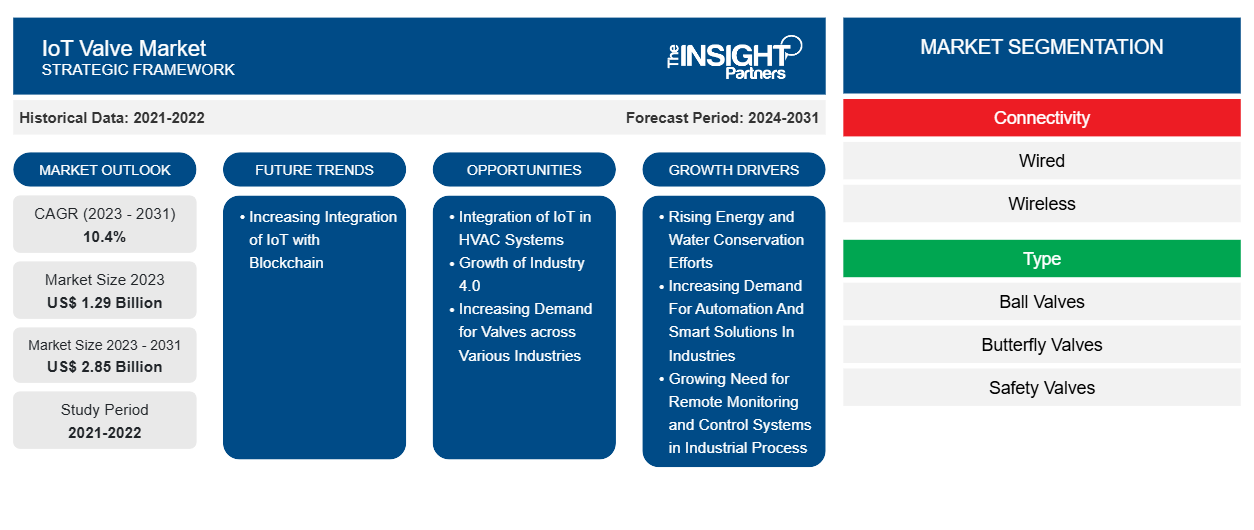

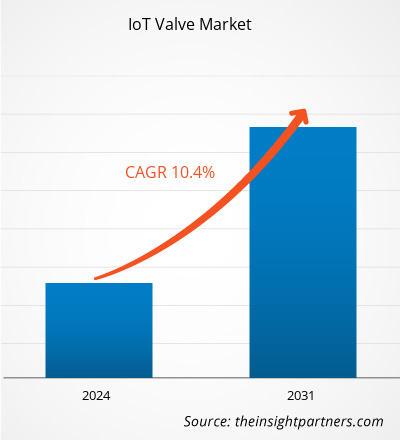

The IoT valve market size is expected to reach US$ 2.85 billion by 2031 from US$ 1.29 billion in 2023. The market is estimated to record a CAGR of 10.4% from 2023 to 2031. The increasing integration of IoT with Blockchain is likely to be a key market trend in the coming years.

IoT Valve Market Analysis

IoT valves have various applications. They can manage the distribution of water within a home or building, allowing for automated control of water usage in kitchens, bathrooms, and irrigation systems. Also, in manufacturing plants, these valves control the flow of liquids and gases. In utilities and infrastructure, these IoT valves are used in water distribution, wastewater treatment, and gas supply networks.

The demand for industrial valves across sectors such as pharmaceuticals, oil & gas, and chemicals and the rapid evolution of IoT technology fuel the global IoT valve market growth. By incorporating IoT capabilities, valves can be remotely controlled, monitored, and automated, reducing maintenance expenses and enhancing efficiency. For instance, with the integration of IoT technology in HVAC systems, intelligent HVAC systems are increasingly used and can be managed and monitored remotely. The rising adoption of IoT in diverse industries, including aerospace, elevators, and process automation, has increased the demand for IoT valves.

IoT Valve Market Overview

Advancements in IoT technology have transformed numerous industries, and one of the most innovative areas is the advancement of smart valves. Smart valves use IoT technology and present an exceptional breakthrough in the process valves industry, enabling the management of various processes and online monitoring control. These allow immediate response for machine learning, optimization, and safety events, along with equipment and machinery protection, device tracking, and additional customer-tailored benefits. Smart valves possess smart metering control systems, enabling accurate distribution and measurement of resources such as water and gas. Smart metering control reduces waste, optimizes resource usage, and improves performance by precisely controlling and monitoring flow rates. Smart valves provide affordable solutions by effectively utilizing resources. They provide accurate gas and water control and distribution, eliminating waste and reducing expenses. Smart valves help organizations reduce utility costs and maintenance costs by minimizing leaks and providing effective automation.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IoT Valve Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IoT Valve Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

IoT Valve Market Drivers and Opportunities

Rising Energy and Water Conservation Efforts

The rise in energy and water conservation efforts is a significant driver for the IoT valves market. As the global focus intensifies on sustainable practices, governments, industries, and consumers are seeking solutions that optimize resource usage. IoT valves provide precise control, monitoring, and automation in these conservation efforts. In manufacturing plants, IoT valves can regulate the flow of steam, gases, and liquids used in various processes. Using sensors and data analytics, these valves can adjust the flow based on real-time requirements, reducing energy waste. For instance, Bosch is developing smart factories utilizing IoT in manufacturing. Sensors in these facilities collect data on all parts of the manufacturing procedure, which includes everything from the chain of distribution to the assembly line. Municipal water supply systems can leverage IoT valves to monitor and control water distribution networks. In a smart city project, IoT valves can detect leaks in the water supply system and shut off the affected section to prevent water loss. They can also optimize water pressure in different areas based on usage patterns, ensuring efficient water distribution. Governments are implementing stricter regulations on energy and water usage, incentivizing industries to adopt smart technologies. For instance, according to the report of Indian Infrastructure, as of April 5, 2024, 645 smart energy projects worth US$ 1,675.0 million have been completed, and 38 projects worth US$ 85.3 million are in progress in India. These projects have several components to ensure efficient energy utilization, such as smart lighting, buildings, metering, waste management, and mobility. Additionally, consumers are becoming more environmentally conscious, seeking products and solutions that contribute to sustainability.

Growth of Industry 4.0

Various countries are widely recognized as pioneers in the implementation of Industry 4.0, or the Fourth Industrial Revolution. The German government has recognized the need for a strategic development of Industry 4.0, providing significant funding for research and development and establishing partnerships between industry and academia. Under its Industrial Strategy 2030, the government set a goal of raising the share of German industries in gross value added in the Germany economy to 25% by 2030.

There is a rise in the incorporation of Industry 4.0 industries as various countries have a strong manufacturing base, which includes well-established companies such as Bosch, Siemens, and Volkswagen. These companies have been early adopters of new technologies and have invested heavily in research and development to create innovative solutions for the challenges of Industry 4.0, such as interoperability. The implementation of Industry 4.0 has had a significant effect on the manufacturing sector. For example, the use of data analytics and predictive maintenance has enabled companies to reduce downtime and improve the efficiency of their operations. The adoption of Industry 4.0 leads to the integration of AI, IoT, and sensors in components such as valves. Also, IoT valves are compatible with Industry 4.0 technologies; for example, the IoTH-800 Series, offered by Ultra Clean technology, is compatible with Industry 4.0. Thus, the growth of Industry 4.0 is likely to create opportunities for the proliferation of the global IoT valve market during the forecast period.

IoT Valve Market Report Segmentation Analysis

Key segments that contributed to the derivation of the IoT valve market analysis are connectivity, type, and end user.

- Based on connectivity, the market is segmented into wired and wireless. The wired segment held a larger IoT valves market share in 2023.

- Based on type, the market is segmented into energy valve, pressure-independent control valve (PICV), and regular valves. The pressure independent control valve (PICV) segment held the largest IoT valves market share in 2023.

- Based on end user, the market is divided into industrial, residential, and commercial. The industrial segment held the largest market share in 2023.

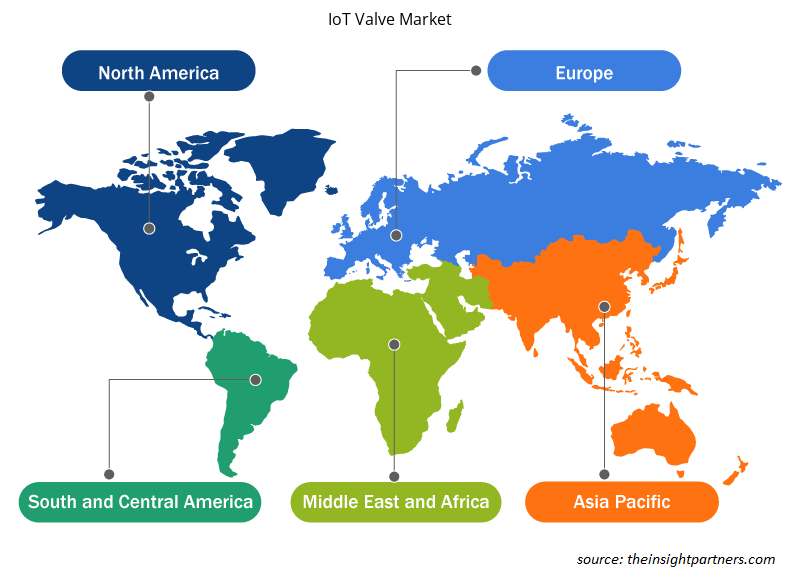

IoT Valve Market Share Analysis by Geography

The IoT valve market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023, followed by North America and Europe.

The high penetration of the Internet across North America, coupled with initiatives by key market players to promote the use of digital technologies for seamless and smooth business operations and human error reduction, catalyzes the adoption of IoT valves across North America. In November 2021, Rusco, a US-based manufacturer of water sediment filtration products, announced the launch of "Smart Ball Valve." These valves can be operated using apps on Android and Apple devices and can be accessed on Zigbee and Wi-Fi models. They are made for commercial, municipal, and residential water filtration systems. This smart valve automates two basic functions—flow shut off and sediment flushing. The apps are alerted if something interrupts normal operations and provide a safe shut-off during power cuts, which improves the overall performance of a water filter system. Thus, the IoT valve market in North America is dominated by automation and the development of smart solutions in water filtration systems.

IoT Valve Market Regional Insights

The regional trends and factors influencing the IoT Valve Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses IoT Valve Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for IoT Valve Market

IoT Valve Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.29 Billion |

| Market Size by 2031 | US$ 2.85 Billion |

| Global CAGR (2023 - 2031) | 10.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Connectivity

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

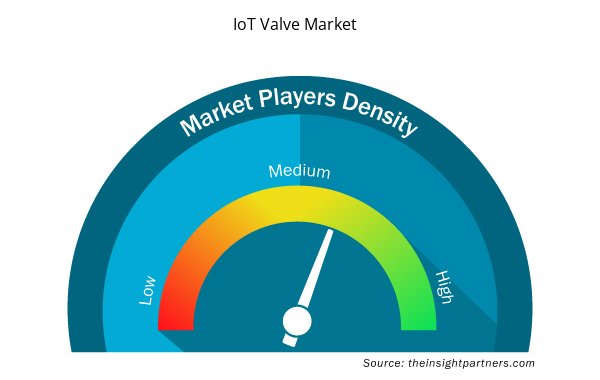

IoT Valve Market Players Density: Understanding Its Impact on Business Dynamics

The IoT Valve Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the IoT Valve Market are:

- Klinger Schoneberg GmbH

- KTW Technology GMBH

- Carrier Global Corp

- IMI Plc

- Siemens AG

- Flowserve Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the IoT Valve Market top key players overview

IoT Valves Market News and Recent Developments

The IoT valve market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- IMI plc acquired Heatmiser UK Ltd. for an enterprise value of US$ 119.5 million, with up to a further US$ 8.6 million based on Heatmiser's future financial performance. Heatmiser became part of IMI Hydronic Engineering ("IMI Hydronic"). (Source: IMI plc, Press Release, November 2022)

- Ultra Clean Holdings, Inc. acquired HIS Innovations Group, a privately held company based in Hillsboro, Oregon. HIS is a leading supplier to the semiconductor sub-fab segment, including the design, manufacturing, and integration of components, process solutions, and fully integrated subsystems. This acquisition aligns with UCT's long-term strategy to pursue sustained and profitable growth by offering a more diversified portfolio of high-quality, high-value solutions to its customers. (Source: Ultra Clean Holdings, Inc., Press Release, October 2023)

IoT Valve Market Report Coverage and Deliverables

The "IoT Valve Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- IoT valves market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- IoT valve market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- IoT valve market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the IoT valve market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Medical Enzyme Technology Market

- Virtual Event Software Market

- Vertical Farming Crops Market

- Constipation Treatment Market

- Wire Harness Market

- Lyophilization Services for Biopharmaceuticals Market

- GNSS Chip Market

- Railway Braking System Market

- Public Key Infrastructure Market

- Ceramic Injection Molding Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rising energy and water conservation efforts, increasing demand for automation and smart solutions in industries, growing need for remote monitoring and control systems in industrial process, and rising implementation of safety and compliance regulations in industrial process are the major factors that propel the global IoT valves market.

The global IoT valves market was estimated to be US$ 1.29 billion in 2023 and is expected to grow at a CAGR of 10.4 % during the forecast period 2023 - 2031.

Increasing integration of IoT with blockchain, which is anticipated to play a significant role in the global IoT valves market in the coming years.

The global IoT valves market is expected to reach US$ 2.85 billion by 2031.

The incremental growth expected to be recorded for the global IoT valves market during the forecast period is US$ 1,561.95 million.

The key players holding majority shares in the global IoT valves market are Flowserve Corp, Carrier Global Corp, Siemens AG, Belimo Aircontrols (Can.) Inc, and IMI Hydronic Engineering.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - IoT Valve Market

- Klinger Holding GmbH

- KTW Technology GMBH

- Carrier Global Corp

- IMI Plc

- Ultra Clean Holdings Inc

- Siemens AG

- Flowserve Corp

- Honeywell International Inc

- Larsen & Toubro Ltd

- Belimo Holding AG

- Smart Wires Inc

- Flow Dynamics LLC

- IoT Technologies

- ChengDu ZhiCheng Technology Co., Ltd.

- Teksun Inc.

- Autorun Control Valve Co.,Ltd.

- Ham-Let Group

- Rusco

Get Free Sample For

Get Free Sample For