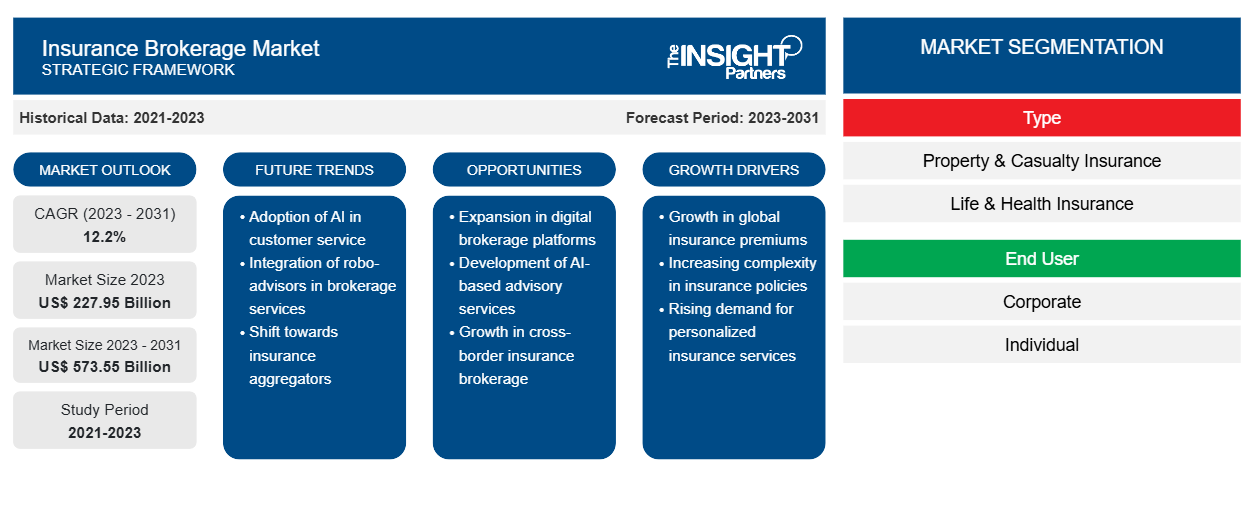

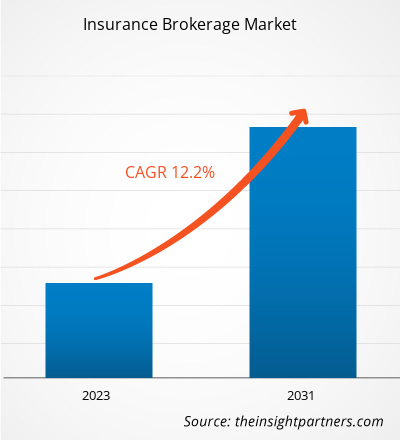

The insurance brokerage market size is expected to grow from US$ 227.95 billion in 2023 to US$ 573.55 billion by 2031; it is anticipated to expand at a CAGR of 12.2% from 2023 to 2031. The market includes growth prospects owing to the current insurance brokerage market trends and their foreseeable impact during the forecast period. The market is a large and expanding sector of the insurance industry. The insurance brokerage market is growing due to factors such as an increase in demand for insurance policies and the expansion of digital brokers. Further, favorable government initiatives provide lucrative opportunities for market growth. However, the availability of alternative online platforms for purchasing insurance restraints the market growth.

Insurance Brokerage Market Analysis

Reinsurance is referred to as insurance for insurance companies. It is a contract between a reinsurer and an insurer. Reinsurance helps insurers stay in business by recouping all or part of the money they have paid to claimants. Reinsurance lowers the net liability for specific risks and provides disaster protection against significant or numerous losses. Insurers buy reinsurance for four reasons: to boost capacity, to stabilize loss experience, to protect themselves and the insured against disasters, and to limit liability on a particular risk. Reinsurance increases the insurer's capacity to bear the financial burden in the event of uncommon, significant events by protecting it from accumulated liabilities. This provides the insurer with more assurance of its equity and solvency. In order to maintain the solvency margins, insurers can underwrite policies that cover a greater amount of risk without unnecessarily increasing administrative expenses by the use of reinsurance. Furthermore, reinsurance provides insurers with significant liquid assets in the event of extraordinary losses.

Globalization has evolved in recent decades as a result of the expansion of commercial and financial networks that cross national borders, making businesses and workers from other economies increasingly interconnected. Greater globalization creates more chances for international investments, resulting in more investment-linked programs. Moreover, industrialization also facilitates increased investments, cross-broader collaborations, partnerships and joint ventures, facilitating the insurance brokerage market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance Brokerage Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insurance Brokerage Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Reinsurance Industry Overview

- As digital technologies evolve, insurance brokerage providers are continuously finding new ways to reduce costs, optimize processes, and connect with their customers.

- Insurance brokers are continuing to boost investments in technologies such as artificial intelligence (AI), automation, big data, and others while expanding the use of mobile devices.

- Moreover, the Internet of Things (IoT) provides brokers and insurers with an extensive volume of data and insights to design efficient risk management tools and systems that boost customer information repository, thereby enabling them to offer timely, pertinent coverage based on customer’s needs.

- Furthermore, technology enables to offer personalized services that are increasingly more accurate.

Insurance Brokerage Market Driver

Increase in Demand for Insurance Policies to Drive the Insurance Brokerage Market

- The insurance industry is one of the fastest-growing sectors across the globe. With insurance products like life insurance, health insurance, motor insurance, and others, the industry figures generate huge volumes.

- The distribution of these insurance products is carried out through various channels, such as direct and intermediary channels.

- Intermediary channels include agents, brokers, retailers, bancassurance, and others. Thus any increase in the adoption of insurance products will also increase the insurance brokerage market growth.

- The insurance brokers provide expert advice related to insurance policies based on customer requirements. In return, they are paid brokerage by the insurance company whose policy is chosen.

- Furthermore, the majority of customers prefer buying insurance from a broker to save time and money. Thus, an increase in demand for insurance policies drives the insurance brokerage market.

Insurance Brokerage Market Report Segmentation Analysis

- Based on type, the insurance brokerage market is segmented into life & health insurance and property & casualty insurance. The property & casualty insurance segment is expected to hold a substantial insurance brokerage market share in 2023.

- The property & casualty insurance segment is also expected to hold the highest CAGR over the forecast period due to the rising frequency and severity of natural disasters, which is increasing the need for property insurance coverage.

- Consumers and businesses are increasingly seeking protection against various natural events such as floods, hurricanes, and wildfires, thus driving the segment's growth in the market.

Insurance Brokerage Market Share Analysis By Geography

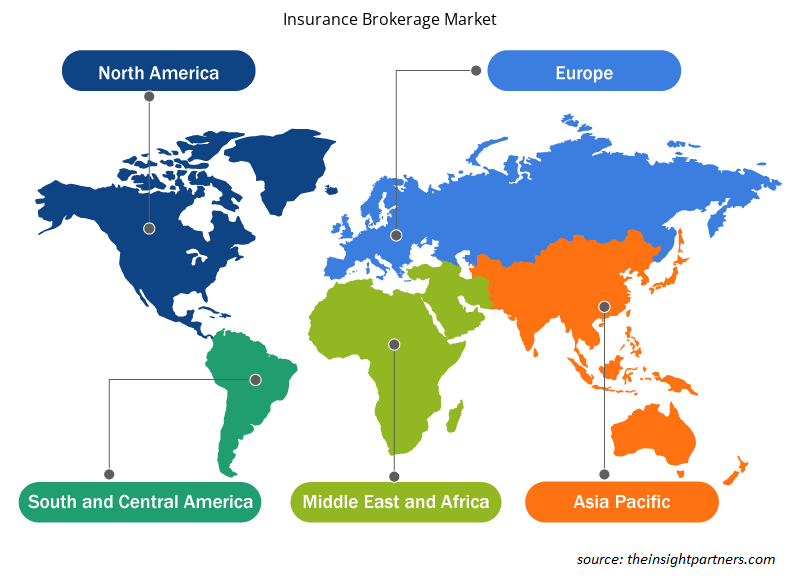

The scope of the insurance brokerage market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant insurance brokerage market share. The region's significant economic development, growing population, and increasing focus on risk management and insurance policies have contributed to the growth of the market in the region.

Insurance Brokerage Market Regional Insights

The regional trends and factors influencing the Insurance Brokerage Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insurance Brokerage Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insurance Brokerage Market

Insurance Brokerage Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 227.95 Billion |

| Market Size by 2031 | US$ 573.55 Billion |

| Global CAGR (2023 - 2031) | 12.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

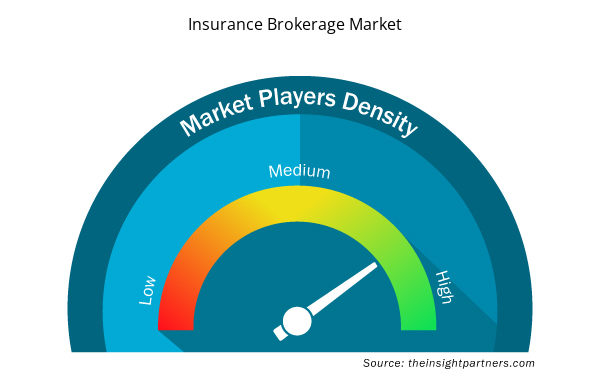

Insurance Brokerage Market Players Density: Understanding Its Impact on Business Dynamics

The Insurance Brokerage Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insurance Brokerage Market are:

- Marsh & McLennan Companies Inc.

- Aon plc

- Willis Towers Watson

- HUB International Limited

- Acrisure, LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insurance Brokerage Market top key players overview

The "Insurance Brokerage Market Analysis" was carried out based on type, end-user, mode, and geography. On the basis of type, the market is segmented into property & casualty reinsurance and life & health reinsurance. Based on the end user, the market is segmented into corporate and individual. Based on mode, the market is segmented into online and offline. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Insurance Brokerage Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. A few recent key market developments are listed below:

- In January 2024, US-based independent insurance brokerage Lockton announced its entry into the Indian market. With over 135 offices worldwide, Lockton's entry into the country is subject to regulatory approval. This will meet India's growing demand for risk consulting and management services.

[Source: Lockton, Company Website]

- In November 2023, insurance broker company RiskBirbal announced the launch of its insurance and risk management products aimed at mitigating financial risks for small and medium businesses. The company uses artificial intelligence and Internet-of-things-based technologies along with risk management strategies to mitigate financial risks and frame solutions for MSMEs.

[Source: RiskBirbal, Company Website]

Insurance Brokerage Market Report Coverage & Deliverables

The insurance brokerage market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Insurance Brokerage Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, End User, Mode and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The increase in demand for insurance policies and the expansion of digital brokers are the major factors that propel the global insurance brokerage market.

The global insurance brokerage market was estimated to be US$ 227.95 billion in 2023 and is expected to grow at a CAGR of 12.2 % during the forecast period 2023 - 2031.

Integration with IT and analytics solutions is anticipated to play a significant role in the global insurance brokerage market in the coming years.

The key players holding majority shares in the global insurance brokerage market are Marsh & McLennan Companies Inc.; Aon plc; Willis Towers Watson; HUB International Limited; and Acrisure, LLC.

The global insurance brokerage market is expected to reach US$ 573.55 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Marsh & McLennan Companies Inc.

- Aon plc

- Willis Towers Watson

- HUB International Limited

- Acrisure, LLC

- Brown & Brown, Inc

- Gallagher

- Lockton

- Truist Insurance Holdings

- USI Insurance Services L.L.C

Get Free Sample For

Get Free Sample For