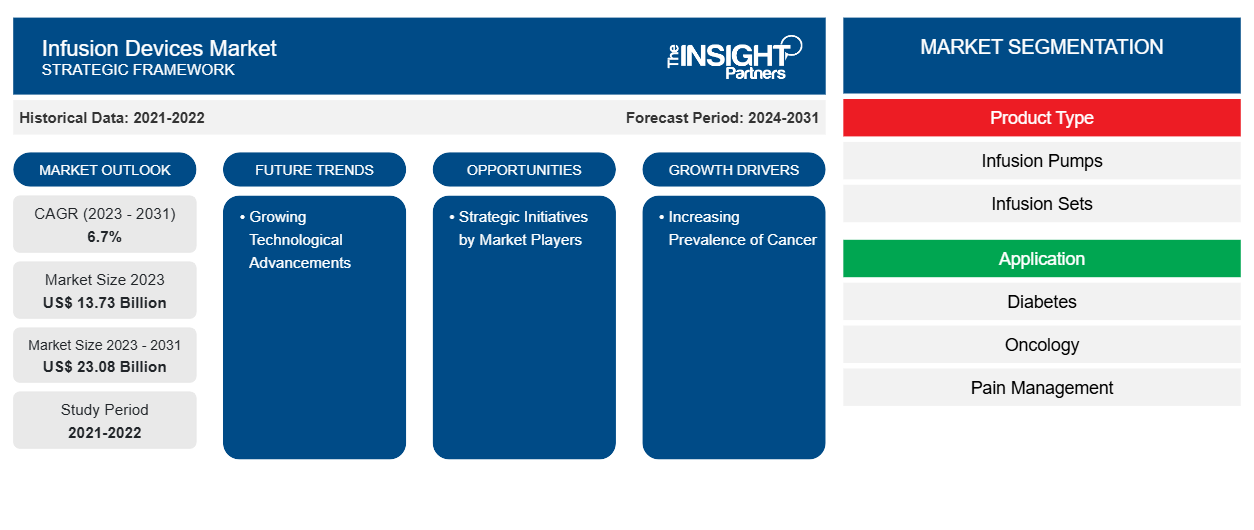

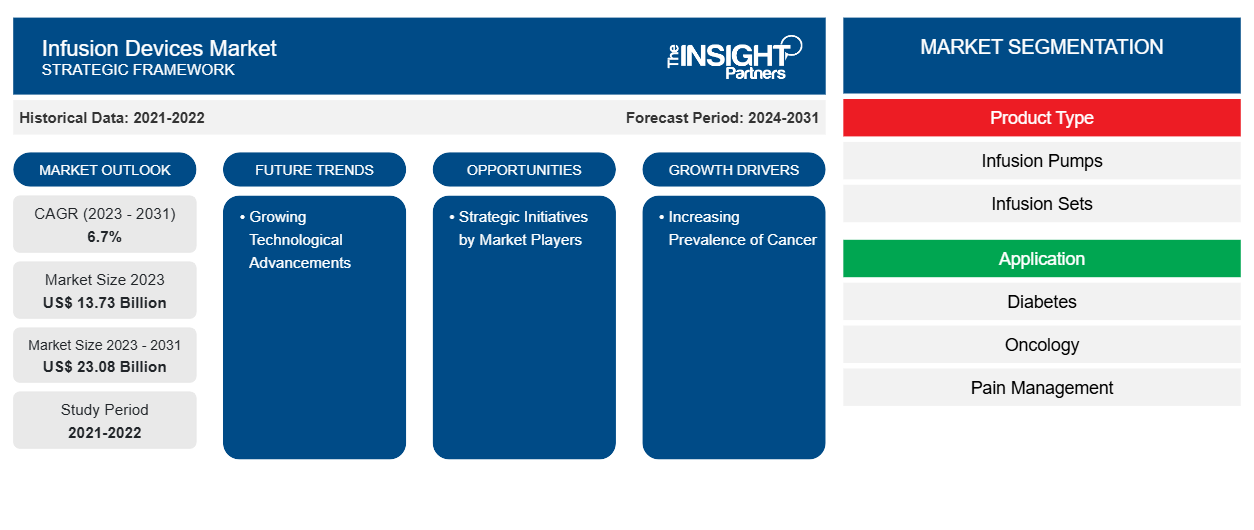

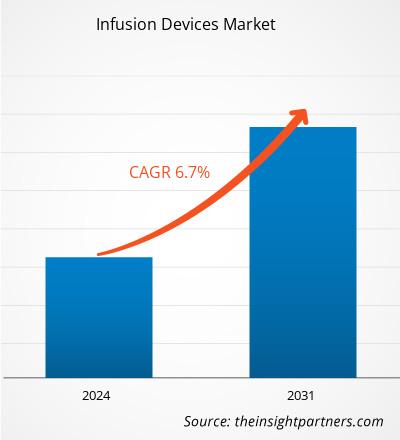

The infusion devices market size is projected to reach US$ 23.08 billion by 2031 from US$ 13.73 billion in 2023; the market is estimated to register a CAGR of 6.7% during 2023–2031. The increase in technological advancements is likely to act as a key trend in the market in the coming years.

Infusion Devices Market Analysis

The infusion devices industry's growth, innovation, and market dynamics are greatly influenced by the increasing prevalence of cancer. According to the National Cancer Institute, breast, lung and bronchus, colorectal, and prostate cancer account for almost 50% of all new cancer cases in the US. Colorectal, pancreatic, lung and bronchus, and breast cancers are responsible for ∼50% of all deaths. The incidence of cancer is rising globally. The surging incidence of cancer fuels the demand for infusion devices designed for treatment and management of cancer.

The potential of infusion devices to transform the healthcare industry has led to a recent surge in strategic developments such as product launches, mergers, acquisitions, and collaborations by the market players to develop advanced products that ease the treatment of chronic disorders such as diabetes, cancer, and chronic pain. For instance, in April 2021, in Europe, Medtronic launched the Medtronic Extended infusion set. It is the first and only infusion set that can be worn for up to 7 days. Similarly, in January 2021, Eitan Medical, a global leader in advanced infusion therapy, launched a UK operation to improve its support of Sapphire infusion pump customers, which include NHS Trusts, private hospitals, and home care providers.

Infusion Devices Market Overview

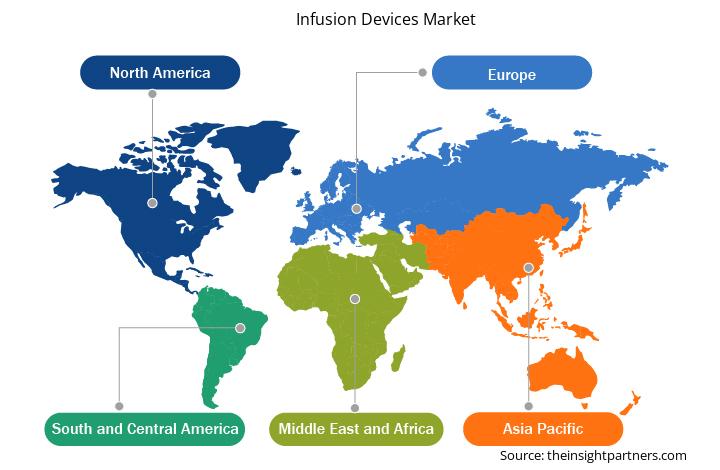

The market in Asia Pacific accounted for the highest growth rate owing to the increasing concentration of market players developing novel products at affordable prices, initiatives by the local government authorities, and a rise in the prevalence of cancer and diabetes. In addition, the presence of local market players in Asia Pacific enhances the availability of infusion devices in the region. China held the largest share of the market in Asia Pacific during 2023–2031.

The Guidelines for the Prevention and Treatment of Type 2 Diabetes in China, released in 2020, showed a diabetes prevalence of 11.2% among adults. According to IDF, the prevalence of diabetes in adults in China increased to 13% in 2021, with 140.86 million adults being affected. Insulin pump therapy closely mimics the natural insulin secretion pattern to achieve improved glycemic control without the need for frequent injections. Additionally, market players are benefitting from this increasing demand for infusion devices by adopting growth strategies, including joint ventures, collaborations, and strengthening their local distribution networks in the China infusion devices market. As per the annual report of MicroTech Medical (Hangzhou) Co., Ltd. for 2021, the company's Equil patch insulin pump was included in the "China Guidelines for Insulin Pump Therapy." It was the first and only patch insulin pump product approved in China in 2021. In terms of commercialization, the revenue of the Equil patch insulin pump increased significantly by 111% in 2021 compared to 2020, owing to its large distribution network covering over 800 hospitals in China. Such developments in the infusion devices market in China, coupled with the mounting prevalence of chronic diseases requiring infusion therapies, are boosting the market growth in the country.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infusion Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infusion Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Infusion Devices Market Drivers and Opportunities

Growing Geriatric Population

According to the US Census Bureau, the number of people in the US aged 65 and above is expected to rise from 58 million in 2022 to 82 million by 2050, which is a 47% increase. Additionally, in the US, the percentage of the total population of 65 and above is projected to rise from 17% in 2022 to 23% in 2050.

As per the WHO, by 2030, one in 6 people in the world will be 60 years or older. One billion people were reported to be 60 and above in 2020 and the number is expected to reach 1.4 billion in 2030 and 2.1 billion by 2050. WHO also stated that by 2050, 80% of older people will be living in low- and middle-income countries.

A few key benefits of infusion therapy used for geriatric populations are listed below.

Enhanced Immune Function: Immune systems need extra support at an older age as they become more vulnerable to infections. Infusion therapy can deliver immune-boosting nutrients such as vitamin C, zinc, and glutathione directly to the body.

Pain Management: The senior population majorly suffers from chronic pain, affecting their quality of life. Infusion therapy can quickly and effectively manage pain by delivering medication directly into the bloodstream, reducing inflammation and providing relief.

Thus, the increasing geriatric population drives the demand for infusion devices across the globe.

Strategic Initiatives by Market Players

Various market players focus on strategic developments such as product launches, mergers, acquisitions, and collaborations to develop advanced products that ease the treatment of chronic disorders such as diabetes, cancer, and chronic pain. Following are a few recent developments in the global infusion devices market.

- In April 2024, Mackenzie Health launched a technology in Canada that allows for two-way information flow between an intravenous (IV) medication pump and a patient's electronic medical record. The technology, known as BD Alaris EMR Interoperability, eliminates the need for healthcare professionals to manually program pumps. It sends infusion safety information back to Epic EMR, reducing the risk of administration errors and providing an accurate infusion record in the EMR.

- In February 2023, Mindray launched its BeneFusion i Series and u Series infusion systems, with high precision, adaptive customization and extraordinary simplicity for guaranteed levels of medication safety in various clinical settings.

- In November 2022, Medtronic plc announced the launch of Medtronic Extended infusion set in the US. It is the first and only infusion set labeled for up to seven-day wear. An infusion set is a tubing that delivers insulin from an insulin pump to the body and usually needs to be changed every two to three days.

- In March 2022, Fresenius Kabi received 510(k) regulatory clearance from the FDA for its wireless Agilia Connect Infusion System. The system includes Agilia Volumetric Pump and Agilia Syringe Pump with Vigilant Software Suite-Vigilant Master Med technology. Both pumps are the first to be cleared following TIR101 standards, which were developed by the Association for the Advancement of Medical Instrumentation (AAMI) in 2021.

An upsurge in the number of product approvals, launches, and strategic collaborations is likely to create lucrative opportunities for the infusion devices market in the future.

Infusion Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the infusion devices market analysis are product type, application, end user, and geography.

The infusion devices market, by product type, is bifurcated into infusion pumps and infusion sets. The infusion pumps segment held a larger share of the global infusion devices market in 2023, and it is expected to register a higher CAGR during 2023–2031. The infusion pump if further divided into volumetric pumps, syringe pumps, insulin pumps, patient control analgesia (PCA) pumps, enteral pumps, implantable pumps, and elastomeric pumps. The infusion set is further divided into vented infusion sets and non-vented infusion sets.

Based on application, the infusion devices market is segmented into diabetes, pain management, hematology, pediatrics, gastroenterology, and others.

Based on end user, the infusion devices market is segmented into hospitals and specialty clinics, ambulatory surgical centers, homecare settings, and others. The hospitals and specialty clinics segment held the largest share of the global infusion devices market in 2023.

Infusion Devices Market Share Analysis by Geography

The geographic scope of the infusion devices market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. The market growth in North America is characterized by the increasing prevalence of chronic diseases and associated risk factors such as obesity, unhealthy lifestyles, and accelerated aging among the American population. According to the Diabetes Research Institute, ~37.3 million people (i.e., 11.3% of the total population) in the US were affected with diabetes in 2022. Nearly 28.7 million people in the country were diagnosed with diabetes, and ~8.6 million people had undiagnosed diabetes. Further, ~1.4 million diabetes cases are diagnosed each year in the US. The mounting prevalence of diabetes in the US is expected to drive the demand for infusion devices for insulin delivery among diabetes patients. The demand for infusion devices attracts market players to adopt growth strategies such as product approvals, launches, and market expansion, enhancing the market size in the country. In May 2024, Moog Inc. received 510(k) clearance for the Industrial segment's CURLIN 8000 Ambulatory Infusion System. The premium infusion platform was specifically developed for use in home infusion settings.

Infusion Devices Market Regional Insights

The regional trends and factors influencing the Infusion Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Infusion Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Infusion Devices Market

Infusion Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.73 Billion |

| Market Size by 2031 | US$ 23.08 Billion |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

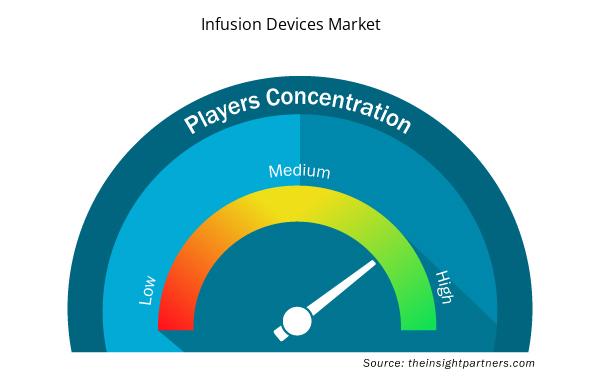

Infusion Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Infusion Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Infusion Devices Market are:

- Becton Dickinson and Co

- Fresenius Kabi AG

- B Braun SE

- CODAN US Corp

- Baxter International Inc

- Elimedical Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Infusion Devices Market top key players overview

Infusion Devices Market News and Recent Developments

The infusion devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

Moog Inc. received US FDA 510(k) clearance for CURLIN 8000 Ambulatory Infusion System. This premium infusion platform was developed specifically for use in home infusion settings. The CURLIN 8000 combines a reliable and robust design with a simple, intuitive user interface designed for easy navigation by both clinical and non-clinical users. The CURLIN 8000 also integrates seamlessly with CURLIN RxManager, a completely new medication safety software developed to complement existing home infusion workflows. (Source: Moog Inc, Company Website, May 2024)

ICU Medical, Inc. received 510(k) regulatory clearance from the USFDA for the Plum Duo infusion pump with LifeShield infusion safety software. The Plum Duo pump and LifeShield software were available to customers in the US from early 2024. (Source: ICU Medical Inc, Company Website, August 2023)

Infusion Devices Market Report Coverage and Deliverables

The "Infusion Devices Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

Infusion devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

Infusion devices market trends, as well as market dynamics such as drivers, restraints, and key opportunities

Detailed PEST and SWOT analysis

Infusion devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the infusion devices market

Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 6.7% during 2023–2031.

The infusion devices market value is expected to reach US$ 23.08 billion by 2031.

The increase in technological advancements is expected to emerge as a prime trend in the market in the coming years.

Becton Dickinson and Co, Fresenius Kabi AG, B Braun SE, CODAN US Corp, Baxter International Inc, Elimedical Inc, ICU Medical Inc, BPL Medical Technologies Pvt Ltd, Nipro Corp, KD Scientific Inc, Medtronic Plc, Zimed Healthcare Ltd, Terumo Corp, Tandem Diabetes, and Polymedicure are among the key players in the market.

The increasing prevalence of cancer and the growing geriatric population are among the most significant factors fueling the market growth.

North America dominated the market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Infusion Devices Market

- Becton Dickinson and Co

- Fresenius Kabi AG

- B Braun SE

- CODAN US Corp

- Baxter International Inc

- Elimedical Inc

- ICU Medical Inc

- BPL Medical Technologies Pvt Ltd

- Nipro Corp

- KD Scientific Inc

- Medtronic Plc

- Zimed Healthcare Ltd

- Terumo Corp

- Eitan Medical Ltd

- Polymedicure

- Moog Inc

- Tandem Diabetes Care Inc

Get Free Sample For

Get Free Sample For