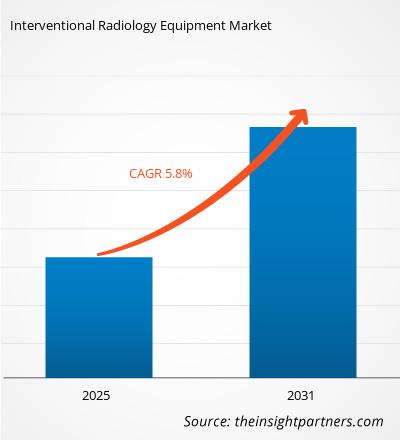

The Interventional Radiology Equipment Market is expected to register a CAGR of 5.8% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product (MRI Systems, Ultrasound Imaging Systems, CT Scanners, Angiography Systems, Fluoroscopy Systems, Biopsy Devices, Other Products). The report further presents analysis based on the Application (Cardiology, Urology and Nephrology, Oncology, Gastroenterology, Other Applications). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Interventional Radiology Equipment Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Interventional Radiology Equipment Market Segmentation

Product

- MRI Systems

- Ultrasound Imaging Systems

- CT Scanners

- Angiography Systems

- Fluoroscopy Systems

- Biopsy Devices

- Other Products

Application

- Cardiology

- Urology and Nephrology

- Oncology

- Gastroenterology

- Other Applications

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Interventional Radiology Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Interventional Radiology Equipment Market Growth Drivers

- Technological Advances: The interventional radiology equipment and technologies are two of the factors that are continuously improving. Furthermore, high-tech 3D ultrasound devices, MRI and CT scans have high resolution imaging technology which has improved the outcomes of most procedures done under IR. Other interventions such as robotic therapy and intra operative imaging have also increased the level of intervention accuracy thus reducing the rate of complications and improving the recovery period of the patients. Furthermore, the introduction of AI techniques within imaging devices and systems has fully begun assisting in procedure applications by enabling fast and accurate diagnosis with the use of treatment planning minimizing errors and also pinpointing the more accurate treatment options using predictive analytics.

- Rise in Chronic Illnesses and Aging Population: On a global scale, the rise in chronic disorders, inclusive of but not limited to cardiovascular diseases, cancer and diabetes, creates a higher demand for carrying out interventional radiology procedures. Most of these conditions however require diagnosis and treatment that allows for very low invasion which interventional radiology has been proven to be. Another factor contributing to the demand is the aging of the global population particularly in developed nations where there is also an increased incidence of geriatric-related diseases especially those that affect the blood vessels and the organs.

- Growing Adoption of Minimally Invasive Approaches: There is a growing concern among patients, as well as their healthcare givers, towards the use of invasive surgical approaches mainly because of the advantages presented by minimization of such procedures. These benefit include shorter recovery times, less pain, significantly reduced infection risks, and scars are smaller. Consequently, interventional radiology has had a significant growth over the traditional surgical methods mainly in fields such as oncology, neurology, and cardiology. The key factor in the ever-growing adoption of IR technologies is the ability to perform complex procedures with minimal invasion into the patient's body.

Interventional Radiology Equipment Market Future Trends

- AI and Automation Integration: Highly prevalent in the interventional radiology market is AI and ML integration into imaging and procedural guidance. With regards to image processing, these technologies allow a much faster and accurate approach to better assist in real-time decision-making during procedures. In areas such as image segmentation, abnormality detection, and even suggesting which interventional procedure should be taken next, AI tools can support in achieving improved results with streamlined workflows.

- Hybrid operating rooms: Hybrid ORs represent a growing trend; advanced imaging technology has been used to perform traditional and minimally invasive procedures by surgeons and interventional radiologists. Hybrid operating rooms provide such an advantage because they integrate the facilities of IR with conventional surgery, which can handle complex cases with flexibility. Hybrid ORs are very beneficial in neurosurgery, vascular interventions, and oncological procedures.

- Point-of-Care Imaging: The need for point-of-care imaging machines, including portable ultrasound and fluoroscopy machines, is on the rise because these devices provide instant imaging results-such as in cases of emergencies or outpatient procedures. These machines, however, are applied in different scenarios such as trauma care, outpatient diagnostic procedure, and are applied in remote places where large imaging machines may not be physically available. Such a trend is of high importance in developing countries and also in rural healthcare facilities, where access to high-end IR equipment is limited.

Interventional Radiology Equipment Market Opportunities

- Emergence of Interventional Oncology as a New Subspecialty: Interventional oncology is going through an enthusiastic growth period as a new substream of IR where opportunities exist for both the treatment providers as well as the equipment manufacturers. RFA, MWA, TACE and other interventions find their applications in the medical sector aimed at effective tumor ablation especially in liver cancer. As global cancer incidence rises, there is much market potential for IR equipment used in interventional oncology.

- Advances in Robotics: Robotic technologies are revolutionizing interventional radiology by enabling very precise and minimally invasive procedures. Complex procedures such as placement of catheter, insertion of stent, and biopsy are increasingly using robotic assistance; the evolution of these new technologies will reduce procedure time, increase accuracy, and lower complications and unlock significant growth opportunities for robotic: assisted interventional radiology.

- Personalized and Targeted Therapies: As the concept of personalized medicine evolves, so the demand for interventional radiology's role in treating individualized conditions is increasing. In that regard, targeted therapies like gene therapy that require precise delivery methods open new space for interventional radiology techniques, involving imaging: guided tools for administering targeted treatments. The IR market will thus face a growing demand for equipment that can facilitate such advanced interventions in oncology and neurology.

Interventional Radiology Equipment Market Regional Insights

The regional trends and factors influencing the Interventional Radiology Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Interventional Radiology Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Interventional Radiology Equipment Market

Interventional Radiology Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

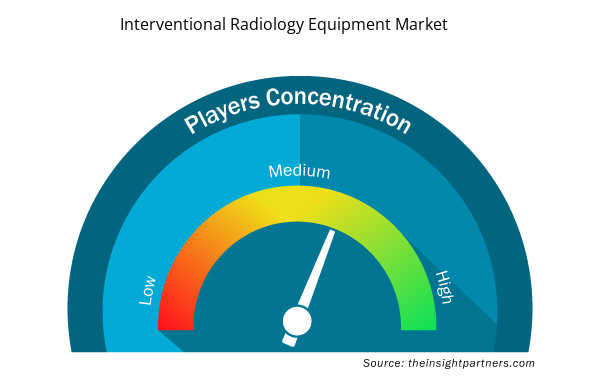

Interventional Radiology Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Interventional Radiology Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Interventional Radiology Equipment Market are:

- Carestream Health

- Esaote SPA

- GE Healthcare

- Hitachi Medical Corporation

- Hologic Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Interventional Radiology Equipment Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Interventional Radiology Equipment Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Interventional Radiology Equipment Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Cardiology segment, by application, dominated the market in 2023.

Players operating in the market are Carestream Health, Esaote SPA, GE Healthcare, Hitachi Medical Corporation, Hologic Inc., Koninklijke Philips NV, Shimadzu Corporation, Siemens Healthineers AG, Canon Medical Systems Corporation

The Interventional Radiology Equipment Market is estimated to witness a CAGR of 5.8% from 202#to 2031

North America region dominated the Interventional Radiology Equipment market in 2023.

Emergence of Interventional Oncology as a New Subspecialty act as a opportunity for growth of the market in forecast period.

The major factors driving the Interventional Radiology Equipment market are:

1. Rise in Chronic Illnesses and Aging Population

2. Growing Adoption of Minimally Invasive Approaches

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Carestream Health

2. Esaote SPA

3. GE Healthcare

4. Hitachi Medical Corporation

5. Hologic Inc.

6. Koninklijke Philips NV

7. Shimadzu Corporation

8. Siemens Healthineers AG

9. Canon Medical Systems Corporation

10. Samsung Medison (Samsung Electronics Co. Ltd)

Get Free Sample For

Get Free Sample For