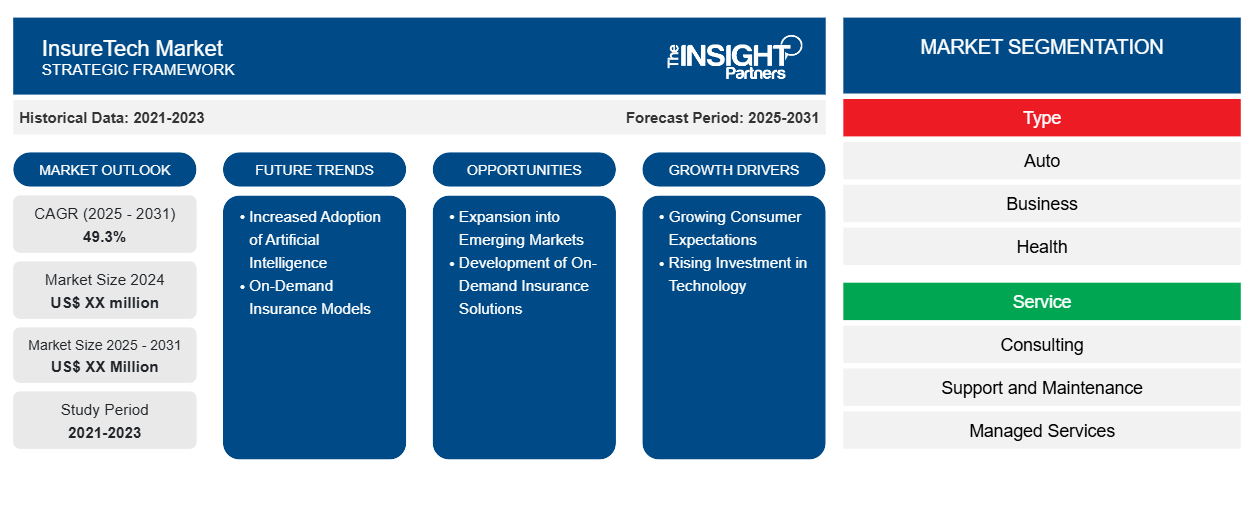

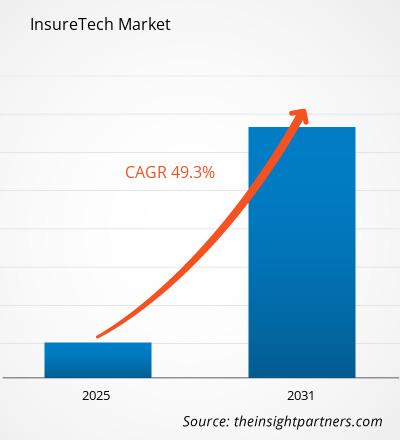

The InsureTech Market is expected to register a CAGR of 49.3% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Component (Software, Services); Deployment (On-Cloud, On-Premise); Technology (Cloud Computing, Blockchain, Artificial Intelligence, Internet of Things, Others); Insurance Type (Property and Casualty Insurance, Health and Life Insurance, Commercial Insurance, Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report InsureTech Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

InsureTech Market Segmentation

Component

- Software

- Services

Deployment

- On-Cloud

- On-Premise

Technology

- Cloud Computing

- Blockchain

- Artificial Intelligence

- Internet of Things

- Others

Insurance Type

- Property and Casualty Insurance

- Health and Life Insurance

- Commercial Insurance

- Others

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

InsureTech Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

InsureTech Market Growth Drivers

- Investment in Digital Technologies: Insurance companies are increasingly relying on innovation and automation as key differentiators to capture scale and competitiveness. Intelligent automation can improve insurance companies' customer satisfaction rate by providing claim handling and processing times that are faster than the non-automated claim process. Hence, insurance companies can enhance the customer experience by expediting the time and energy is required for insurance customers to file and resolve claims.

- Increasing Insurance Claims: A considerable increase in the number of annual claims being made around the world has been one of the key driving forces of the market growth. Such circumstances will evidently press several claims for more efficient processing & management, thus badgering insurers to adopt InsurTech solutions.

InsureTech Market Future Trends

- Technological Advacements: AI and ML continue to become more significant in insurance underwriting and claims handling, but more importantly with fraud detection, customer service, and automation of Underwriting and Claims processes. By analyzing large and progressively larger amounts of data pertaining to client profiles and past historical claims and market trends, AI and ML algorithms are being part of the insurance Underwriters’ repertoire. Even consumer behaviors are being analyzed to have more accurate risk assessments, and quicker, more supportive underpinning decisions.

- Telematics and IoT Integration:The integration of telematics and Internet of Things (IoT) devices in the InsurTech market will enable insurers to offer usage-based policies and real-time monitoring of risks. These technologies will provide personalized pricing, enhance risk assessment, and improve claim management. As a result, insurers can offer more tailored services, increasing customer satisfaction and industry growth.

InsureTech Market Opportunities

- Fraud Detection : The utilization of InsureTech can greatly improve underwriting processes and risk management for insurance companies and can potentially help to drive profitability and advance competitive positioning. InsureTech facilitates the use of previously untapped data, sophisticated predictive modelling, and data and AI based algorithms to provide improved and more accurate assessments and pricing of various risks. This, in turn, leads to a more precise categorization of risk.

- Digital Transformation in Emerging Economies:The InsureTech market holds a major opportunity in emerging economies, where increasing smartphone penetration and internet access create demand for digital insurance solutions. By offering mobile-based platforms, AI-driven underwriting, and personalized policies, InsureTech companies can cater to underinsured populations, improving access to affordable coverage and driving market expansion in regions like Asia, Africa, and Latin America.

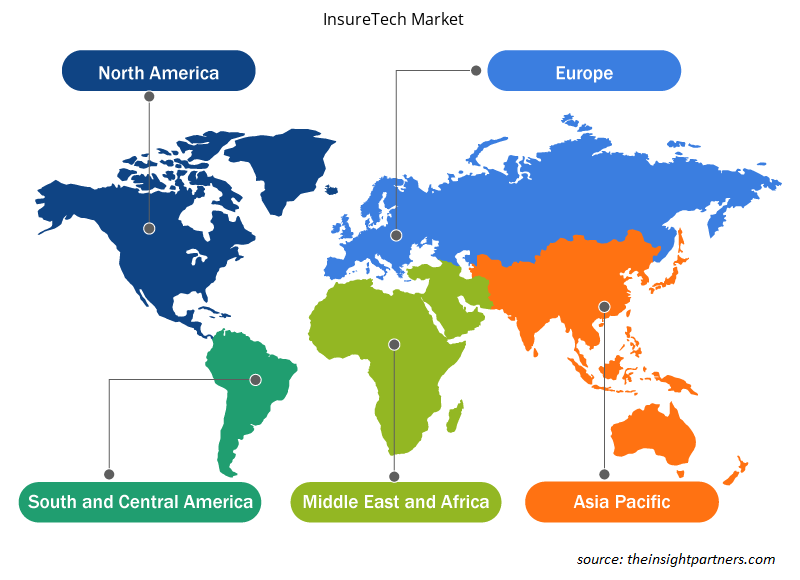

InsureTech Market Regional Insights

The regional trends and factors influencing the InsureTech Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses InsureTech Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for InsureTech Market

InsureTech Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 49.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

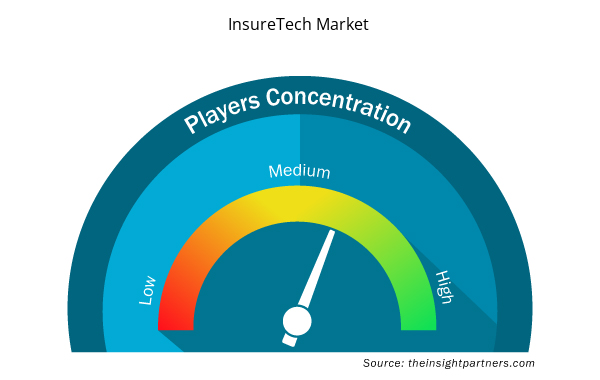

InsureTech Market Players Density: Understanding Its Impact on Business Dynamics

The InsureTech Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the InsureTech Market are:

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the InsureTech Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the InsureTech Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the InsureTech Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Bio-Based Ethylene Market

- Non-Emergency Medical Transportation Market

- Cosmetic Bioactive Ingredients Market

- Queue Management System Market

- 3D Mapping and Modelling Market

- Artwork Management Software Market

- Intradermal Injection Market

- Workwear Market

- Nuclear Decommissioning Services Market

- Electronic Toll Collection System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

The InsureTech Market is estimated to witness a CAGR of 52.1% from 2023 to 2031

The major factors driving the InsureTech market are Investment in Digital Technologies and Increasing Insurance Claims.

Increased Adoption of Machine Learning (ML) and Artificial Intelligence (AI) is anticipated to play a significant role in the global InsureTech market in the coming years

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

1. Amazon Web Services, Inc.

2. BIMA

3. IBM

4. Intel Corporation

5. Microsoft Corporation

6. Oracle

7. Shift Technology

8. Tractable Ltd

9. Untangl Limited

10. Wipro Limited

Get Free Sample For

Get Free Sample For