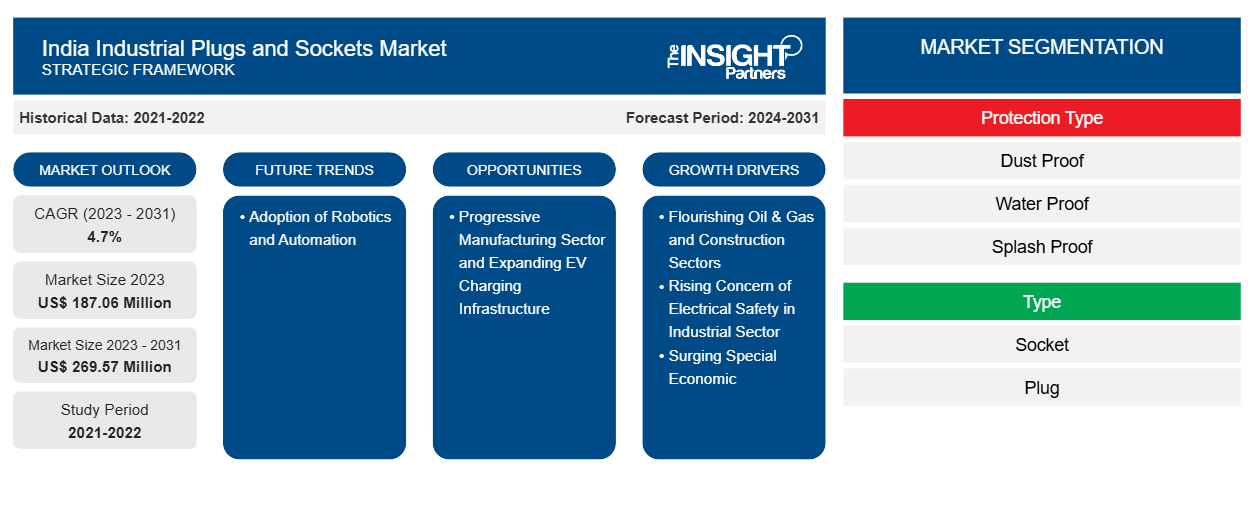

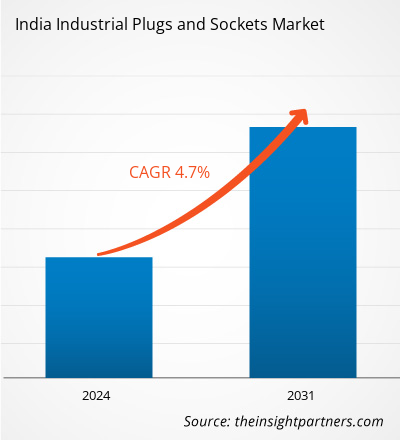

The India industrial plugs and sockets market size is expected to reach US$ 269.57 million by 2031 from US$ 187.06 million in 2023. The market is estimated to record a CAGR of 4.7% from 2023 to 2031. Adoption of robotics and automation is likely to remain a key market trend in the coming years.

India Industrial Plugs and Sockets Market Analysis

Flourishing oil & gas and construction sectors, rising concern of electrical safety in industrial sector, and surging special economic zones propel the India industrial plugs and sockets market. On the other hand, supply chain disruptions hinder the growth of the market. Further, progressive manufacturing sector and expanding EV charging infrastructure create an opportunity for the growth of the market. The adoption of robotics and automation is expected to bring significant growth trends in the market in the future.

India Industrial Plugs and Sockets Market Overview

Industrial plugs and sockets are being used across different industries to safeguard the equipment to which they are connected by securing electric connections. They are designed to deal with extreme temperatures and possible exposure to chemicals. These components are easy to install and usually manufactured with efficient and low-cost materials to enable resistance to chemicals, dust, and water, among others. The demand for these plugs and sockets is increasing in India with an upsurge in energy & power generation, construction, and electrical projects. Rising industrialization generates notable growth opportunities for companies in the international plugs and sockets market to expand their businesses in India. Industrial plugs and sockets feature excellent conductivity, large connection area, and compact design. Various types of these components are available on the market; these include surface mounting and panel mounting sockets, and multiphase plugs, among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Industrial Plugs and Sockets Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Industrial Plugs and Sockets Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

India Industrial Plugs and Sockets Market Drivers and Opportunities

Flourishing Oil & Gas and Construction Sectors Favor Market Growth

The oil & gas sector, which is closely related to its energy demand, plays a significant role in boosting the Indian economy. According to the International Energy Agency (IEA), in February 2024, India became the third-largest consumer of oil in the world. The Government of India has adopted several policies to cater to the rise in the demand for oil and gas. 100% FDI provisions in various segments of this sector, including petroleum products, natural gas, and refineries, further favor its growth. In March 2022, the Board of Oil India approved an investment of INR 6,555 crore (US$ 839.49 million) for the Numaligarh petrochemical project. In March 2024, the Indian Prime Minister launched a series of oil and gas sector projects totaling ~US$ 19.27 billion (INR 1.62 lakh crore) across the country, including those from Bihar, Maharashtra, Karnataka, and Punjab. In the oil and gas industry, industrial plugs and sockets are employed to ensure the safe and efficient operations of a wide range of equipment, including drilling rigs and hydraulic systems, by offering reliable electrical connections.

According to the Construction Industry Development Council, the Indian construction industry provides employment to nearly 32 million candidates, and it is the second largest contributor to its national GDP after the agricultural sector. The construction industry in India is divided into two segments: real estate and urban development. The real estate segment includes residential spaces, offices, hotels, retail chains, and leisure park properties, among others. The urban development segment includes subsegments such as water supply, sanitation, urban transportation, schools, and healthcare. With the rising population and FDI inflow, the construction sector in India is continuously growing. Construction sites require an uninterrupted power supply for the functioning of heavy machinery such as excavators, cranes, and concrete mixers. Industrial plugs and sockets are required for the electrical connections of the tools and machinery. They also play a vital part in the continuous operations of site management systems. Thus, the flourishing oil and gas, and construction industries bolster the India industrial plugs and sockets market

Progressive Manufacturing Sector to Create Significant Opportunities for Market

According to the Indian Brand Equity Foundation (IBEF), India is the world's third most preferred destination for manufacturing plants, and it is likely to attain the capability of exporting US$ 1 trillion worth of goods by 2030. The country is implementing different programs and policies with an aim to raise the manufacturing sector's contribution to 25% of the economic output by 2025. The Make in India program and the Production-Linked Incentive (PLI) scheme, attracting foreign direct investments (FDIs) and enhancing industrial infrastructure, provide a boost to the growth of the manufacturing industry. A few of the developments in the manufacturing sector in India are mentioned below:

- In September 2024, Copeland, headquartered in the US, announced its plans to invest US$ 60 million in India to expand its manufacturing facility in Atit, Maharashtra. With this investment, the company also intends to construct a new global R&D center in Pune.

- Till March 2024, PLI for 14 key sectors was announced with an outlay of over US$ 26 billion to enhance India's manufacturing capabilities and exports.

The manufacturing industries such as automotive, chemicals, and pharmaceuticals are receiving massive investments. Efforts being made to set up new manufacturing facilities or modernize the existing ones would generate the need for industrial plugs and sockets to enable electrical connections and minimize workplace-based accidents. Thus, the proliferating manufacturing sector presents numerous opportunities for the future growth of the India industrial plugs and sockets market.

India Industrial Plugs and Sockets Market Report Segmentation Analysis

Key segments that contributed to the derivation of the India industrial plugs and sockets market analysis are protection type, type, end user, and rating.

- Based on protection type, the India industrial plugs and sockets market is segmented into dustproof, splash proof, waterproof, and others. The dustproof segment dominated the market in 2023.

- Based on type, the India industrial plugs and sockets market is bifurcated into plugs and sockets. The sockets segment dominated the market in 2023.

- Based on end user, the India industrial plugs and sockets market is segmented into chemical and pharmaceutical, heavy industry, oil & gas, power generation, automotive, and others. The heavy industry segment dominated the market in 2023.

- Based on current rating, the India industrial plugs and sockets market is segmented into 16 amp, 32 amp, 63 amp, and 125 amp. The 32 amp segment dominated the market in 2023.

India Industrial Plugs and Sockets Market Share Analysis by Geography

- India has a robust automotive sector majorly driven by the middle-class income and youth population. The industrial plugs and switches in vehicle manufacturing plants are crucial for uninterrupted power supply. According to the India Brand Equity Foundation, the country holds a strong position in the heavy vehicles market, as it is the largest tractor producer, second-largest bus manufacturer, and third-largest heavy truck manufacturer globally. The annual production of automobiles in India was 22.93 million vehicles in FY 2022. In addition, rising investments in the automotive sector fuel the production of automobiles. For instance, in January 2023, MG Motor India invested US$ 100 million to expand capacity, expecting ~70% growth in production in 2023. In December 2022, Mahindra & Mahindra invested US$ 1.2 billion (Rs 10,000 crore) in an electric vehicle manufacturing plant in Pune. Such investments drive the demand for industrial plugs and switches in automotive manufacturing plants for uninterrupted power supply. Modern automotive plants are increasingly implementing advanced robotics and automated systems, with each production line requiring numerous industrial-grade power connections.

India Industrial Plugs and Sockets Market Regional Insights

The regional trends and factors influencing the India Industrial Plugs and Sockets Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses India Industrial Plugs and Sockets Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for India Industrial Plugs and Sockets Market

India Industrial Plugs and Sockets Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 187.06 Million |

| Market Size by 2031 | US$ 269.57 Million |

| Global CAGR (2023 - 2031) | 4.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Protection Type

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

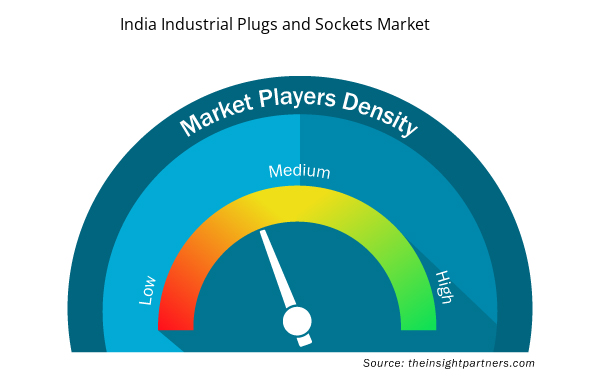

India Industrial Plugs and Sockets Market Players Density: Understanding Its Impact on Business Dynamics

The India Industrial Plugs and Sockets Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the India Industrial Plugs and Sockets Market are:

- ABB Ltd.

- Amphenol Corporation

- BCH Electric Limited

- Eaton Corporation plc

- General Industrial Controls Private Limited (GIC)

- Legrand SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the India Industrial Plugs and Sockets Market top key players overview

India Industrial Plugs and Sockets Market News and Recent Developments

The India industrial plugs and sockets market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the India industrial plugs and sockets market are listed below:

- Schneider Electric announced the launch of the UNICA X range of slimline stainless-steel switches and sockets in the first of the series’ global rollouts at Festival Walk in Hong Kong. The UNICA X switches and sockets combine premium quality and functionality. They are developed to fit seamlessly onto walls with an ultra-slim 6.5 mm visible profile thickness, making it Schneider Electric’s slimmest product available to date. The aesthetically pleasing range is claimed to meet the design expectations of homebuilders, interior designers, and hoteliers inclined toward stylish interiors.

(Source: Schneider Electric, Press Release, September 2024)

India Industrial Plugs and Sockets Market Report Coverage and Deliverables

The "India Industrial Plugs and Sockets Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- India industrial plugs and sockets market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- India industrial plugs and sockets market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- India industrial plugs and sockets market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the India industrial plugs and sockets market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the India industrial plugs and sockets market are ABB, Legrand, Schneider Electric, BCH Electric Limited, and MENNEKES.

The India industrial plugs and sockets marketis expected to reach US$ 269.57 million by 2031.

The incremental growth expected to be recorded for the India industrial plugs and sockets market during the forecast period is US$ 82.51 million.

The India industrial plugs and sockets market was estimated to be US$ 187.06 million in 2023 and is expected to grow at a CAGR of 4.7 % during the forecast period 2023 – 2031.

Adoption of robotics and automation is anticipated to play a significant role in the India industrial plugs and sockets market in the coming years.

Flourishing oil & gas and construction sectors; rising concern of electrical safety in industrial sector; and surging special economic zones are the major factors that propel the India industrial plugs and sockets market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - India Industrial Plugs and Sockets Market

- ABB Ltd.

- Amphenol Corporation

- BCH Electric Limited

- Eaton Corporation plc

- General Industrial Controls Private Limited (GIC)

- Legrand SA

- MENNEKES

- SCAME PARRE S.p.A.

- Schneider Electric

- Super Engineering Works

Get Free Sample For

Get Free Sample For