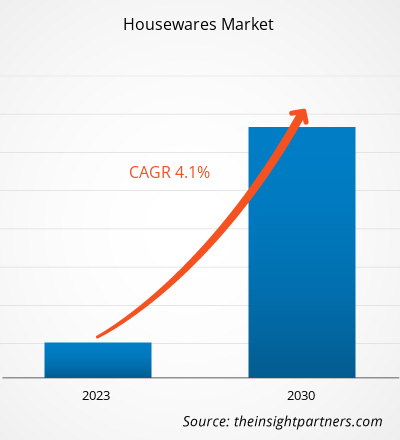

[Research Report] The housewares market size was valued at US$ 321.40 billion in 2022 and is expected to reach US$ 442.51 billion by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

Housewares are products and items used within a household for cooking, baking, and home organization, among other purposes. The housewares market has been growing steadily due to factors such as changing lifestyles and more time spent at home, which have triggered the demand for functional and aesthetically pleasing housewares. During the COVID-19 pandemic, people spent more time at home and invested in improving their living spaces. Additionally, a rise of e-commerce and online shopping platforms has made it easier for consumers to access and buy a wide range of houseware products from their homes. These factors, coupled with innovative designs and sustainable options made available by houseware companies favor the expansion of the housewares market.

Growth Drivers and Challenges:

Dynamic changes in lifestyle and the rising dual-income families led to an upsurge in disposable incomes and improved living standards of households. With increasing disposable incomes, consumers spend significant amounts on housewares and other appliances supporting convenient living. They are often willing to purchase new products owing to their unique styles, which appeal to their individuality, resulting in a higher buying frequency. Moreover, a burgeoning number of single-person households triggers the need for home modifications, thereby driving the demand for housewares such as kitchen appliances, cookware, bakeware, tableware, and bathroom essentials.

Further, a rise in urbanization has been bolstering the demand for residential units and, ultimately, homewares products. As per the US Census Bureau and the US Department of Housing and Urban Development, the US completed construction of ~1,3 million housing units in 2021, whereas construction of ~1,7 million housing units was in progress. Similarly, rising urbanization in European countries has created a huge demand for residential housing. According to the European Commission, residential building permits increased by 42.3% from 2015 to 2021 in the European Union. In 2021, France, Germany, and Poland accounted for the most commencements of residential construction in Europe. Thus, the increasing construction of housing units across various countries further boosts the demand for housewares. Thus, the increasing purchase of housewares along with the rising number of households propels the housewares market growth.

However, the housewares market is highly fragmented and disorganized due to many untapped small private enterprises and street vendors operating in developing countries. According to an article published in Business Standards, as of 2020, 80% of the kitchenware market was unorganized in India. Local small businesses use low-quality raw materials to manufacture housewares such as cookware, bakeware, bathroom accessories, and tableware. The usage of low-quality raw materials results in poor-quality end products that are prone to damage. Also, manufacturers offer these products at low costs; therefore, the majority of consumers buy these products due to affordability and easy availability. This factor results in the shrinkage of the customer base of major houseware manufacturers.

Further, more often, local manufacturers in the unorganized housewares market do not comply with the regulatory standards, which can raise quality issues and hamper the perception of consumers toward houseware products. Further, the availability of counterfeit products can hamper the brand image of key players. Thus, the lack of uniformity in operations and regulations hampers the growth of the housewares market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Housewares Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Housewares Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global housewares market is segmented on the basis of product type, distribution channel, and geography. Based on product type, the market is categorized into cookware and bakeware, tableware, kitchen appliances, bathroom essentials, and others. By distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. By geography, the global housewares market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis:

Based on product type, the housewares market is categorized into cookware and bakeware, tableware, kitchen appliances, bathroom essentials, and others. The tableware segment is expected to register the highest CAGR during 2022–2030. The tableware segment includes products such as crockery, cutlery, glassware, and serveware. A surge in demand for tableware in the housewares market can be attributed to transformed dining habits during the COVID-19 pandemic. With more people dining at home, people have started focusing on aesthetic and functional tableware, as it enhances home dining experiences. From everyday meals to special gatherings, consumers are looking for tableware sets that elevate their dining experience. Furthermore, the growing appreciation for unique and artisanal designs plays a significant role in driving the demand for tableware. Consumers are increasingly drawn to handcrafted and artistically inspired tableware pieces that bring a touch of individuality and personality to their dining settings. Thus, a shift toward more personalized and visually striking tableware choices has contributed to the progress of the housewares market for the tableware segment. Vivo - Villeroy & Boch Group, Corelle, Pyrex, Luminarc, and Schott Zwiesel are a few of the prominent players operating in the market for tableware.

Regional Analysis:

The housewares market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global housewares market in 2022 as the market in this region was valued at US$ 120.63 billion in that year. Europe is a second major contributor, holding more than 23% share of the global market. Asia Pacific is expected to register a considerable CAGR of over 5% during 2022–2030. The growing urbanization and disposable income of the middle-class population is a prime factor propelling the demand for modern and convenient housewares, including advanced kitchen appliances and stylish tableware.

Housewares Market Regional Insights

Housewares Market Regional Insights

The regional trends and factors influencing the Housewares Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Housewares Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Housewares Market

Housewares Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 321.4 Billion |

| Market Size by 2030 | US$ 442.51 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Housewares Market Players Density: Understanding Its Impact on Business Dynamics

The Housewares Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Housewares Market are:

- Bradshaw Home Inc

- The Denby Pottery Co Ltd

- HF Coors Co Inc

- Inter Ikea Holding Bv

- Hutzler Manufacturing Co Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Housewares Market top key players overview

COVID-19 Pandemic Impact:

The COVID-19 pandemic initially hindered the global housewares market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of operations in various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the housewares supply. Moreover, various stores were closed, which limited the sales of housewares. Nevertheless, businesses started gaining ground as previously imposed limitations were revoked across various countries in 2021. Moreover, the implementation of COVID-19 vaccination drives by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the housewares market, reported growth after the ease of lockdowns and movement restrictions.

Competitive Landscape and Key Companies:

Bradshaw Home Inc, Denby Pottery, HF Coors Co Inc, Inter Ikea Holding Bv, Hutzler Manufacturing Co Inc, TTK Prestige Ltd, Newell Brands Inc, BSH Hausgerate GmbH, Kohler Co, and Haier US Appliance Solutions Inc are among the prominent players operating in the global housewares market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Airline Ancillary Services Market

- Genetic Testing Services Market

- Real-Time Location Systems Market

- Vision Guided Robotics Software Market

- Machine Condition Monitoring Market

- Wind Turbine Composites Market

- Dry Eye Products Market

- Fishing Equipment Market

- Vertical Farming Crops Market

- Online Exam Proctoring Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on distribution channel, the housewares market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Buying convenience and accessibility are the significant characteristics of supermarkets and hypermarkets. These stores are typically located in areas that are easily accessible by the masses, making it convenient for customers to check and purchase housewares alongside completing the planned shopping. Many supermarkets and hypermarkets have introduced their private label houseware brands, offering consumers superior-quality products at competitive prices. Supermarkets and hypermarkets have extended operating hours, which allows customers to shop at convenient hours. Also, these larger retail establishments often have the advantage of bulk purchasing power, which allows them to offer products at competitive prices. Moreover, supermarkets and hypermarkets tend to stock a variety of houseware in different product types, brands, and varieties, providing customers with a more elaborate range of selections. Walmart, Costco Wholesale Corporation, Tesco, Target, and Bed Bath & Beyond are some of the supermarkets and hypermarket stores offering houseware products.

The major players operating in the global housewares market are Bradshaw Home Inc, Denby Pottery, HF Coors Co Inc, Inter Ikea Holding Bv, Hutzler Manufacturing Co Inc, TTK Prestige Ltd, Newell Brands Inc, BSH Hausgerate GmbH, Kohler Co, and Haier US Appliance Solutions Inc among others.

Dynamic changes in lifestyle and the rising dual income families led to an upsurge in disposable incomes and improved living standards of households. With increasing disposable incomes, consumers spend significant amounts on housewares and other appliances supporting convenient living. They are often willing to purchase new products owing to their unique styles, which appeal to their individuality, resulting in a higher buying frequency. Moreover, a burgeoning number of single-person households triggers the need for home modifications, thereby driving the demand for housewares such as kitchen appliances, cookware, bakeware, tableware, and bathroom essentials. Further, a rise in urbanization has been bolstering the demand for residential units and, ultimately, homewares products. As per the US Census Bureau and the US Department of Housing and Urban Development, the US completed construction of ~1,337,800 housing units in 2021, whereas construction of 1,702,000 housing units was in progress. Similarly, rising urbanization in European countries has created a huge demand for residential housing. For instance, according to the European Commission, between 2015 to 2021, residential building permits increased by 42.3%. In 2021, France, Germany, and Poland had the most residential construction starts in Europe. Thus, the increasing construction of housing units across various countries further boosts the demand for housewares.

Smart appliances can be operated using smartphones or tablets connected via Bluetooth, near–field communication (NFC), or Wi-Fi. These technologies allow users to control their smart appliances via an app. Manufacturers are continuously modifying and developing smart home appliances to support easy lifestyles, which especially appeals to tech-savvy consumers. Well-known brands have been developing devices with automation and hi-tech features for smart homes. Moreover, voice assistants and artificial intelligence (AI) are bringing significant evolution into smart housewares.

Energy-saving appliances, notifications enabled on connected devices, and Wi-Fi capabilities are the key functional upgrades in smart kitchen appliances. For example, smart microwaves can seamlessly download cooking instructions, read barcodes on food products, and offer AI voice assistants to enable a completely hands-free experience. Whirlpool, in January 2022, announced that some of its smart, Wi-Fi-connected microwave would be upgraded to incorporate an air fry mode via a software update to replicate the crispy reheating specifications. Thus, the incorporation of innovative technologies into housewares is likely to bring new trends in the housewares market in the coming years.

Based on product type, the housewares market is categorized into cookware and bakeware, tableware, kitchen appliances, bathroom essentials, and others. The tableware segment is expected to register the highest CAGR during 2022–2030. The tableware segment includes products such as crockery, cutlery, glassware, and serveware. A surge in demand for tableware in the housewares market can be attributed to transformed dining habits during the COVID-19 pandemic. With more people dining at home, people have started focusing on aesthetic and functional tableware, as it enhances home dining experiences. From everyday meals to special gatherings, consumers are looking for tableware sets that elevate their dining experience. Furthermore, the growing appreciation for unique and artisanal designs plays a significant role in driving the demand for tableware. Consumers are increasingly drawn to handcrafted and artistically inspired tableware pieces that bring a touch of individuality and personality to their dining settings. Thus, a shift toward more personalized and visually striking tableware choices has contributed to the progress of the housewares market for the tableware segment. Vivo - Villeroy & Boch Group, Corelle, Pyrex, Luminarc, and Schott Zwiesel are a few of the prominent players operating in the market for tableware.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Houseware Market

- Bradshaw Home Inc

- The Denby Pottery Co Ltd

- HF Coors Co Inc

- Inter Ikea Holding Bv

- Hutzler Manufacturing Co Inc

- TTK Prestige Ltd, Newell Brands Inc

- BSH Hausgerate Gmbh

- Kohler Co

- Haier US Appliance Solutions Inc.

Get Free Sample For

Get Free Sample For