Indexable Inserts Market Analysis, Size, and Share by 2031

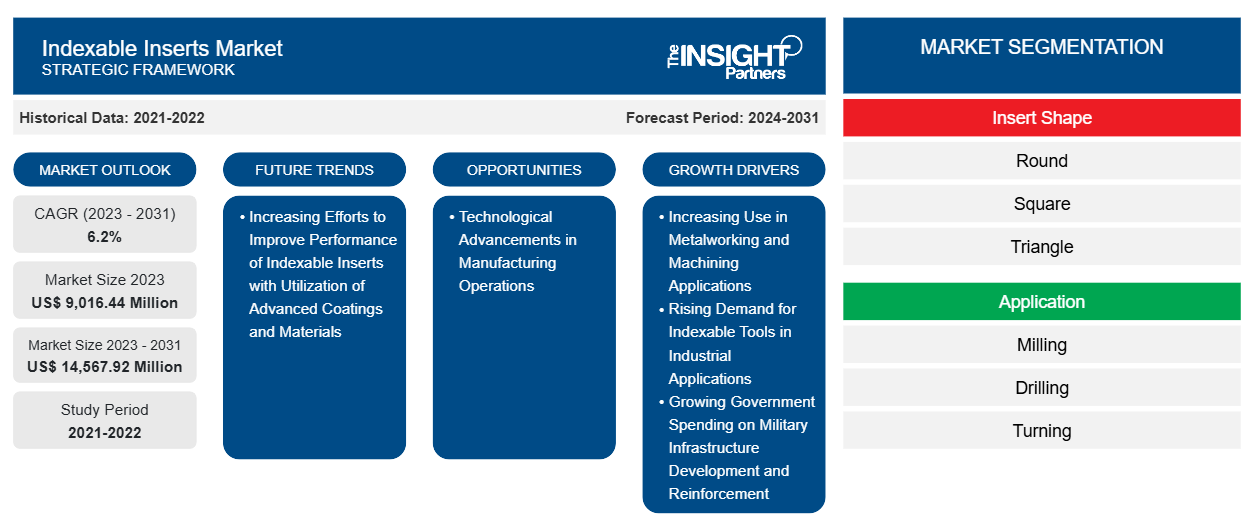

Indexable Inserts Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insert Shape (Round, Square, Triangle, Rhombic, and Others), Application (Milling, Drilling, Turning, Threading, and Others), Size (Up to 10 mm, 10-20 mm, and Above 20 mm), Insert Material (Carbide, Ceramic and Composites, PCD Inserts, and Others), Industry (Aerospace and Defense, General Industry, Oil and Gas, Power Generation, Automotive, Electric and Electronics, Medical, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Dec 2024

- Report Code : TIPRE00039373

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 433

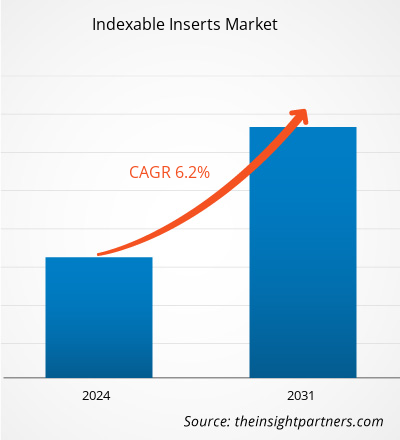

The indexable inserts market size is projected to reach US$ 14,567.92 million by 2031 from US$ 9,016.44 million in 2023. The market is expected to register a CAGR of 6.2% during 2023–2031. Increased utilization of advanced coatings and materials to improve the performance of indexable inserts is likely to emerge as a new trend during the forecast period.

Indexable Inserts Market Analysis

Indexable cutting tools provide an efficient and cost-effective way to create complex shapes while maintaining accuracy and repeatability. These tools have become increasingly popular in recent decades due to their ability to quickly produce intricate shapes with minimal material waste. Their indexable cutting parts also make them extremely versatile and durable, making them an overall efficient choice for many machining tasks. By using indexable inserts, manufacturers can ensure projects are completed in less time while maximizing quality and efficiency. Hence, the increasing use of indexable inserts in metalworking and machining applications drives the market growth.

The increasing need for automation in the manufacturing industry is driving the expansion of the indexable inserts market. Milling machines can perform multiple tasks simultaneously, reducing the need for a manual workforce and increasing overall productivity. Furthermore, technological advancements have contributed significantly to the growth of the indexable inserts market. By integrating CNC technology, precise cuts and shapes can be easily produced, increasing the popularity of indexable inserts in the metalworking and machining industry.

The prices of raw materials, particularly metals such as steel, aluminum, and copper, are influenced by various key factors such as global supply and demand dynamics, geopolitical tensions, currency fluctuations, and trade policies. The inherent volatility in these markets poses challenges for machine manufacturers and other end users. Variations in raw material prices can directly impact the cost of production for indexable inserts, machining tools, and cutting tools, leading to a reluctance among end users to buy these machines. When prices rise, manufacturers may face higher input costs, which can reduce profit margins.

Indexable Inserts Market Overview

Indexable inserts are an important component in modern machining and manufacturing and are revolutionizing the way tools are used in cutting, shaping, and finishing materials. These indexable inserts, also called replaceable cutting edges, are designed to be physically attached to a tool holder and allow for quick replacement without having to replace the entire tool. A typical insert has multiple edges, often three to eight, depending on the shape and design. If an edge is worn or damaged, the indexable inserts can be rotated to a new edge, maximizing material utilization and reducing downtime. The indexable tool holder and insert are designed to provide a secure fit, with the insert sitting in the pocket of the holder and clamped tightly. This design ensures that the insert remains stable during machining and prevents movement that could affect precision and surface quality.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndexable Inserts Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Indexable Inserts Market Drivers and Opportunities

Rising Demand for Indexable Tools in Industrial Applications

Indexable inserts are increasingly used in industries such as automotive, aerospace, medical, and general manufacturing in various applications, including milling, drilling, grooving, and threading. Indexable inserts represent a significant advancement in cutting tool technology and offer numerous advantages over traditional tooling methods. Easy interchangeability, high performance, and versatility of cutting edges make indexable inserts indispensable in modern machining. Manufacturers can optimize their machining processes, improve productivity, and reduce costs by understanding operating principles, benefits, and applications of indexable inserts. Automobile production is steadily increasing worldwide, especially in Asian and European countries, increasing the demand for indexable inserts. In the industry, indexable inserts are widely used in the metal machining of crankshafts, face milling and hole drilling, and other machining operations in producing auto parts. Indexable inserts are used for a variety of purposes in the aerospace industry. They are particularly used in milling operations that require high precision and smooth surfaces. Indexable inserts are commonly employed in this industry as they can cut through materials such as titanium, aluminum, steel alloy, and plastics. They are crucial in manufacturing aircraft components such as engines, wings, fuselage structures, and landing gears.

Technological Advancements in Manufacturing Operations

The importance of efficient and cost-effective manufacturing operations is increasing with the growing demand for process automation across the manufacturing sector. Automated manufacturing processes and high-end technologies such as computer numerical control (CNC) offer several advantages over traditional manual manufacturing techniques. By integrating computer-aided design (CAD) and computer-aided manufacturing (CAM) systems with automated manufacturing processes, tasks such as cutting, drilling, milling, welding, and bending can be streamlined and automated while reducing the need for manual labor and improving overall efficiency. Automated processes can also enhance the quality of products by minimizing errors and differences associated with manual production.

Indexable Inserts Market Report Segmentation Analysis

Key segments that contributed to the derivation of the indexable inserts market analysis are type, system, and application.

- Based on insert shape, the indexable inserts market is segmented into round, square, triangle, rhombic, and others. The rhombic segment held the largest market share in 2023.

- Based on application, the indexable inserts market is segmented into milling, drilling, turning, threading, and others. The milling segment held the largest market share in 2023.

- Based on size, the market is divided into up to 10 mm, 10–20 mm, and above 20 mm. The up to 10 mm segment held the largest share of the market in 2023.

- Based on Insert Material, the market is divided into Carbide, Ceramic and Composites, PCD Inserts and Others. Carbide segment held the largest share of the market in 2023.

- Based on Industry, the market is divided into Aerospace and Defense, General Industry, Oil and Gas, Power Generation, Automotive, Electric and Electronics, Medical and Others. Automotive segment held the largest share of the market in 2023.

Indexable Inserts Market Share Analysis by Geography

The geographic scope of the indexable inserts market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. Europe is the second-largest contributor to the global indexable inserts market. The indexable inserts market in Europe is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Western Europe is a highly developed region with different types of companies. Europe has a well-established manufacturing industry that uses cutting-edge technologies, such as automation, robotics, the Industrial Internet of Things (IIoT), and Industry 4.0. Across Europe, technological advancements have created a highly competitive market for indexable inserts. Europe is one of the most important automobile manufacturers in the world. The presence of world-leading automobile manufacturers such as Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA is driving the industry's growth. As per the European Automobile Manufacturers Association (ACEA), new car registrations in Europe increased by 18.6% from 12.93 million units in 2022 to 15.33 million units in 2023. Germany accounted for the highest share in new car registration in the region, followed by the UK, France, and Italy. Such a rise in car and other vehicle sales in the region is expected to fuel the demand for cutting tools, such as indexable inserts, in metalworking operations in the region.

Indexable Inserts Market Regional Insights

The regional trends and factors influencing the Indexable Inserts Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Indexable Inserts Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Indexable Inserts Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 9,016.44 Million |

| Market Size by 2031 | US$ 14,567.92 Million |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Insert Shape

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Indexable Inserts Market Players Density: Understanding Its Impact on Business Dynamics

The Indexable Inserts Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Indexable Inserts Market top key players overview

Indexable Inserts Market News and Recent Developments

The indexable inserts market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the indexable inserts market are listed below:

Kennametal Inc. expanded its turning portfolio with the introduction of new inserts and cutting tools that significantly broaden its machining capabilities in the small parts and medical machining space. The three new products—TopSwiss Turning Inserts, Micro Boring Solid (MBS) tooling, and KCU25B Turning Inserts—are designed to improve output, enhance component quality, reduce errors, and help customers achieve accurate and clean results. (Source: Kennametal Inc., Press Release, October 2024)

On the occasion of EMO 2023 in Hanover, CERATIZIT kicked off the introduction of the first Product Carbon Footprint (PCF) Standard for carbide products. Since September 18, the PCF classification of the first wave of products has been displayed in the shop. Products from the upGRADE family, which are made from 100% secondary raw materials and have a particularly low PCF, also take on a special position. With these products, detailed PCF information is already included in the purchase price. The CT-GS20Y grade for rods for cutting tools and the KLC20+ grade for wood working are made from strictly selected secondary raw materials and combine premium performance with a particularly low PCF. (Source: CERATIZIT S.A, Press Release, September 2023)

Indexable Inserts Market Report Coverage and Deliverables

The "Indexable Inserts Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Intelligent transportation system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Intelligent transportation system market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Intelligent transportation system market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the indexable inserts market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For