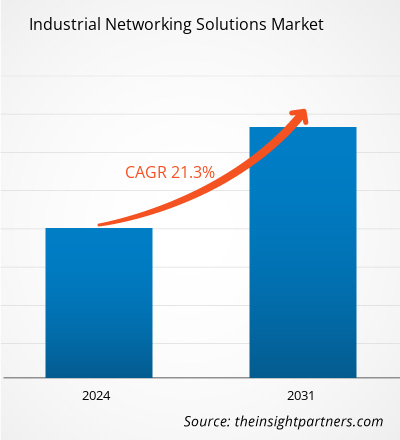

The industrial networking solutions market size is expected to reach US$ 137.70 billion by 2031 from US$ 29.45 billion in 2023. The market is estimated to record a CAGR of 21.3% from 2023 to 2031. The increasing demand for SD-WAN solution is likely to remain a key market trend.

Industrial Networking Solutions Market Analysis

By leveraging advanced networking technologies, industries can monitor and analyze data in real time, enabling them to analyze potential issues and perform proactive maintenance, thus, minimizing downtime and optimizing operational efficiency. Another significant driver is the growth of the Industrial Internet of Things (IIoT). As more industrial devices and equipment become connected, there is a growing need for robust networking solutions that can support the ever-increasing number of connected devices, handle the massive amounts of data generated, and ensure secure and reliable communication. In addition to these drivers, other factors, such as the increased focus on cybersecurity, the integration of cloud computing in industrial networks, and the demand for high-speed and low-latency communication, are also contributing to the industrial networking solutions market growth.

Industrial Networking Solutions Market Overview

Industrial networking is the use of networking technologies and protocols to connect industrial devices and systems, such as sensors, controllers, and other equipment, to allow for communication and data sharing. Industrial networks provide communication between control system components. Control communications can affect performance, quality, and reliability. Furthermore, control devices or the controller itself play an essential role in acquiring information to support layered analytics, such as Supervisory Control and Data Acquisition (SCADA), Artificial Intelligence (AI), and Machine Learning (ML). Further, the growing adoption of industrial networking solutions in automotive, BFSI, manufacturing, telecommunication, logistics, and transportation, among other industries, is expected to boost market growth during the forecast period.

Overall, the rise in demand for wireless technologies, the need for predictive maintenance, and the growth of the Industrial IoT are contributing to the growing industrial networking solutions market. This market presents significant opportunities for businesses operating in this marketplace to provide innovative and reliable networking solutions to meet the evolving needs of industries.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Networking Solutions Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Networking Solutions Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Networking Solutions Market Drivers and Opportunities

Increasing Adoption of Wireless Technologies

There is a growing utilization of wireless technologies in industrial operations, driven by the demand for flexibility, mobility, and scalability in industrial networks. Wireless networks offer advantages such as easy reconfiguration, adaptability to changing environments, seamless connectivity on the go, and the ability to add new devices and expand network coverage without extensive infrastructure modifications. This trend allows organizations to futureproof their network infrastructure and prepare for advancements in wireless technology. Ultimately, the adoption of wireless technologies in industrial operations is revolutionizing the design and deployment of industrial networks, providing greater flexibility, mobility, scalability, and futureproofing capabilities. This enables organizations to enhance productivity, improve operational efficiency, and meet the growing needs of the industrial landscape, further boosting the industrial networking solutions market growth.

Market players are emphasizing product and technology development. For instance, in May 2022, Rajant Corporation—the pioneer of Kinetic Mesh wireless networks—and Acubis Technologies, a Kinetic Mesh Premier Partner (KMPP) in Australia, delivered the first FE1 series BreadCrumbs–Rajant Peregrine and Hawk–to a government-owned utilities provider in southwest Queensland. Acubis Technologies was selected to provide a wireless industrial networking solution capable of handling the demands of utility providers. The latest FE1 Series BreadCrumbs, Peregrine, and Hawk, with InstaMesh, proved to be the industrial networking solution of choice for the client, providing high bandwidth and ruggedized mobile connections throughout their entire operations. Such developments are boosting the industrial networking solutions market growth.

Emergence of Industry 4.0

Industry 4.0 is the result of the digital transformation in numerous industries, bringing real-time decision-making, increased productivity, flexibility, and agility to alter the business's operations. Industry 4.0 allows stakeholders to optimize facilities and increase efficiency by leveraging interconnected industrial equipment and advanced computation. The Fourth Industrial Revolution refers to the rapid transformation of 21st-century technology, industries, societal patterns, and procedures as a result of interconnectedness and intelligent automation. Multiple industries are looking to increase the operational efficiency of their assets and production systems through convergence and digitization, leveraging innovative technologies in the Industrial Internet of Things (IIoT) and Industry 4.0. However, these initiatives must securely connect production environments to standard networking technologies for industries and their key partners to gain access to a rich stream of new data, real-time visibility, and remote access to operational systems and assets. With Industry 4.0, industrial applications and digitalization efforts may benefit from LTE/4G.

Additionally, it is a key step to boost the adoption of cellular technology in industrial verticals and create the framework for future advanced networking. The benefits of Industry 4.0 processes, technologies, and systems include enhanced productivity and efficiency, better flexibility and agility, and increased profitability in networking solutions. Thus, the emergence of Industry 4.0 is expected to create opportunities for the industrial networking solutions market growth during the forecast period.

Industrial Networking Solutions Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial networking solutions market analysis are component, technology, and end user.

- In terms of component, the market is segmented into hardware and software & services.

- Based on connectivity, the market is categorized into wired and wireless.

- Based on deployment, the market is bifurcated into on-premises and cloud.

- Based on end-use industry, the market is segmented into automotive, BFSI, manufacturing, telecommunication, logistics & transportation, and others.

Industrial Networking Solutions Market Share Analysis by Geography

- The industrial networking solutions market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- The market in Asia Pacific is experiencing significant growth due to the rise in the adoption of automation, government initiatives, and a robust manufacturing sector. This growth is fueled by technological advancements, including the integration of the Industrial Internet of Things (IIoT), edge computing, and wireless communication. These technological developments have greatly improved connectivity and real-time monitoring capabilities in industrial environments, leading to increased efficiency and productivity.

- China dominates the market in Asia Pacific, holding the largest industrial networking solutions market share, followed by India. Both countries are experiencing a notable increase in the adoption of wireless technologies and cloud services and heightened security concerns, driving the demand for industrial networking solutions. Furthermore, the implementation of industrial IoT solutions is contributing positively to the market expansion in this region.

Industrial Networking Solutions Market Regional Insights

The regional trends and factors influencing the Industrial Networking Solutions Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Networking Solutions Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Networking Solutions Market

Industrial Networking Solutions Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 29.45 billion |

| Market Size by 2031 | US$ 137.70 Billion |

| Global CAGR (2023 - 2031) | 21.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

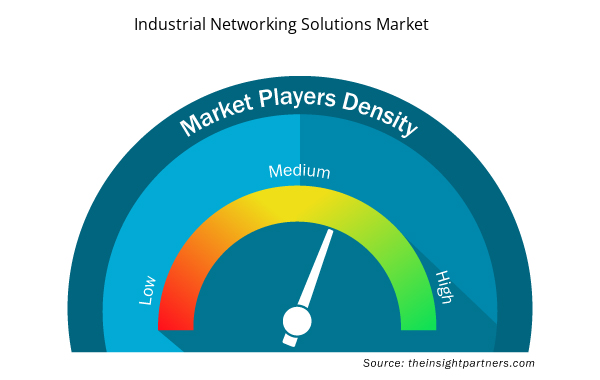

Industrial Networking Solutions Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Networking Solutions Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Networking Solutions Market are:

- ABB

- Belden Inc.

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Moxa Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Networking Solutions Market top key players overview

Industrial Networking Solutions Market News and Recent Developments

The industrial networking solutions market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the industrial networking solutions market are listed below:

- Fortinet expanded its lineup of industrial network protection solutions. The company has introduced new hardware and software additions to its OT Security Platform, specifically designed to safeguard assets connected to industrial networks. These additions aim to help enterprises converge their operational technology (OT) and information technology (IT) network operations while ensuring the protection of critical resources. (Source: Fortinet, Press Release, December 2023)

- RS Components formed a strategic partnership with HMS Networks to enhance its range of industrial equipment networking solutions. The collaboration aims to broaden the selection of networking solutions available to customers, enabling them to connect and integrate their industrial equipment more effectively. (Source: RS Component, Press Release, July 2022)

Industrial Networking Solutions Market Report Coverage and Deliverables

The "Industrial Networking Solutions Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Industrial networking solutions market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Industrial networking solutions market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Industrial networking solutions market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the industrial networking solutions market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Connectivity, Deployment, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to reach a value of US$ 137.7 billion by 2031.

Increasing demand for SD-WAN solutions is a key trend in the market.

Cisco Systems, Inc., Nokia, Rockwell Automation, Inc., Hewlett Packard Enterprise Development LP, and Huawei Technologies Co., Ltd. are major players in the market.

Asia Pacific dominated the industrial networking solutions market in 2023.

The increasing adoption of wireless technologies and the rising need for predictive maintenance are driving the market growth.

The market is anticipated to expand at a CAGR of 21.3% during 2023-2031.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Industrial Networking Solutions Market

- ABB

- Belden Inc.

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Moxa Inc.

- Nokia

- Rockwell Automation, Inc.

- Semtech

- Siemens

Get Free Sample For

Get Free Sample For