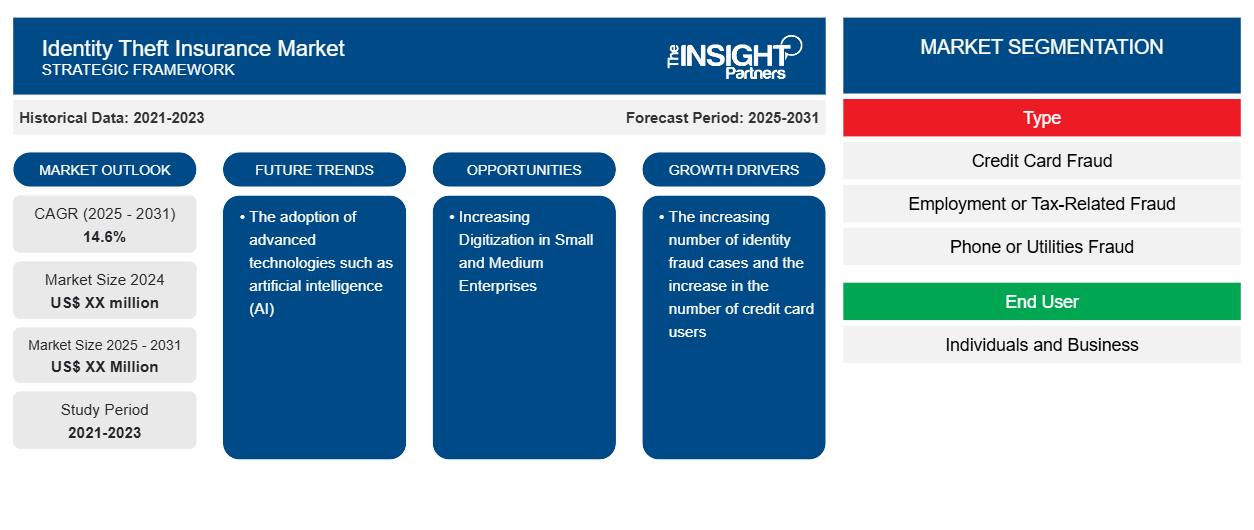

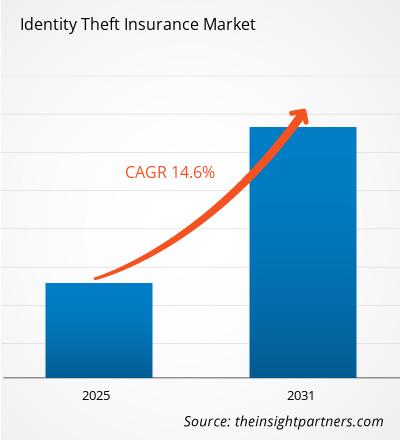

The identity theft insurance market size is expected to register a CAGR of 14.6% during 2023–2031. The adoption of advanced technologies such as artificial intelligence (AI) is likely to remain a key trend in the market.

Identity Theft Insurance Market Analysis

The identity theft insurance market includes growth prospects owing to the current market trends and their foreseeable impact during the forecast period. The identity theft insurance market is growing due to the increasing number of identity fraud cases and the increase in the number of credit card users. Increasing digitization in small and medium enterprises provides lucrative opportunities for identity theft insurance market growth.

Identity Theft Insurance Market Overview

Identity theft insurance helps pay for costs associated with restoring credit after identity theft. Identity theft insurance assists customers in covering identity theft-related expenses, such as lost fees and lost wages. Identity theft insurance covers expenses such as credit application fees, notary and postage fees, legal fees, other financial institutions fees, lost wages, and child care services. At the same time, customers take necessary actions to restore their identity. Identity theft insurance only pays for subsequent costs, such as application fees, missed income, and litigation fees. It will not compensate for any immediate monetary damages brought on by identity theft, such as unauthorized credit card charges.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Identity Theft Insurance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Identity Theft Insurance Market Drivers and Opportunities

Increase in Identity Frauds to Favor Market

The digitalization has gained traction in the pandemic period across all industry verticals. People have shifted towards e-commerce over the brick-and-mortar model. The majority of the transactions and exchange of critical information are taking place via digital platforms which has opened gates for the fraudsters to carry out identity fraud. According to Regula, ~95% of enterprises and approximately 90 percent of small businesses experienced identity fraud in 2022. On average, a company experienced ~30 cases in 2022. Such frauds result in business disruption, legal expenditures, and loss of existing and potential clients. The table below provides the total number of identity theft reports in 2022.

Theft Type |

Number of Reports (2022) |

|

Credit Card Fraud |

441,822 |

|

Other Identity Theft |

326,590 |

|

Bank Fraud |

156,099 |

|

Loan or Lease Fraud |

153,547 |

|

Employment or Tax-Related Fraud |

103,402 |

|

Phone or Utility Fraud |

77,284 |

|

Government Documents or Benefits Fraud |

57,877 |

Source: Federal Trade Commission Consumer Sentinel Network Data Book

Due to such rising cases of identity fraud, individuals and organizations are increasingly adopting identity theft insurance.

Increasing Digitization in Small and Medium Enterprises

SMEs are major contributors to economic growth as they account for the majority of businesses (~90%) worldwide. However, due to financial constraints, the growth of SMEs slows down. Thus, the government sector and organizations are constantly supporting SMEs to expand their business, which further contributes to the economic growth of any country. In Europe, initiatives such as European Digital Innovation Hubs or the Enterprise Europe Network offer help for SMEs to adopt digital tools securely. It provides solutions such as raising awareness, assessing digital maturity, access to finance, offering mentoring, and facilitating experimentation with digital tools. Increasing digitization also increases the risk of cyber attacks. The increasing need for digitization in small and medium enterprises to improve operational workflow and to adapt to the fast-changing marketplace is anticipated to offer massive growth opportunities for market players.

Identity Theft Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the identity theft insurance market analysis are type, and end user.

- Based on type, the identity theft insurance market is divided into credit card fraud, employment or tax-related fraud, phone or utility fraud, bank fraud, and others.

- By end user, the market is segmented into individuals and businesses.

Identity Theft Insurance Market Share Analysis by Geography

The geographic scope of the identity theft insurance market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The increasing number of identity theft and cybercrime in the US is driving the adoption of identity theft insurance in North America. Data breaches are becoming more common and expensive, and businesses and consumers are adopting identity verification solutions to protect themselves. According to the National Council on Identity Theft Protection, the number of identity theft scenarios in the US is nearly three times higher than in other countries. According to the same source, approximately 33% of Americans have faced some form of identity theft; furthermore, Georgia reported the highest number of cases of identity theft. Further, according to the Federal Bureau of Investigation’s (FBI) 2021 Internet Crime Report, the US recorded 51,629 victims of identity theft in 2021, and over 50,000 cases of identity theft are reported each year in the country. In addition, according to Consumer Sentinel Network, approximately 20% of US citizens were a victim of identity fraud in 2021.

Identity Theft Insurance Market Regional Insights

The regional trends and factors influencing the Identity Theft Insurance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Identity Theft Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Identity Theft Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 14.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Identity Theft Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Identity Theft Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Identity Theft Insurance Market top key players overview

Identity Theft Insurance Market News and Recent Developments

The identity theft insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the identity theft insurance market are listed below:

- Malwarebytes, a global leader in real-time cyber protection, launched an essential new consumer solution, Identity Theft Protection. The new service helps individuals secure their digital identities and defend against identity and online threats. Malwarebytes identity theft protection includes real-time identity monitoring and alerts, robust credit protection and reporting and live agent-supported identity recovery and resolution services backed by up to a US$2 million identity theft insurance policy. (Source: Malwarebytes, Press Release, October 2023)

- Vero announced a partnership with automotive privacy-tech pioneer Privacy4Cars to offer Identi-FI, the first and only full-circle solution that protects against personal data abuses by providing peace-of-mind vehicle data deletion and ID theft recovery. (Source: Vero, Press Release, March 2024)

Identity Theft Insurance Market Report Coverage and Deliverables

The “Identity Theft Insurance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Identity theft insurance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Identity theft insurance market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Identity theft insurance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the identity theft insurance market

- Detailed company profiles

Frequently Asked Questions

What are the deliverable formats of the identity theft insurance market report?

What are the options available for the customization of this report?

Which are the leading players operating in the identity theft insurance market?

What are the future trends of the identity theft insurance market?

What is the expected CAGR of the identity theft insurance market?

What are the driving factors impacting the global identity theft insurance market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For