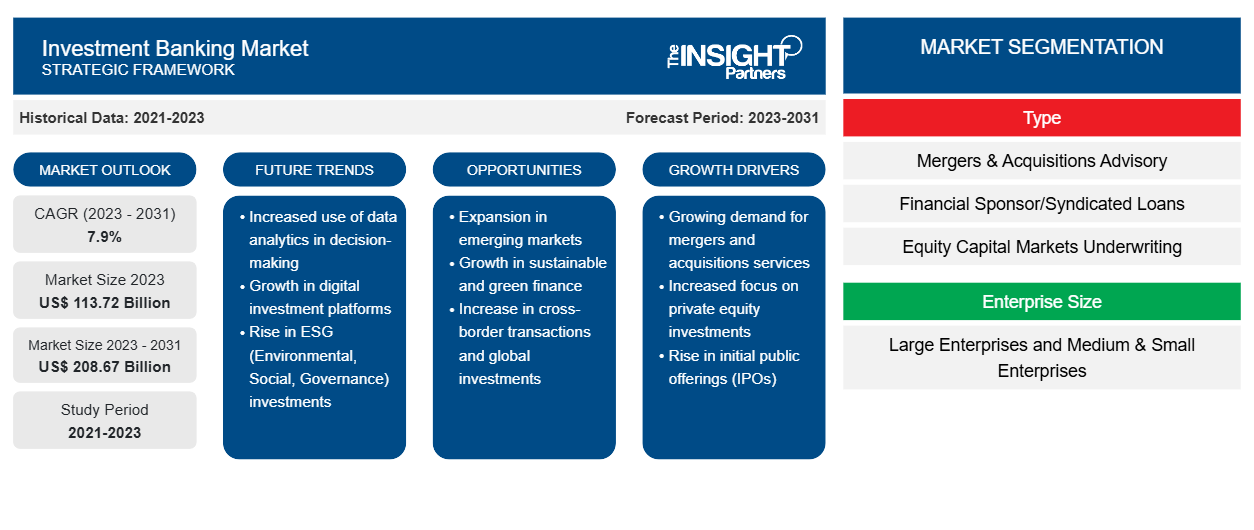

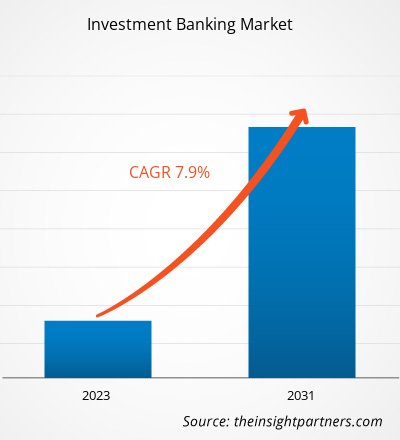

The investment banking market size is expected to grow from US$ 113.72 billion in 2023 to US$ 208.67 billion by 2031; it is anticipated to expand at a CAGR of 7.9% from 2023 to 2031. The investment banking market trends include technological advancement, growing adoption of digital currencies, and collaboration between fintech companies.

Investment Banking Market Analysis

The report includes growth prospects owing to the current investment banking market trends and their foreseeable impact during the forecast period. The investment banking industry is embracing technological advancements to enhance its services and global reach. This includes the use of artificial intelligence (AI), machine learning (ML), digital platforms, and innovative financial technologies. Banks are highly adopting AI technology to streamline their diverse business applications. For instance, ING Group introduced KATANA and employs predictive analytics to support bond traders to make more educated trading decisions quickly. KATANA helps traders in analyzing historical and current data to quote the correct price in the buying and selling of bonds. Similarly, AI technology is gaining traction and accelerating the investment banking industry. Moreover, the governments and regulatory bodies of various nations are working together to balance financial stability, protect consumer data, and foster innovation, positively influencing the investment banking market growth.

Investment Banking Market Overview

- Investment banking refers to the division of a bank or financial institution that provides mergers and acquisitions (M&A) and underwriting (capital raising) advisory services to corporations, governments, and institutions. Investment banks act as intermediaries between investors (an entity that has money to invest) and corporations (entities that require capital to grow and run their businesses).

- The primary categories of investment banking are mergers and acquisitions advisory, equity capital markets underwriting, debt capital markets underwriting, and financial sponsor/syndicated loans. M&A consultants serve their customers by advising on buy-side and sell-side businesses on their mergers and acquisitions.

- Investment banking plays a crucial role in helping companies by raising capital for businesses through different strategies such as bond assurance, initial public offerings (IPOs), and syndicate loans. The increasing need for money to operate and grow their operations creates demand for investment bankers who help businesses in raising funds. Investment bankers support businesses by marketing the company to investors. They also conduct market research and help companies secure funding and raise finance for M&A.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Investment Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Investment Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Investment Banking Market Drivers and Opportunities

Increasing Capital Requirement Among Businesses Across the Globe is Driving the Investment Banking Market Growth

- Increasing capital requirements among businesses across the globe are expected to drive the investment banking market during the forecast period. Capital requirement refers to the regulatory commands and guidelines set by financial administration that order the minimum amount of capital a bank must hold to protect depositors and stakeholders by ensuring its financial stability. Banks are facing challenges to deal with huge capital requirements, which increases the demand for investment banking services.

- Banks are actively seeking advisory and consulting services to improve their capital structures in order to meet their customers’ requirements. Banks are usually the ones to start capital-raising campaigns, and investment banks play a crucial part in helping businesses increase their revenue expansion.

- For instance, according to the European Central Bank, in February 2023, the average amount of overall capital requirements and advice in Common Equity Tier 1 (CET1) grew to approximately 10.7% of RWA for 2023 increased from 10.4% in 2022. Therefore, growing capital requirements among consumers for managing their business operations are driving the investment banking market during the forecast period.

Investment Banking Market Report Segmentation Analysis

- Based on type, the investment banking market is segmented into mergers & acquisitions advisory, financial sponsor/syndicated loans, equity capital markets underwriting, and debt capital markets underwriting.

- The mergers & acquisitions advisory segment holds a significant investment banking market share and is anticipated to expand at a significant CAGR during the forecast period. The growing number of corporate mergers, acquisitions, and strategic partnerships between companies across the globe is driving the segment.

- Companies are planning to expand their business worldwide by consolidating market share and diversifying their products/services portfolios through M&A activities. Investment banking plays a key role in order to facilitate these transactions, carrying out due diligence, and structuring acquisitions deals, fueling the market.

- Similarly, the financial sponsor/syndicated loans segment is anticipated to hold a significant investment banking market share by 2030. The syndicated loans offer businesses an easy and convenient way to raise large amounts of capital for a variety of purposes, including working capital, expansion, and refinancing. Syndicated loans provide a flexible, versatile, and efficient financing solution to institutional lenders and corporate borrowers. Syndicated loans comprise a large amount of capital, allowing borrowers to access significant funding for business expansion.

- Moreover, syndicated loans reduce the risk for individual lenders by distributing the loan amount among several lenders. Lenders share the risk in the event of a borrower default, lessening the impact on any one institution are positively supporting the segment growth.

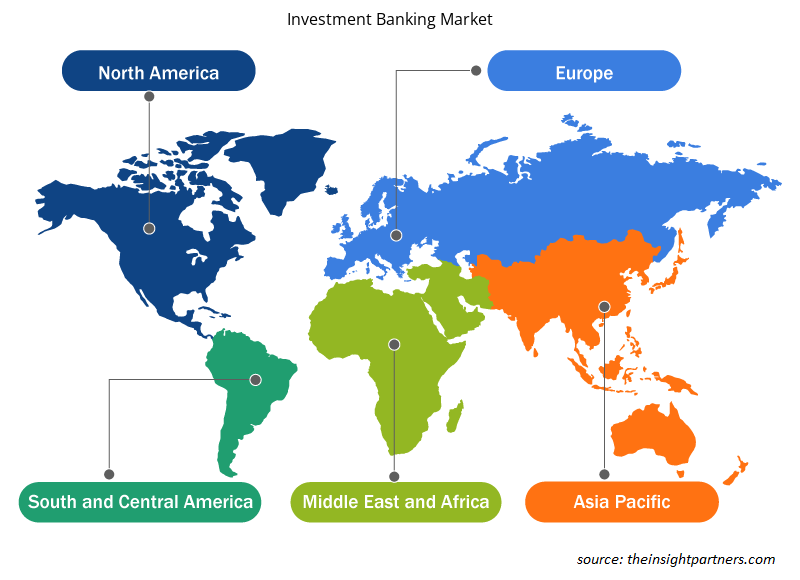

Investment Banking Market Regional Analysis

The scope of the investment banking market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant investment banking market share. Technological advancements and the growing adoption of digital platforms for simplifying the syndication process are driving the market. Chatbots help customers to effectively manage their finances, and support banks to identify patterns in cybercrime by using machine learning algorithms. This encourages individuals to invest in advanced technologies to expand their businesses. Significant benefits provided by the signification process, such as being more accessible and cost-effective, are fueling the market.

Investment Banking Market Regional Insights

Investment Banking Market Regional Insights

The regional trends and factors influencing the Investment Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Investment Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Investment Banking Market

Investment Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 113.72 Billion |

| Market Size by 2031 | US$ 208.67 Billion |

| Global CAGR (2023 - 2031) | 7.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Investment Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Investment Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Investment Banking Market are:

- Barclays Plc

- Bank of America Corp

- Citigroup Inc

- Morgan Stanley

- Goldman Sachs Group Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Investment Banking Market top key players overview

The " Investment Banking Market Analysis" was carried out based on type, enterprise size, industry, end-user, and geography. Based on type, the market is segmented into mergers & acquisitions advisory, financial sponsor/syndicated loans, equity capital markets underwriting, and debt capital markets underwriting. In terms of enterprise size, the investment banking market is categorized into large enterprises and medium & small enterprises (SMEs). Based on end-users, the investment banking market is segmented into individuals and corporate institutions. On the basis of industry, the market is divided into financial services, retail & wholesale, information technology, manufacturing, healthcare, construction, and others. By region, the investment banking market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Investment Banking Market News and Recent Developments

The investment banking market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. Companies adopt inorganic and organic strategies such as mergers and acquisitions in the investment banking market. A few recent key market developments are listed below:

- In September 2023, Bank of America Corp introduced CashPro Supply Chain Solutions for digitalizing trade finance. CashPro Supply Chain Solutions is a next-generation online supply chain finance (SCF) that supports both buyer and supplier by providing faster access to funds and information. These solutions offer significant benefits to the user, starting with open account automation, streamlined invoice approval, enhanced visibility within the supply chain, and faster processing and decision-making capabilities.

[Source: Bank of America Corp, Company Website]

- In August 2023, Goldman Sachs Group sold its personal financial management unit to Creative Planning, LLC, to strengthen its strategic partnership. This acquisition strengthens Creative Planning, LLC by expanding its wealth management offerings to high-net-worth individuals worldwide.

[Source: Bank of America Corp, Company Website]

- In May 2023, JPMorgan Chase & Co acquired First Republic Bank to strengthen its position in the U.S. banking system while expanding its wealth strategy.

[Source: JPMorgan Chase & Co, Company Website]

- In March 2023, Citigroup Inc announced the sales of its India consumer banking business to Axis Bank. Citigroup Inc adopted a broader strategy to exit consumer banking across various global markets.

[Source: Citigroup Inc, Company Website]

- On March 22, JPMorgan Chase & Co acquired Aumni to streamline investment analysis in the private markets. Alumni is a data analytics platform used by venture capital investors. The platform supports JPMorgan Chase & Co to enhance relationships in the private markets.

[Source: JPMorgan Chase & Co, Company Website]

Investment Banking Market Report Coverage & Deliverables

The market report on “Investment Banking Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, End-user, Industry, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global investment banking market are Barclays Plc; Bank of America Corp; Citigroup Inc; Morgan Stanley; Goldman Sachs Group Inc; HSBC Holdings Plc; Credit Suisse Group AG; JPMorgan Chase & Co; UBS; and Deutsche Bank AG.

The global investment banking market is expected to reach US$ 208.67 billion by 2031.

The global investment banking market was estimated to be US$ 113.72 billion in 2023 and is expected to grow at a CAGR of 7.9% during the forecast period 2023 - 2031.

Increasing capital requirements among businesses and the growing number of merger & acquisition activities are the major factors that propel the global investment banking market.

Rising digital transformation in the financial sector is impacting investment banking, which is anticipated to play a significant role in the global investment banking market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Barclays Plc

- Bank of America Corp

- Citigroup Inc

- Morgan Stanley

- Goldman Sachs Group Inc

- HSBC Holdings Plc

- Credit Suisse Group AG

- JPMorgan Chase & Co

- UBS

- Deutsche Bank AG

Get Free Sample For

Get Free Sample For