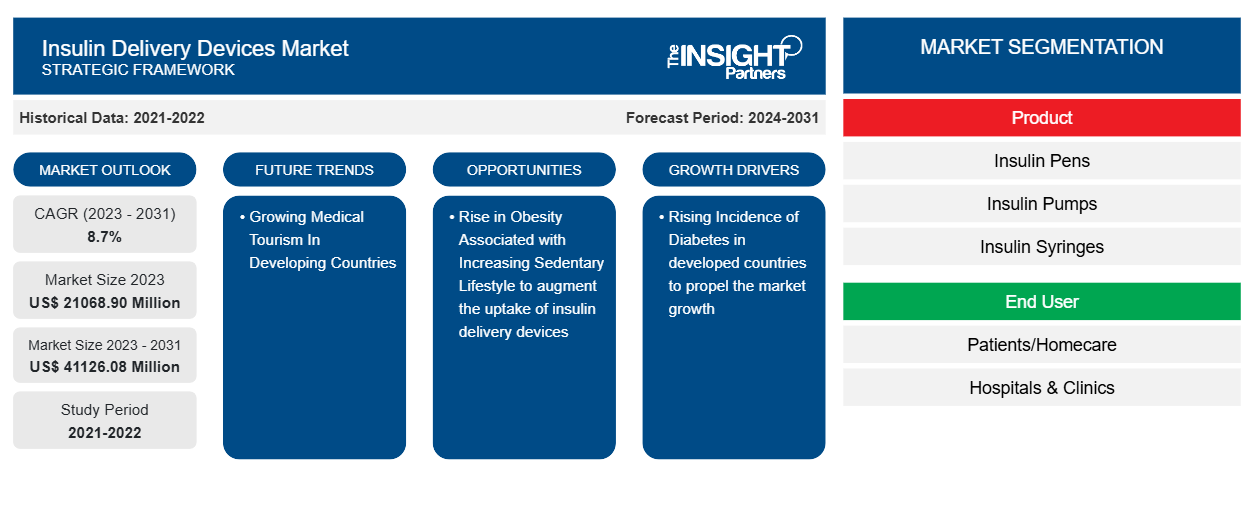

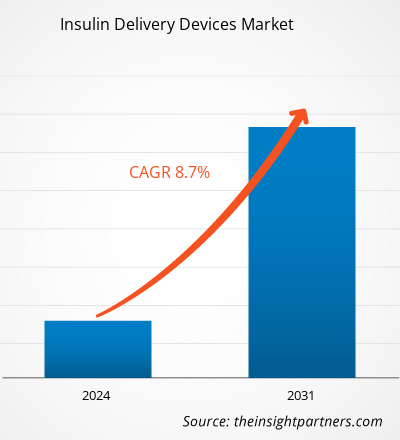

The insulin delivery devices market size is projected to reach US$ 41126.08 million by 2031 from US$ 21068.90 million in 2023. The market is expected to register a CAGR of 8.7% during 2023–2031. The growing advancements in insulin delivery devices are likely to serve as key trends in the market.

Insulin Delivery Devices Market Analysis

The growth of the market is mainly fueled by the surging number of diabetic population due to aging, obesity, and unhealthy lifestyles. Syringes and pen needles are the most widely used devices for injecting insulin into diabetic patients. Numerous manufacturers are coming up with innovative products to sustain themselves in this highly fragmented market. Furthermore, the easy regulatory approvals in Asian countries have helped mid-sized companies enter the market and compete with the local and established market players.

Insulin Delivery Devices Market Overview

Obesity is one of the major issues and the biggest concern among global communities. According to a report published by Forbes in June 2023, more than 1 billion people worldwide have obesity—650 million adults, 340 million adolescents, and 39 million children. According to the World Health Organization (WHO), ~1.9 billion adults aged 18 and older were overweight in 2020. Of these, about 650 million adults were obese. Obesity is linked to 30–53% of new diabetes cases in the US every year, as per the research presented in the Journal of the American Heart Association. Unhealthy diet, lack of exercise, and rapid growth in the obese population are anticipated to increase the susceptibility to diabetes among people globally. This is expected to increase the demand for insulin delivery devices in the coming years. Factors such as the rising geriatric population, favorable reimbursement policies, and increasing need for faster and safer diagnosis and treatment of diabetes are stimulating the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulin Delivery Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulin Delivery Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insulin Delivery Devices Market Drivers and Opportunities

Rising Incidence of Diabetes to Favor Market Growth

Diabetes is a life-threatening chronic disease with no specific cure. It is mainly caused by the body's lack of ability to produce or effectively utilize the hormone insulin. This inability prevents the body from properly regulating blood glucose levels. Diabetes is of two types, namely diabetes type-I (diabetes insipidus) and diabetes type-II (diabetes mellitus). In high-income countries, about 91% of adults have type 2 diabetes. According to the International Diabetes Federation (IDF), ~537 million people will be living with diabetes in 2021, and the number is expected to reach 738 million by 2045 worldwide. Patients suffering from diabetes require frequent monitoring and external administration of insulin. The growing prevalence of diabetes worldwide is driving the growth of the insulin delivery devices market.

Growing Medical Tourism In Developing Countries

Most of the market players focus on emerging nations due to an increase in the prevalence of diabetes and the increasing popularity of insulin pumps among the population. In India, medical science has advanced rapidly over the past few decades. Numerous international patients visit India in the pursuit of highly affordable medical care. Health travelers who visit developing countries for medical reasons save 65–80% on health costs compared to the US. Due to existing exchange rates and various other factors, diabetes treatment in the country has become exceptionally affordable compared to other countries. According to the Malaysia Healthcare Travel Council, more than 850,000 travelers visited Malaysia for healthcare purposes in 2022.

The growth of medical tourism in emerging nations is anticipated to provide significant growth opportunities for the players operating in the insulin delivery devices market during the forecast period. In November 2022, Roche featured two new glucose meter products—ACCU-CHEK Instant Glucometer and ACCU-CHEK Guide Me Glucometer—and a new digital diabetes management platform at the China International Import Expo (CIIE) to provide patients with professional and easier diabetes management solutions.

Insulin Delivery Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the insulin delivery devices market analysis are product and end user.

- Based on product, the insulin delivery devices market is divided into insulin pens, insulin pumps, insulin syringes, pen needles, and others. The insulin pens segment held the largest market share in 2023. The insulin pump segment is anticipated to register the highest CAGR during the forecast period.

- By end user, the market is segmented into patients/homecare and hospitals & clinics. The patients/homecare segment held a larger share of the market in 2023 and is projected to register a higher CAGR during the forecast period.

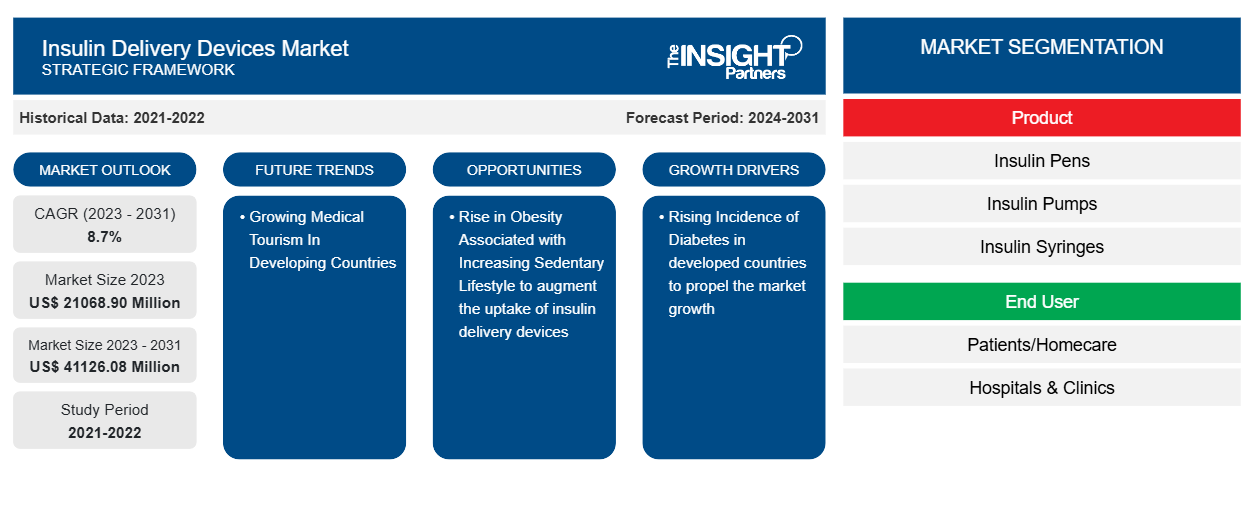

Insulin Delivery Devices Market Share Analysis by Geography

The geographic scope of the insulin delivery devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the insulin delivery devices market. The growth of the market in this region is attributed to the rising prevalence of diabetes, the growing prevalence of obesity globally, the rising geriatric population, and the rising number of product innovations among the market players. Market players are launching new products to the market. In addition, increasing awareness programs and campaigns about diabetes and technological advancements are likely to have a positive impact on the growth of the insulin delivery devices market in the coming years.

In 2021, the Government of Canada announced US$ 35 million for investment in diabetes, of which US$ 25 million specifically for diabetes research, surveillance, and prevention and for the development of a national framework for diabetes. This involves a recommitment to the Juvenile Diabetes Research Foundation (JDRF) and the Canadian Institutes of Health Research (CIHR) Partnership to Defeat Diabetes by investing up to US$ 15 million to be matched by the JDRF Canada and its donors for type 1 diabetes research. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Insulin Delivery Devices Market Regional Insights

The regional trends and factors influencing the Insulin Delivery Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insulin Delivery Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insulin Delivery Devices Market

Insulin Delivery Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 21068.90 Million |

| Market Size by 2031 | US$ 41126.08 Million |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

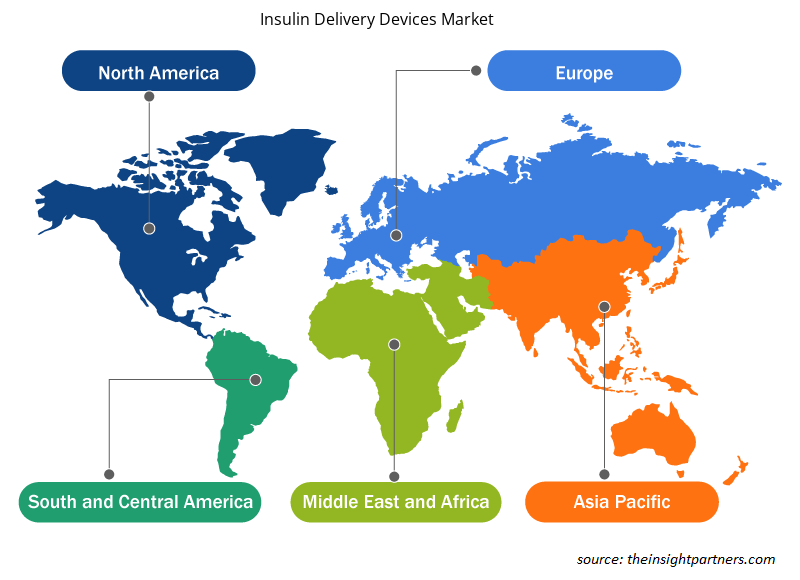

Insulin Delivery Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Insulin Delivery Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insulin Delivery Devices Market are:

- BD

- Novo Nordisk A/S

- B. Braun Melsungen AG

- Insulet Corporation

- Medtronic

- Tandem Diabetes Care, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insulin Delivery Devices Market top key players overview

Insulin Delivery Devices Market News and Recent Developments

The insulin delivery devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the insulin delivery devices market are listed below:

- Novo Nordisk introduced two smart connected insulin pens, NovoPen 6 and NovoPen Echo Plus, which are available on prescription for people living with diabetes treated with Novo Nordisk insulin in the UK. NovoPen 6 and NovoPen Echo Plus are insulin injection pens that record dosing information, including when and how much insulin was administered. (Source: Novo Nordisk, Press Release, March 2022)

- Eli Lilly and Company launched its insulin glargine biosimilar, Rezvoglar (insulin glargine-agar), on the US market, making it the second interchangeable insulin biosimilar to become commercially available to American patients with diabetes. (Source: Eli Lilly and Company, Press Release, April 2023)

Insulin Delivery Devices Market Report Coverage and Deliverables

The “Insulin Delivery Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Insulin delivery devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Insulin delivery devices market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Insulin delivery devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the insulin delivery devices market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Microcatheters Market

- Point of Care Diagnostics Market

- Employment Screening Services Market

- Virtual Event Software Market

- Collagen Peptides Market

- High Speed Cable Market

- Predictive Maintenance Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Pipe Relining Market

- Integrated Platform Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America region dominated the insulin delivery devices market in 2023.

Increasing incidence of diabetes, rise in obesity associated with the increasingly sedentary lifestyle and improper diet, and increasing technological advancement in insulin delivery devices are the most influential factors responsible for market growth.

BD; Novo Nordisk A/S; Insulet Corporation; B. Braun Melsungen AG; Medtronic; Eli Lilly and Company; Tandem Diabetes Care, Inc.; Biocon; Owen Mumford, Ltd.; and Sanofi are the market players in the insulin delivery devices market.

The estimated value of the insulin delivery devices market accounted for US$ 41126.08 million in 2031.

The global insulin delivery devices market is estimated to register a CAGR of 8.7% during the forecast period 2023–2031.

Get Free Sample For

Get Free Sample For