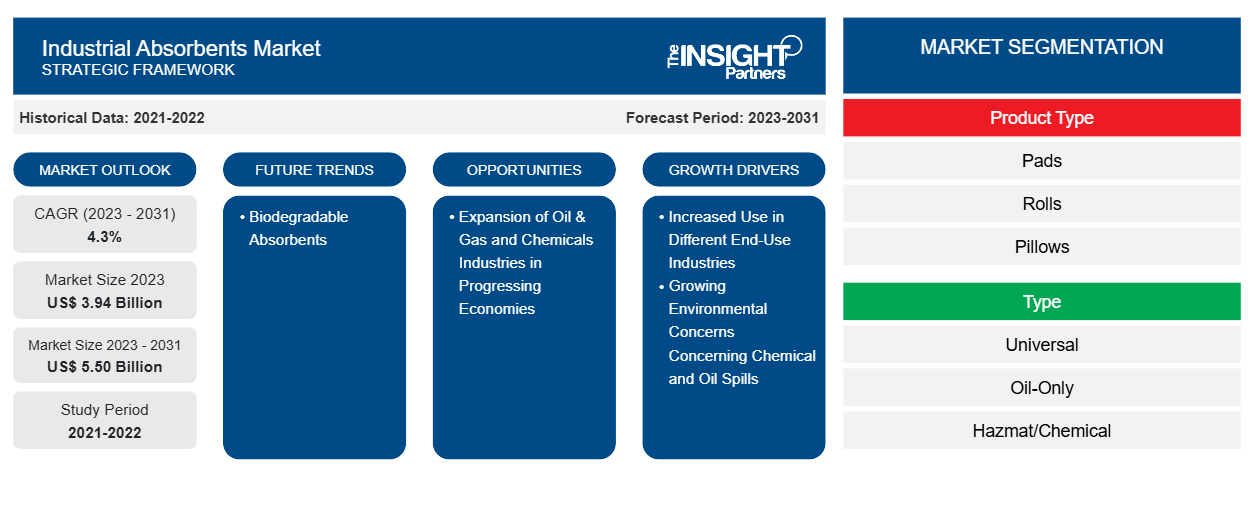

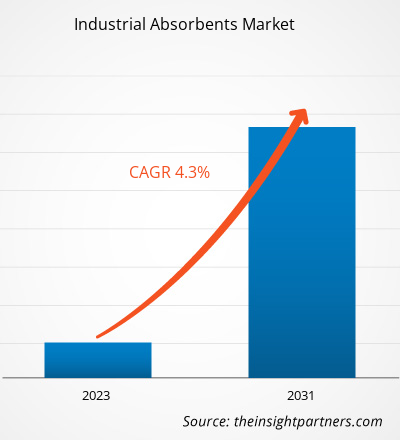

The industrial absorbents market is projected to grow from US$ 3.94 billion in 2023 to US$ 5.50 billion by 2031; the market is expected to register a CAGR of 4.3% from 2023 to 2031. The conceptualization of natural industrial absorbents is likely to remain a key trend, as it plays a vital role in ensuring environmental sustainability by absorbing oil spills and other fluids in various industrial processes.

Industrial Absorbents Market Analysis

The use of industrial absorbents is crucial within the broader environmental management and safety industry, which primarily focuses on products designed to control and clean up oil spills, chemicals, and other hazardous materials. These absorbents are vital for maintaining workplace safety and preventing environmental contamination, particularly in industries such as oil & gas, chemical manufacturing, pharmaceuticals, and food processing. The market is driven by a surge in industrial activities worldwide, as well as due to heightened awareness and regulatory measures taken for environmental protection and workplace safety. Operations of oil & gas and chemicals sectors, coupled with accidental spillage and discharge operations, among others, have hazardous effects on proximate ecosystems. Therefore, companies are mandated to have effective spill management and control measures in place. The expansion of oil & gas and chemicals industries in developing economies in Asia Pacific and the Middle East & Africa is likely to create significant opportunities in the market in the coming years.

Industrial Absorbents Market Overview

Oil & gas, chemicals, food processing, healthcare, and pharmaceutical industries are among the major end users of industrial absorbents. They are used to clean large- and small-scale oil spills in the oil & gas industry. Accidental spillage of oil due to fuel discharge during oil processing, leakage through large-scale offshore petroleum units, mishaps during oil drilling, and oil transportation through oceanic routes can pose a severe threat to the surrounding environment. Oil spillage worsens the water quality and adversely affects the aquatic ecosystem. A surge in the incidents of oil spillage triggers the demand for industrial absorbents in the oil & gas industry. For instance, according to the International Tanker Owners Pollution Federation Limited, in 2023, one large oil spill and nine medium oil spills from tankers were recorded, which accounted for approximately 2,000 tons of volume of oil lost to the environment. These incidents occurred in Asia, Africa, Europe, and the Americas. The rising number of oil refineries is another factor propelling the demand for industrial absorbents. The increasing number of drilling operations in the oil & gas industry in North America and the Middle East majorly contributes to the increasing demand for industrial absorbents. In the chemicals industry, chemical spills generally occur while transporting stored chemicals. Industrial absorbents are broadly used for cleaning chemicals that can be hazardous if left unattended. Thus, the increased use in different industries, including oil & gas, chemicals, food processing, and healthcare, propels the growth of the industrial absorbents market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Absorbents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Absorbents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Absorbents Market Drivers and Opportunities

Surging Environmental Concerns Regarding Chemical and Oil Spills Favor Market Growth

Oil spills are long-lasting environmental disasters with a wide range of impacts. The effects of oil spills can vary, ranging from minimal to serious ones, depending on the magnitude and location of the spillage. Oil can kill surface-dwelling animals and birds by poisoning or suffocating them, or by affecting their buoyancy and natural waterproofing abilities. Contaminated food supplies may lead to the malnourishment of animals, which may be followed by poisoning over time. The damage can be significant if oil spills happen in an area with wildlife. Oil obstructs the insulating ability of fur on mammals and impacts the water-repelling qualities of a bird's feathers. Without insulation or water-repelling qualities, mammals and birds can die from hypothermia. Further, oil and oil products (petroleum products) have many volatile compounds that are emitted as gases. These gases may or may not produce strong chemical odors but can contaminate the surrounding air, which could lead to health risks when exposed to these compounds for a prolonged period. Moreover, once in the air, pollutants can travel over long distances. The original contamination levels at the source and specific weather conditions may dictate the final spread of oil-contaminated air vapors. Oil spills, leading to oil slicks and sheens, also harm the aesthetic appeal and recreational value of coastal waters, shorelines, beaches, wetlands, etc. Serious consequences include the discontinuation of recreational activities in these areas, at least temporarily, until the spill is removed and the cleanup process is completed.

The incidences of oil spills may further have immediate effects on humans, fish, animals, birds, and wildlife, in general, if they come in direct contact with the spilled oil, breathe in volatilized oil components, consume food contaminated at any level in the food chain, and so on. Governments of various countries have implemented regulations concerning oil and chemical spills. For instance, Section 14 regulations of the Canada Oil and Gas Operations Act prescribe measures necessary to prevent air, land, or water pollution due to the exploration and drilling, production, storage, transportation, distribution, and other operations in the oil & gas industry. Therefore, growing concerns about the environment and the associated regulations to prevent oil spills bolster the demand for industrial absorbents across the world.

Expansion of Oil & Gas and Chemicals Industries in Progressing Economies to Create Significant Opportunities

According to the International Energy Agency, China and India have been leading contributors to the total oil production in Asia Pacific. The US Energy Information Administration ranks China as the world's fifth-largest oil-producing country. Although Asia has seen a slow but steady decline in its share in global oil production, it is expected to account for ~77% of the rise in world oil demand through 2025. Moreover, its reliance on oil imports would increase to 81% by 2025. China is also a chemical processing hub, and it accounts for a significant portion of chemicals produced globally. The country contributes to more than 35% of global chemical sales. With the growing demand for various chemicals globally, this industry is scaling up its production operations.

According to Invest India, India is the third-largest consumer of energy and oil in the world. The crude oil and petroleum products consumption in India accounted for 223.04 million metric tons in fiscal year 2023. Thus, the oil & gas industry in the country has been flourishing, with players making investments to ramp up production volumes to cater to the burgeoning demand. The Government of India has approved an order allowing 100% foreign direct investment (FDI) in sectors including petroleum products, refineries, and natural gas under automatic route for oil & gas public sector undertakings. The country also has a highly diversified chemical processing industry, which manufactures more than 70,000 products. It stands third among the largest chemical producers in Asia, in terms of volume, and it ranks seventh by output globally. According to the India Brand Equity Foundation, India is the fourth-largest producer of agrochemicals across the world. The country accounts for ~16% of the world’s dyestuffs and dye intermediates produced. The colorant industry in the country has emerged as a business with a global market share of ~15%.

The chemicals industry in the Middle East continues its dominance in global petrochemical production. The diversification strategy implemented by several players in the petrochemical field is a factor favoring the growth of the chemicals industry in this region. For instance, Saudi Aramco joined Dow Chemical to set up a joint venture that includes process units for the production of a wide range of chemicals, including glycol ethers, polyether polyols, polyolefin elastomers, isocyanates, and propylene glycol. Saudi Aramco completed the acquisition of a 70% stake in SABIC through the Public Investment Fund of Saudi Arabia to integrate their petrochemicals businesses and refining processes to address the competitive needs of the global market.

Thus, such developments in the oil & gas and chemicals industries in developing countries are likely to create significant expansion opportunities for industrial absorbents market players during the forecast period.

Industrial Absorbents Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial absorbents market analysis are product type, type, and end-use Industry.

- The industrial absorbents market, based on product type, is segmented into pads, rolls, pillows, booms, socks, and others. The booms segment held the largest market share in 2023.

- By type, the market is segmented into universal, oil-only, and hazmat/chemical. The hazmat/chemical segment accounted for the largest share of the industrial absorbent market in 2023.

- In terms of end-use industry, the industrial absorbents market is segmented into oil & gas, chemical, food processing, healthcare, automotive, and others. The oil & gas segment led the market in 2023 with the largest revenue share.

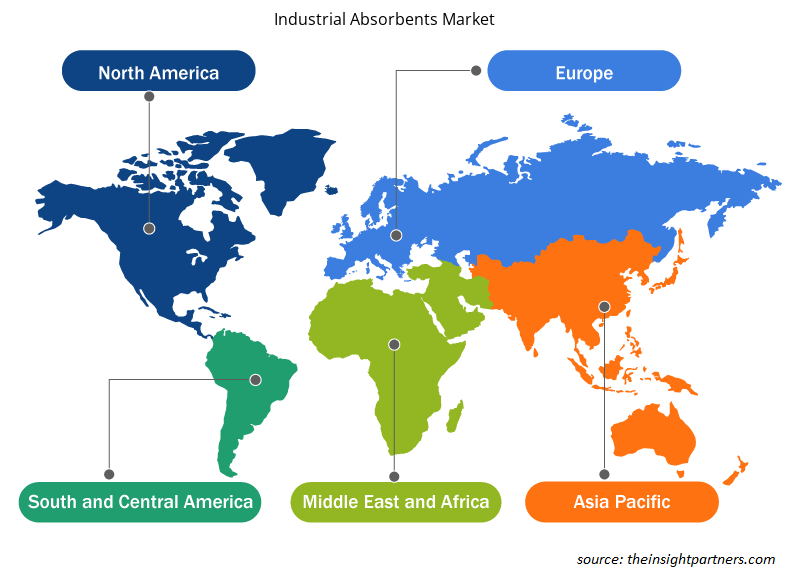

Industrial Absorbents Market Share Analysis by Geography

In terms of geography, the industrial absorbents market is primarily segmented into North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. Asia Pacific held the largest market share in 2023 and is expected to register the highest CAGR during the forecast period. Asia Pacific has been one of the prominent markets for industrial absorbents, owing to the rapid growth of the chemicals, oil & gas, healthcare, automotive, and food processing industries, among others. Government initiatives and policies encourage the setup of different manufacturing plants by encouraging FDIs, further bolstering industrialization in their respective countries. China, South Korea, India, Australia, and Japan are among the key contributors to the industrial absorbents market in Asia Pacific. China held the largest share of the market in 2023, followed by India with the second-largest share. The China Maritime Safety Administration keeps an eye on marine pollution incidents in Chinese waters, and it is also responsible for conducting investigations and responding to these mishaps. The country also put into effect a series of new pollution regulations to control transportation via ships during 2010–2012. Such a stringent regulatory environment favors the industrial absorbent market growth in China.

Industrial Absorbents Market Regional Insights

The regional trends and factors influencing the Industrial Absorbents Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Absorbents Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Absorbents Market

Industrial Absorbents Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.94 Billion |

| Market Size by 2031 | US$ 5.50 Billion |

| Global CAGR (2023 - 2031) | 4.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Industrial Absorbents Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Absorbents Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Absorbents Market are:

- 3M Co

- Ansell Ltd

- Brady Corp

- Decorus Europe Ltd

- Meltblown Technologies Inc

- Oil-Dri Corp of America

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Absorbents Market top key players overview

Industrial Absorbents Market News and Recent Developments

The industrial absorbents market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Finite Fiber launched PurAbsorb, an industrial super absorbent for efficient spill cleanup. (Source: Finite Fiber, Press Release, Jan 2024)

- Progressive Planet Solutions Inc. acquired Absorbent Products Ltd, a dominant manufacturer of mineral-based products derived from diatomaceous earth, zeolite, and bentonite. (Source: Progressive Planet Solutions Inc, Press Release, Feb 2022)

- Domtar expanded its Engineered Absorbent Materials (EAM) manufacturing plant in Jesup, Georgia, to support its air-laid nonwoven business. (Source: Domtar, Press Release, May 2021)

Industrial Absorbents Market Report Coverage and Deliverables

The “Industrial Absorbents Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Industrial absorbents market size and forecast for all the key market segments covered under the scope

- Industrial absorbents market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Industrial absorbents market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the industrial absorbents market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- EMC Testing Market

- Employment Screening Services Market

- Lyophilization Services for Biopharmaceuticals Market

- Battery Testing Equipment Market

- Nuclear Waste Management System Market

- Sleep Apnea Diagnostics Market

- Grant Management Software Market

- HVAC Sensors Market

- Pressure Vessel Composite Materials Market

- Vaginal Specula Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Type, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 4.3% during 2023–2031.

Increased use in different end-use industries and rising environmental concerns associated with chemical and oil spills fuel the market growth.

In 2023, Asia Pacific held the largest share of the global industrial absorbents market. Asia Pacific has been one of the prominent markets for industrial absorbents, owing to growth in chemical, healthcare, food processing, and other sectors. The rise in foreign direct investments leads to regional economic growth, further bolstering industrialization in the region.

The booms segment held the largest share in the global industrial absorbents market in 2023. An absorbent boom is a temporary floating barrier used to contain an oil spill. Booms reduce the possibility of polluting shorelines and other resources and help make the recovery from spills easier. These factors led to the dominance of the booms segment in 2023.

The adoption of biodegradable absorbents is expected to emerge as a future trend in the market.

3M Co, Ansell Ltd, Brady Corp, Decorus Europe Ltd, Meltblown Technologies Inc, Oil-Dri Corp of America, Schoeller Industries, Fentex Ltd, Complete Environmental Products Inc, TOLSA SA, SpillTech Environmental Inc, New Pig Corp, Empteezy Ltd, and Green Stuff Absorbentes are among the leading market players.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Industrial Absorbents Market

- 3M Co

- Ansell Ltd

- Brady Corp

- Decorus Europe Ltd

- Meltblown Technologies Inc

- Oil-Dri Corp of America

- Schoeller Industries

- Fentex Ltd

- Complete Environmental Products Inc

- TOLSA SA

- SpillTech Environmental Inc

- New Pig Corp

- Empteezy Ltd

- Green Stuff Absorbentes

Get Free Sample For

Get Free Sample For