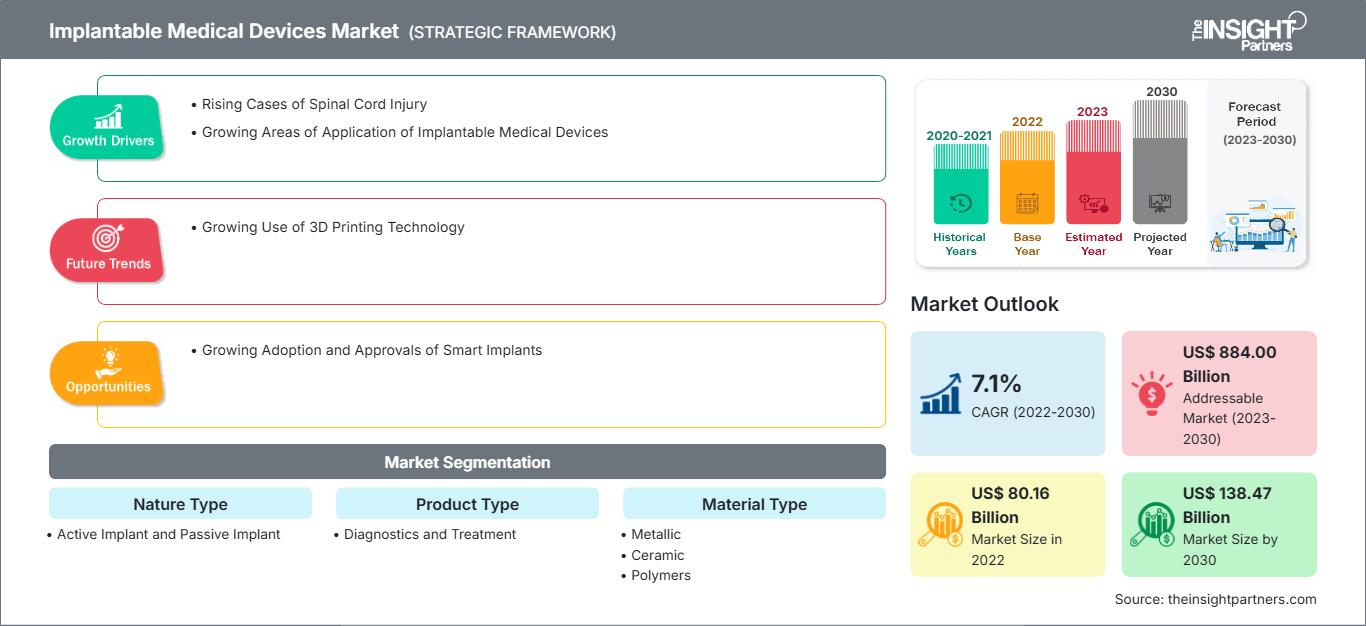

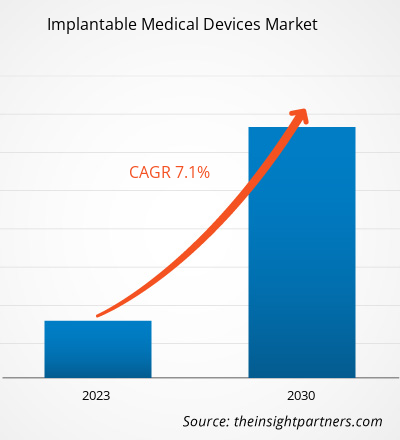

[Research Report] The implantable medical devices market is expected to grow from US$ 80,156.0 million in 2022 and is expected to reach a value of US$ 138,474.35 million by 2030; it is anticipated to record a CAGR of 7.1% from 2022 to 2030.

Market Insights and Analyst View:

An implantable medical device is a device that is either completely or partially implanted into the body. These medical devices are often implanted during surgical procedures by physicians. Implantable medical devices, as compared to surgical medical devices, remain in the body after the surgery. Key factors driving the implantable medical devices market growth include the growing areas of application of implantable medical devices and rising cases of spinal cord injury.

Growth Drivers and Restraints:

According to the WHO, in 2022, the US recorded 50 million epilepsy cases; 1 billion migraine cases; and 400,000 spinal cord injury cases. Spinal cord stimulation is one of the most preferred techniques in treating chronic back pain, primarily due to the anatomical and functional abilities of the spinal cord nerves to control the sensation of pain. The incidence of spinal cord injuries has rapidly increased over the past decade. The National Spinal Cord Injury Statistical Center (NSCISC) 2021 fact sheet states that the annual incidence of spinal cord injuries is 60 cases per million. According to the article "Epidemiology of traumatic spinal cord injuries: a large population-based study," published in April 2022, the overall age-sex standardized incidence rate of traumatic spinal cord injuries was 26.5 per 1 million population, and the rates were directly related to age in both sexes, in 2021. According to the same source, in the elderly population (65 years and older), the rate is 59.2 and 23.3 per 1 million in males and females, respectively. Spinal cord stimulators are widely used for managing postoperative pain associated with spinal surgery. According to the report titled "Spinal Cord Injury Facts and Stats,” in 2021, ∼17,700 Americans suffer from a spinal cord injury yearly, of which ∼78% are men of an average age of 43. Therefore, the high incidence of spinal cord injuries in the geriatric population and adults fuels the demand for implantable neurostimulation devices, boosting the market growth.

However, the use of implantable medical devices can be life-saving, as these devices reduce pain and discomfort while restoring mobility and improving patient’s well-being. However, there are a few complications, such as fracture fixation, device failure, and arthroplasty complications, including the dislocation of joints, shoulder, elbow, hip, and knee, associated with orthoboric implant surgery. Moreover, implant rejection by the body, joint implant infection, blood clots, joint implant loosening, and neurovascular injury are the complications associated with orthopedic implants.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Implantable Medical Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Moreover, there are various devices for administering intravenous and intrathecal medications and managing diverse comorbidities and complications related to cancer therapy. A few of the devices are central venous access devices (CVADs), cardiac-implantable electronic devices (CIEDs), Ommaya reservoirs, external ventricular drains (EVDs), breast implants plus tissue expanders (TEs), and percutaneous nephrostomy tubes (PCNTs), among others.

Infections associated with these devices are common, which leads to increasing healthcare costs and complications in patients’ oncological management over the short and long term. This usually leads to delays in further cancer therapy until the infection has resolved. Treating these infections and replacing or removing the device is often necessary. However, removing an implant can be difficult, and in some cases, it is even prohibitive because of the patient’s underlying thrombocytopenia, comorbidities, lack of vascular access, immunosuppression, and prior surgical interventions. Also, the reimbursements for treating these infections are low. Thus, post-surgical complications hinder the market growth.

Report Segmentation and Scope:

The global implantable medical devices market is categorized on the basis of nature type, product type, material type, application, and end user. Based on nature type, the implantable medical devices market is bifurcated into active implant and passive implant. Based on product type, the implantable medical devices is divided into diagnostics and treatment. Based on material type, the market is segmented into metallic, ceramics, and polymers. In terms of application, the implantable medical devices market is segmented into cardiovascular implants, orthopedic implants, cardiovascular implants, breast implants, prosthetics implants, brain implants, and others. In terms of end user, the market is categorized into hospitals, specialty clinics, ASCs, and others. The implantable medical devices market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The implantable medical devices market, by nature type, is segmented into active implant and passive implant. The passive implant segment held a larger market share in 2022. However, the active implant segment is anticipated to register a higher CAGR during 2022-2030. Passive implants do not have any electronic or magnetic components, and they do not require any external power source to function. Some examples of passive implants include catheters, electric leads, aneurysm clips, stents, external fixation devices, hip prostheses, and inferior vena cava (IVC) filters. MRI may affect passive implants through mechanisms such as heating, rotation, displacement, and magnetization.

The implantable medical devices market, by product type, is segmented into diagnostic and treatment. The treatment segment held a larger market share in 2022; also, the same segment is anticipated to register a higher CAGR during 2022-2030. Implantable medical devices are placed into the body to deliver medicines and support the functions of specific organs. Implantable medical devices are commonly used in the treatment of cardiac conditions. Additionally, various types of prosthetics, such as orthopedic and dental implants, are used to replace damaged body parts.

The implantable medical devices market, by material type, is segmented into metallic, ceramic, and polymers. The metallic segment held the largest market share in 2022, and the polymers segment is anticipated to register the highest CAGR during 2022-2030. Metallic implants are widely used in dentistry, cardiac devices, orthopedic surgeries, and gynecological procedures. For instance, cobalt-chromium-molybdenum alloys are used in orthopedic implants and denture frameworks. Similarly, cobalt and its alloys are used in the manufacturing of defibrillators. Furthermore, Polymers such as ethylene-vinyl acetate copolymers (EVA), silicone, polyether ether ketone (PEEK) polymer, and ultra-high molecular weight polyethylene (UHMW-PE) are widely used for manufacturing medical implants because of the ease of fabrication, flexibility, and biocompatibility.

The implantable medical devices market, by application, is segmented into dental implants, orthopedic implants, cardiovascular implants, breast implants, brain implants, and others. The orthopedic implants segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022-2030. Orthopedic implants are used to replace cartilage, bone, or joint due to deformity or damage. Most orthopedic implants are made of titanium alloys and stainless steel, and a few of them may even be covered with plastic. The plastic lining serves as artificial cartilage, while the metallic structure provides the implant with the necessary strength. Usually, the implant is attached into place, supporting the bone to grow into it for improved strength. Metal alloys such as titanium are among the most commonly used materials in orthopedic implants used as prosthetics, including knee and hip replacements. Metal alloys are also used in bone plates and bone screws. Ceramics and polymers are among other materials used in the synthesis of orthopedic implants.

The implantable medical devices market, by end users, is segmented into hospitals, specialty clinics, ASCs, and others. In 2022, the hospitals segment held the largest market share, and the same segment is anticipated to register the highest CAGR during 2022–2030.

Regional Analysis:

Based on geography, the global implantable medical devices market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the global implantable medical devices market size. Asia Pacific is estimated to register the highest CAGR during 2022–2030.

The US is estimated to hold the largest implantable medical devices market share during 2022–2030. Rising incidence of neurological diseases such as Parkinson's disease, increasing awareness about neurological disorders, and growing investments in developing transcranial stimulators are among the main factors driving the overall implantable devices market in the US. Low dopamine readings and other genetic factors are among the leading causes of Parkinson's disease. According to a study titled "2022 Alzheimer's Disease Facts and Figures," published in the Alzheimer's Association, approximately 6.5 million Americans aged 65 and above were diagnosed with Alzheimer's disease in 2022. The number is projected to reach 13.8 million by 2060. According to the Brain Aneurysm Foundation's data published in 2019, in the US, ~6 million people had unruptured brain aneurysms. Also, the annual rupture rate is nearly 8–10 per 100,000 people; ~30,000 people in the US suffer from a brain aneurysm rupture. Deep brain stimulation (DBS) devices have been observed to control the tremors associated with Parkinson's disease effectively.

According to the Parkinson's Foundation, ~1 million people in the US suffer Parkinson's disease, which is expected to increase to 1.2 million by 2030. Technological advancements and new product launches drive the implantable medical devices market. In January 2020, Abbott's Infinity DBS System received approval from the USFDA for treating Parkinson's disease. This system allows for the targeted treatment of a specific area of the brain, called the inner globus pallidus (GPi), which is associated with the symptoms of Parkinson's disease. Therefore, the increasing prevalence of neurological disorders and technological advancements fuel the US's implantable medical device market growth.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global implantable medical devices market are listed below:

- In August 2023, Medtronic plc received CE (Conformite Europeenne) Mark approval for its Inceptiv closed-loop rechargeable spinal cord stimulator (SCS). It is the first Medtronic SCS device to offer a closed-loop feature that senses each person's unique biological signals and adjusts stimulation moment to moment, as needed, to keep therapy in harmony with the motions of daily life.

- In May 2023, BIOTRONIK announced the latest addition of Amvia Sky and Amvia Edge to its cardiac rhythm management portfolio. BIOTRONIK received a CE mark for their newest technology – the world’s first pacemakers and CRT-Ps approved for left bundle branch pacing. Amvia Sky and Amvia Edge represent cutting-edge innovations and incorporate the latest cardiology trends.

- In March 2023, Dentsply Sirona introduced the DS OmniTaper Implant System, the newest member of the EV Implant Family. The DS OmniTaper Implant System is an innovative solution that combines the proven technologies of Dentsply Sirona’s EV Implant Family with new features that deliver efficiency and versatility.

- In February 2023, Medtronic plc received CE (Conformite Europeenne) Mark for the Aurora EV-ICD MRI SureScan (Extravascular Implantable Cardioverter-Defibrillator) and Epsila EV MRI SureScan defibrillation lead to treat dangerously fast heart rhythms that can lead to sudden cardiac arrest. The Aurora EV-ICD system provides the life-saving benefits of traditional ICDs while avoiding certain risks because its lead (thin wire) is placed outside the heart and veins.

- In January 2023, Abbott announced that the US Food and Drug Administration (FDA) has approved its Proclaim XR spinal cord stimulation (SCS) system to treat painful diabetic peripheral neuropathy (DPN), a debilitating complication of diabetes. The Proclaim XR SCS system can provide relief to DPN patients in need of alternatives to traditional treatment approaches, such as oral medication. People who receive therapy from the Proclaim XR SCS system will also be able to use Abbott's NeuroSphere Virtual Clinic, a connected care app that allows people to communicate with a physician and receive treatment adjustments remotely.

The regional trends and factors influencing the Implantable Medical Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Implantable Medical Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Implantable Medical Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 80.16 Billion |

| Market Size by 2030 | US$ 138.47 Billion |

| Global CAGR (2022 - 2030) | 7.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Nature Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Implantable Medical Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Implantable Medical Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Implantable Medical Devices Market top key players overview

Competitive Landscape and Key Companies:

Abbott Laboratories, Boston Scientific Corp, Dentsply Sirona Inc, Johnson & Johnson, Medtronic Plc, Institut Straumann AG, Smith & Nephew Plc, BIOTRONIK SE & Co KG, LivaNova Plc, and MED-EL Elektromedizin Gerate GmbH are among the prominent players operating in the implantable medical devices market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

Frequently Asked Questions

Which application segment dominates the implantable medical devices market?

Which product type segment dominates the implantable medical devices market?

Which end user segment dominates the implantable medical devices market?

Which material type segment dominates the implantable medical devices market?

Which nature type segment dominates the implantable medical devices market?

What are the growth estimates for the implantable medical devices market till 2030?

What was the estimated implantable medical devices market size in 2022?

What factors drive the implantable medical devices market?

What are implantable medical devices?

Who are the major players in the implantable medical devices market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For