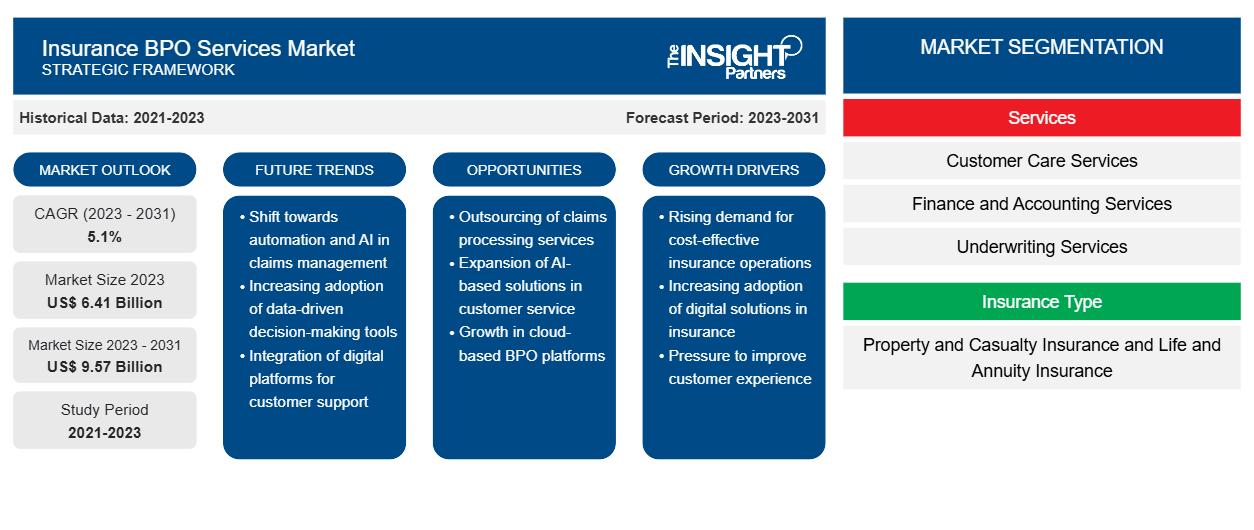

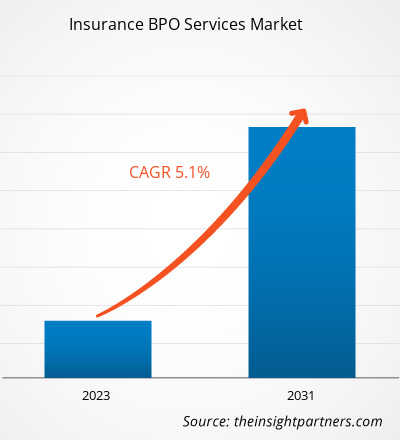

The insurance BPO services market size is expected to grow from US$ 6.41 billion in 2023 to US$ 9.57 billion by 2031; it is anticipated to expand at a CAGR of 5.1% from 2023 to 2031. The insurance BPO services market trends include technological advancement, demand for cost-effective services, and strategic partnerships between fintech companies.

Insurance BPO Services Market Analysis

The report includes growth prospects owing to the current investment banking market trends and their foreseeable impact during the forecast period. The insurance BPO services industry is embracing technological advancements to enhance its customer's services and expand its global reach. This includes the use of artificial intelligence (AI), the Internet of Things (IoT), data analytics techniques, and innovative financial technologies. The rising adoption of cloud-based solutions and the growing organization’s need to standardize business processes are expected to drive the insurance BPO services market during the forecast period.

Insurance BPO Services Market Overview

- Insurance business process outsourcing (BPO) services is the process used for outsourcing backend office tasks and complex functions from third-party service providers. Companies use insurance BPO services to outsource their numerous backend tasks, such as data entry, bookkeeping, accounting, policy administration, claims processing, underwriting, and other tasks.

- Insurance firms face various challenges, such as intense competition, strict laws, shrinking profit margins, and increasing customer demands for high-quality services creating demand for insurance BPO services. Insurance businesses are outsourcing non-core operations to take advantage of the technology and expertise of BPO service providers to reduce labor costs.

- Insurance BPO services aim to increase efficiency, improve business processes, reduce additional costs, and provide better customer experiences. These services frequently include digitizing processes, using data analytics techniques for business insights, and focusing on cybersecurity to safeguard client’s data and corporate information.

- Companies highly adopt insurance BPO as a sustainable and beneficial option to manage in-house departments and hire experienced personnel. Increasing demand for cost-effective operations among consumers across the globe is driving the insurance BPO services market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance BPO Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance BPO Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insurance BPO Services Market Driver

Technological Advancements are Driving the Insurance BPO Services Market Growth

- Insurance BPO service providers are leveraging advanced technologies such as AI, IoT, cloud computing, and analytics techniques to improve operational efficiency, enhance service quality, and manage overall business costs is driving the market.

- Companies use numerous advanced analytics techniques such as machine learning, data mining, and predictive modeling to extract insights from huge insurance data. These insights support insurance companies to detect fraudulent claims, streamline underwriting procedures, identify trends, and personalize consumer experiences, leading to improved decision-making for managing risks.

- The growing adoption of automation technology among insurance companies to streamline routine and rule-based tasks such as policy administration, data entry, and claims processing is driving the market. Robotic process automation (RPA) technology helps companies improve operational accuracy, speeds up processing, and allows HR to focus on more complex and high-value activities. This allows BPO firms to manage larger volumes of transactions at lower costs with greater accuracy.

- Therefore, technology plays a major role in the expansion of the insurance BPO services market by allowing providers to increase operational effectiveness, offer innovative solutions, and deliver enhanced value to insurance businesses and their clients.

Insurance BPO Services Market Report Segmentation Analysis

- Based on enterprise size, the insurance BPO services market is segmented into large enterprises and small & medium enterprises (SMEs).

- Small & medium enterprises (SMEs) segment is anticipated to hold a significant investment banking market share by 2030. SMEs are highly outsourcing non-core insurance operations from third-party service providers to streamline business procedures, enhance operational efficiency, and reduce overall operational costs.

- Moreover, outsourcing supports SMEs by shifting their focus to strategic initiatives and core competencies. In contrast, the outsourcing partner handles and manages all ordinary and repetitive tasks such as policy servicing, claims processing, and underwriting support. Thus driving the segment and positively supporting overall market insurance BPO services growth during the forecast period.

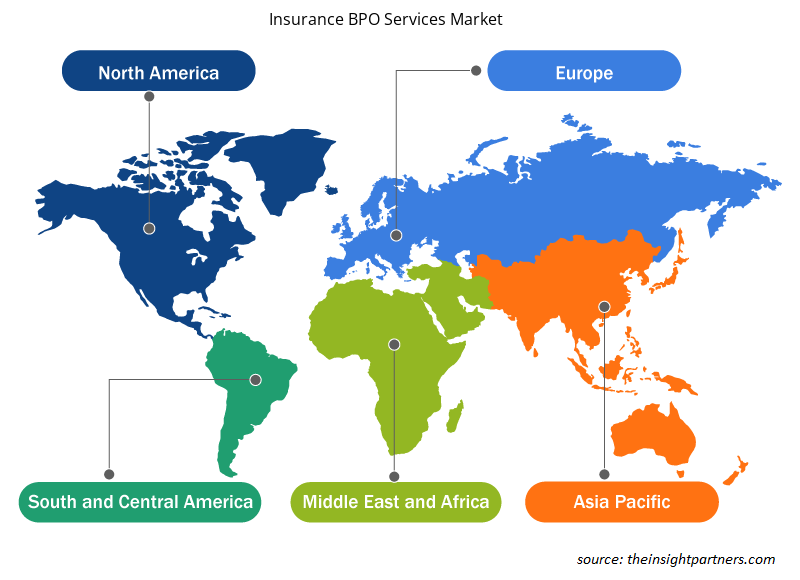

Insurance BPO Services Market Regional Analysis

The scope of the insurance BPO services market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant insurance BPO services market share. Technological advancements and the presence of a large number of service providers such as Dell Technologies Inc, Cogneesol BPO Pvt. Ltd., Cognizant Technology Solutions Corp, and others. These players are continuously engaged in developing advanced solutions to help their customers manage their business processes effectively. Significant benefits provided by the insurance BPO services, such as being more accessible and cost-effective, are fueling the market.

Insurance BPO Services Insurance BPO Services Market Regional Insights

Insurance BPO Services Market Regional Insights

The regional trends and factors influencing the Insurance BPO Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insurance BPO Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insurance BPO Services Market

Insurance BPO Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.41 Billion |

| Market Size by 2031 | US$ 9.57 Billion |

| Global CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

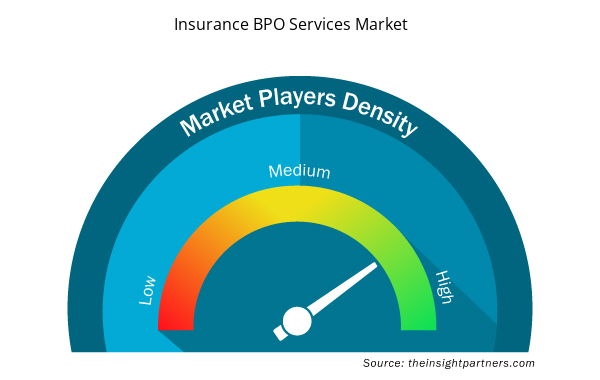

Insurance BPO Services Market Players Density: Understanding Its Impact on Business Dynamics

The Insurance BPO Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insurance BPO Services Market are:

- WNS (Holdings) Ltd

- Wipro Ltd

- Accenture Plc

- Infosys Ltd

- Tata Consultancy Services Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insurance BPO Services Market top key players overview

The "Insurance BPO Services Market Analysis" was carried out based on services, insurance type, enterprise size, application, and geography. Based on services, the market is segmented into customer care services, finance and accounting services, underwriting services, claims management, and others. On the basis of insurance type, the market is segregated into property and casualty insurance and life and annuity insurance. In terms of enterprise size, the insurance BPO services market is categorized into large enterprises and small and small enterprises (SMEs). Based on application, the insurance BPO services market is segmented into BFSI, manufacturing, healthcare, telecom, and others. By region, the insurance BPO services market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Insurance BPO Services Market News and Recent Developments

The insurance BPO services market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. Companies adopt inorganic and organic strategies such as mergers and acquisitions in the insurance BPO services market. A few recent key market developments are listed below:

- In April 2023, Capgemini SE was recognized by Information Services Group Inc (IGS), as a leader in its provider lens procurement BPO and transformational services. Capgemini SE’s robust solution/platform partner network supports its client by providing core procurement operations, workforce optimization, risk management, process mining and advanced analytics, and tail spend management.

- In August 2022, Infosys BPM was recognized as a Leader in the BPO Services and Digital Transformation Services categories in the ISG Provider Lens Procurement BPO and Transformation Services.

Insurance BPO Services Market Report Coverage & Deliverables

The market report on “Insurance BPO Services Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country-level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Services, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global investment banking market is expected to reach US$ 9.57 billion by 2031.

The key players holding majority shares in the global insurance BPO services market are WNS (Holdings) Ltd; Wipro Ltd; Accenture Plc; Infosys Ltd; Tata Consultancy Services Ltd; Capgemini SE; Genpact Ltd; Cognizant Technology Solutions Corp; Cogneesol BPO Pvt. Ltd.; and Dell Technologies Inc.

Demand for cost-effective services and strategic partnerships between fintech companies are the major factors that propel the global insurance BPO services market.

The global insurance BPO services market was estimated to be US$ USD 6.41 billion in 2023 and is expected to grow at a CAGR of 5.1% during the forecast period 2023 - 2031.

Technological advancement, the rising adoption of cloud-based solutions and the growing organization’s need to standardize business processes is anticipated to play a significant role in the global insurance BPO services market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- WNS (Holdings) Ltd

- Wipro Ltd

- Accenture Plc

- Infosys Ltd

- Tata Consultancy Services Ltd

- Capgemini SE

- Genpact Ltd

- Cognizant Technology Solutions Corp

- Cogneesol BPO Pvt. Ltd.

- Dell Technologies Inc

Get Free Sample For

Get Free Sample For