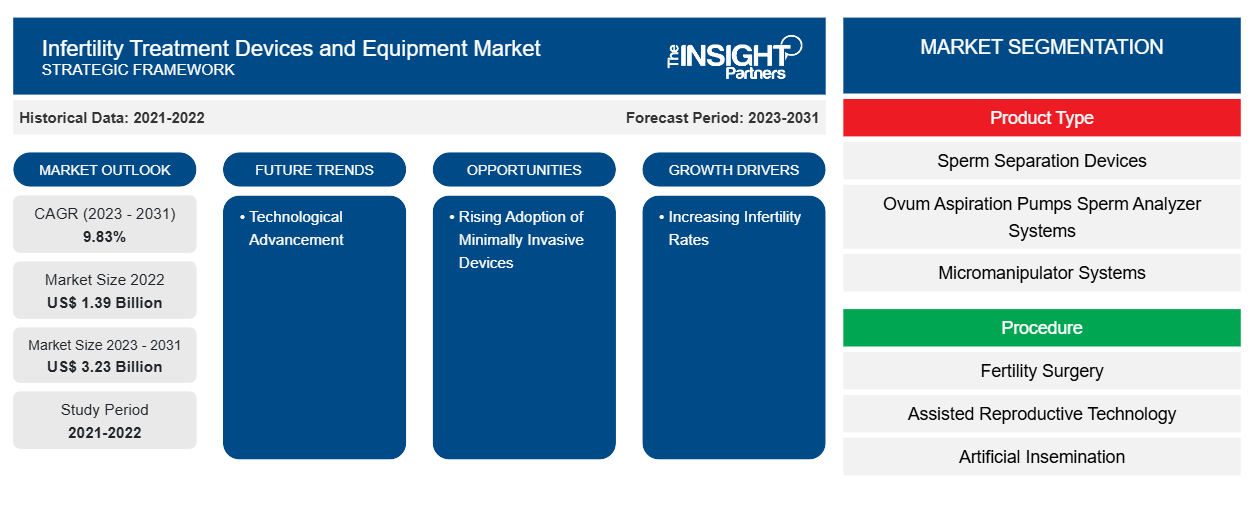

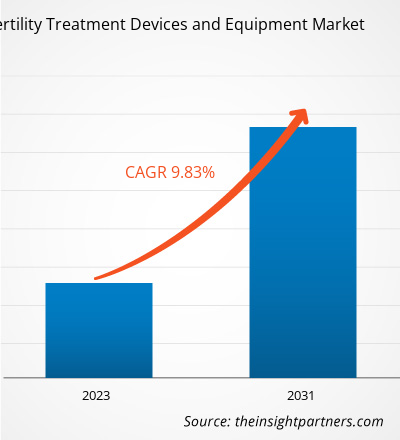

The Infertility Treatment Devices and Equipment Market size is projected to reach US$ 3.23 billion by 2031 from US$ 1.39 billion in 2022. The market is expected to register a CAGR of 9.83% in 2023–2031. The development of novel infertility treatments such as intracytoplasmic sperm injection are likely to remain key infertility treatment devices and equipment market trends.

Infertility Treatment Devices and Equipment Market Analysis

Infertility is the inability to conceive after one year of unprotected sex. The World Health Organisation (WHO) has recognized it as a public health issue. The global infertility treatment devices and equipment market is experiencing significant growth due to various factors, including the decreasing global fertility rate, the higher success rate of advanced reproductive technologies, and the growing support from the government and other healthcare organizations. These factors are expected to favor the development of new treatments to improve fertility.

Infertility Treatment Devices and Equipment Market Overview

As reported by the WHO, nearly 17.5% of the adults worldwide experience infertility. The lifetime prevalence of the condition was found to be 17.8% in high-income countries and 16.5% in low- and middle-income countries. Rising cases of infertility lead to a growth in the number of patients seeking infertility treatments. This highlighted the need for affordable, high-quality fertility care, which contributes to the expansion of the infertility treatment devices and equipment market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infertility Treatment Devices and Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infertility Treatment Devices and Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Infertility Treatment Devices and Equipment Market Drivers and Opportunities

High Success Rates of Advanced Infertility Treatment Technologies to Favor Market

Reproductive treatments have advanced significantly, expanding the options and success rates of infertility treatments such as Assisted Reproductive Technology (ART). According to an article published in Cureus in October 2022, in the coming years, IVF is anticipated to be widely used across multiple regions globally, leading to the birth of up to 10% of all children and the success rates of In vitro maturation (IVM) have increased up to 56% due to technological advancements, improved necessary tools, and the accumulated experience and training of those performing the procedure. In addition, fertility awareness methods, like ovulation tracking apps, have become more accessible and reliable, enabling informed family planning decisions

Minimally Invasive Devices– An Opportunity in Infertility Treatment

Several abnormalities and conditions, including uterine fibroids, müllerian anomalies, ovarian cysts, and endometriosis, can reduce the chances of pregnancy. These issues can also cause unpleasant side effects, including chronic pelvic pain and heavy bleeding. Surgical intervention can be the most effective treatment for these symptoms in such cases. Adoption of minimally invasive techniques such as laparoscopy and hysteroscopy can address the underlying cause of infertility with reduced pain, recovery time, risk of infection, and blood loss. The procedures involve using small incisions and high-definition cameras that project the area of operation onto a monitor rather than large, open incisions used in conventional surgeries.

infertility treatment devices and equipment market Report Segmentation Analysis

Key segments contributing to the derivation of the infertility treatment devices and equipment Market analysis are product type, procedure, and end user.

- Based on product type, the infertility treatment devices and equipment Market is divided into sperm separation devices, ovum aspiration pumps, sperm analyzer systems, micromanipulator systems, incubators, and others. The ovum aspiration pumps segment held the largest market share in 2023.

- By procedure, the market is segmented into assisted reproductive technology, fertility surgery, and artificial insemination. The artificial insemination segment held the largest market share in 2023. Furthermore, the assisted reproductive technology segment is expected to register the highest CAGR from 2023 to 2031.

- In terms of end user, the market is segmented into fertility clinics, hospitals and other healthcare facilities, and clinical research institutes. The fertility clinics segment dominated the market in 2023.

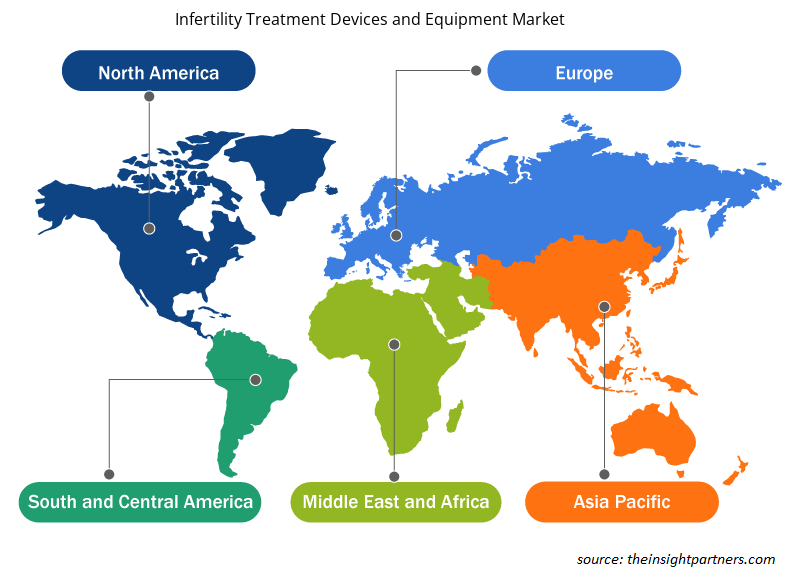

Infertility Treatment Devices and Equipment Market Share Analysis by Geography

The geographic scope of the infertility treatment devices and equipment market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the infertility treatment devices and equipment market. According to the US Department of Health and Human Services, in 2021, around 2.3% of infants born in the US were conceived using ART, with ~ 413,776 cycles performed at 453 clinics, resulting in 112,088 pregnancies. The increasing number of AR procedures such as IVF, growing infertility rates among men, and the presence of global market players are factors contributing to the dominance of the North America infertility treatment devices and equipment Market. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Infertility Treatment Devices and Equipment Market Regional Insights

Infertility Treatment Devices and Equipment Market Regional Insights

The regional trends and factors influencing the Infertility Treatment Devices and Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Infertility Treatment Devices and Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Infertility Treatment Devices and Equipment Market

Infertility Treatment Devices and Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.39 Billion |

| Market Size by 2031 | US$ 3.23 Billion |

| Global CAGR (2023 - 2031) | 9.83% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Infertility Treatment Devices and Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Infertility Treatment Devices and Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Infertility Treatment Devices and Equipment Market are:

- Thermo Fisher Scientific

- Cook Group

- Vitrolife

- IVFtech APS

- Hamilton Thorne Ltd.

- Esco Micro Pte Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Infertility Treatment Devices and Equipment Market top key players overview

Infertility Treatment Devices and Equipment Market News and Recent Developments

The infertility treatment devices and equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for infertility treatment devices and equipment:

- Trajan Scientific and Medical supplied CE-IVD-registered Mitra devices to Fertilly, a German start-up. Fertilly launched Europe's first At-Home Fertility Test Kits using dried blood microsampling with VAMS technology. The Mitra microsampling devices allow for quick and easy collection of blood samples through finger sticks, which can then be mailed to a lab for analysis as dried blood. (Source: Trajan Scientific Australia Pty Ltd, Press Release, 2023)

- Merck Specialties Pvt ltd, the healthcare business of Merck in India, launched the Pergoveris Pen for advanced infertility treatment in India. This launch emphasizes the company’s motive of fulfilling unmet medical needs by providing an improved, convenient, and ready-to-use combination treatment option for women with severe follicle-stimulating hormone (FSH) and luteinizing hormone (LH) deficiency. (Source: Merck Specialties Pvt ltd, Press Release, 2021)

Infertility Treatment Devices and Equipment Market Report Coverage and Deliverables

The “Infertility Treatment Devices and Equipment Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Vertical Farming Crops Market

- Virtual Event Software Market

- Electronic Shelf Label Market

- Automotive Fabric Market

- Rugged Phones Market

- Mesotherapy Market

- Biopharmaceutical Tubing Market

- Environmental Consulting Service Market

- Water Pipeline Leak Detection System Market

- Machine Condition Monitoring Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Procedure ; End User , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For