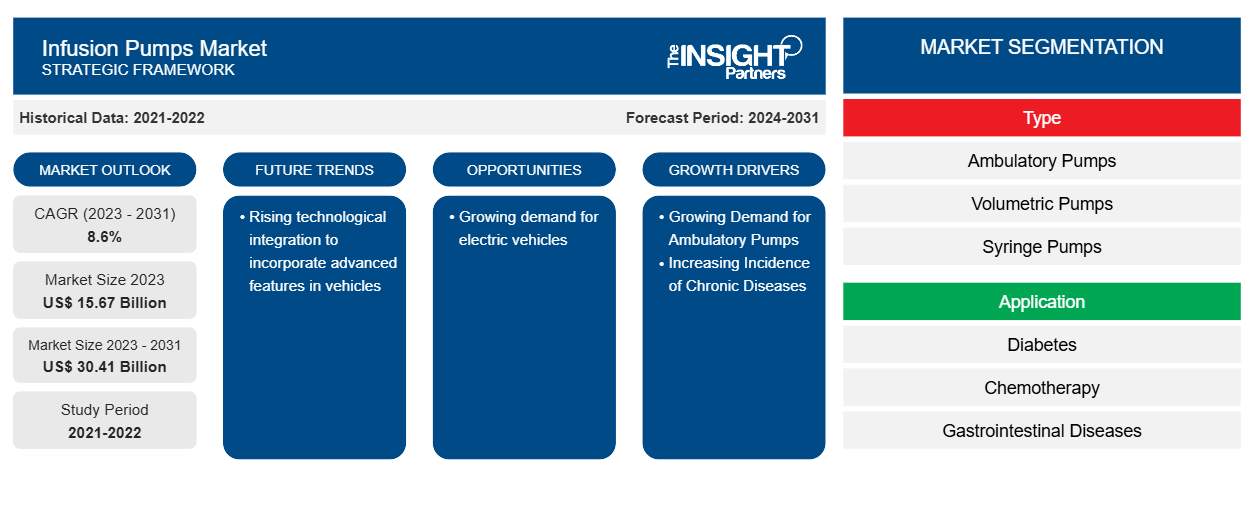

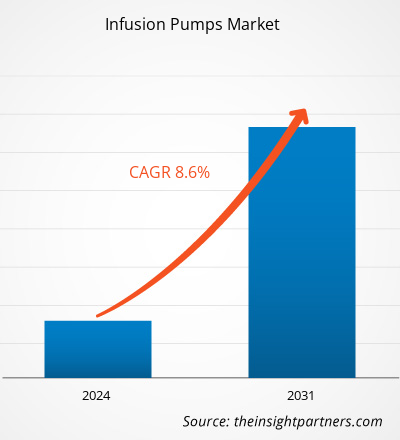

The infusion pumps market size is projected to reach US$ 30.41 billion by 2031 from US$ 15.67 billion in 2023. The market is expected to register a CAGR of 8.6% in 2023–2031. The internet of things (IoT) is set to revolutionize infusion pump technology, which serves as a key infusion pumps market trends.

Infusion Pumps Market Analysis

The rising prevalence of chronic diseases and the growing number of surgeries are some factors that provide opportunities for players in the market to offer new and innovative products. The worldwide infusion pump market is anticipated to expand due to the aging population. Infusion pumps may be necessary for those people over 65 for various reasons, including nourishment, hormones, and medication. Technological developments are fueling the infusion pump market's expansion. More precise, user-friendly, and dependable pumps are being produced by manufacturers than ever before. The need for infusion pumps is increasing as a result of innovations that make the devices more accessible to both patients and healthcare professionals. Infusion pumps help precisely distribute fluids like medicine, antibiotics, and nourishment throughout the body in a regulated environment.

Infusion Pumps Market Overview

The infusion pump is a commonly used medical device for patients with chronic conditions such as cancer and diabetes used at hospitals, homes, and healthcare centers. Infusion pumps are used to deliver medications such as insulin or other hormones, antibiotics, chemotherapy drugs, and pain relievers. Infusion pumps successfully address the delivery-related problems that have serious implications on patient safety, with their ability to administer fluids, medication, and nutrients at very precise intervals, volume, and frequency. Diabetes and cancer patients are contributing significantly to the usage of infusion pumps, which in turn boosts market growth. Further, according to the latest Global Burden of Disease study published in October 2020, the prevalence of chronic and infectious diseases, such as ischemic heart disease, respiratory infection, chronic kidney disease, cancer, and diabetes, is increasing in the US. The Canadian Cancer Society reported that cancer remains the leading cause of death in Canada in 2021. It is estimated that every 2 in 5 Canadians will be diagnosed with cancer in their lifetime.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infusion Pumps Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Infusion Pumps Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Infusion Pumps Market Drivers and Opportunities

Increasing Incidence of Chronic Diseases to Drive the Market Growth

The infusion pump is a commonly used medical device for patients with chronic conditions such as cancer and diabetes used at hospitals, homes, and healthcare centers. Infusion pumps provide significant advantages over the manual delivery of fluids, such as the ability to administer the fluids in a very small dosage and at accurately programmed rates. In many chronic cases, such as cancer and diabetes, these pumps are employed to deliver medication to maintain medicine levels in the bloodstream at a steady state. Cancer is one of the prominent causes of death worldwide, responsible for almost 10 million deaths in 2020. According to the GLOBOCAN Report 2020, ~19.29 million new cancer cases have been reported globally, along with 9.95 million reported deaths caused by the disease. The major cancer types affecting economies are breast cancer, lung cancer, prostate cancer, and colorectum cancer. Moreover, according to the International Diabetes Federation, 537 million people globally, aged 20–79, had diabetes in 2021, and the number is projected to reach to 783 million by 2045. Chronic diseases typically require long-term treatment, and infusion pumps are a necessary tool for delivering medication to patients for long periods. The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases surge the demand for infusion pumps, thereby driving the growth of the market.

Increasing Healthcare Potential of Emerging Economies to Favor Market Growth

Developing countries report a high prevalence of chronic diseases due to significant shifts in people’s lifestyles. In developing nations like China, India, and Brazil, players in the infusion pump market are presented with substantial development potential. This can be attributed to advancements in these nations' healthcare systems, large patient populations, as well as patients' increasing awareness about treatment alternatives. Major pharmaceutical companies have been focusing on expanding their reach across emerging markets by growing their distribution networks and augmented manufacturing capabilities. Moreover, rising per capita income and healthcare spending in developing countries across the Asia Pacific and Latin America has increased patients' access to cutting-edge medical treatments. These factors offer noteworthy opportunities for expansion to players involved in the infusion pumps market

Infusion Pumps Market Report Segmentation Analysis

Key segments that contributed to the derivation of the infusion pumps market analysis are type, application, and end user.

- Based on type, the infusion pumps market is divided into ambulatory pumps, volumetric pumps, syringe pumps, accessories. The volumetric pumps segment held the largest market share in 2023. In addition, the ambulatory pumps segment is anticipated to register the highest CAGR during the forecast period.

- In terms of application, the market is categorized into diabetes, chemotherapy, gastrointestinal diseases, pediatrics. The chemotherapy segment held the largest market share in 2023. In addition, the diabetes segment is projected to register the highest CAGR during the forecast period.

- Based on end user, the infusion pumps market is segmented into hospitals & clinics, ambulatory surgical centers, homecare. The hospitals & clinics segment held the largest market share in 2023 and is estimated to register the highest CAGR during the forecast period.

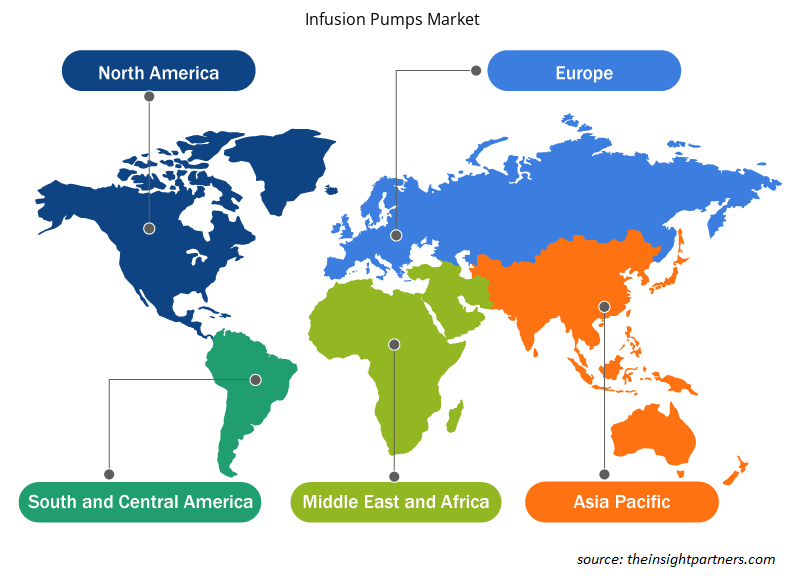

Infusion Pumps Market Share Analysis by Geography

The geographic scope of the infusion pumps market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the infusion pumps market. The presence of leading market players and their product developments, the growing geriatric population, and rising prevalence of chronic diseases and infections favor the market’s growth in the region. Moreover, the greater diagnosis and treatment rates for diabetes linked with the surge in adoption of ambulatory pumps, and favorable reimbursement procedures in the region fuel the growth of the market.

Asia Pacific is anticipated to grow with the highest CAGR in the coming years. Growing prevalence of chronic diseases, rising healthcare infrastructure, growing disposable income, and growing awareness about the availability and accessibility to advanced therapies are some of the factors that are likely to support the market growth in the region.

Infusion Pumps Market Regional Insights

The regional trends and factors influencing the Infusion Pumps Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Infusion Pumps Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Infusion Pumps Market

Infusion Pumps Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 15.67 Billion |

| Market Size by 2031 | US$ 30.41 Billion |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

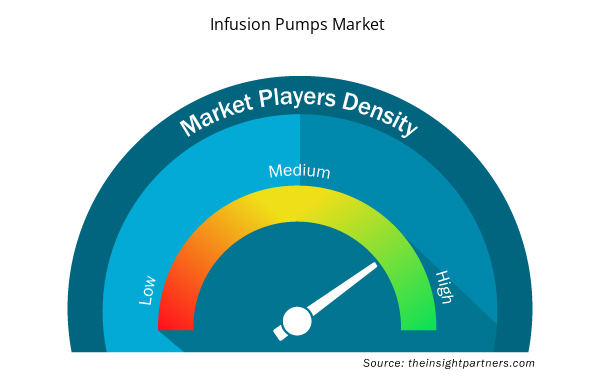

Infusion Pumps Market Players Density: Understanding Its Impact on Business Dynamics

The Infusion Pumps Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Infusion Pumps Market are:

- BD

- B. Braun

- Terumo Corporation

- F. Hoffman-La Roche Ltd

- Medtronic

- Baxter

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Infusion Pumps Market top key players overview

Infusion Pumps Market News and Recent Developments

The infusion pumps market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for biodefense and strategies:

- In August 2023, ICU Medical Inc. received 510(k) regulatory clearance from the US Food and Drug Administration for the Plum Duo infusion pump with LifeShield infusion safety software. The pump features a large touch screen with a highly intuitive user interface and two channels capable of delivering up to four compatible IV medications. (Source: ICU Medical Inc., Press Release, 2023)

- In May 2022, Fresenius Kabi completed the acquisition of Ivenix, a manufacturer of infusion systems. Fresenius Kabi now offers health care professionals in the US a broad and expanding portfolio of advanced infusion pumps and solutions to meet needs across the continuum of care. (Source: Fresenius SE & Co. KGaA, News Release, 2022)

- In June 2021, Baxter Healthcare and Micrel Medical, entered into an agreement for the distribution of the Micrel Mini Rythmic PN+ infusion pump for parenteral nutrition. As part of the agreement, Baxter Healthcare is the sole distributor of the Micrel Mini Rythmic PN+ infusion pump and its accessories across Australia and New Zealand. (Source: Baxter, Press Release, 2021)

Infusion Pumps Market Report Coverage and Deliverables

The “Infusion Pumps Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , By Application and End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For