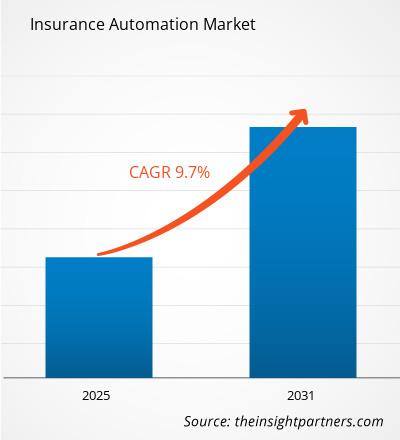

The Insurance Automation Market is expected to register a CAGR of 9.7% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Component (Solution, Service), Enterprise (Small & Medium Enterprise, Large Enterprise). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Insurance Automation Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Insurance Automation Market Segmentation

Component

- Solution

- Service

Enterprise

- Small & Medium Enterprise

- Large Enterprise

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insurance Automation Market Growth Drivers

- Growing Digital Transformation: Insurance companies are increasingly relying on innovation and automation as key differentiators to capture scale and competitiveness. Intelligent automation can improve insurance companies' customer satisfaction rate by providing claim handling and processing times that are faster than the non-automated claim process. Hence, insurance companies can enhance the customer experience by expediting the time and energy is required for insurance customers to file and resolve claims.

- Rising Need to Improve Customer Satisfaction: The integration of automated systems will enable insurance companies to process claims in a timely manner and improve satisfaction. Technologies, such as Robotic Process Automation (RPA) and Intelligent Document Processing (IDP), facilitate the claims handling process occurring with greater speed and efficiency. Automated systems drive efficiency by completing repetitive processes involving data entry, document verification, and status updates in a timely manner — reducing time spent processing and closing claims.

Insurance Automation Market Future Trends

- Increased Adoption of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML continue to become more significant in insurance underwriting and claims handling, but more importantly with fraud detection, customer service, and automation of Underwriting and Claims processes. By analyzing large and progressively larger amounts of data pertaining to client profiles and past historical claims and market trends, AI and ML algorithms are being part of the insurance Underwriters’ repertoire. Even consumer behaviors are being analyzed to have more accurate risk assessments, and quicker, more supportive underpinning decisions.

- Robotic Process Automation (RPA) for Back-End Operations: Robotic Process Automation (RPA) is gaining traction in the insurance industry, particularly for back-end operations such as data entry, claims processing, and policy administration. RPA enables insurers to deploy software robots that can perform repetitive tasks with high speed and accuracy, reducing the need for manual intervention. This trend toward RPA is helping insurers reduce operational costs, accelerate processes, and improve accuracy in policy administration and claims management. As RPA technology becomes more advanced and accessible, its adoption is expected to expand across various functions in the insurance value chain, from underwriting to billing and customer service.

Insurance Automation Market Opportunities

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): The integration of AI and machine learning into insurance automation solutions presents a major opportunity to enhance decision-making and improve service offerings. AI and ML can be used to automate underwriting decisions, claims validation, fraud detection, and customer interaction. For example, AI-powered chatbots and virtual assistants can handle routine customer queries, while machine learning algorithms can analyze vast amounts of data to assess risk more accurately. These technologies enable insurers to improve efficiency, reduce human bias, and deliver more personalized services to customers, providing a significant competitive advantage.

- Expansion of Automation in Customer Experience and Personalization: There is an opportunity for insurance companies to leverage automation to enhance the customer experience and drive greater personalization. Automated systems can gather and analyze customer data to offer tailored policies, premiums, and coverage options based on individual needs and preferences. Additionally, automating customer service processes, such as policy renewals, claims updates, and real-time communications, can enhance convenience and engagement for policyholders. The ability to offer personalized, seamless, and responsive services will help insurers build stronger customer loyalty and differentiate themselves in a competitive market.

Insurance Automation Market Regional Insights

The regional trends and factors influencing the Insurance Automation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insurance Automation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insurance Automation Market

Insurance Automation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 9.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

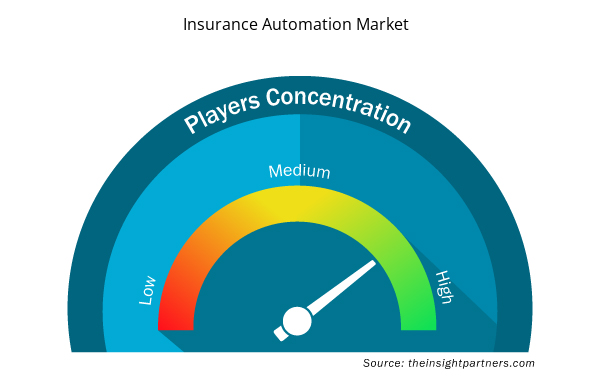

Insurance Automation Market Players Density: Understanding Its Impact on Business Dynamics

The Insurance Automation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insurance Automation Market are:

- Acko General Insurance

- IBM Corporation

- Microsoft Corporation

- Shift Technology

- Zurich Insurance Group

- Lemonade

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insurance Automation Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Insurance Automation Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Insurance Automation Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Semiconductor Metrology and Inspection Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Malaria Treatment Market

- Explosion-Proof Equipment Market

- Mice Model Market

- Virtual Event Software Market

- Medical Audiometer Devices Market

- Skin Graft Market

- Wind Turbine Composites Market

- Nitrogenous Fertilizer Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

The Insurance Automation Market is estimated to witness a CAGR of 22.1% from 2023 to 2031

The major factors driving the insurance automation market are Growing Digital Transformation and Growing Need to Improve Customer Satisfaction.

Increased Adoption of Machine Learning (ML) and Artificial Intelligence (AI) is anticipated to play a significant role in the global insurance automation market in the coming years

-

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

1.Acko General Insurance

2.IBM Corporation

3.Microsoft Corporation

4.Shift Technology

5.Zurich Insurance Group

6.Lemonade

7.Cape Analytics LLC

8.Trov, Quantemplate

9.ZhongAn

10.Oracle

Get Free Sample For

Get Free Sample For