incisions, and cuts. Suture material is categorized as absorbable and non-absorbable. The monofilament sutures easily travel through tissues. Various benefits offered by sutures in surgical procedures are likely to soar the segment’s growth.

Another segment, automated suturing devices have simplified the surgical techniques allowing even novice surgeons to execute laparoscopic suturing and knot tying at ease. The tissue can be accessed in its normal anatomical position instead of pushing or manipulating the suturing device. Newer laparoscopic techniques such as Endo Stitch and SILS Stitch allow surgeons to widen their surgical repertoire of advanced operations.

By Application

Complex Sutural Techniques Involved in Various Procedures Strengthened the Segment’s Dominance

Based on application, the global hospital sutures market is segmented into general surgery, cardiovascular surgery, orthopedic surgery, and others. The general surgery segment, with the largest revenue share, dominated the market in 2021. Several general surgeries such as breast biopsy, appendectomy, mastectomy, aesthetic procedures, plastic surgeries, skin grafting, and more involve the inherent use of sutures.

The cardiovascular surgery segment is projected to expand with the highest CAGR during 2021–2028. These surgical procedures require sutures made of stainless steel or Prolene. Sutures are used in conjunction with the needle, much fine, firm, and shaped than regular 420 grades steel. Coronary artery bypass grafting, heart valve repair/replacement, arrhythmia treatment, and other CVD procedures require surgical sutures.

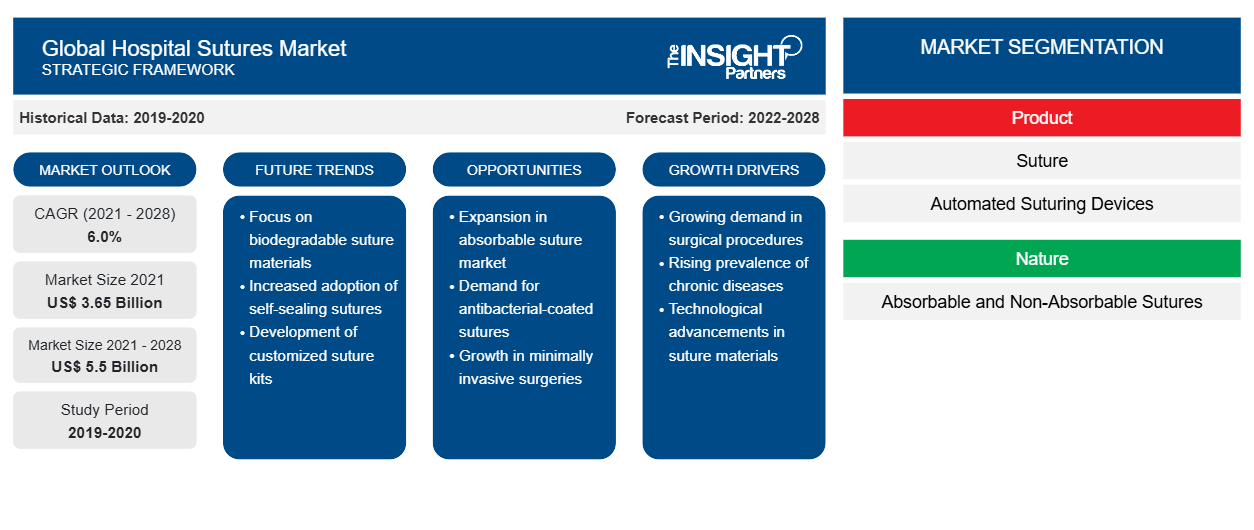

Regional Insights

The global hospital sutures market is segmented into North America, Europe, Asia Pacific (APAC), South & Central America (SCAM), and Middle East & Africa (MEA).

North America occupied the largest market share in 2021 and is speculated to retain its dominance over the forecast period. The growing geriatric population, rising prevalence of lifestyle diseases, favorable healthcare reforms, and the growing number of surgical procedures are the potential parameters aiding the regional hospital sutures market growth. In the US, the market growth is attributed to the rising demand for advanced surgical methods and clinical products such as biocompatible surgical sutures with antimicrobial coatings. Some players are venturing with start-up companies to strengthen their market positions. Besides, cardiovascular diseases and strokes create immense health burdens in the country, leading to more surgeries and orthopedic treatments. The prevalence of CVDs, cancer, and obesity with eventual orthopedic and bariatric surgeries spur the market growth in Canada.

Asia Pacific hospital sutures market is likely to surge with the highest CAGR during the forecast period. In China, the market growth thrives on the rising prevalence of CVDs and the increasing geriatric population. Moreover, the increasing number of plastic surgeries, general surgeries, and orthopedic treatments fuels the regional sutures market. The higher cases of coronary heart disease and the growing number of eyelid, hip replacement, and gastroenterological surgeries demand more sutural procedures in the Japanese medical domain.

Hospital Sutures Global Hospital Sutures Market Regional Insights

Global Hospital Sutures Market Regional Insights

The regional trends and factors influencing the Global Hospital Sutures Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Global Hospital Sutures Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Global Hospital Sutures Market

Global Hospital Sutures Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.65 Billion |

| Market Size by 2028 | US$ 5.5 Billion |

| Global CAGR (2021 - 2028) | 6.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

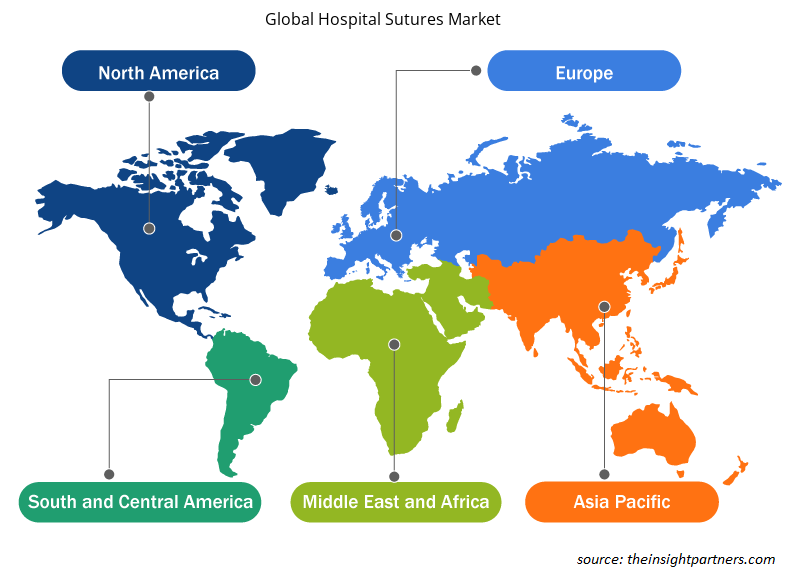

Global Hospital Sutures Market Players Density: Understanding Its Impact on Business Dynamics

The Global Hospital Sutures Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Global Hospital Sutures Market are:

- Assut Medical Sarl

- Péters Surgical

- SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang

- DemeTECH Corporation

- Teleflex Incorporated

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Global Hospital Sutures Market top key players overview

Key Market Players:

- Assut Medical Sarl (Switzerland)

- Péters Surgical (France)

- SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang (Germany)

- DemeTECH Corporation (US)

- Teleflex Incorporated (US)

- Smith & Nephew (UK)

- B. Braun Melsungen AG (Germany)

- Johnson and Johnson Services, Inc. (US)

- Medtronic (Ireland)

- W. L. Gore and Associates, Inc. (US)

Key Developments:

- August 2021:Péters Surgical acquired Germany-based Catgut GmbH for the expansion purpose and became independent of its Asian suppliers.

- October 2020 :Teleflex Medical OEM announced the expansion of its Georgia facility. The project added 16,000 square feet to the facility to house a renovated wire development area, expanded state-of-the-art film-cast tubing center, and support functions.

- June 2021 :Ethicon, part of Johnson & Johnson Medical Devices Company, announced that the National Institute for Health and Care Excellence (NICE) issued medical technologies guidance (MTG) recommending the use of Plus Sutures in surgeries within the National Health Services.

Report Coverage

The global hospital sutures market research report provides detailed insights into the market in terms of size, share, trends, and forecasts. It delivers crisp and precise know-how of drivers, restraints, opportunities, segments, and industrial landscape. The COVID-19 impact analysis is discussed with the aftermath observed in global and regional markets. A list of key market players with their respective developments in recent years has been reserved as a special mention.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Digital Language Learning Market

- Advanced Planning and Scheduling Software Market

- Hummus Market

- Terahertz Technology Market

- Digital Pathology Market

- Hand Sanitizer Market

- Social Employee Recognition System Market

- Transdermal Drug Delivery System Market

- Single Pair Ethernet Market

- Occupational Health Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Nature, Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The hospital sutures market is analyzed in the basis of product, type, nature, and application. Based on product, is segmented into sutures, automated suturing devices and others. The suture segment held the largest share of the hospital sutures market size, and it is anticipated to register the highest CAGR. Based type, the market is segmented as monofilament and braided. The braided segment held the largest share of the market, and it is estimated to register the highest CAGR. based on nature, the market is divided into absorbable sutures and non-absorbable sutures. The absorbable sutures segment held the largest share of the market, and it is estimated to register the highest CAGR. And based on application, the is fragmented into general surgery, cardiovascular surgery, orthopedic surgery, and others. General surgery segment accounts for the largest market share and cardiovascular surgery segment is estimated to register the highest CAGR over the forecast period.

Hospital suture is a thread used to close incisions and wounds on skin or other tissues after surgical procedure or injury. A length of suture is attached to a needle or anchor to stitch or close a wound. There are a variety of sutures materials available in the market that are used appropriately depending upon the wound type.

The factors that are driving the growth of market are advancements in suture and increasing cases of chronic wounds and surgeries. On the other hand, the non-invasive alternative to stiches is likely to hinder the growth of the market during the forecast period.

The hospital sutures market majorly consists of the players such as Assut Medical Sarl; Péters Surgical; SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang; DemeTECH Corporation; Teleflex Incorporated; Smith & Nephew; B. Braun Melsungen AG; Johnson and Johnson Services, Inc.; Medtronic, and W. L. Gore and Associates, Inc. among others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Hospital Suture Market

- Assut Medical Sarl

- Péters Surgical

- SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang

- DemeTECH Corporation

- Teleflex Incorporated

- Smith & Nephew

- B. Braun Melsungen AG

- Johnson and Johnson Services, Inc.

- Medtronic

- W. L. Gore and Associates, Inc

Get Free Sample For

Get Free Sample For