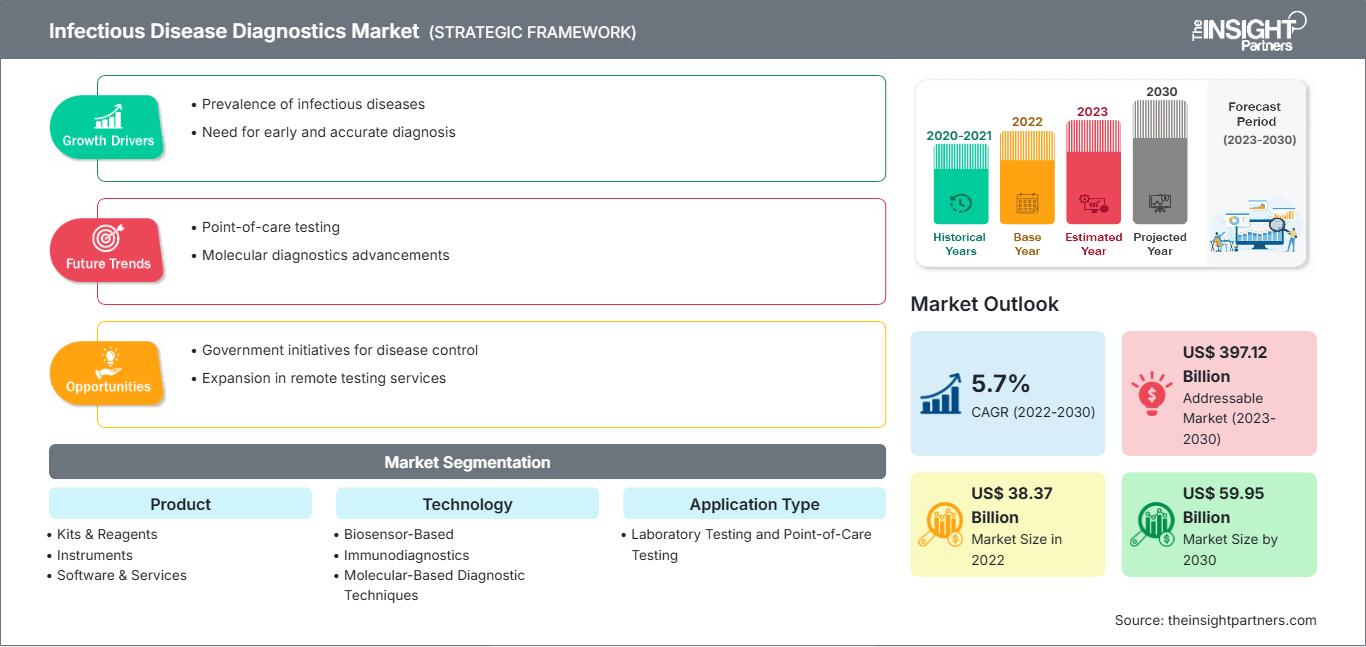

Infectious Disease Diagnostics Market Drivers and Forecasts by 2030

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Infectious Disease Diagnostics Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Product (Kits & Reagents, Instruments, and Software & Services), Technology (Biosensor-Based, Immunodiagnostics, Molecular-Based Diagnostic Techniques, Clinical Biology, and Others), Application Type (Laboratory Testing and Point-of-Care Testing), Testing Type (Human Testing and Veterinary Testing), End User (Diagnostic Laboratories, Hospitals & Clinics, Research Institutes, Homecare Settings, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

- Report Date : Nov 2023

- Report Code : TIPHE100001430

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 280

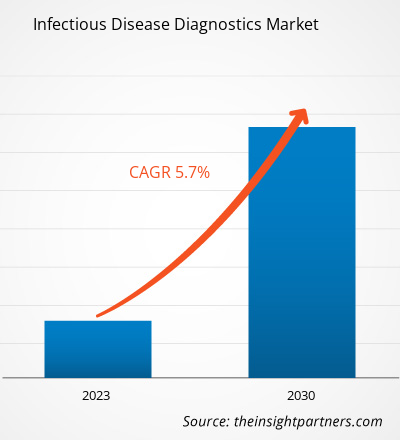

[Research Report] The infectious disease diagnostics market is expected to grow from US$ 38,366.38 million in 2022 to US$ 59,954.22 million by 2030; it is anticipated to register a CAGR of 5.7% from 2022 to 2030.

Market Insights and Analyst View:

The infectious disease diagnostics market size is expanding with the rising cases of infectious diseases and increasing product launches and product approvals due to development of technologically advanced products. In May 2022, BD launched its fully automated, high-throughput infectious disease molecular diagnostic platform—BD COR MX instrument—in the US. This instrument automates and integrates the complete molecular laboratory workflow, from the processing of samples to the result of the diagnostic test for large, high-throughput labs. The BD COR System eliminates the task of sorting specimens, aiding the lab tech to have minimal interaction with the specimen, thereby freeing up time for other critical lab processes. In response to the growing cases of infectious diseases and the shortage of laboratory capabilities and molecular testing reagents, some diagnostic testing manufacturers offer rapid and easy-to-use devices to facilitate out-of-laboratory testing.

Growth Drivers and Challenges:

Veterinary infectious diseases negatively impact the health of domestic animals, livestock, and wildlife. As a result of intensive animal farming, there are conditions for the emergence and amplification of disease epidemics due to the genetic and physical proximity of the billions of animals, often in frail health, that are raised indoors every year. Moreover, animal farming contributes to the spread of infections from wild animals due to deforestation caused by the expansion of agricultural land use.

Diagnostic technologies that can detect emerging infectious animal diseases at an early stage are essential to reduce economic losses associated with outbreaks of such diseases. Polymerase chain reaction (PCR) remains the most widely used molecular assay globally to detect animal pathogens. Diagnostic methods of this type are easy to use, cost-effective, susceptible, and specific, with the ability to detect at a high volume.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infectious Disease Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Even though conventional virological methods are incredibly reliable, they are time-consuming and labor-intensive procedures. Lateral flow and enzyme-linked immunosorbent assay can be used for rapid detection. Multiplex bead immuno or Luminex assay is a fluorescent beads-based high-throughput quantitative technique used for the detection of multiple antibodies specific for different infectious diseases at the same time in a single reaction, leading to more rapid, economical, and accurate results compared with conventional ELISA. In addition, the protein chip based on surface plasmon resonance (SPR) appears to be a rapid valuable tool in the sero-diagnosis of infection or antibody titration. Recombinant antibodies can also be produced in heterologous systems by using rDNA technology and used for developing diagnostic tests.

Point-of-care diagnostics (POCDs) are simple, rapid, and portable diagnostic devices that can detect the disease status at the field level. In recent years, real-time PCR (qPCR) has been transitioned into a POCD platform. These fully automated platforms combine nucleic acid extraction, thermal cycling, and on-site reporting results. For instance, MiniLab from Enigma Diagnostics is a molecular diagnostic platform of 10–35 kg that is carried at the field level and used for validating African swine fever virus, classical swine fever virus, avian influenza virus, and foot-and-mouth disease virus for research purposes. The genesig detection kits of Primerdesign Ltd, UK supply lyophilized qPCR assay kits for the diagnosis of 62 bovine, 42 equine, 47 porcine, 60 avian, 40 canine, and 26 feline pathogens for research purposes. Similarly, Boster offers Bosterbio qPCR kits to detect up to 48 individual or pooled samples. It is used for gene expression profiling, target DNA quantification, microbial detection, viral or bacterial pathogen load determination, and evaluation of primer pair performance for probe-based qPCR.

Thus, diagnostics methods such as PCR and qPCR to diagnose bacterial, viral, fungal, and parasitic infections in animals is fueling the diagnostics in veterinary diagnosis.

Low reimbursement rates for most diagnostic tests discourage manufacturing companies from developing new tests and conducting research on a large scale to support widespread use. Also, reimbursement remains low if there is data with no expected results to support the cost-effectiveness of the new test or prove the existing test.

Difficulties and concerns about the reimbursement of new or expensive diagnostic tests can impede innovation and pose significant challenges to the widespread deployment of diagnostic technologies. In the US, reimbursement comprises coverage by third-party payers, coding of health services or conditions to determine payment, and determination of payment level.

For outpatient tests with Current Procedural Terminology (CPT) codes, the Medicare Coverage Advisory Committee promotes the Centers for Medicare & Medicaid Services (CMS) regarding diagnostic test coverage, including the determination of sufficient evidence and health benefits. However, most Medicare reimbursement decisions are made locally and not at the national level. Coverage for diagnostic tests differs as per region. Also, the lack of standards in determining coverage can pose challenges for the development and availability of a new diagnostic product.

In some cases, the reimbursement does not cover test cost, which limits laboratories in offering the test and reduces test availability and use. In other cases, the charge may be high but may leave a considerable cost to the patient, which limits physicians from ordering the test routinely. Compliance and billing remain challenges for clinical laboratories and limit testing availability. Thus, the inadequate reimbursement scenario hinders the growth of the infectious disease diagnostics market.

Report Segmentation and Scope:

The infectious disease diagnostics market, by product, is segmented into kits & reagents, instruments, and software & services. The infectious disease diagnostics market, by technology, is segmented into biosensor-based, immunodiagnostics, molecular-based diagnostic, clinical biology, and others. The market for the immunodiagnostics segment is further segmented into enzyme-linked immunosorbent assay, western blotting analysis, and immunofluorescence assay. The market for the molecular-based diagnostic techniques segment is further segmented into polymerase chain reaction, in situ hybridization, isothermal nucleic acid amplification technology, next generation sequencing, DNA microarrays, and others. The infectious disease diagnostics market, by application type, is bifurcated into point-of-care testing and laboratory testing. The infectious disease diagnostics market, by testing type, is bifurcated into human testing and veterinary testing. The market for the human testing segment is further segmented into HIV, Hepatitis, HAIs, HPV, tuberculosis, influenza, and others. The infectious disease diagnostics market, by end user, is segmented into diagnostic laboratories, hospitals and clinics, research institutes, homecare settings, and others. Based on geography, the infectious disease diagnostics market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The infectious disease diagnostics market, by product, is segmented into kits & reagents, instruments, and software & services. In 2022, the kits & reagents segment held the largest share of the market. However, the market for the software & services segment is expected to grow at the fastest rate during 2022–2030. The kits and reagents segment is growing due to the presence of a large number of manufacturers such as Abbott; F. Hoffmann-La Roche Ltd; and Bio-Rad Laboratories, Inc. Further, in response to the growing cases of infectious diseases such as HAIs, influenza, and HIV and shortages of laboratory-based molecular testing capacity and reagents, multiple diagnostic test manufacturers have developed and begun selling rapid and easy-to-use devices to facilitate testing outside of laboratory settings. Moreover, kits and reagents are frequently used in various research processes, and there is a constant rise in product launches. For instance, in July 2021, Cepheid announced that it had received CE-IVD clearance for Xpert HIV-1 Viral Load XC and Xpert HIV-1 Qual XC, next-generation extended-coverage (XC) tests for HIV testing. Xpert HIV-1 Viral Load XC provides a second target for HIV-1 detection that provides extended strain coverage to improve performance and reduce the risk of false negative results due to gene mutations or deletions. Hence, owing to the presence of the various market players that are offering multiple reagents & kits and the rise in technological advancements, the segment is expected to grow during the forecast period.

The software and service segment is anticipated to grow in the coming years owing to factors such as rising technological advancement and the adoption of new software to reduce the infectious disease burden. Many companies are launching software to analyze the rising incidence of infectious diseases, predict trends over time and breakout situations, and assess the effectiveness of containment measures. Consequently, several statistical models have been established, primarily based on the susceptible-exposed-infected-recovered or removed (SEIR) model. Additionally, inspired by multidisciplinary and collaborative efforts in the scientific community, the Institute for Disease Modeling has been building modeling tools that result from extensive collaboration among members of research and software teams. These tools provide quantitative and analytical means to represent the transmission of infectious diseases with a model. IDM software tools are freely and openly shared with the scientific community to speed up disease eradication efforts with the help of computational modeling. Thus, such initiatives taken by the key players are also expected to boost the segment growth in the coming years.

Regional Analysis:

Based on geography, the infectious disease diagnostics market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the largest contributor to the growth of the global infectious disease diagnostics market. Asia Pacific is expected to register the highest CAGR in the infectious disease diagnostics market during 2022–2030. The infectious diseases diagnostics market growth in the US is primarily driven by the increasing prevalence of infectious diseases, rising geriatric population, and growing number of product launches by key players. Aging is a prominent risk factor for infectious diseases, as people above 60 generally have compromised immunity. According to a study published by the Population Reference Bureau in 2020, the population of individuals aged 65 and above was 55 million in the US in 2020, and the number is expected to reach 95 million by 2060. Regulatory agencies in the US are imposing favorable policies for the development of point-of-care (POC) products for the diagnosis and treatment of various indications. In March 2021, the US Food Drug Administration (FDA) authorized Binx Health IO CT/NG Assay for community-based clinics, urgent care settings, and outpatient healthcare facilities; it is the first POC testing product for diagnosing chlamydial and gonorrheal infections. In May 2022, Becton Dickinson and Company (BD), one of the leading global medical technology companies, announced the launch of its new, fully automated, high-throughput molecular diagnostics platform for infectious diseases for the market in the US. The new BD COR MX instrument was launched as an analytical instrument option for the BD COR platform, with 510(k) clearance from the FDA. The BD CTGCTV2 molecular assay, the first test available on the new system, is a single test that detects the three most prevalent non-viral sexually transmitted infections (STIs)—Neisseria gonorrhoeae (GC), Chlamydia trachomatis (CT), and Trichomonas vaginalis (TV).

Infectious Disease Diagnostics Market Regional InsightsThe regional trends and factors influencing the Infectious Disease Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Infectious Disease Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Infectious Disease Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 38.37 Billion |

| Market Size by 2030 | US$ 59.95 Billion |

| Global CAGR (2022 - 2030) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Infectious Disease Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Infectious Disease Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Infectious Disease Diagnostics Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the Infectious Disease Diagnostics Market are listed below:

- In January 2023, Trinity Biotech announced a strategic partnership with imaware Inc that combined their built-to-partner digital health platform with Trinity Biotech’s advanced reference laboratory facilities to power the Digital Health Industry with at-home and remote testing programs.

- In November 2022, Bio-Rad Laboratories Inc expanded its product portfolio of independent quality controls, including InteliQ and Liquichek compact vials. The products will be used for Abbott's Alinity CI-Series, which is integrated with clinical chemistry and immunoassay testing instruments.

- In December 2021, F. Hoffmann-La Roche Ltd launched the first infectious disease tests on the cobas 5800 System, a new molecular laboratory instrument, in countries accepting the CE mark. These include cobas HIV-1, cobas HBV, cobas HCV, cobas HIV-1/HIV-2 Qualitative, and the cobas omni Utility Channel kit. These launches expand the Roche Molecular portfolio offering by providing standardized performance and efficiencies across low, medium, and high-volume molecular laboratory testing needs.

Competitive Landscape and Key Companies:

Abbott Laboratories, Bruker Corp, Cardinal Health, F. Hoffmann-La Roche Ltd, Trinity Biotech Plc, Danaher Corp, Bio-Rad Laboratories Inc, AccuBioTech Co Ltd, ACON Laboratories, and DiaSorin SpA are among the prominent players operating in the infectious disease diagnostics market. These companies focus on new product launches and geographic expansions to meet the growing consumer demand across the world and increase their product range in specialty portfolios. Their global presence allows them to serve a large base of customers, subsequently facilitating market expansion.

Frequently Asked Questions

What are the driving factors for the infectious disease diagnostics market across the country?

What is the infectious disease diagnostics market?

Who are the major players in market the infectious disease diagnostics market?

Which segment is dominating the infectious disease diagnostics market?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For