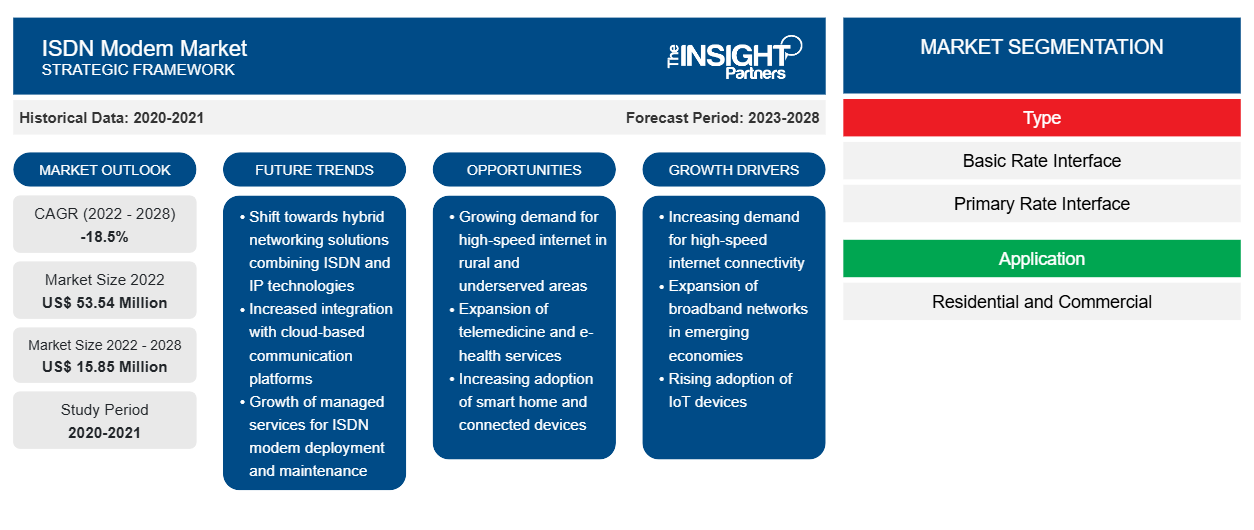

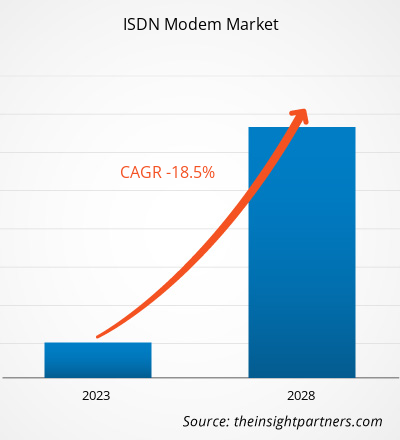

The ISDN modem market is expected to decline from US$ 53.54 million in 2022 to US$ 15.85 million by 2028; it is estimated to register a CAGR of -18.5% from 2022 to 2028.

The ISDN industry started in the 1980s at Bell Labs and was commercialized in 1988, along with its standards. The companies operating worldwide in that era had taken full advantage of ISDN lines for their operations. However, by 2000, several countries started moving toward upgraded technologies that provided them with more advanced internet speed and modern telecom operations. For instance, the adoption of broadband, Digital Subscriber Lines (DSL) routers, and Asymmetrical Digital Subscriber Lines (ADSL) started replacing the ISDN modem technologies across different regions.

ISDN modems are more widely available than the Digital Subscriber Line (DSL) and cable modem technologies and are still being used as a backup line when the main line of a network fails across underdeveloped countries. It is widely used in residential applications, such as small home offices, for additional telephone lines and good voice service. Further, the ISDN modem market growth was mainly driven by several advantages such as high-speed data transfer during teleconferencing to support the growing need for integrated business communication among small-scale enterprises. Further, the various features of ISDN modem such as call forwarding, call hold, and caller ID had increased the preference for ISDN modem as backup lines across multiple corporate enterprises.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ISDN Modem Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ISDN Modem Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Moreover, the adoption of ISDN modem as a backup line has been witnessed across underdeveloped countries such as Ethiopia. For instance, in June 2021, Target Business Consultants Pvt. Ltd. Co., an Ethiopia-based company, procured ~8 units of ISDN modems in collaboration with MasterCard Foundation for a COVID-19 project implemented by the Federal Democratic Republic of Ethiopia, Ministry of Innovation and Technology (MInT). Such instances have driven the demand for ISDN modems across African region.

The Broadband Integrated Services Digital Network (B-ISDN) is a virtual circuit-switched network that can use high packet switching services and a flexible format, i.e., asynchronous transfer mode, for data transmission. B-ISDN, a high-speed fiber network, can operate at 100 Mbps, which is ideal for video applications, including video surveillance and videoconferencing. However, the B-ISDN technology is also expected to be discontinued by 2025, which will restrain the current ISDN modem market size.

Impact of COVID-19 Pandemic on ISDN Modem Market

The COVID-19 pandemic severely impacted different industries, from manufacturing to airlines. However, it positively influenced the technology industry globally. As a safety measure, governments worldwide enforced work from home to curb the spread of COVID-19 virus. Due to such government measure, lots of businesses were pressurized to catch on remote working at a fast pace. In this measure, several businesses adopted Webex, Microsoft Teams, and different methods of communication such as smartphones. Instead of making a shift into VOIP by replacing existing communication, the companies opted for aforesaid methods. This factor has positively impacted the ISDN modem market size, as many companies have refrained themselves to replace existing system with new system such as VoIP or other additional services including ISDN. Moreover, some of the poor telecom infrastructure countries such as Ethiopia has also opted ISDN modems for remote area campaigns during the COVID-19 pandemic. For instance, in July 2021, the Federal Democratic Republic of Ethiopia, Ministry of Innovation and Technology (MInT) in collaboration with the MasterCard Foundation had released a tender for the purchase of 8 units of ISDN modems for their respective COVID-19 project in Ethiopia. Such instances have driven the market during the FY 2020-2021.

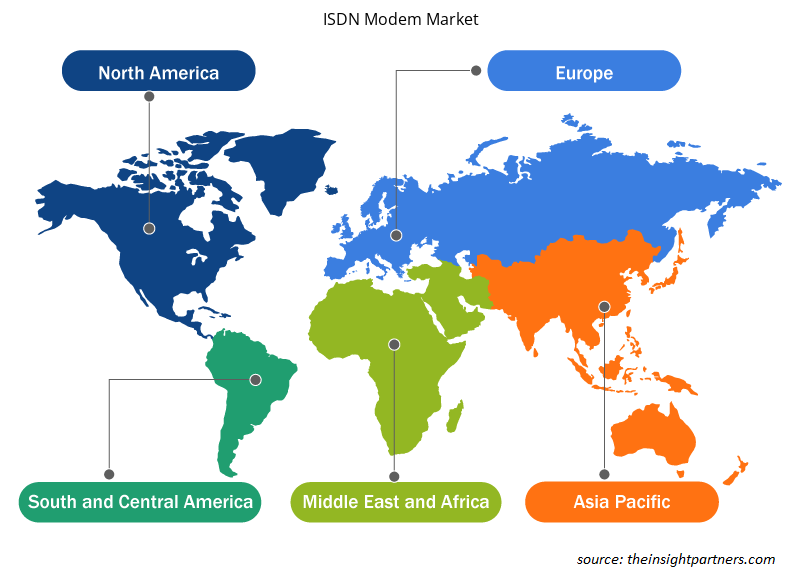

Market Insights – ISDN Modem Market

Based on region, the ISDN modem market analysis is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America. North America is expected to dominate the market with a largest ISDN modem market share in 2022, and it is expected to retain its dominance during the forecast period, followed by Europe and Asia Pacific. Further, the ISDN modem market in Asia Pacific is attributed to the increasing exports of ISDN terminals and adapters from the countries such as India. Moreover, India is also expected to dominate the Asia Pacific regional market with a larger ISDN modem market share in 2022.

Application Insights – ISDN Modem Market

Based on application, the ISDN modem market analysis is segmented into residential and commercial. The commercial segment is expected to dominate the market in 2022. Also, the segment is expected to retain its dominance during the forecast period as well. The ISDN modem market growth for the commercial segment is mainly attributed to the demand for ISDN modems across corporate companies in poor telecom infrastructure countries such as Mexico, Venezuela, and the Netherlands. Mexican companies have still been using ISDN networks for their respective operations wherein the demand for new ISDN modems is fulfilled by international ISDN modem market players such as the US and the UK.

ISDN Modem Market Regional Insights

The regional trends and factors influencing the ISDN Modem Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses ISDN Modem Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for ISDN Modem Market

ISDN Modem Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 53.54 Million |

| Market Size by 2028 | US$ 15.85 Million |

| Global CAGR (2022 - 2028) | -18.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

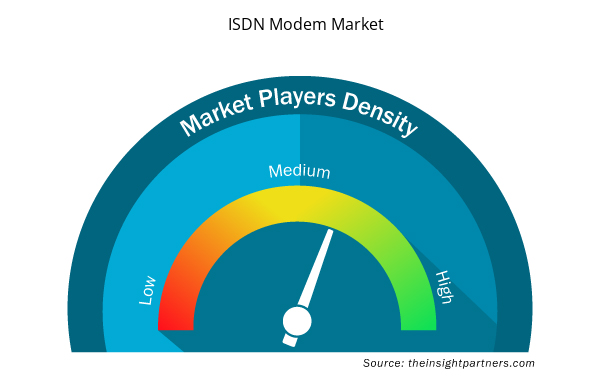

ISDN Modem Market Players Density: Understanding Its Impact on Business Dynamics

The ISDN Modem Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the ISDN Modem Market are:

- Ekinops

- TERRATEL

- Patton LLC

- A TLC S.r.l.

- Epygi Technologies LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the ISDN Modem Market top key players overview

Epygi Technologies LLC, Polycom, Ekinops, Xiamen Yeastar Information Technology Co. Ltd., and HypermediaS are among the prominent ISDN modem market players operating globally. The ISDN modem market is highly consolidated and has well-established market players and leaders.

The ISDN modem market players are majorly focusing on catering to the underdeveloped country-level customers that are still operating with the traditional ISDN lines infrastructure. Several major countries have already replaced their existing ISDN and Public Safety Data Network (PSDN) lines with Digital Subscriber Lines (DSL), Asymmetrical Digital Subscriber Line (ADSL), Wide Area Network (WAN), and Voice Over Internet Protocol (VoIP) systems for their respective operations. Moreover, the existing ISDN modem market players are focusing to transform their product offerings to cater to market demands and retain their market position in their respective industries.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, South Africa, United Kingdom, United States

Frequently Asked Questions

Primary Rate Interface (PRI) segment is expected to hold a major market share of ISDN modem market in 2022

India, UK, and France are expected to register slow declining rate during the forecast period

The US is expected to hold a major market share of ISDN modem market in 2022

Asia Pacific is expected to decline at a slower rate in the ISDN modem market during the forecast period (2022-2028)

Deployment of B-ISDN systems

Epygi Technologies LLC, Polycom, Ekinops, Xiamen Yeastar Information Technology Co. Ltd., and HypermediaS are the key market players expected to hold a major market share of ISDN modem market in 2022

The global market size of ISDN modem market by 2028 will be around US$ 15.85 million

The estimated global market size for the ISDN modem market in 2022 is expected to be around US$ 53.54 million

Demand for Backup Line Across Underdeveloped Countries

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - ISDN Modem Market

- Ekinops

- TERRATEL

- Patton LLC

- A TLC S.r.l.

- Epygi Technologies LLC

- Polycom

- Xiamen Yeastar Information Technology Co. Ltd.

- HypermediaS

- Aristel Networks

Get Free Sample For

Get Free Sample For