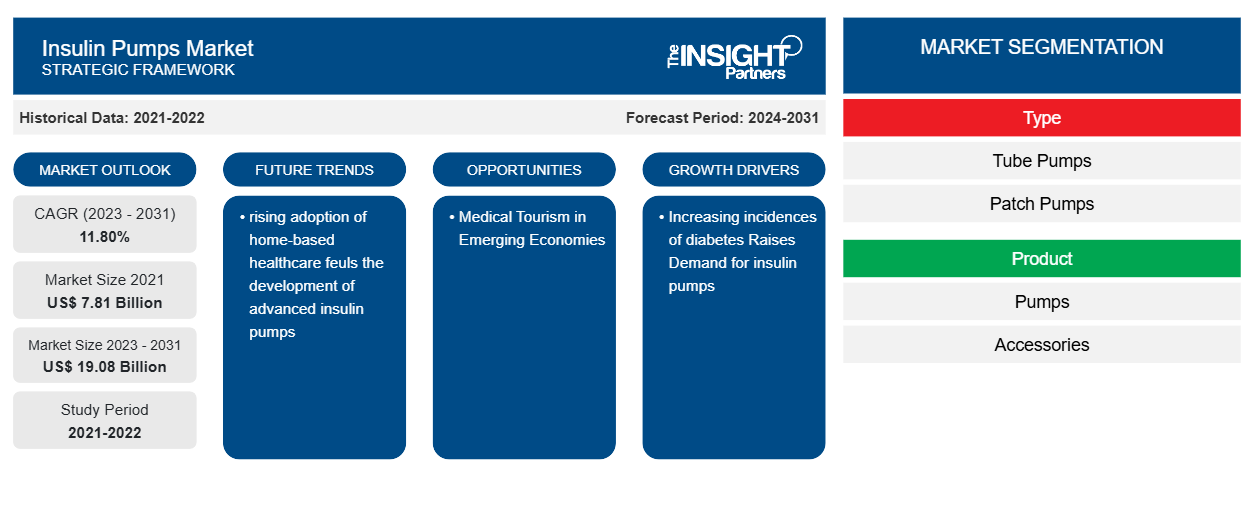

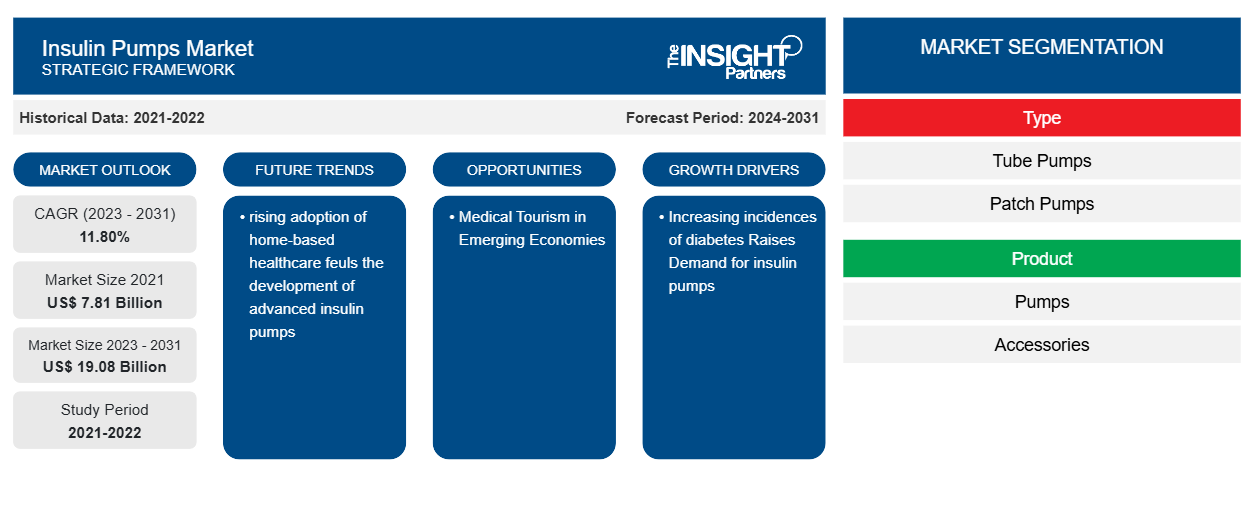

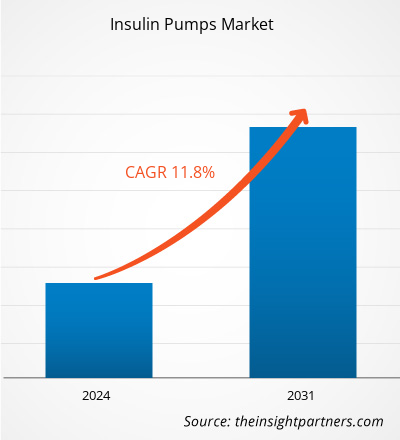

The insulin pumps market was valued at US$ 7.81 billion in 2021 and is expected to reach US$ 19.08 billion by 2031. The market is expected to register a CAGR of 11.80% from 2023–2031. Technological advancement is likely to remain key Insulin Pumps Market trends.

Insulin Pumps Market Analysis

Insulin pumps deliver insulin, a hormone that helps reduce blood sugar levels in patients with diabetes. Insulin therapy is an essential treatment for patients with Type 1 and Type 2 diabetes. Diabetes is one of the significant health problems whose prevalence is increasing rapidly. Therefore, there is a need for early diagnosis and management of the disease to avoid further problems such as heart disease. The rising incidences and prevalence of diabetes and associated risk factors, including lifestyle changes, obesity, and the aging population, boost the demand for insulin pumps in the market.

Insulin Pumps Market Overview

Technological innovations and smart solutions continue to influence the insulin pump market significantly.

Asia Pacific is the fastest-growing regional market for insulin pumps. The market in this region is segmented into China, Japan, South Korea, India, Australia, and the Rest of APAC. The growing global prevalence of diabetes, rising incidences of lifestyle-related disorders, and the aging population are expected to drive market growth over the coming years. Insulin pumps are indicated for the diabetic patient population as they mimic the function of a normal pancreas in delivering a basal insulin dose and bolus doses when blood glucose levels rise above the normal range. The growing prevalence is expected to impact the market growth significantly over the forecast period. Additionally, a strong product pipeline portfolio and future commercialization of insulin pumps are expected to provide a future growth opportunity for this market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulin Pumps Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulin Pumps Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insulin Pumps Market Drivers and Opportunities

Mounting Prevalence of Diabetes to Favor Market

As highlighted in the American Diabetes Association report published in 2024, 38.4 million Americans had diabetes in 2021. Among them, 29.7 million were diagnosed, and 8.7 million were undiagnosed. Additionally, the International Diabetes Federation report published in 2022 revealed that North America and the Caribbean accounted for 51 million, Europe accounted for 61 million, Middle East & North Africa reported 73 million, Africa for 24 million, South East Asia for 90 million, Western Pacific for 206 million, and South & Central America accounted for 32 million diabetes cases in 2021.

Thus, the growing prevalence of diabetes and increasing technological advancements in delivery devices drive the growth of insulin pumps.

Growing Medical Tourism– An Opportunity

The technological advancements in the healthcare in developing countries are attracting patients to travel for better and cost-effective treatments and the major players to expand their business. Most manufacturers of insulin pumps focus on emerging markets such as India, Brazil, Argentina and countries in Latin America due to an increase in the prevalence of diabetes and the increasing utilization of devices in the region. In India, medical science has proliferated in the past few decades. Diabetes treatment is cost effective and readily available in the emerging market and people from other countries travel to get themselves treated. The most possible reason might be their country's excessively high healthcare expenses. Due to existing exchange rates and other factors, treatment for diabetes in India has become affordable compared to other foreign countries. Thus, the rising medical tourism in emerging nations such as India is anticipated to provide significant opportunities to the players operating in the insulin pumps market during the forecast period.

Insulin Pumps Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Insulin Pumps Market analysis are type,

product, and application.

- Based on type, the insulin pumps market is divided into tube pumps and patch pumps. The Disposable segment may hold a larger market share in 2023.

- Based on product, the insulin pumps market is bifurcated pumps and accessories. The pumps segment may hold a larger market share in 2023.

- Based on application, the insulin pumps market is bifurcated into Type I Diabetes and Type II Diabetes. The Type 1 Diabetes segment may hold a larger market share in 2023.

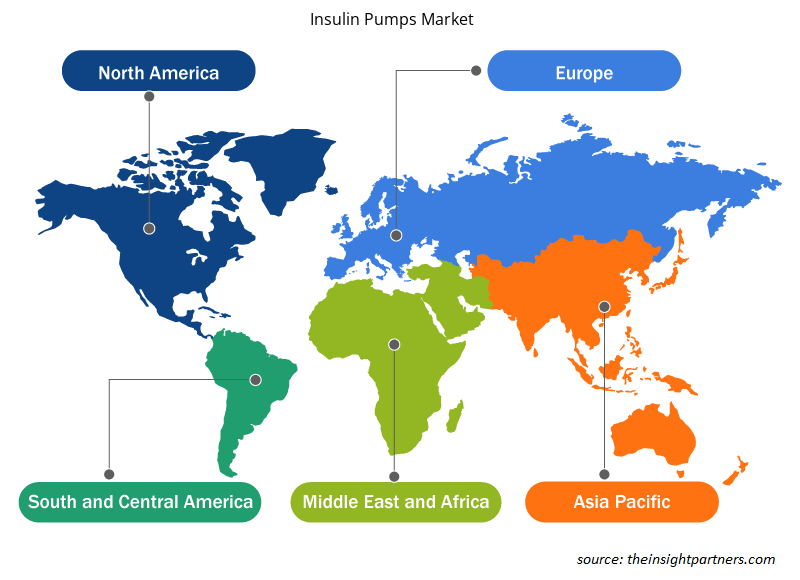

Insulin Pumps Market Share Analysis by Geography

The geographic scope of the Insulin Pumps Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the insulin pumps market. The US accounts for a considerable share of the insulin pumps market in North America. The presence of top healthcare service providers in the US are among the most influential factors responsible for market growth. Asia Pacific is projected to grow with the highest CAGR in the coming years.

Insulin Pumps Market Regional Insights

The regional trends and factors influencing the Insulin Pumps Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insulin Pumps Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insulin Pumps Market

Insulin Pumps Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.81 Billion |

| Market Size by 2031 | US$ 19.08 Billion |

| Global CAGR (2023 - 2031) | 11.80% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Insulin Pumps Market Players Density: Understanding Its Impact on Business Dynamics

The Insulin Pumps Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insulin Pumps Market are:

- Insulet Corporation

- Medtronic

- Tandem Diabetes Care, Inc

- Debiotech S.A.

- CELLNOVO

- SOOIL Developments Co., Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insulin Pumps Market top key players overview

Insulin Pumps Market News and Recent Developments

The Insulin Pumps Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in them market for Insulin Pumps and strategies:

- Switzerland-based PharmaSens applied for FDA approval for its 'niia essential' insulin patch pump system. The company also achieved ISO 13485 certification in November 2023 for the system's design, development, manufacture, and distribution. The product is a basal-bolus patch pump with a streamlined design that combines the ease of an insulin pen with the advantages of a sophisticated insulin pump. It features an innovative 3ml reservoir, making it one of the most compact patch pumps on the market. The insulin patch pump system also incorporates an automatic needle insertion mechanism and a semi-reusable concept for cost-efficiency and sustainable product design. (Source: PharmaSens AG, Press Release, 2023)

- The US Food and Drug Administration (FDA) approved the Beta Bionics iLet ACE Pump and the iLet Dosing Decision Software for people aged 6 and above with type 1 diabetes. These two devices and a compatible FDA-cleared integrated continuous glucose monitor (iCGM) form a new system called the iLet Bionic Pancreas. The new automated insulin dosing (AID) system uses an algorithm to determine and command insulin delivery. (Source: US FDA, Press Announcements, 2023)

Insulin Pumps Market Report Coverage and Deliverables

The “Insulin Pumps Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Product, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America dominated the insulin pumps market in 2023.

Factors including increasing incidences of diabetes and rising adoption of home-based healthcare are driving the insulin pumps market growth.

Growing technological advancements in insulin pumps is a future trend in the market.

Insulet Corporation; Medtronic; Tandem Diabetes Care, Inc; Debiotech S.A.; CELLNOVO; SOOIL Developments Co., Ltd; Microport Scientific Corporation; Valeritas Inc.; F. Hoffmann-La Roche Ltd.; and Ypsomed AG are some leading players operating in the Insulin pumps market.

The insulin pumps market is estimated to reach US$ 19.08 billion by 2031.

The insulin pumps market is anticipated to grow at a CAGR of 1119.08 billion.80% during 2023-2031.

Get Free Sample For

Get Free Sample For