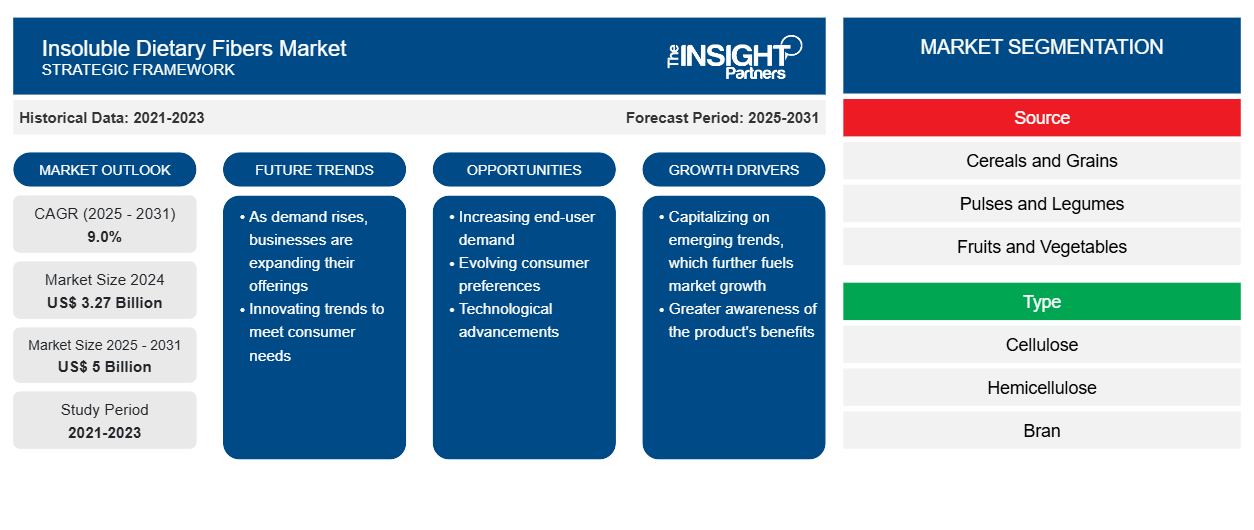

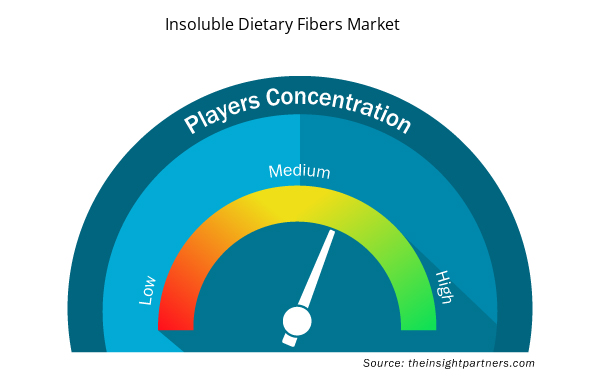

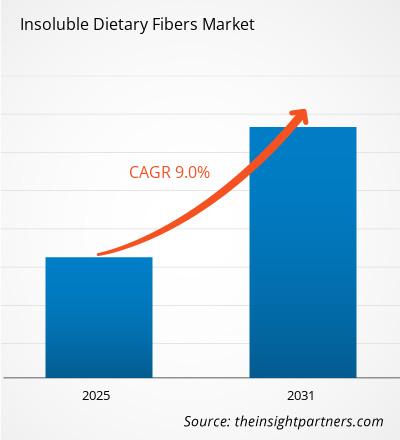

The insoluble dietary fibers market size is projected to reach US$ 5 billion by 2031 from US$ 3 billion in 2023. The market is expected to register a CAGR of 9% in 2023–2031.

Rising demand for dietary fiber-fortified and functional food and increasing digestive health awareness are likely to remain key insoluble dietary fibers market trends.

Insoluble Dietary Fibers Market Analysis

Insoluble dietary fiber plays a crucial role in promoting digestive health. It adds bulk to stool, preventing constipation, and supports regular bowel movements. Foods rich in insoluble fiber, such as whole grains, fruits and beverages, pulses, and legumes, are increasingly sought by consumers aiming for a balanced and fiber-enriched diet.

Over the past few years, there have been rising incidences of digestive and gastrointestinal disorders due to lifestyle changes and changes in dietary habits. According to a survey conducted by the American Gastroenterological Association, about 40% of Americans' daily routine activities are disrupted by digestive problems. Hectic work schedules, improper diet and timings, and an increase in the consumption of junk food are the factors that trigger digestive issues. Thus, consumers are increasingly shifting toward high-fiber food products to ensure digestive well-being. This factor is significantly driving the insoluble dietary fiber market.

Food manufacturers are responding to this demand by incorporating insoluble dietary fiver into various products, including breakfast cereals, baked goods, and snacks. Moreover, manufacturers of nutraceuticals and dietary supplements are also launching supplements that aid digestive health and well-being. These products not only cater to individuals actively seeking fiber but also appeal to a broader market interested in overall health and well-being. For instance, in July 2021, Herbalife Nutrition launched a new line of products specially for digestive health under the brand name "Active Fiber Complex Select" across the US, Canada, and Puerto Rico. Active Fiber Complex Select is a high-fiber, gluten-free, and low-glycemic index product with a proper balance of soluble and insoluble dietary fibers that aid digestion. These products are available in a variety of tropical flavors, making them delicious. Such products are expected to witness immense demand among customers, driving the growth of the insoluble dietary fiber market.

Insoluble Dietary Fibers Market Overview

Insoluble dietary fibers are plant components that resist digestion in the human stomach and small intestine. They help retain water in stools, which makes them softer, lighter, and easier to pass through the intestines. Insoluble dietary fibers aid digestive health by preventing constipation. It also prevents intestinal blockages, which reduce the risk of small folds and hemorrhoids in the colon. It also minimizes the risk of colorectal cancer. Some of the common sources of insoluble dietary fibers are whole wheat and wheat bran, leafy greens, brown rice, nuts, and seeds, among others. Cellulose, hemicellulose, bran, chitin, and chitosan are the major types of insoluble dietary fiber.

The demand for insoluble dietary fiber has been on the rise due to growing awareness of its health benefits. As people focus more on digestive wellness, food products with added insoluble dietary fibers are gaining immense popularity. The demand is also driven by the increasing prevalence of lifestyle-related health issues, prompting consumers to seek fiber-rich options for improved digestive function. Thus, the rising focus on digestive health and wellness is driving the insoluble dietary fiber market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insoluble Dietary Fibers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insoluble Dietary Fibers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insoluble Dietary Fibers Market Drivers and Opportunities

Increasing Demand for Packaged Food and Beverages with Functional Benefits to Favor Market

Consumers are increasingly seeking products with transparent and clean labels with ethically sourced and minimally processed ingredients. Insoluble dietary fiber derived from natural sources such as fruits, grains, and cereals align with this trend as these ingredients are 100% natural and plant-based. The market sees a rise in the development of products that promote digestive health and overall wellness, especially after the outbreak of COVID-19. The pandemic has altered consumer food preferences with an increasing number of people seeking products with functional benefits. This trend is expected to boost the demand for insoluble dietary fiber across the food & beverages industry over the coming years. Further, growing awareness of the benefits of fiber for digestive wellbeing is driving the market. In recent years, there has been a rising prevalence of digestive disorders due to the increased consumption of fast food. However, people are shifting toward products that aid digestive health and are participating in physical activities. This factor is significantly propelling the insoluble dietary fiber market growth.

Rising Product Innovation and Emphasis on Plant-Based Food to Provide Massive Growth Opportunities

There is room for continued innovation to develop functional foods that seamlessly integrate insoluble fiber. Products focusing on taste, convenience, and diverse dietary preferences have the potential to capture a broader market. Further, given the increasing demand for natural and plant-based products, there is an opportunity to highlight the natural sources of insoluble fiber in foods. Emphasizing the correlation between plant-rich diets and digestive health can be a powerful marketing strategy for emerging players in the insoluble dietary fiber market. Companies operating in the insoluble dietary fiber market are collaborating with manufacturers of health and fitness products to launch innovative products with organic, plant-based, high-fiber, and health claims that ensure digestive wellness and support overall health. This factor is expected to open new opportunities in the insoluble dietary fibers market over the forecast period.

Insoluble Dietary Fibers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Insoluble Dietary Fibers Market analysis are source, type, and application.

- Based on type, the Insoluble Dietary Fibers Market is divided into cellulose, hemicellulose, bran, chitin and chitosan, and others. The cellulose segment held a larger market share in 2023. Cellulose is a complex carbohydrate found in plant cell walls and is known for its excellent ability to provide bulk to the diet without contributing calories. As consumers become more health conscious, there is a growing interest in food products rich in cellulose for its potential benefits to digestive health. Food manufacturers usually use cellulose as a functional ingredient in various processed foods, including baked goods, breakfast cereals, snack bars, and meat and meat substitute products, to enhance their fiber content. Cellulose also improves the texture of the food products, retains moisture, and enhances the overall product quality. All these factors are influencing the growth of the cellulose segment in the global insoluble dietary fiber market.

- In terms of packaging type, the market is segmented into food and beverages, pharmaceuticals and nutraceuticals, and animal nutrition. The food and beverages segment dominated the market in 2023. Rising demand for fiber-rich food and beverages for better digestion and overall digestive well-being drives the segment's growth. Moreover, the rise of the global food & beverages industry, rising demand for functional and fortified food products, and increasing focus on gut health are the key factors driving the insoluble dietary fiber market growth.

Insoluble Dietary Fibers Market Share Analysis by Geography

The geographic scope of the Insoluble Dietary Fibers Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The Asia Pacific insoluble dietary fibers market held the largest market share in 2023. Changing lifestyles, dietary patterns, and increased prevalence of digestive health issues contribute to the growing demand for insoluble dietary fiber. Government initiatives promoting healthier eating habits and the inclusion of fiber in daily diets further boost the market demand. The trend toward natural and plant-based ingredients also aligns with the appeal of insoluble dietary fibers found in abundance in fruits, vegetables, whole grains, pulses, and legumes. The Asia Pacific market for insoluble dietary fibers reflects a broader global movement toward healthier food choices. Further, as awareness of health benefits of fiber-enriched food and beverages among millennials and younger populations is increasing, the insoluble dietary fiber market across the Asia Pacific is expected to witness massive growth in the upcoming years.

Insoluble Dietary Fibers Market News and Recent Developments

The Insoluble Dietary Fibers Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- Bonn Group launched a new line of digestive biscuits with high fiber content under the brand name "Americana." (Source: Insoluble Dietary Fibers – Bonn Group, Press Release/Company Website/Newsletter, 2022)

- Ingredion launched Novelose 3490 dietary fiber for bakery and snack applications. (Source: Insoluble Dietary Fibers Ingredion, Press Release/Company Website/Newsletter, 2021)

- Herbalife Nutrition launched a new range of products for digestive health under the brand name "Active Fiber Complex Select" across the US, Canada, and Puerto Rico. (Source: Insoluble Dietary Fibers Herbalife Nutrition, Press Release/Company Website/Newsletter, 2021)

Insoluble Dietary Fibers Market Regional Insights

Insoluble Dietary Fibers Market Regional Insights

The regional trends and factors influencing the Insoluble Dietary Fibers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insoluble Dietary Fibers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insoluble Dietary Fibers Market

Insoluble Dietary Fibers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.27 Billion |

| Market Size by 2031 | US$ 5 Billion |

| Global CAGR (2025 - 2031) | 9.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

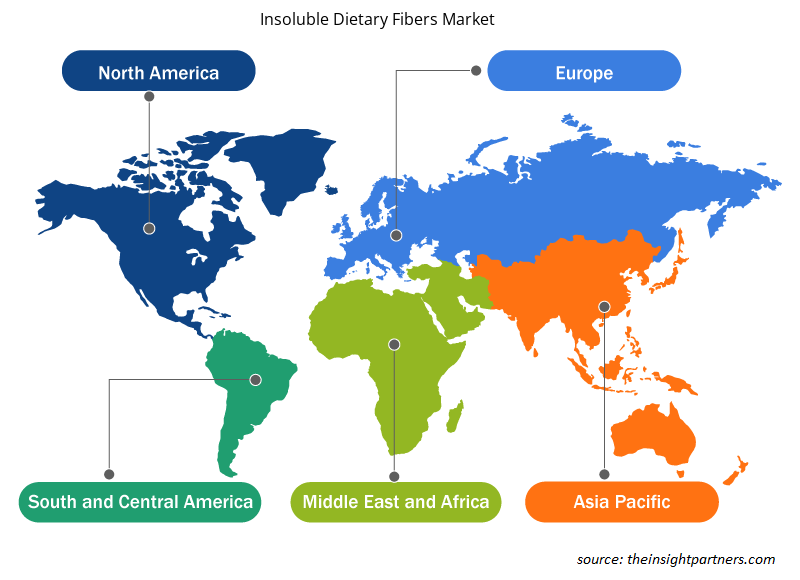

Insoluble Dietary Fibers Market Players Density: Understanding Its Impact on Business Dynamics

The Insoluble Dietary Fibers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insoluble Dietary Fibers Market are:

- Roquette Frères

- Ingredion

- Batory Foods

- Gillco Ingredients

- Stauber USA

- Cargill Incorporated

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insoluble Dietary Fibers Market top key players overview

Insoluble Dietary Fibers Market Report Coverage and Deliverables

The “Insoluble Dietary Fibers Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Health Record Market

- Legal Case Management Software Market

- Medical Audiometer Devices Market

- Vertical Farming Crops Market

- Bathroom Vanities Market

- Electronic Toll Collection System Market

- Electronic Data Interchange Market

- Fixed-Base Operator Market

- Hair Wig Market

- Biopharmaceutical Tubing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

- Roquette Frères

- Ingredion

- Batory Foods

- Gillco Ingredients

- Stauber USA

- Cargill Incorporated

- Ardent Mills

- Sunimpex

- AUSPERL Pty Ltd

- JELU-WERK J. Ehrler GmbH & Co. KG

Get Free Sample For

Get Free Sample For