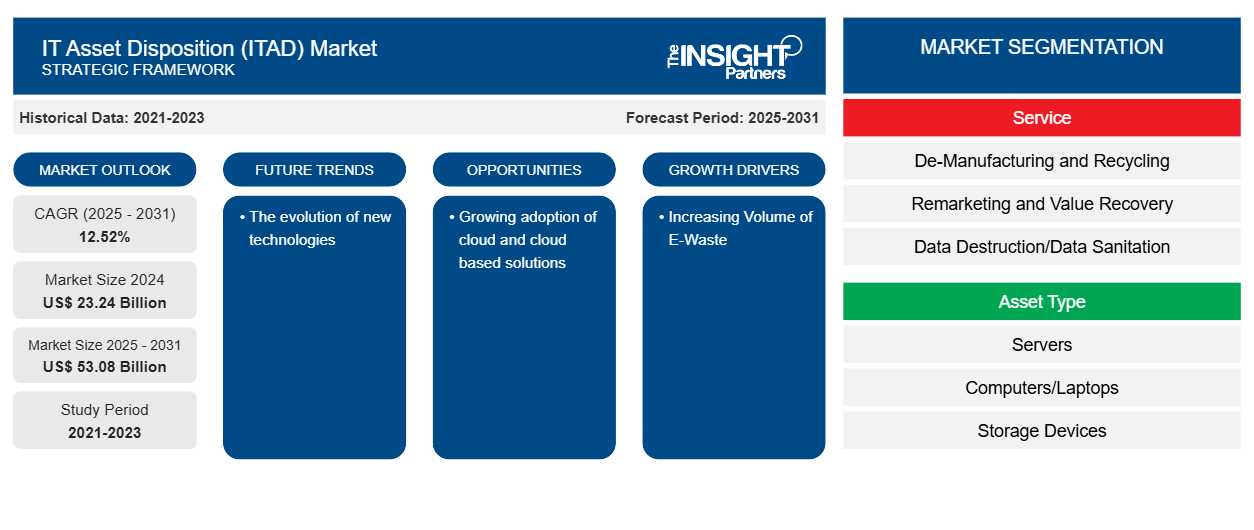

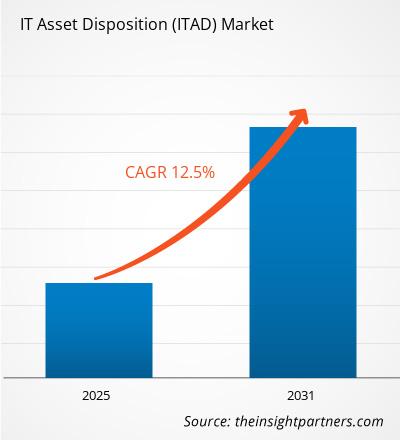

The IT asset disposition (ITAD) market size is projected to reach US$ 53.08 billion by 2031 from US$ 20.65 billion in 2023. The market is expected to register a CAGR of 12.52% during 2023–2031. The evolution of new technologies is likely to remain a key trend in the market.

IT Asset Disposition (ITAD) Market Analysis

The rising demand for consumer electronics and growing consumer awareness of the significance of properly disposing of IT assets are driving the development of IT asset disposition (ITAD) services. To reduce its environmental effect, ITAD fixes recycles, and repurposes outdated IT equipment. Reusing the internal components of IT equipment can help cut down on electronic waste. It also helps to keep plastics and heavy metals from environmental damage as they can be recycled. Additionally, the sales are influenced by the requirement for appropriate e-waste disposal methods, environmental regulations that businesses must adhere to, and the massive volume of e-waste produced. Furthermore, a rise in the need for IT asset disposal, particularly due to the growing worries regarding data security and regulatory compliance, is expected to boost the growth of the IT asset disposition market in the forecasted period.

IT Asset Disposition (ITAD) Market Overview

Information Technology Asset Disposition is referred to as ITAD. It is the safe and secure disposal of obsolete or unwanted technology assets. Recycling, repurposing, reselling, or giving these assets are all part of ITAD, which aims to minimize environmental impact and reduce e-waste. Data destruction is a step in the ITAD process that guarantees all sensitive data is removed from devices before being disposed of. By doing this, confidential data is protected from any potential security breaches. By assisting businesses in tracking their IT assets from acquisition to retirement, IT asset management plays a crucial part in ITAD procedures. An effective asset tracking system contributes to adherence to laws like GLBA and HIPAA. Organizations can expedite their asset disposal procedures and guarantee regulatory compliance by collaborating with a reputable and accredited ITAD supplier. Businesses can reduce the risk of fines and brand damage connected with inappropriate disposal methods by selecting the appropriate vendor.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IT Asset Disposition (ITAD) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IT Asset Disposition (ITAD) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

IT Asset Disposition (ITAD) Market Drivers and Opportunities

Increasing Volume of E-Waste to Favor Market

As the lives of people are becoming ever more electrified, the demand for new electronic devices or advanced devices such as smartphones, tablets, laptops, and others are continuously coming into the market. Because of the growing innovation and launches of new electronic devices, the older ones end up as e-waste, leading to a tremendous increase in the e-waste stream and making it the fastest-growing waste stream worldwide. According to the World Health Organization (WHO), e-waste is the fastest-growing solid waste stream in the world, growing 3 times faster than the world’s population. Nevertheless, e-waste streams comprise valuable and limited resources that can be recycled properly to extend their useful life. People with low and middle incomes, especially children, are more vulnerable to the risks associated with e-waste if it is not adequately managed. This is because there are insufficient laws, recycling facilities, and training programs. Also, e-waste contains dangerous components or, if improperly handled, might produce harmful chemicals, making it hazardous waste. Hence, as the growing e-waste is harmful to human health and the environment, the need for IT asset disposition services is increasing worldwide, fueling the growth of the IT asset disposition market.

Growing Adoption Of Cloud and Cloud Based Solutions

Cloud computing can facilitate businesses to rapidly develop and deploy applications, enhance customer experience, and reduce costs. Therefore, cloud adoption is gaining increasing significance as businesses seek to leverage the benefits of cloud-based technologies for their digital transformation journey. With the increasing use of cloud and cloud-based solutions, it requires the disposal of its equipment. Thus, the growing adoption of cloud and cloud-based solutions creates ample opportunities for the growth of the IT asset disposition market.

IT Asset Disposition (ITAD) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the IT asset disposition (ITAD) market analysis are service, asset type, and end-user.

- Based on the service, the IT asset disposition (ITAD) market is divided into de-manufacturing and recycling, remarketing and value recovery, data destruction/data sanitation, and others.

- By asset type, the market is segmented into servers, computers/laptops, storage devices, peripherals, and others.

- In terms of end-users, the market is segmented into BFSI, IT and telecom, healthcare, manufacturing, logistics, and transportation, among others.

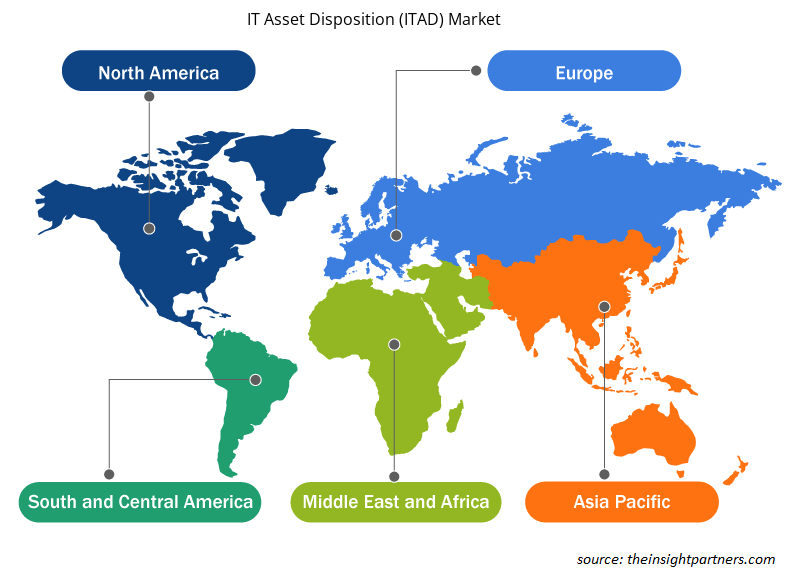

IT Asset Disposition (ITAD) Market Share Analysis by Geography

The geographic scope of the IT asset disposition (ITAD) market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. North American countries such as the US and Canada have been pioneers in the adoption of new technology across their businesses over the years. Also, the growing product innovation, stringent regulations, and environmental consciousness are other factors fueling the growth of the IT asset disposition market in the region. Additionally, a thriving IT industry and an increase in cloud data centers in the area are anticipated to support the growth of the North American IT asset disposition market in the forecast year.

IT Asset Disposition (ITAD) Market Regional Insights

The regional trends and factors influencing the IT Asset Disposition (ITAD) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses IT Asset Disposition (ITAD) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for IT Asset Disposition (ITAD) Market

IT Asset Disposition (ITAD) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 23.24 Billion |

| Market Size by 2031 | US$ 53.08 Billion |

| Global CAGR (2025 - 2031) | 12.52% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

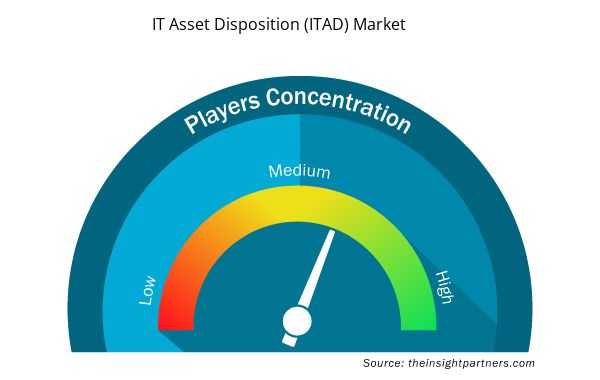

IT Asset Disposition (ITAD) Market Players Density: Understanding Its Impact on Business Dynamics

The IT Asset Disposition (ITAD) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the IT Asset Disposition (ITAD) Market are:

- Apto Solution, Inc.

- Arrow Electronics, Inc.

- Castaway Technologies

- Dell Inc.

- Hewlett Packard Enterprise Company

- Iron Mountain Incorporated

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the IT Asset Disposition (ITAD) Market top key players overview

IT Asset Disposition (ITAD) Market News and Recent Developments

The IT asset disposition (ITAD) market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the IT asset disposition (ITAD) market are listed below:

- Hewlett Packard Enterprise announced that Yahoo! JAPAN has chosen HPE Asset Upcycling Services to ensure end-of-use hardware gets refurbished and reused wherever possible to meet its sustainability goals. This service is part of HPE’s full range of solutions to help customers modernize multi-generational IT estates, extend the life of legacy systems and associated software, and extract value from end-of-use technology. (Source: Hewlett Packard Enterprise, November 2022)

- Full Circle Electronics (FCE), backed by private equity firm Tide Rock, announced the acquisition of an IT Asset Disposition (ITAD) business from SIPI Asset Recovery. With the acquisition, Full Circle gained ITAD geographic reach across Northern California, Illinois, Texas, Mexico, and Columbia. SIPI ITAD provides a "full ITAD pick-up scheduling system, detailed auditing, and integrated testing, wiping, and grading for optimal data security and product quality. (Source: Full Circle Electronics, October 2023)

IT Asset Disposition (ITAD) Market Report Coverage and Deliverables

The “IT Asset Disposition (ITAD) Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- IT asset disposition (ITAD) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- IT asset disposition (ITAD) market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- IT asset disposition (ITAD) market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the IT asset disposition (ITAD) market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Industrial Inkjet Printers Market

- Virtual Event Software Market

- Sweet Potato Market

- Flexible Garden Hoses Market

- Artwork Management Software Market

- Bathroom Vanities Market

- Medical Devices Market

- Wire Harness Market

- Water Pipeline Leak Detection System Market

- Emergency Department Information System (EDIS) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service, Asset Type, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 12.52% during 2023–2031.

The global IT asset disposition (ITAD) market is expected to reach US$ 53.08 billion by 2031.

Increasing the Volume of E-Waste is the major factors that propel the global IT asset disposition (ITAD) market.

The evolution of new technologies to play a significant role in the global IT asset disposition (ITAD) market in the coming years.

The leading players operating in the global IT asset disposition (ITAD) market are Apto Solution, Inc., Arrow Electronics, Inc., Castaway Technologies, Dell Inc., Hewlett Packard Enterprise Company, Iron Mountain Incorporated, Lifespan International Inc., Sims Limited, TBS Industries, TES group, 3steplT, Total IT Global, Flex IT Distribution, Ingram Micro, CSI Leasing, Inc., Inrego AB, Tierl, Atea, OceanTech, and Blancco Technology Group.

North America dominated the IT asset disposition (ITAD) market in 2023.

Get Free Sample For

Get Free Sample For