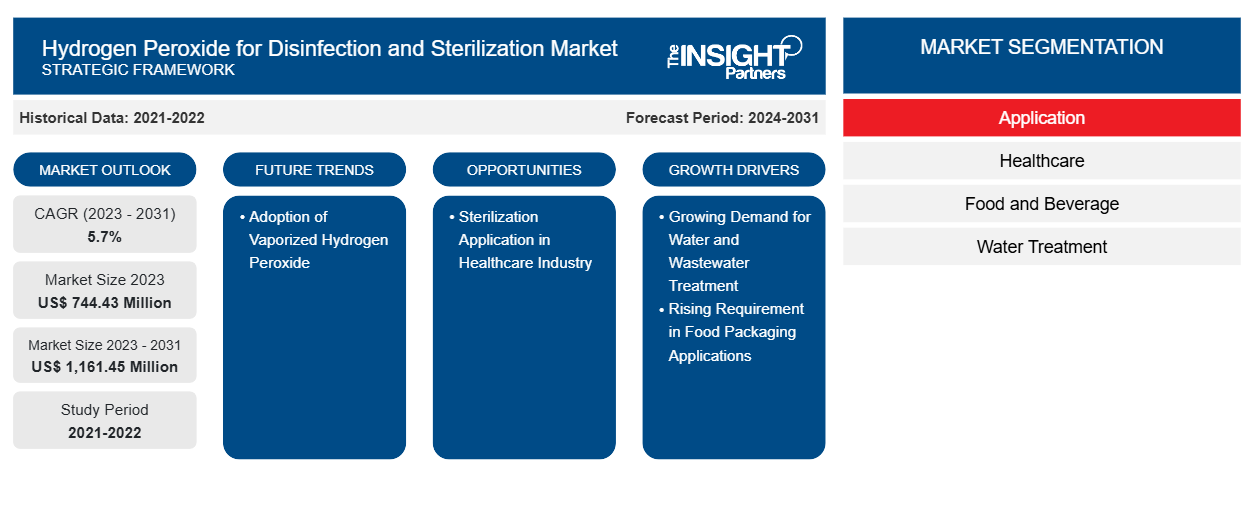

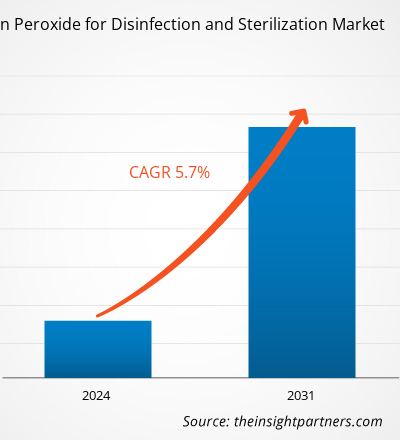

The hydrogen peroxide for disinfection and sterilization market size is projected to reach US$ 1,161.45 million by 2031 from US$ 744.43 million in 2023. The market is expected to register a CAGR of 5.7% during 2023–2031. The adoption of vaporized hydrogen peroxide is likely to bring new trends in the market during the forecast period.

Hydrogen Peroxide for Disinfection and Sterilization Market Analysis

Hydrogen peroxide is used in several industries, such as water treatment, food & beverages, healthcare, livestock, and horticulture. The market is widespread, with the manufacturers and service providers expanding their operations across different regions to tap into emerging markets and diversify their revenue streams. Hydrogen peroxide is used in drinking water treatment and industrial effluents. An increase in environmental regulations and a transition toward sustainable environmental practices are driving the demand for hydrogen peroxide. It is used for wound care, disinfection, and sterilization in the healthcare industry. The growing demand for water treatment and the rising utilization of hydrogen peroxide in the healthcare industry is expected to favor hydrogen peroxide for disinfection and sterilization market growth.

Hydrogen Peroxide for Disinfection and Sterilization Market Overview

According to the Centers for Disease Control and Prevention, commercially available 3% hydrogen peroxide is a stable and effective disinfectant when used on inanimate surfaces. It is used at concentrations of 3–6% for spot disinfecting ventilators, endoscopes, and fabrics in patients' rooms. The substance is also used as a topical disinfectant and antimycotic to sterilize contact lenses. The COVID-19 pandemic significantly influenced the demand for hydrogen peroxide due to its effectiveness as a disinfectant. In healthcare, it is indispensable for infection control in medical facilities and sterilization of surgical tools and medical devices. Industrial applications of hydrogen peroxide include cleaning and water treatment. The stringent government regulations for sterilization in pharmaceutical manufacturing fuel the demand for hydrogen peroxide. Thus, growing demand from various end-use industries is driving the hydrogen peroxide for disinfection and sterilization market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hydrogen Peroxide for Disinfection and Sterilization Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hydrogen Peroxide for Disinfection and Sterilization Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hydrogen Peroxide for Disinfection and Sterilization Market Drivers and Opportunities

Rising Requirement in Food Packaging Applications

According to the FoodDrinkEurope report published in 2022, the European Union is the world's largest exporter of food and beverages, with exports outside the EU accounting for US$ 167.49 billion and a trade surplus of US$ 73 billion in 2022. Hydrogen peroxide is used as a disinfectant for cardboard, polyethylene, and polyethylene terephthalate packaging in direct contact with food and beverages. It is an environment-friendly disinfection product suited for application in the food industry. Thus, the rising demand for hydrogen peroxide in food packaging applications fuels the market growth.

Sterilization Application in Healthcare Industry

The operational and examination surfaces in healthcare facilities can be contaminated with microbes, which implies that failure to maintain a clean environment can lead to a risk of infection among patients and staff. Contaminated endoscopes that have been used widely are linked to a significant cause of infection in tertiary healthcare systems. Hydrogen peroxide is utilized as a disinfectant and sterilant by direct application in the form of aqueous solution at 3 to 9% concentration range. In March 2024, the Environmental Protection Agency finalized restrictions on a carcinogenic gas called ethylene oxide, which was used to sterilize most medical devices. Strict limits on the utilization of cancer-inducing chemicals in sterilizing medical and healthcare facilities boost the hydrogen peroxide market.

Hydrogen Peroxide for Disinfection and Sterilization Market Report Segmentation Analysis

The key segment that contributed to the derivation of the hydrogen peroxide for disinfection and sterilization market analysis is the application segment.

- Based on application, the hydrogen peroxide for disinfection and sterilization market is segmented into healthcare, food and beverage, water treatment, industrial cleaning, personal care, horticulture, livestock, and others. The healthcare segment dominated the market in 2023.

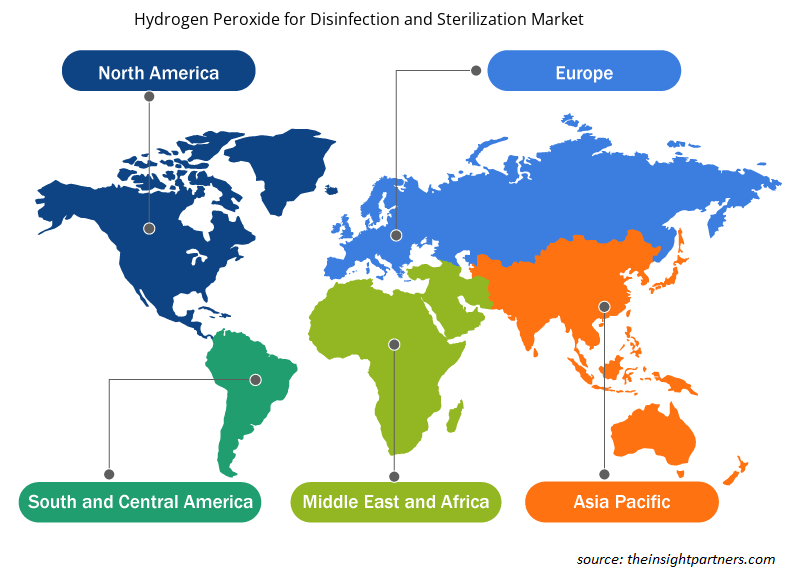

Hydrogen Peroxide for Disinfection and Sterilization Market Share Analysis by Geography

The geographic scope of the hydrogen peroxide for disinfection and sterilization market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific dominated the hydrogen peroxide for disinfection and sterilization market. Countries such as China, India, and Japan are leading the market in Asia Pacific due to their large population, expanding healthcare infrastructure, and rising awareness regarding the importance of hygiene and infection control. In addition, government initiatives promoting cleanliness and disinfection practices have fueled the adoption of hydrogen peroxide. The food & beverages industry in the region also contributes significantly to the demand, as hydrogen peroxide is used to ensure microbial safety in packaging and processing. Thus, the Asia Pacific hydrogen peroxide for disinfection and sterilization market is poised for continued expansion, driven by ongoing public health initiatives, industrial growth, and technological innovations in producing and applying hydrogen peroxide.

Hydrogen Peroxide for Disinfection and Sterilization Market Regional Insights

The regional trends and factors influencing the Hydrogen Peroxide for Disinfection and Sterilization Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hydrogen Peroxide for Disinfection and Sterilization Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hydrogen Peroxide for Disinfection and Sterilization Market

Hydrogen Peroxide for Disinfection and Sterilization Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 744.43 Million |

| Market Size by 2031 | US$ 1,161.45 Million |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

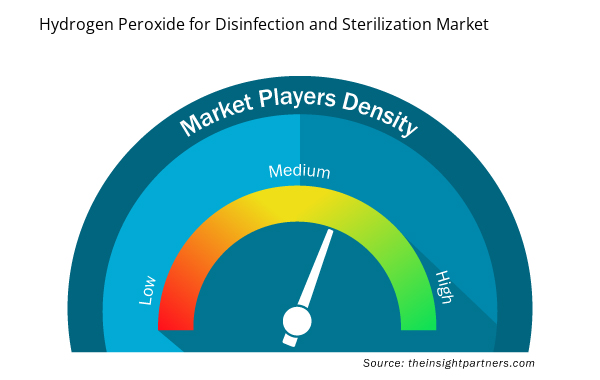

Hydrogen Peroxide for Disinfection and Sterilization Market Players Density: Understanding Its Impact on Business Dynamics

The Hydrogen Peroxide for Disinfection and Sterilization Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hydrogen Peroxide for Disinfection and Sterilization Market are:

- Evonik Industries AG

- Solvay SA

- Arkema SA

- Mitsubishi Gas Chemical Co Inc

- Kemira Oyj

- Nouryon Chemicals Holding BV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hydrogen Peroxide for Disinfection and Sterilization Market top key players overview

Hydrogen Peroxide for Disinfection and Sterilization Market News and Recent Developments

The hydrogen peroxide for disinfection and sterilization market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the hydrogen peroxide for disinfection and sterilization market are listed below:

- Mitsubishi Gas Chemical Co Inc announced its plans to expand the Texas Plant of MGC Pure Chemicals America, Inc, a consolidated subsidiary that manufactures and markets super-pure hydrogen peroxide and super-pure ammonium hydroxide for use during the manufacturing process of semiconductors. (Source: Mitsubishi Gas Chemical Co Inc, Press Release, April 2024)

- Arkema SA announced a two-and-a-half-fold increase in its organic peroxide production capacities at its Changshu site in China. (Source: Arkema SA, Press Release, September 2023)

Hydrogen Peroxide for Disinfection and Sterilization Market Report Coverage and Deliverables

The "Hydrogen Peroxide for Disinfection and Sterilization Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Hydrogen peroxide for disinfection and sterilization market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Hydrogen peroxide for disinfection and sterilization market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces analysis and SWOT analysis

- Hydrogen peroxide for disinfection and sterilization market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the hydrogen peroxide for disinfection and sterilization market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

End Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 5.7% during 2023–2031.

The market value is estimated to be US$ 1,161.45 million by 2031.

Evonik Industries AG, Solvay SA, Arkema SA, Mitsubishi Gas Chemical Co Inc, and Kemira Oyj are among the leading players operating in the hydrogen peroxide for disinfection and sterilization market.

The adoption of vaporized hydrogen peroxide is likely to set trends in the coming years.

Growing demand for water and wastewater treatment and rising requirements for food packaging applications are among the factors accelerating the hydrogen peroxide for disinfection and sterilization market growth.

Asia Pacific dominated the hydrogen peroxide for disinfection and sterilization market in 2023.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Hydrogen Peroxide for Disinfection and Sterilization Market

- Evonik Industries AG

- Solvay SA

- Arkema SA

- Mitsubishi Gas Chemical Co Inc

- Kemira Oyj

- Nouryon Chemicals Holding BV

- Stepan Co

- Aditya Birla Chemicals India Ltd

- Merck KGaA

- Ecolab Inc

- Taekwang Industrial Co Ltd

Get Free Sample For

Get Free Sample For