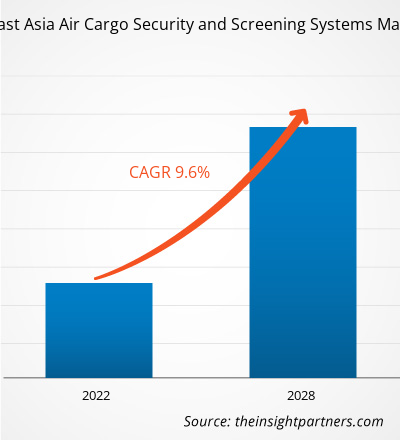

The India & South-East Asia air cargo security and screening systems market is expected to grow from US$ 46.2 million in 2021 to US$ 87.9 million by 2028; it is estimated to grow at a CAGR of 9.6% from 2021 to 2028.

Governments across India & South-East Asia are bringing advancements in the aviation sector and associated industries. Growing investments in the construction of new airports and expansion of the existing ones encourage the adoption of enhanced solutions for better operations. The increasing number of airports propels the growth of the air cargo business. Therefore, the need for deploying security and screening systems in airports to detect narcotics, explosive objects, and metal & contraband is increasing.

For instance, in August 2020, Singapore Changi Airport extended its partnership with Smiths Detection to supply advanced explosives detection systems. For the Terminal 2 Parcel Handling System redevelopment, the airport installed 20 Smiths Detection HI-SCAN 10080 XCT automatic explosives detection systems (EDS). Similarly, several metal detectors were installed at Tan Son Nhat International Airport for cargo detection and passengers screening in April 2021. Additionally, in September 2018, Vietnam’s Noi Bai International Airport installed an X-ray machine provided by the US. The donation was within the framework of the Export Control and Related Border Security (EXBS) Program, with a total cost of nearly US$ 200,000. The initiative was done to strengthen Vietnam's capabilities to prevent unauthorized trading of weapons of mass destruction from entering the country. Indian & South-East Asian countries are increasingly installing x-ray systems, ETD (explosives trace detectors), and EDS (explosives detection system) technology to detect narcotics, explosive objects, and metal & contraband to reduce the risk of terror attacks. Thus, the deployment of security and screening systems at airports across the region fuels the growth of the India & South-East Asia air cargo security and screening systems market

Impact of COVID-19 Pandemic on India Air Cargo Security and Screening Systems Market

The demand for air cargo was unaffected by the lockdowns in India, and the operating conditions remain supportive for air cargo. The air cargo and freighter operators have reported brisk business owing to the increased transportation of COVID-19 related essentials by air. For instance, SpiceExpress (an air cargo subsidiary of SpiceJet) is encouraging performance as its fleet is increasingly being deployed to transport essential items and medical goods to deal with the COVID-19 pandemic. The cargo delivered to various parts of the country includes COVID-19 related medical equipment, reagents, enzymes, masks, testing kits & PPE, gloves & other accessories. Further, the ministry of civil aviation in India has undertaken continuous efforts at the policy level and ground level to add substantially to the country’s fight against COVID-19. For instance, Air India and IAF (Indian Air Force) collaborated for supplying medical equipment across Ladakh, Imphal, Dimapur, Gangtok, Bagdogra, Guwahati, Chennai, and Port Blair. A dedicated medical air cargo-related website Lifeline Udan has been launched and is functional. Therefore, with the growing demand for air cargo for supplying medical equipment, the requirement for security and screening systems has also increased. Thus, the air cargo business in India has reflected positive market growth.

India & South-East Asia Air Cargo Security and Screening Systems Market Revenue and Forecast to 2028 (US$ Million)

India & South-East Asia Air Cargo Security and Screening Systems Market Segmentation

India & South-East Asia Air Cargo Security and Screening Systems Market – by Size

- Small Parcel

- Break and Pallet Cargo

- Oversized Cargo

India & South-East Asia Air Cargo Security and Screening Systems Market – by Technology

- X-ray systems

- ETD

- EDS

- Others

India & South-East Asia Air Cargo Security and Screening Systems Market – by Application

- Narcotics detection

- Explosive detection

- Metal and Contraband Detection

- Others

India & South-East Asia Air Cargo Security and Screening Systems Market - Companies Mentioned

- Astrophysics Inc.

- Dhonaadhi Hitec Innovations

- Krystalvision Image Systems Pvt. Ltd.

- Nuctech Company Limited

- Rapiscan Systems, Inc.

- Safran

- VOTI Detection Inc.

- Safeway Inspection System Limited

- Smiths Detection Group Ltd. (Smiths Group plc)

- FocusTest Inc.

India & South-East Asia Air Cargo Security and Screening Systems Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 46.2 Million |

| Market Size by 2028 | US$ 87.9 Million |

| Global CAGR (2021 - 2028) | 9.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Size

|

| Regions and Countries Covered | India and Southeast Asia

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - India & South-East Asia Air Cargo Security and Screening Systems Market

- Astrophysics Inc.

- Dhonaadhi Hitec Innovations

- Krystalvision Image Systems Pvt. Ltd.

- Nuctech Company Limited

- Rapiscan Systems, Inc.

- Safran

- VOTI Detection Inc.

- Safeway Inspection System Limited

- Smiths Detection Group Ltd. (Smiths Group plc)

- FocusTest Inc.

Get Free Sample For

Get Free Sample For