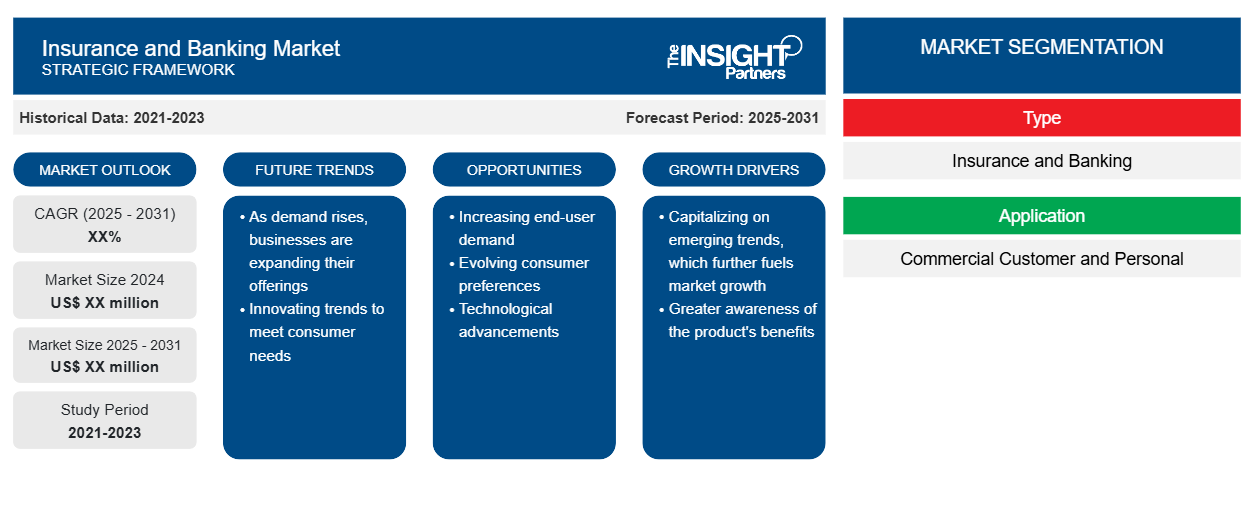

The banking and insurance market is expected to expand at a CAGR of XX% from 2025 to 2031. The introduction of direct-to-customer sales and the demand for a personalized experience are likely to be key trends in the market.

Insurance and Banking Market Analysis

In the banking industry, digital transformation is altering the way firms operate. From retail to mobile banking, technology innovations have an impact on every aspect of the economy, driven by a growing desire for a digital experience among Millennials and Generation Z. A prevalent practice in the banking sector is to make prudent investments to position themselves for long-term success while keeping costs under control. On the other hand, the insurance business is undergoing a massive transformation. The industry is focusing on cloud migration and core process digitization. Technology adoption, which was slow in the insurance industry, has accelerated in recent years. This, in turn, is expected to boost the market growth during the forecast period.

Insurance and Banking Market Industry Overview

As customers become more aware of digital solutions provided by businesses outside the banking and insurance markets, they are looking for more customer-centric digital solutions from these businesses. Thus, market players are focusing on providing personalized banking and insurance services to their clients. Further, although there have been numerous technical developments and improvements in recent years, banking and insurance organizations are increasingly looking at technologies to provide a better digital experience for their clients while also improving operational efficiency. This, in turn, is anticipated to boost the market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance and Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance and Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insurance and Banking Market Driver and Opportunities

Digital Experience in the Banking and Insurance Industry to Drive Market Growth

Innovation through new technology is a fundamental driver of change in the banking and insurance industry. In recent years, technological developments have gradually changed the insurance and banking landscapes. There are various ways in which this digital transformation is facilitating better consumer experiences in the space. Multiple financial technology-driven innovations are steadily emerging and altering the market. According to studies, some insurance companies are exploring AI for technological advancement. This, in turn, is projected to drive the market growth during the forecast period.

Technological Advancements to Create Lucrative Market Opportunities

In recent years, major technology trends have emerged that have an impact on almost every industry. A handful of rising technological trends are poised to change the fundamental nature of the banking and insurance sector. Digitalization is transforming the way businesses operate and interact with customers. Leveraging developing technologies, such as Robotic Process Automation (RPA), Machine Learning (ML), data analytics, and Artificial Intelligence (AI), can increase operational efficiency for the insurance and banking industry. This, in turn, is anticipated to shape growth prospects for the banking and insurance market during the forecast period.

Insurance and Banking Market Report Segmentation Analysis

The key segments that contributed to the derivation of the insurance and banking market analysis are type and applications.

- By type, the market is bifurcated into insurance and banking segments.

- Based on application, the market is divided into commercial customer and personal segment.

- The insurance segment is expected to grow significantly during the forecast period. This growth may be attributed to the growing digitization in the insurance sector and the rising focus on improving customer services.

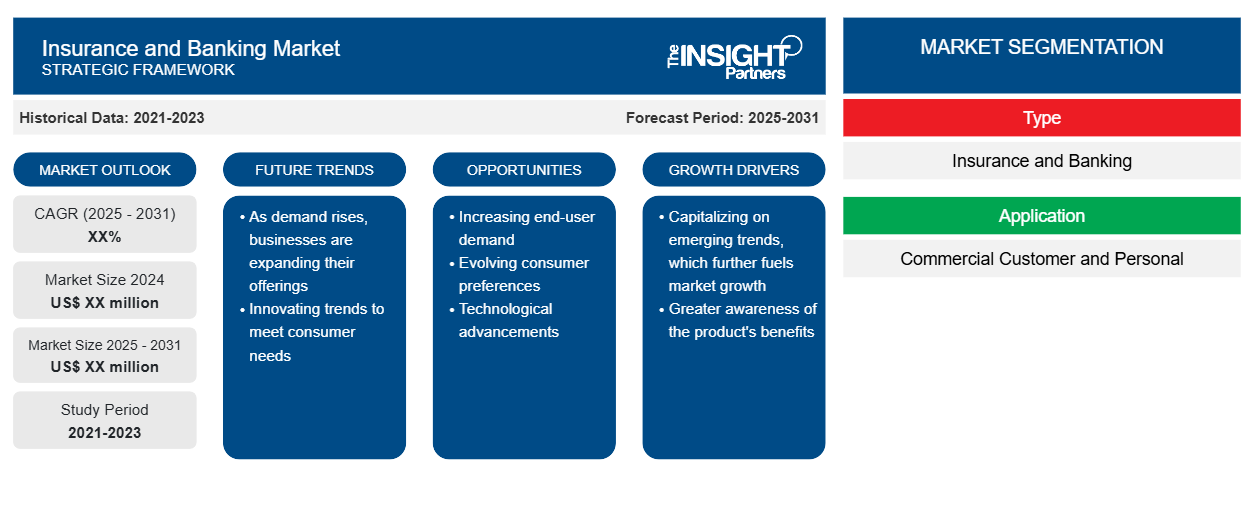

Insurance and Banking Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

North America is expected to hold a prominent share of the insurance and banking market during the forecast period. This growth may be attributed to the presence of key market players and the early adoption of technology. The banking and insurance market is expected to grow exponentially in the Asia Pacific region due to rising per capita income, the introduction of new products, technological innovation, expanded distribution, networking, and increased customer knowledge of financial services.

Insurance and Banking Market Regional Insights

The regional trends and factors influencing the Insurance and Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insurance and Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insurance and Banking Market

Insurance and Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Insurance and Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Insurance and Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insurance and Banking Market are:

- Bitex International C.V.

- Coinbase

- CoolBitX

- Xapo Holdings Limited

- Solidi Ltd

- Safello AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insurance and Banking Market top key players overview

Insurance and Banking Market News and Recent Developments

The insurance and banking market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the insurance and banking market are listed below:

- Allianz Partners announced the launch of the Allyz mobile app, a digital platform providing travelers with trusted advice and expertise as well as access to the full suite of insurance benefits available to customers. The launch of the mobile app in France, Germany, and the Netherlands is an important milestone in the expansion of Allianz Partners' digital platform, with the rollout of new digitally accessible services to continue across all lines of business until 2024. (Source: Allianz Partners, Press Release, January 2024)

Insurance and Banking Market Report Coverage & Deliverables

The insurance and banking market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Insurance and Banking Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Insurance and banking market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Insurance and banking market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Insurance and banking market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the insurance and banking market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share an excel dataset based on the request.

Bitex International C.V., Coinbase, CoolBitX, Xapo Holdings Limited, Solidi Ltd, Safello AB, Digital Asset Services Ltd., BitMain Technologies Holding Company, Advanced Micro Devices, Inc, Bitfury Group Limited, AIA Group, Berkshire Hathaway, MetLife, United Health Group, Ping An Insurance, Cigna, Zurich Insurance Group Ltd, Assicurazioni Generali, Munich Re Group, and Gerber Life Insurance are the major market players.

Technological advancement and product and service developments market are the major trends in the market.

The global banking and insurance market was estimated to grow at a CAGR of XX% during 2023 - 2031.

Digital experience in the banking and insurance industry and increasing merger and acquisition activities are the major factors that drive the global banking and insurance market.

Get Free Sample For

Get Free Sample For