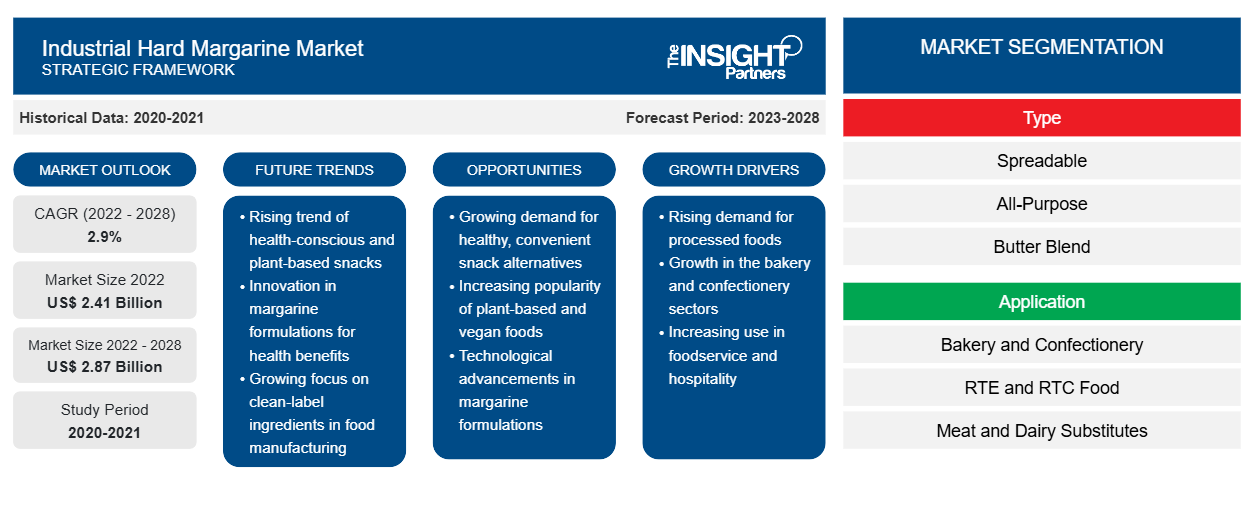

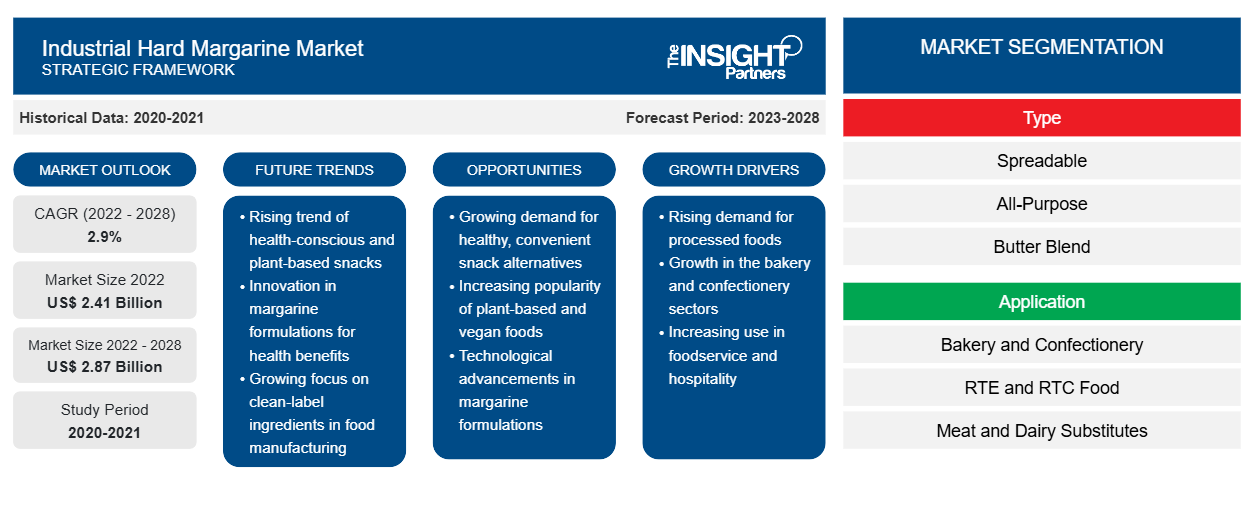

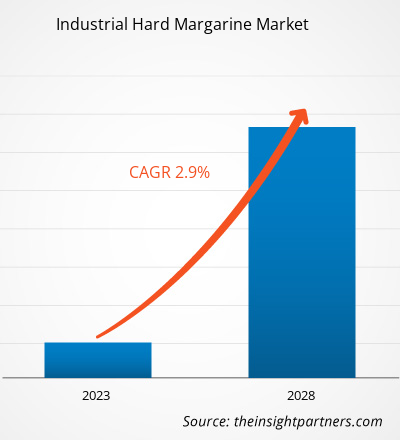

The industrial hard margarine market size is expected to grow from US$ 2,414.51 million in 2022 to US$ 2,869.63 million by 2028; it is estimated to register a CAGR of 2.9% from 2022 to 2028.

Margarine is produced by hydrogenating vegetable oils such as palm oil, sunflower oil, canola oil, and safflower oil. Generally, hard margarine has more saturated fatty acid content than other types of margarine, such as soft/tub margarine and liquid margarine. The rising demand for hard margarine in the food & beverages industry for bakery and confectionery applications is significantly driving the market. Moreover, the rising consumption of packaged bakery products due to changing lifestyles and evolving consumer preferences is driving the industrial hard margarine market

In 2022, North America held the largest share of the industrial hard margarine market. The market in Asia Pacific is estimated to grow at the highest CAGR during the forecast period. Consumers are moving toward a healthy lifestyle and preferring products that provide health benefits, owing to the growing incidence of diseases such as diabetes, high blood pressure, and constipation. According to the Centers for Diseases Control and Prevention (CDC), 37.3 million people in the US had diabetes in 2021. Further, the demand for plant-based food has increased in the young population, which is fueling the industrial hard margarine market growth. In addition, the well-established food processing industry in the region uses industrial hard margarine to prepare several food products. Key food processing manufacturers in the region are focusing on the adoption of low-cost alternatives to butter, which is surging the demand for industrial hard margarine.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Hard Margarine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Hard Margarine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Industrial Hard Margarine Market

The COVID-19 pandemic affected economies and industries in various countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the food & beverages industry. The shutdown of manufacturing units disrupted global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. Moreover, the bans imposed by governments of various countries in Europe, Asia Pacific (APAC), and North America on international travel compelled companies to temporarily discontinue their collaboration and partnership plans. All these factors hampered various industries in 2020 and early 2021, thereby restraining the growth of various markets, including the industrial hard margarine market.

Rising demand for margarine as a low-cost alternative to butter, growing requirement for margarine from the food industry in emerging economies, and increasing consumer enthusiasm toward adopting a healthy lifestyle were the key factors that boosted the growth of the industrial hard margarine market. Before the onset of the COVID-19 outbreak, the industrial hard margarine market was also driven by the rising consumption of bakery products and growing demand for affordable, sustainable, and healthier ingredients by food manufacturers. However, industries experienced unprecedented challenges after the onset of the COVID-19 pandemic in 2020, including supply chain constraints caused by nationwide lockdowns, trade bans, and travel restrictions. The supply chain disruptions created a shortage of raw materials, which affected the production and distribution of various products, leading to increased prices.

In 2021, various economies resumed operations as governments of various countries announced relaxation in the previously imposed restrictions, which boosted the global marketplace. Further, manufacturers were permitted to operate at full capacity, which helped them overcome the demand and supply gap and other repercussions.

Further, the COVID-19 pandemic had a long-term favorable impact on the industrial hard margarine market as the food processing industries observed a remarkable growth owing to rising demand for process and convenience food. The growing adoption of industrial hard margarine by food manufacturers to replace butter with a low trans-fat substitute fueled the market growth. Consumers gravitated toward a healthy lifestyle and increased adoption of healthy food options due to the rising number of COVID-19 patients. Due to the COVID-19 pandemic, consumers have been increasingly attentive to their health and wellness. Furthermore, the market witnessed an increased demand for food products with high clean ingredients used in them, which boosted the sales of industrial hard margarine. As consumers' focus increased on finding healthier alternatives during the pandemic, the need for industrial hard margarine also grew globally.

Market Insights

Strategic Developments by Key Players Favor Industrial Hard Margarine Market Growth

In June 2022, AAK AB acquired the aquafaba-fueled plant-based 'Butter'' brand For A: Butter: It can act as a 1:1 replacement for dairy butter. Additionally, in June 2021, Bunge Loders Croklaan, the plant-based lipids business of Bunge (NYSE: BG), announced the plan to build a state-of-the-art, sustainable production facility in the Port of Amsterdam. Such strategic developments by key players in the market are expected to propel the growth of the industrial hard margarine market in the coming years.

Type Insights

Based on type, the industrial hard margarine market is segmented into spreadable, all-purpose, and butter blend. The all-purpose segment held the largest market share in 2022, and the spreadable segment is expected to register the highest CAGR during the forecast period. Spreadable margarine is a soft tub margarine made with less hydrogenated and more liquid oils than block margarine. It is typically composed of vegetable oils. Margarine spread has various applications, ranging from ready-to-eat products such as toast sandwiches and cakes to sponge production. Manufacturers offer spreadable margarine in different fat contents categorized as high-fat, medium-fat, low-fat, and very low-fat spreads. The low and very low-fat spreads are developed for ready-to-eat product applications. The industrial hard margarine market is witnessing several trends, including the development of flavored spreads, diet spreads, and balanced spreads.

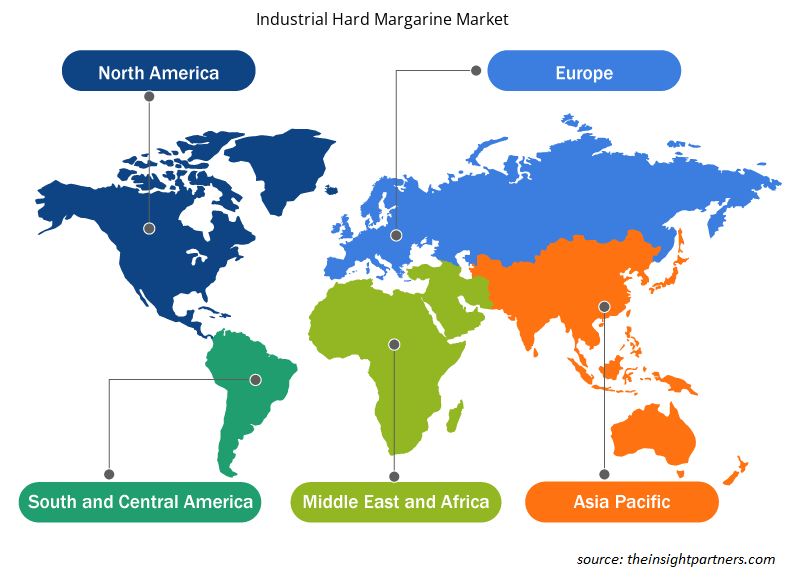

Industrial Hard Margarine Market Regional Insights

Industrial Hard Margarine Market Regional Insights

The regional trends and factors influencing the Industrial Hard Margarine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Hard Margarine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Hard Margarine Market

Industrial Hard Margarine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.41 Billion |

| Market Size by 2028 | US$ 2.87 Billion |

| Global CAGR (2022 - 2028) | 2.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Industrial Hard Margarine Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Hard Margarine Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Hard Margarine Market are:

- Vandemoortele NV

- Bunge Ltd

- Puratos NV

- NMGK Group of Co

- Fuji Oil Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Hard Margarine Market top key players overview

Application Insights

Based on application, the industrial hard margarine market is segmented into bakery and confectionery, RTE and RTC food, meat and dairy substitutes, and others. The bakery and confectionery segment is subsegmented into cookies and biscuits, cakes, flaky pastries, and other bakery and confectionery. The bakery and confectionery segment held the largest market share in 2022 and is expected to register the highest CAGR during the forecast period. Increasing purchasing power and changing eating habits of people have led to the increasing popularity of bakery and confectionery products among the masses. Bakery products such as biscuits account for a major share of the total bakery products produced worldwide. The bakery sector comprises cakes, puffs, frozen bakery products, etc. Hard margarine is an integral baking ingredient as it provides tenderness, improved texture, and a better sensory profile and increases the nutritional value of food.

Vandemoortele NV, Bunge Ltd, Puratos NV, NMGK Group of Co, Fuji Oil Co Ltd, Wilmar International Ltd, Nubeser Soluciones SLU, Cardowan Creameries Ltd, AAK AB, and Eccelso Ltd are among the major players operating in the industrial hard margarine market. These companies mainly focus on product innovation to expand their market size and follow emerging trends.

Report Spotlights

- Progressive industry trends in the industrial hard margarine market to help companies develop effective long-term strategies

- Business growth strategies adopted by market players in developed and developing countries

- Quantitative analysis of the market from 2022 to 2028

- Estimation of global demand for industrial hard margarine

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the industrial hard margarine market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and growth drivers and restraints in the industrial hard margarine market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the industrial hard margarine market at various nodes

- Detailed overview and segmentation of the market and growth dynamics of the industrial hard margarine industry

- Size of the industrial hard margarine market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Belgium, Brazil, Canada, China, Czech Republic, France, Germany, Hungary, India, Italy, Japan, Mexico, Netherlands, Poland, Romania, Saudi Arabia, Slovakia, South Africa, South Korea, Spain, United Arab Emirates, United States

Frequently Asked Questions

Based on the application, bakery and confectionery segment is projected to grow at the fastest CAGR over the forecast period. Increasing purchasing power and changing eating habits of people has surged the growth of bakery and confectionery segment.

Margarine is traditionally produced by the hydrogenation of vegetable oils such as palm oil, canola oil, rapeseed oil, and safflower oil. Being a cheaper alternative to butter, it is widely used in the industrial-scale production of bakery products, which may allow manufacturers to lower the prices of their final products. With characteristics that are similar to butter, margarine improves the texture and stability of various bakery products, such as cakes, flaky pastries, cookies, biscuits, and croissants. Moreover, it is convenient to use and has a high shelf life. Margarine has less saturated fat content compared to butter. Moreover, it is free from any animal-derived ingredients. Nowadays, manufacturers are providing margarine that is free of palm oil, which is increasing their appeal among consumers.

North America accounted for the largest share of the global industrial hard margarine market. North America is one of the most significant regions for the industrial hard margarine market owing to consumers are moving toward a healthy lifestyle and preferring products that provide health benefits and well-established food industry.

Based on type, all-purpose segment mainly has the largest revenue share. The growth of the segment is attributed to its characteristic features such as softness, aroma, and creaminess. The ingredients provide the all-purpose margarine with a uniform structure and a smooth crust.

The major players operating in the global industrial hard margarine market are Vandemoortele NV, Bunge Ltd, Puratos NV, NMGK Group of Co, Fuji Oil Co Ltd, Wilmar International Ltd, Nubeser Soluciones SLU, Cardowan Creameries Ltd, AAK AB, and Eccelso Ltd.

Manufacturers are also developing new technologies to launch palm-free margarine with no undesirable flavors. Rapeseed oil and other alternatives to palm oil are associated with various challenges, including intense organoleptic properties, high oxidation potential, and individual processing requirements. In March 2021, Grüninger AG, a Swiss producer of industrial and commercial margarine, developed a new technology to launch palm-free, vegan/vegetarian margarine, in which off-note flavors are effectively masked. The new process developed by Grüninger AG helps in masking the undesirable flavors of palm oil alternatives by using the natural antioxidant derived from rosemary extract. Such new technologies are expected to provide potential growth opportunities to the manufacturers of industrial hard margarine.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Industrial Hard Margarine Market

- Vandemoortele NV

- Bunge Ltd

- Puratos NV

- NMGK Group of Co

- Fuji Oil Co Ltd

- Wilmar International Ltd

- Nubeser Soluciones SLU

- Cardowan Creameries Ltd

- AAK AB

- Eccelso Ltd

Get Free Sample For

Get Free Sample For