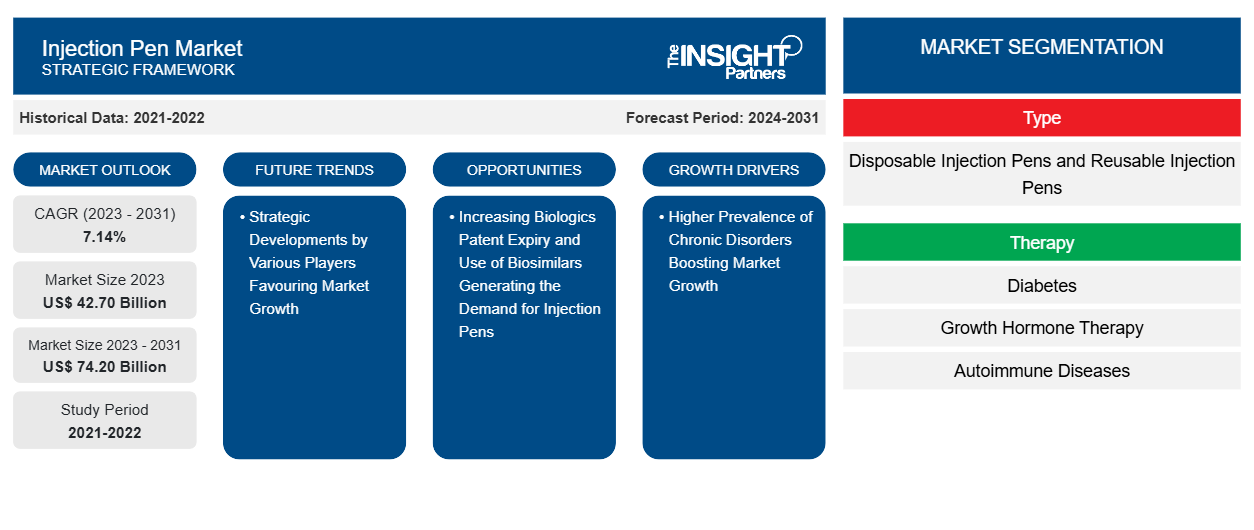

The injection pen market size is projected to reach US$ 74.20 billion by 2031 from US$ 42.70 billion in 2023. The market is expected to register a CAGR of 7.14% in 2023–2031. Primary factors driving the market growth are rising prevalence of chronic disorders such as, cancer, diabetes, stroke, heart disease and arthritis and increase in strategic developments. However, presence of alternate drug delivery devices and inadequate reimbursement policies are restricting the market growth.

Injection Pen Market Analysis

An injector pen, also called a medication pen, is a device that is used to inject medication under the skin. Injector pens are designed to make injectable therapy easier and more convenient for patients, aiming to increase patient adherence. Given the additional work involved in administering an injection and the possibility of an adverse reaction to self-injecting medication, this is particularly troublesome with injectable treatments.

Injection Pen Market Overview

A few prevalent and expensive long-term health issues are influenced by societal behavioural shifts and the aging population. The World Health Organization (WHO) projects that by 2026, 57% of people would have a chronic lifestyle condition. Given that developing nations are predicted to have a population increase, emerging markets will be particularly heavily hit. People are more likely to lead sedentary lifestyles as a result of the rapid urbanization, which contributes to obesity and diabetes. One of the main issues facing world health in the twenty-first century is diabetes. The International Diabetes Federation (IDF) estimates that there were roughly 46 million diabetics in North America in 2019 and that figure is expected to rise to 62 million by 2045.

The disease prevalence has increased by almost 35% within the anticipated time frame. In addition, many chronic illnesses like multiple sclerosis, osteoporosis, and cardiovascular diseases necessitate repeated medication administration for illness management. The World Health Organization (WHO) reports that cardiovascular problems account for over 17.9 million fatalities annually, making them the leading cause of death. It is becoming the new norm for injectable drug delivery across a sizable patient base worldwide. Injection pens are widely utilized in home healthcare settings, which contributes to their market growth. Additionally, a large patient population may use them with little training and no ongoing help from healthcare experts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Injection Pen Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Injection Pen Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Injection Pen Market Drivers and Opportunities

Adoption of Strategic Growth Development by Major Players for Injection Pen Products Favors Market

The presence of multiple market players is a defining feature of the injection pen market. Market participants employ a variety of tactics, including new product releases, regional growth, and technology improvements, to grow their market share. The industry participants are beginning to accept injection pens more because of their growing involvement in ongoing innovation and technical advancements. Prominent firms make R&D investments to create cutting-edge technologies and increase profits.

A few key developments related to injection pen are mentioned below:

- In May 2022, the FDA authorized Lilly's Mounjaro injectable in May 2022 as the first and only glucagon-like peptide-1 (GLP-1) receptor agonist and glucose-dependent insulinotropic polypeptide (GIP) injection for the management of adult type 2 diabetes. Six doses of Mounjaro are available: 2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, and 15 mg. It is packaged in Lilly's renowned auto-injector pen, which has a hidden needle already attached.

- In January 2022, SHL Medical and Innovation Zed teamed up to provide linked pen injector solutions . It introduced InsulCheck DOSE, a linked add-on gadget that upgrades conventional pen injectors into intelligent tools to assist in the tracking of treatment plans.

- In November 2021, In order to boost the uptake of a connected add-on for disposable insulin pens, Sanofi and Roche teamed up to collaborate in France. The partners will work together to create a scientific education program for pharmacists and doctors.

- In September 2021, a new deal on the Mallya Smart Sensor with Novo Nordisk FlexTouch insulin pens was signed. Further solidifying BIOCORP and Novo Nordisk's cooperation. Immediately attached to Novo Nordisk FlexTouch insulin pens is a smart sensor known as Mallya. Patients utilizing FlexTouch pens will be able to record and capture daily insulin injection data with Mallya, including insulin units and the date and time the medication was administered. The agreement states that Novo Nordisk would begin selling Mallya commercially in Japan in the first half of 2023.

Therefore, all the above-mentioned key developments are driving the growth of injection pen market.

Increasing Biologics Patent Expiry and Use of Biosimilars – An Opportunity in Injection Pen Market

Many chronic illnesses, including diabetes, multiple sclerosis, and cancer, are being treated with biologics. These medications are one-of-a-kind in their own right, and the companies who make and sell them are granted 20 years of patent protection. Due to the fact that the majority of patents have either expired or are about to expire, other market participants have started to introduce biosimilars, or their own versions of these medications.

In comparison to the original biologics, biosimilars—low-cost generic medications that are favoured by the government and insurance companies—have become extremely popular in recent years. The prominent market players are promoting the adoption of biosimilars, which further creates the demand for injection pens for its administration. As per AJMC, a total of forty biosimilars were approved and twenty-five new biosimilars were launched in the US till December 2022. Additionally, due to the rapid response, injectables have been used extensively, which has increased demand for injection pens for safety.

In addition, the producers of injection pens are continuously offering instruction on how to use them correctly to prevent complications like needle stick injuries and hypoglycaemia, which is anticipated to further expand the market for injection pen. For instance, Noble, a Aptar Pharma company is the global leader in the medical device training solution which improves the patient experience and outcomes by developing patient-centric drug delivery training devices including injection pen, autoinjector, prefilled syringe and others. Therefore, increased use of biosimilars, patent expiry and increased use of injectables for drug administration are likely to create ample opportunity for the growth of injection pen market in the coming years.

Injection Pen Market Report Segmentation Analysis

Key segments that contributed to the derivation of the injection pen market analysis are type, therapy, and end user.

- Based on type, the injection pen market is divided into disposable injection pens and reusable injection pens. The disposable segment held a higher market share in 2023.

- Based on therapy, the market is segmented into diabetes, growth, autoimmune diseases, fertility, hormone therapy, cancer, and other therapies.

- In terms of end user, the market is segmented into hospitals and clinics, home care, and others

Injection Pen Market Share Analysis by Geography

The geographic scope of the injection pen market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In North America, the Injection Pen market is currently experiencing exponential growth during the forecast years. The US market dominates the global injection pen market in 2023 As per the American Diabetes Association, 37.3 million Americans (or 11.3% of the total population) were diagnosed with diabetes in 2019. Type 1 diabetes affects around 1.9 million people in the US, 244,000 of whom are children and teenagers. Moreover, almost 1.4 million Americans receive a diabetes diagnosis each year. The Centers for Disease Control and Prevention estimate that 88 million adults in the US have prediabetes in 2020, accounting for 34.5% of the adult population. By 2022, almost 30 million Americans will have diabetes, and about 7 million of them will need daily insulin, according to Yale researchers.

There is an increase in demand for infertility treatment in the US. For instance, according to the CDC, in 2019, in the US, 9% of men and 10% of women aged 15 to 44 reported infertility problems. The prominent players are introducing novel products to meet the growing demand for injection pens globally. For instance, Merck KGaA offers a prefilled, ready-to-use pen to administrate GONAL-f for treatment of infertility. Thus, the rise in cases of diabetes and infertility problems and innovative product launches by key players are driving the injection pen market in the US.

Injection Pen Market Regional Insights

The regional trends and factors influencing the Injection Pen Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Injection Pen Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Injection Pen Market

Injection Pen Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 42.70 Billion |

| Market Size by 2031 | US$ 74.20 Billion |

| Global CAGR (2023 - 2031) | 7.14% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Injection Pen Market Players Density: Understanding Its Impact on Business Dynamics

The Injection Pen Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Injection Pen Market are:

- Eli Lilly and Co

- Novo Nordisk AS

- Owen Mumford Ltd

- Sanofi SA

- Merck KGaA

- Haselmeier GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Injection Pen Market top key players overview

Injection Pen Market News and Recent Developments

The Injection Pen market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In May 2022, FDA approves Lilly's Mounjaro injection, the first and only GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptor agonist for the treatment of adults with type 2 diabetes. Mounjaro will be available in six doses (2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, 15 mg) and will come in Lilly's well-established auto-injector pen with a pre-attached, hidden needle that patients do not need to handle or see. (Source: FDA)

Injection Pen Market Report Coverage and Deliverables

The “Injection Pen Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

Injection Pen Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

Injection Pen Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

Injection Pen market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

Injection Pen Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Therapy, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the injection pen market in 2023

The rising prevalence of chronic disorders is the major factors fuelling the market growth of injection pens over the years.

Technological advancements and healthcare waste reduction are likely to remain a key trend in the market.

Eli Lilly and Co, Novo Nordisk AS, Owen Mumford Ltd., Sanofi SA, Merck KGaA, Haselmeier GmbH, Gerresheimer AG, Becton Dickinson and Co., AstraZeneca Plc, Teva Pharmaceutical Industries Ltd

The market is expected to register a CAGR of 7.14% during 2023–2031.

Get Free Sample For

Get Free Sample For