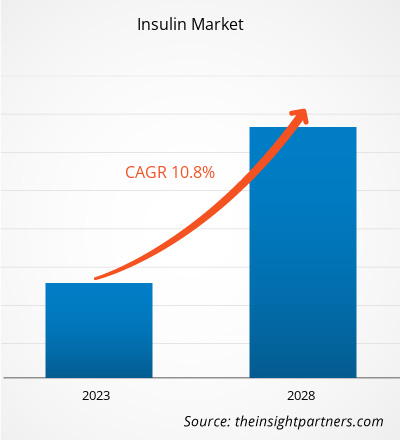

[Research Report] The insulin market is expected to grow to US$ 1,11,213.73 million by 2028 from US$ 60,183.09 million in 2022; the insulin market is estimated to grow with a CAGR of 10.8% from 2022-2028.

Analyst Perspective:

Rising prevalence of diabetes and increasing technological advancement in drug delivery devices are driving the growth of the insulin market. For instance: In May 2020, Biocon launched Semglee in vial and pre-fillled pen presentations in US. The product is offered at the lowest wholesale acquisition cost (WAC) for any long-acting Insulin Gargline on the US market. Moreover, launch of new products is the another driving factor prmoting the growth of the market. For instance: Novo Nordisk announced to launch GLP-1 injectable diabetes drug in tablet form. This oral drug will also help the patients in weight reduction and reduce cardiac risk. In 2022, North America had the largest insulin market share, followed by Europe. Further, Asia Pacific is expected to grow with a highest CAGR owing to presence of large pool of diabetic patients and increasing awareness on lifestyle disorders, increase in healthcare expenditure helps to boost the insulin market growth in the region.

Market Overview:

Insulin is a hormone that helps in lowering blood sugar levels. Insulin therapy is often an essential part of diabetes treatment. It is made by the beta cells of the pancreas and released into the blood when glucose levels rise, for example, after eating. Insulin helps the glucose to get into the body cells, which can be used for energy or stored for future use. Different types of insulin available varies in how quickly and for how long they can control blood sugar. Insulin does not come in pill form because the digestive system would break it down before it could work. Insulin therapy is exhausting; however, it is an effective way of lowering blood sugar levels.

The key factors that are driving the insulin market growth are increasing incidence of diabetes followed by rapid technological development in insulin delivery devices are the major driving factor promoting the growth of the insulin market. However, risk associated with insulin delivery devices is expected to restrict the insulin market growth during the forecast period. Europe occupies second position in the global insulin market and is expected to register robust growth rate over the forecast period. Increasing incidences of type 1 and type 2 diabetes, rising demand for insulin, and the favorable government initiatives for diabetes treatment are likely to be the major factors driving the insulin market growth of the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulin Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulin Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rapid Technological Development in Insulin Delivery Devices by Major Players Drive the Insulin Market Growth

Products with advanced insulin technology with more effective benefits are a major requirement in the treatment of diabetes. There has been a rise in advancements in diabetes treatment over the past few years. As the prevalence of diabetes is increasing worldwide, the demand for more advanced products is also boosting. The insulin market is expected to grow owing to an increase in the strategic efforts made by the industry players. The market players actively support their public and private research and academic institutes for increasing research activities.

A few of the recent developments related to rapid technological advancement in the insulin market are mentioned below:

- In May 2022, Eli Lilly and Company received USFDA approval for its Mounjar (tirzepatide) once-weekly Glucose-Dependent Insulinotropic Polypeptide (GIP) and GLP-1 Glucagon-like Peptide-1 (GLP-1) receptor agonist for the treatment of adults with type 2 diabetes. The injection is decided to be available in six doses (2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, and 15 mg) as an auto-injector pen with a preattached, hidden needle.

- In Oct 2021, Adocia announced that its partner Tonghua Dongbua Pharmaceutical Co. Ltd. received the clearance from the Center for Drug Evaluation (CDE) of the China National Medical Products Administration (NMPA) to conduct the Phase 3 clinical trial of BioChaperone Lispro, and Ultra-Rapid Insulin for the treatment of Type 1 and Type 2 diabetes.

- In October 2021, Tonghua Dongbao Pharmaceutical Co., Ltd. received approval from the National Medical Products Administration (NMPA) for the clinical trial of its ultra-rapid-acting insulin lispro injection, BC Lispro. Currently, the drug is under phase III clinical trial initiated in China.

- In May 2021, Bigfoot Biomedical received 510(k) clearance by USFDA for its Bigfoot Unity Diabetes Management System, which features connected smartpen caps that recommend insulin doses for people using multiple daily injections (MDI) therapy.

Thus, rapid technological advancements in insulin delivery devices are boosting the growth of the global insulin market.

Segment Analysis:

Based on type, the insulin market is segmented into long-acting insulin, rapid acting insulins, short acting insulins and traditional human insulins, concentrated insulins and combination insulins, biosimilar insulins, Glucagon-like peptide-1 (GLP-1), pens and needles, and others. The long-acting insulin segment is anticipated to hold the largest market share in 2021 and however, biosimilar insulins segment is expected to register the highest CAGR of 16.0 % during the forecast period. The major driving factors for the growth of the biosimilar insulins segment are increasing applications of inbred mice in cardiovascular & immunology studies and the production of monoclonal antibodies, among others. Longer-acting insulin analogs are genetically engineered. Long-acting insulin analogs were initially developed to address the need of diabetics to maintain healthy blood sugar levels throughout the night. This insulin is slowly released into the circulation due to its acidic pH, causing it to precipitate when injected subcutaneously. Long-acting insulins are also called basal or background insulins. They keep working in the background to keep the blood sugar under control throughout the daily routine. These long-acting insulins help in controlling blood sugar for a whole day. This is similar to how the pancreas produces insulin to maintain blood sugar levels between meals. The National Health Service (NHS) has favored long-acting insulin analogs because the insulins do not have peak activity, allowing activity to be delivered consistently throughout the day.

Tresiba is a long-acting insulin used to control high blood sugar levels in adults and children aged 1 year and older with diabetes. It is not suitable for people with diabetic ketoacidosis. Tresiba contains the active ingredient insulin degludec. Tresiba is usually injected under the skin once a day at any time of the day. Long-acting insulins work continuously throughout the day to control your blood sugar between meals and overnight. It is available in 2 concentrations namely 200 units/ml and 100 units/ml. Tresiba is supplied in multidose vials or as a FlexTouch pen for single patient use. Tresiba FlexTouch is a single-use, pre-filled pen available in two different strengths, U-100 (100 units/mL) containing 300 units of insulin and U-200 (200 units/mL) containing 600 units of insulin. Tresiba must not be administered with an insulin pump or mixed with other insulins. Side effects commonly associated with Tresiba include hypoglycemia, allergic reactions, injection site reactions, lipodystrophy, pruritus, rash, edema, and weight gain.

Regional Analysis:

North America held the largest insulin market which was valued at US$ 23,946.85 million in 2022 with a CAGR of 10.5% and is expected to continue its position owing due to the significantly rising prevalence of diabetes across the countries, high prevalence of obesity, and increasing awareness regarding diabetes care in the region. In North America, the US held the largest market of 84.88% for insulin market in 2022. The US healthcare system is witnessing massive investments new product introductions. Further, the insulin market growth is attributed to increasing product development and growing government support for diabetic treatment. In addition, rising new cases of diabetes in the country is also offering a favorable growth opportunity. For instance, according to the National Diabetes Statistics Report 2020, approximately 30.3 million people in the US have diabetes representing 94% of the total population. Among the diabetic population nearly 5% of the population is diagnosed with type 1 diabetes whereas, 90-95% have type 2 diabetes. Of the more than 30 million Americans with diabetes, approximately 7.4 million rely on insulin to manage their condition. In addition, the data also revealed approximately 86 million adults aged 18 years or above were pre-diabetes and nearly 23.1 million elders above 65 years were pre-diabetes. Across the US, diabetes is the leading cause of blindness and end stage of renal diseases or renal failure among adults. Furthermore, extending network of healthcare facilities and medical tourism is likely to accelerate the insulin market growth in Mexico.

However, Asia Pacific (APAC) is the fastest-growing regional market for insulins. The market in APAC is segmented into China, India, Japan, South Korea, Australia, and the Rest of APAC. The growing global prevalence of diabetes and rising incidence rates of lifestyle-related disorders such as obesity are expected to drive market growth over the next six years. Insulin is aimed at the diabetic patient population. The rapid prevalence growth is expected to significantly impact the market growth over the forecast period. Additionally, a strong product pipeline portfolio and future commercialization of these products are expected to provide a future growth opportunity for this market.

Key Player Analysis:

Eli Lily and Company; Novo NordiskA/S; Biocon; Wockhardt; Adocia; GlaxoSmithKline plc; Sanofi; Pfizer; Merck &Co., Inc.; Tonghua Dongbao Pharmaceutical Co., Ltd.; and Bigfoot Biomedical, Inc. amongst others. Novo NordiskA/S. and Sanofi are the top two players in the Insulin market. Novo Nordisk is a Europe based company, headquartered in Denmark. The company is focused on providing treatment for obesity, haemophilia, growth disorders and other serious chronic diseases. The company is focusing on so many therapeutic area such as Type 1 diabetes, Type 2 diabetes, Obesity, Atherosclerosis,NASH, Haemophilia and Growth disorders. The comany is operating through its subsidiaries such as Ziylo Ltd, MB2 LLC,Novo Nordisk Pharmaceuticals Limited,Novo Nordisk Pharma, S.a. among others. The company also offers treatments for diabetes, obesity, and rare blood and endocrine diseases.

Insulin Market Regional Insights

The regional trends and factors influencing the Insulin Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insulin Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insulin Market

Insulin Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 60.18 Billion |

| Market Size by 2028 | US$ 111.21 Billion |

| Global CAGR (2022 - 2028) | 10.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

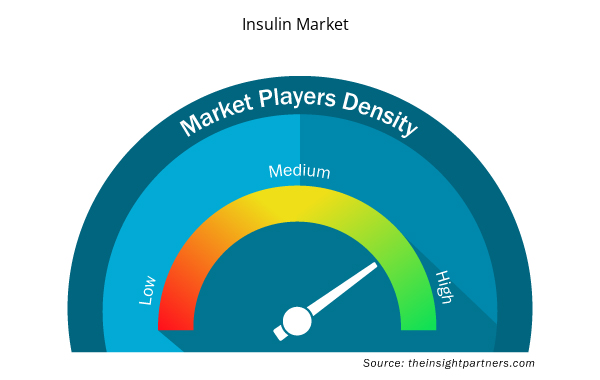

Insulin Market Players Density: Understanding Its Impact on Business Dynamics

The Insulin Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insulin Market are:

- Eli Lily and Company

- Novo NordiskA/S

- Biocon

- Wockhardt

- Adocia

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insulin Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the insulin market. A few recent key market developments are listed below:

- In Jun 2022, Sanofi and Health2Sync have signed a partnership to bring digital solutions for insulin management to Japan. Both the companies will jointly develop digitized features on insulin in Japan such as connected caps for insulin and titration alerts.

- In Jun 2022, Sanofi announced that the company would cap the monthly price of its insulin for uninsured Americans at US$ 35, down from US$ 99. The company will be commercializing the insulins such as Lantus Insulin Glargine U-100, Toujeo, Admelog, and Apidra for the uninsured at US$35 for a 30-day supply.

- In Jan 2022, Merck announced an extension to the label for metformin products in EU such as Glucophage, Glucophage XR, and Stagid for use throughout the pregnancy.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Single Pair Ethernet Market

- Smart Mining Market

- Portable Power Station Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Small Internal Combustion Engine Market

- Visualization and 3D Rendering Software Market

- Bioremediation Technology and Services Market

- Unit Heater Market

- Space Situational Awareness (SSA) Market

- Rugged Servers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global insulin market based on regions is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In 2021, the North American region held the largest market share. However, the Asia Pacific region is estimated to grow at the fastest CAGR of 12.7% during the forecast period

Risks associated with insulin delivery devices are expected to restrict the insulin market growth during the forecast period.

Insulin controls the body's fat and glucose metabolism. It is a peptide hormone that is secreted by beta cells in the islets of Langerhans in the pancreas and helps in glucose metabolism regulation. It promotes glucose to be absorbed from the blood by skeletal muscle cells and fat tissues. But due to some diseases and disorders body is not able to make a sufficient amount of insulin which results in hyperglycemia due to imbalanced metabolism. In such conditions, insulin is given externally to maintain normal blood glucose levels.

The factors driving the growth of the insulin market are the increase in the incidence of diabetes and rapid technological developments in insulin delivery devices by major players.

The insulin market majorly consists of the players, such as Eli Lilly and Company; Novo Nordisk A/S; Biocon; WOCKHARDT; Adocia; GlaxoSmithKline plc.; Sanofi; Pfizer Inc.; Merck & Co., Inc.; Tonghua Dongbao Pharmaceutical Co., Ltd.; BIGFOOT BIOMEDICAL, INC.; among others.

The global insulin market based on type is segmented into long-acting insulin, rapid-acting insulin, short-acting insulin & traditional human insulin, concentrated insulin & combination insulin, biosimilar insulin, glucagonlike-peptide-1 (glp-1), pens & needles, and others. In 2021, the long-acting insulin segment held the largest share of the market. However, the biosimilar insulin segment of the insulin market is expected to register the highest CAGR of 16.0% during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Insulin Market

- Eli Lily and Company

- Novo NordiskA/S

- Biocon

- Wockhardt

- Adocia

- GlaxoSmitheKline plc

- Sanofi

- Pfizer

- Merck &Co., Inc.

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Bigfoot Biomedical, Inc.

Get Free Sample For

Get Free Sample For