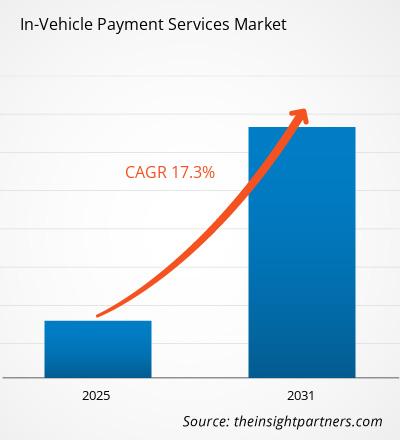

The in-vehicle payment services market size is expected to grow at a CAGR of 17.3% from 2025 to 2031. The in-vehicle payment services market includes growth prospects owing to the current in-vehicle payment services market trends and their foreseeable impact during the forecast period. The in-vehicle payment services market is a large and expanding sector. The in-vehicle payment services market is growing due to increasing trends of contactless payment post-COVID outbreak, a growing customer base to achieve convenience in vehicles, and growing technology innovation.

In-Vehicle Payment Services Market Analysis

In-vehicle payments are one of the technical innovations that are gaining enormous popularity among consumers due to the advantages it provides to digital payment technology. In-vehicle payments enable vehicle owners to buy goods and services from inside the vehicle without any payment equipment. The drivers can use in-vehicle payments to pay or transact at gas/charging stations, parking, restaurants and bars, toll gates and others.

In-Vehicle Payment Services Market Industry Overview

- The in-vehicle payment services market is a growing industry and is becoming more important. The in-vehicle payment services encompass various services such as paying for fuel at gas stations, covering toll charges, handling parking fees, and even making purchases from drive-thru restaurants or other vendors.

- The in-vehicle payment services market is gaining traction due to the increasing amount of time people spend in their cars, whether it's for commuting, travel, or running errands. With the rise of connected vehicles and smart technology, there are ample opportunities for companies to develop innovative solutions that streamline the payment process and enhance the overall driving experience.

- Key players in this market are constantly working on developing new solutions, such as mobile apps, integrated payment systems, and partnerships with merchants, to meet the evolving needs of consumers and businesses.

In-Vehicle Payment Services Market Driver

Increasing Trends Of Contactless Payment Post-COVID Outbreak To Drive The In-Vehicle Payment Services Market

- The COVID pandemic highlighted the importance of contactless payment. As more consumers prefer quick, convenient, and hygienic payment options, the demand for seamless payment solutions within vehicles is expected to surge. Contactless payment methods, such as tap-to-pay cards, mobile wallets, and wearable devices, offer users a hassle-free way to complete transactions without the need for physical contact or handling cash.

- Contactless technology enables drivers and passengers to effortlessly pay for fuel, tolls, parking, and other services without having to handle cash or interact with traditional payment terminals. This not only enhances convenience but also contributes to a safer and more hygienic payment experience, especially in light of health concerns and the emphasis on reducing germ transmission.

- Thus, the growing preference for contactless payment methods, driven by convenience, hygiene, and safety considerations, is expected to drive the in-vehicle payment services market.

In-Vehicle Payment Services Market Report Segmentation Analysis

- Based on the mode of payment, the in-vehicle payment services market is segmented NFC, QR Code/RFID, App/E-wallet Based, Credit/Debit Card Based. The NFC segment is expected to hold a substantial in-vehicle payment services market share in 2023.

- Near-field communication (NFC) technology allows a device such as a smartphone or a smartwatch to communicate with a payment terminal by being held close to it. This eliminates the need for drivers to physically hand over cash or a card to a cashier, reducing the risk of exposure to viruses or other contaminants.

In-Vehicle Payment Services Market Share Analysis By Geography

The scope of the in-vehicle payment services market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant in-vehicle payment services market share with a large population of car owners and a strong culture of convenience and innovation. Moreover, the increasing adoption of connected car technology has further boosted the demand for in-vehicle payment services in North America.

In-Vehicle Payment Services Market Report Scope

The "In-Vehicle Payment Services Market Analysis" was carried out based on mode of payment, application and geography. On the basis of plan type, the market is segmented into fully insured plans, mixed-insured plans, and self-insured plans. On the basis of enterprise size, the market is segmented into large enterprises and SMEs. Based on distribution channels, the market is segmented into agents, direct sales, banks, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

In-Vehicle Payment Services Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the in-vehicle payment services market. A few recent key market developments are listed below:

- In September 2023, Hyundai partnered with Parkopedia to launch Hyundai Pay’s first service, which lets drivers locate, reserve, and pay for parking at 6000 designated locations – all from the comfort of their vehicles. The service keeps personal details secure using tokenization, which replaces card account details with a unique digital identifier or token.

[Source: Hyundai, Press Release]

- In November 2023, Skoda Auto introduced in-car payments with a brand-new Pay to Fuel service. Pay to Fuel allows drivers to pay for fuel via the car’s infotainment system, skipping the queue at the cashier. The service is available in six European countries, with more in the pipeline.

[Source: Skoda Auto, Press Release]

In-Vehicle Payment Services Market Report Coverage & Deliverables

The in-vehicle payment services market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "In-Vehicle Payment Services Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

In-Vehicle Payment Services Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 17.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Mode of Payment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For