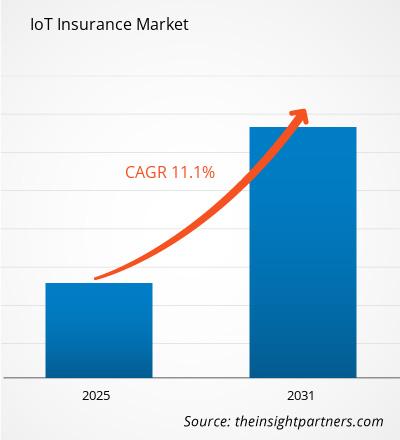

The IoT Insurance market size is expected to grow at a CAGR of 11.1% from 2025 to 2031. The IoT Insurance market includes growth prospects owing to the current IoT Insurance market trends and their foreseeable impact during the forecast period. The IoT Insurance market is a large and expanding sector. The IoT Insurance market is growing due to the increasing adoption of IoT devices and personalized insurance solutions.

IoT Insurance Market Analysis

IoT insurance is a specialist area of the insurance market that makes use of IoT devices and data to offer more precise risk assessment, tailored coverage, and policy pricing for a range of industries, including commercial, residential, healthcare, and automobile. It makes use of the information gathered by Internet of Things devices to track and handle risks, stop losses, and boost productivity.

IoT Insurance Market Industry Overview

- The IoT insurance market is expanding rapidly as more businesses adopt IoT technology to enhance their operations and reduce risks.

- Insurers are developing innovative solutions to leverage IoT data for better risk assessment, pricing, and claims management.

IoT Insurance Market Driver

Increasing Adoption of IoT Devices To Drive The IoT Insurance Market

- Globally, the Internet of Things has impacted consumers' daily lives and changed business models in a variety of sectors. In this environment, insurers leverage to develop new products, establish new channels of distribution, and broaden their function to include prediction, prevention, and assistance.

- Up until now, insurers have mostly exploited IoT capabilities to facilitate client interactions and expedite and streamline the underwriting and claims processing processes. On the other hand, insurers are finding new IoT-based services and business models to be increasingly appealing.

- IoT technologies enable insurance companies to determine risks more precisely. Insurers can communicate with their clients more regularly and provide new services based on the data they have gathered due to networked devices. IoT may greatly improve customer relations by enabling businesses to engage in more focused and extensive consumer interaction. Thus, the increasing adoption of IoT devices drives the IoT insurance market growth.

IoT Insurance Market Report Segmentation Analysis

- Based on the mode of payment, the IoT Insurance market is segmented into life and health insurance, property and casualty insurance, and others. The life and health insurance segment is expected to hold a substantial IoT Insurance market share in 2023 due to the growing use of internet-connected medical devices, such as fitness trackers, smartwatches, and smartphones, which continuously track users' habits and lifestyles and gather user data.

- The property and casualty insurance market is expected to grow with the highest CAGR over the forecast period owing to the growing use of machine-to-machine (M2M) communication products, the installation of anti-lock brake systems to facilitate faster communication with drivers, and the raising of policyholders' awareness of premiums.

IoT Insurance Market Share Analysis By Geography

The scope of the IoT Insurance market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant IoT Insurance market share. Businesses across various industries are embracing IoT technology to enhance their operations and manage risks more effectively. This increased adoption of connected devices has created a growing demand for insurance coverage tailored to the unique needs of IoT-enabled businesses. Insurers in North America are responding by developing innovative solutions that leverage IoT data to offer more personalized and cost-effective policies.

IoT Insurance Market Report Scope

The "IoT Insurance Market Analysis" was carried out based on insurance type, application and geography. On the basis of insurance type, the market is segmented into life and health insurance, property and casualty insurance, and others. On the basis of application, the market is segmented into automotive, transportation, logistics, life and health, commercial and residential buildings, agriculture, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

IoT Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the IoT Insurance market. A few recent key market developments are listed below:

- In May 2023, Sky announced a partnership with Zurich Insurance to launch a new smart home protection service that offers customers home insurance and smart home technology worth US$ 311.95.

[Source: Sky, Press Release]

- In October 2023, Najm for Insurance Services signed an agreement with IoT squared, a provider of Internet of Things (IoT) solutions for smart logistics and cities, to advance insurance services in Saudi Arabia.

[Source: Najm, Press Release]

IoT Insurance Market Report Coverage & Deliverables

The IoT Insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "IoT Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

IoT Insurance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 11.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insurance Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Wheat Protein Market

- Parking Management Market

- Identity Verification Market

- Electronic Shelf Label Market

- Microcatheters Market

- Medical Audiometer Devices Market

- Visualization and 3D Rendering Software Market

- Resistance Bands Market

- Biopharmaceutical Contract Manufacturing Market

- Equipment Rental Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For