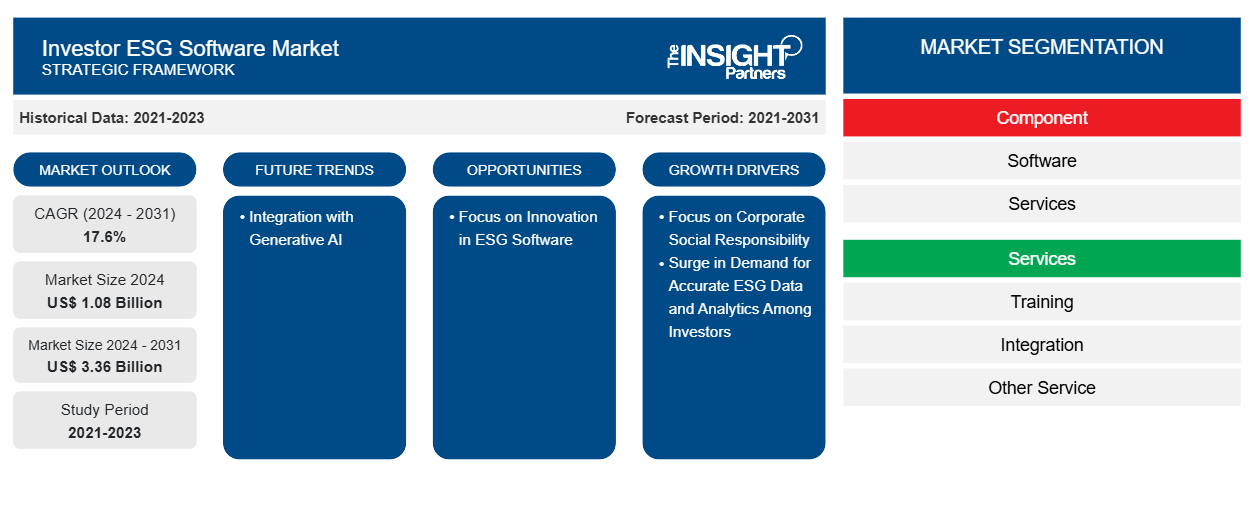

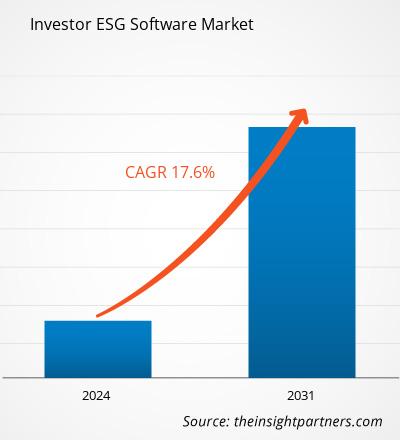

The investor ESG software market size was valued at US$ 1.08 billion in 2024 and is expected to reach US$ 3.36 billion by 2031; it is estimated to record a CAGR of 17.6% from 2024 to 2031. The integration of ESG software with generative AI is likely to bring new trends to the market in the coming years.

Investor ESG Software Market Analysis

The investor ESG software market has witnessed significant growth due to increasing demand for responsible investing, rising concerns over climate change, social issues, and governance practices, as well as the need for transparency and compliance with evolving global ESG standards. The demand for investor ESG software is driven by institutional investors, asset managers, and financial institutions seeking to integrate ESG factors into their decision-making processes. Factors such as the focus on corporate social responsibility and growing investor demand for accurate ESG data and analytics are also driving the investor ESG software market. Furthermore, the focus on innovation in ESG software and integration with generative AI are creating lucrative opportunities for the growth of the investor ESG software market players during the forecast period.

Investor ESG Software Market Overview

Organizations utilize investor ESG software to tailor questionnaires and streamline data collection, enabling the aggregation of precise and comparable ESG performance metrics. This software-as-a-service platform enhances ESG initiatives, helping businesses maximize value and evaluate investments. ESG investing, or sustainable investing, focuses on identifying factors that define responsible, sustainable, or ethical investments. ESG software is used by both investors and capital market firms to assess corporate behaviors, providing insights to forecast future financial performance. Many companies implement these software solutions to mitigate risks related to their operations, business relationships, assets, and investments

ESG platforms support investment analysis, providing more informed and strategic investment decisions. Investor ESG software is customized to help investors assess, track, and manage the ESG performance of their portfolios and investment decisions. These platforms provide data-driven insights, analytics, and reporting on various ESG metrics, enabling investors to align their investment strategies with sustainability goals and regulatory requirements.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Investor ESG Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Investor ESG Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Investor ESG Software Market Drivers and Opportunities

Focus on Corporate Social Responsibility

The enactment of the Corporate Sustainability Reporting Directive (CSRD) represents a major regulatory shift significantly driving the demand for Investor ESG software. The CSRD, which replaced the Non-Financial Reporting Directive (NFRD) in January 2023, dramatically expands the scope of mandatory ESG reporting within the European Union. Under the NFRD, ~11,000 large companies were required to disclose ESG information. However, the CSRD extends this obligation to approximately 50,000 companies, which accounts for ~75% of the total turnover of all EU companies. This includes large corporations as well as listed small and medium-sized enterprises (SMEs), significantly broadening the scope of ESG disclosures and compliance requirements. The CSRD mandates that companies must disclose detailed social, environmental, and governance information, covering areas such as human rights, climate risks, biodiversity, and supply chain transparency. This comprehensive reporting framework ensures that companies address and mitigate adverse environmental and human rights impacts within Europe and other regions. By enforcing these new rules, the CSRD aims to enhance the consistency, comparability, and reliability of ESG data, making it more transparent and accessible to investors, regulators, and the general public.

Focus on Innovation in ESG Software

The focus on innovation in ESG software is expected to create numerous opportunities for the investor ESG software market growth during the forecast period. As the demand for transparent, accurate, and actionable ESG data continues to rise, investors are increasingly relying on advanced ESG software solutions to make informed investment decisions. The evolving landscape of environmental, social, and governance (ESG) factors requires investors to access comprehensive, real-time insights that can only be provided by innovative software tools. Innovation in ESG software involves the integration of cutting-edge technologies such as artificial intelligence (AI), which are reshaping the way ESG data is collected, processed, and analyzed. For instance, in April 2024, ESG data solutions provider ESGgo announced the launch of its One-Click Sustainability Report, an AI-powered tool designed to help companies effortlessly generate sustainability reports in line with regulatory frameworks and stakeholder expectations. ESGgo states that this new solution simplifies the sustainability reporting process for organizations, ensuring compliance with evolving standards. The platform's AI-driven data engine processes both numerical and text-based information, calculates emissions, and synthesizes datasets to create customized sustainability reports. These advancements allow investors to monitor a company's sustainability performance more efficiently as well as predict future ESG risks and opportunities based on real-time data. The ability to process vast amounts of data, often coming from disparate sources, and synthesize it into actionable ESG metrics is a significant benefit for investors looking for transparency and reliability.

Investor ESG Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the investor ESG software market analysis are component, services, and enterprise size.

- Based on component, the investor ESG software market is bifurcated into software and services. The software segment dominated the market in 2024.

- In terms of services, the investor ESG software market is segmented into training, integration, and other services. The other services segment held the largest share of the market in 2024.

- On the basis of enterprise size, the investor ESG software market is divided into large enterprises and SMEs. The large enterprises segment dominated the market in 2024.

Investor ESG Software Market Share Analysis by Geography

- The investor ESG software market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2024, followed by Europe and Asia Pacific.

- The investor ESG software market in North America is projected to grow during the forecast period owing to the increased legal requirements, such as the U.S. Securities and Exchange Commission (SEC)'s proposed climate disclosures. These legal obligations create pressure on asset managers and institutional investors to address ESG concerns and rules in their decision-making processes. Moreover, increasing emphasis on sustainability and growing climate change concerns create demand for ESG software among investors and stakeholders for clear, data-driven insights. These insights support them in evaluating the businesses' ESG performance effectively. The software provides greater accountability to firms by allowing real-time ESG reporting, compliance tracking, and risk assessment.

- Governments of various countries in Europe are taking measures such as the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation that promote sustainability among business operations. These requirements necessitate asset managers and institutional investors to disclose and assess the ESG impact of their investments, which surge the adoption of technologically advanced ESG software that enables compliance and data management. Further, European investors have expanded their sustainable investment to support the region's Green Deal goals, which increases the demand for investor ESG software that helps manage data and make informed decisions.

Investor ESG Software Market Regional Insights

The regional trends and factors influencing the Investor ESG Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Investor ESG Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Investor ESG Software Market

Investor ESG Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.08 Billion |

| Market Size by 2031 | US$ 3.36 Billion |

| Global CAGR (2024 - 2031) | 17.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2021-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Investor ESG Software Market Players Density: Understanding Its Impact on Business Dynamics

The Investor ESG Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Investor ESG Software Market are:

- MSCI

- Workiva Inc.

- Morningstar Inc.

- London Stock Exchange Group plc

- Cority Software Inc

- Prophix Software Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Investor ESG Software Market top key players overview

Investor ESG Software Market News and Recent Developments

The investor ESG software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the investor ESG software market are listed below:

- Cority announced that all customers leveraging one of its sustainability solutions will be upgraded to the company's SaaS-based and integrated CorityOne platform in 2025. Built on the existing technology that customers have trusted for sustainability management for over a decade, this upgrade will unite multiple solutions into a seamless, enhanced user experience with elevated functionality, further streamlining operations and improving data integration.

(Source: Cority Software Inc, Press Release, August 2024)

- Sphera announced the acquisition of SupplyShift, a supply chain sustainability software company that empowers businesses to build transparent, responsible, and resilient supply chains. The acquisition enhances the leading ESG firm's supply chain offering with expanded supplier mapping, scoring and traceability capabilities to further empower customers in creating sustainable supply chains.

(Source: Sphera Solutions, Inc., Press Release, January 2024)

Investor ESG Software Market Report Coverage and Deliverables

The "Investor ESG Software Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Investor ESG software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Investor ESG software market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Investor ESG software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the investor ESG software market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, and Enterprise Size

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Focus on corporate social responsibility, and surge in demand for accurate ESG data and analytics among investors are the major factors that propel the global investor ESG software market.

The global investor ESG software market is expected to reach US$ 3.36 billion by 2031.

The global Investor ESG software market was estimated to be US$ 1.08 billion in 2024 and is expected to grow at a CAGR of 17.6% during the forecast period 2025 – 2031.

The key players holding majority shares in the global investor ESG software market are MSCI, FactSet, Workiva Inc., SAP SE, and Bloomberg Finance L.P.

The incremental growth expected to be recorded for the global investor ESG software market during the forecast period is US$ 2.27 billion.

Integration with Generative AI is anticipated to play a significant role in the global investor ESG software market in the coming years.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Investor ESG Software Market

- MSCI

- Workiva Inc.

- Morningstar Sustainalytics

- London Stock Exchange Group plc

- Cority

- Prophix Software Inc.

- SAP SE

- Sphera

- FactSet

- Bloomberg Finance L.P.

Get Free Sample For

Get Free Sample For