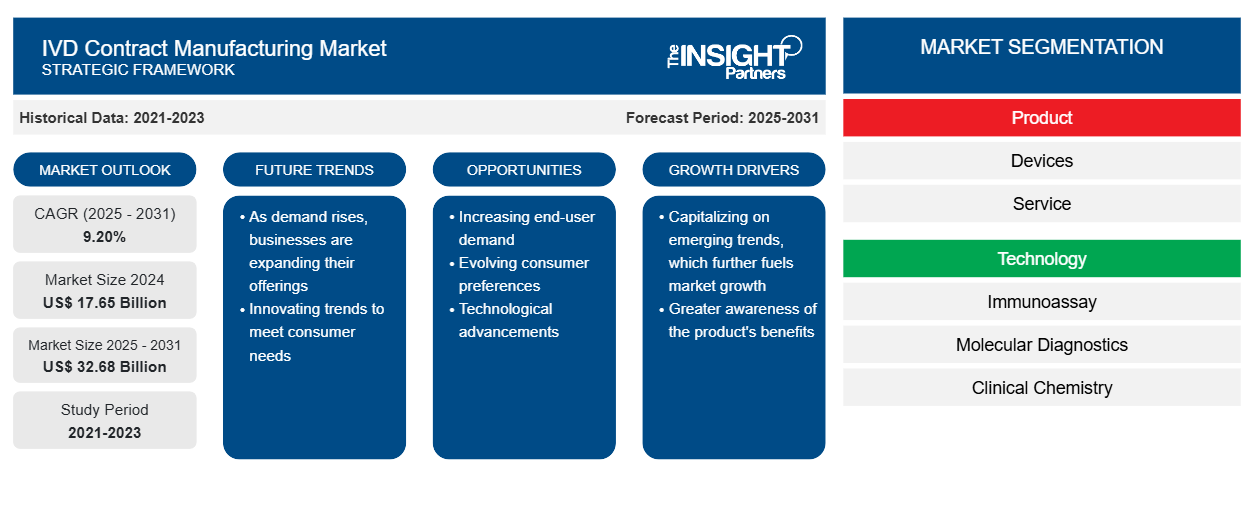

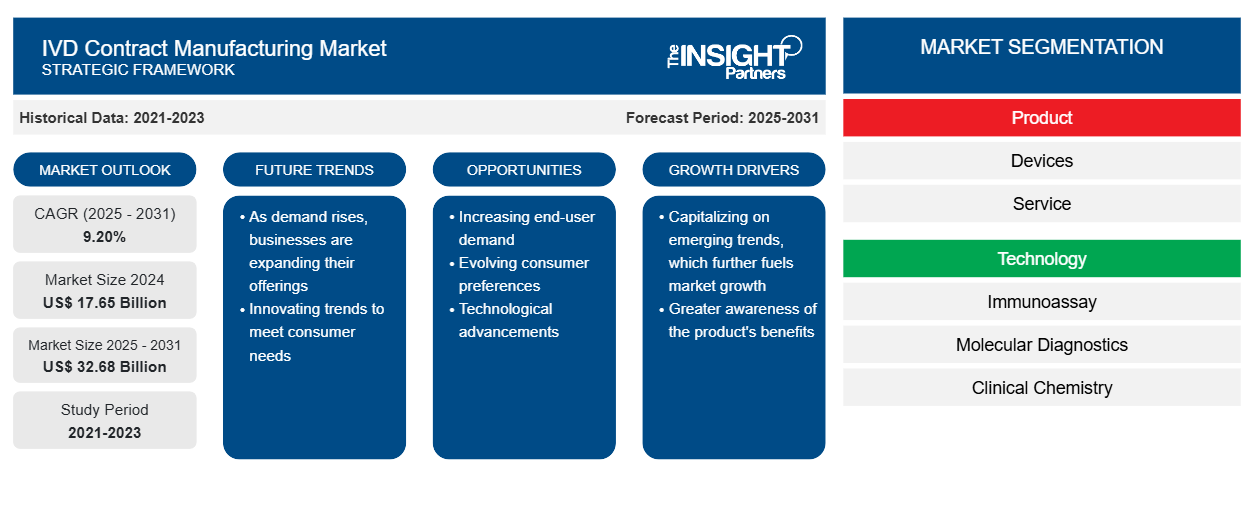

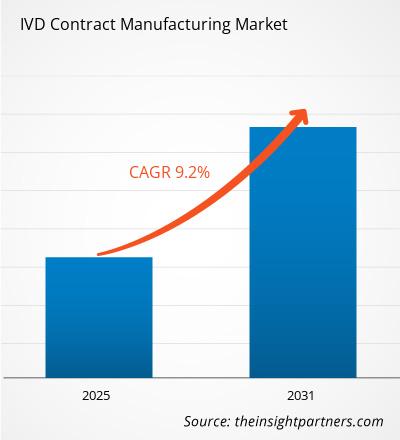

[Research Report] The IVD contract manufacturing market size is expected to grow from US$ 14,800.01 million in 2022 to US$ 29,925.62 million by 2031; it is estimated to register a CAGR of 9.20% from 2022 to 2031.

Analyst’s View Point

In vitro diagnostics (IVD) contract manufacturing involves outsourcing the production of diagnostic tests to a third-party manufacturer. This can include manufacturing components, assembling the final product, and sometimes even packaging. It's a common practice for companies in the diagnostics industry to streamline their operations and leverage the expertise of specialized manufacturers. IVD contract manufacturing has several benefits. This enables diagnostic companies to concentrate on their core skills, like marketing, development, and research, and to rely on specialized manufacturers for productive and affordable production. This strategy can shorten the time it takes for new diagnostic products to reach the market, save production costs, and improve overall operational efficiency. Contract manufacturers have a global presence, enabling companies to access international markets without requiring extensive infrastructure investments. The rapid growth in demand for in vitro diagnostics products used in clinical laboratories is causing manufacturers to require assistance in keeping up with the pace of production. This, in turn, drives the demand for IVD contract manufacturing. Thus, key players like Invetech, Zentech, Merck KGaA, etc., offer services for IVD contract manufacturing.

There are several prospects for expansion and innovation in the in vitro diagnostics (IVD) contract manufacturing sector. Emerging and persistent global health issues, like pandemics and infectious diseases, present chances for IVD contract manufacturers to speed up the creation and development of diagnostic tests. Rapid response to these kinds of obstacles increases market potential. IVD contract manufacturing can benefit from the trend toward personalized medicine by producing diagnostics specific to each patient's profile. There is a need for customized solutions, such as genetic and molecular diagnostics.

Furthermore, there are plenty of opportunities in developing nations where the demand for better healthcare infrastructure is rising. IVD contract manufacturers can set up shops in these areas to address regional healthcare issues and support market expansion. IVD contract manufacturers can establish themselves as essential collaborators in advancing diagnostic technologies and meet the changing demands of the healthcare sector by seizing these opportunities.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IVD Contract Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IVD Contract Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Prevalence of Infectious Diseases

IVD contract manufacturing is essential in producing diagnostic tests to combat infectious diseases. Contract manufacturers can develop rapid diagnostic tests for infectious diseases more quickly, which will help with early detection and containment efforts. Contract manufacturers can quickly ramp up production in response to infectious disease outbreaks, meeting the increased demand for diagnostic tests and facilitating prompt identification and management. A comprehensive approach to diagnosing infectious diseases can be aided by the variety of diagnostic tests that contract manufacturers can produce, such as antigen tests, serological assays, and nucleic acid tests. Using contract manufacturers with cutting-edge technology can help develop more complex and precise diagnostic tests, improving the ability to identify different infectious agents. Thus, an increase in the prevalence of infectious diseases is anticipated to drive the market's growth. For instance, according to the Centers for Disease Control and Prevention, in 2022, approximately 8,331 Tuberculosis (TB) cases were reported in the United States. According to the Government of Canada, 1,829 cases of active tuberculosis were reported in Canada in 2021. In comparison, there were 4.8 active TB cases for every 100,000 people, 4.3 cases per 100,000 for females, and 5.3 cases per 100,000 for males.

Moreover, IVD companies and contract manufacturers can work together to promote ongoing innovation in diagnostic technologies, eventually increasing the speed and precision of infectious disease diagnosis. IVD companies can strategically plan and optimize production capacities through contract manufacturing partnerships, which enables them to respond more efficiently to emerging infectious disease challenges.

The IVD contract manufacturing market is often constrained by strict regulations, difficulties in maintaining quality control, and the requirement to follow global standards. Additionally, entry barriers for new manufacturers may arise due to the complexity of technology and the need for specialized facilities. Economic variables and shifts in healthcare spending may also affect market expansion, posing difficulties for the industry's long-term growth.

Future Trend

Technological Advancement in IVD Contract Manufacturing

Several technological advancements are shaping the landscape of in vitro diagnostics (IVD) contract manufacturing. Advances in automation and robotics have improved the precision and efficiency of manufacturing processes. This includes automated assembly, quality control, and packaging, contributing to higher production capacities and reduced error rates. Diagnostic device integration of digital technologies and the Internet of Things (IoT) is becoming popular. This improves the overall functionality and usability of IVD products by enabling real-time data collection, connectivity, and remote monitoring. Technological advancements in molecular diagnostics, including polymerase chain reaction (PCR) and other nucleic acid testing methods, have led to more sensitive and specific diagnostic assays. Contract manufacturers play a role in producing components for these sophisticated tests. Technological advancements also extend to sustainable manufacturing practices. Contract manufacturers are adopting eco-friendly technologies, such as energy-efficient processes and recyclable materials, aligning with the industry's growing emphasis on sustainability. These technological advancements collectively produce more advanced, efficient, and accurate diagnostic devices in the IVD contract manufacturing sector.

Report Segmentation and Scope

Product - Based Insights

Based on product, the global IVD contract manufacturing market is bifurcated into devices and services. The devices segment held a larger market share in 2022. IVD contract manufacturing is growing due to the growing need for diagnostic tests worldwide, fueled by factors like an aging population, a rise in the prevalence of chronic diseases, and the continuous need for diagnostics for infectious diseases. The ongoing advancement of diagnostic technologies, such as point-of-care testing, molecular diagnostics, and advanced imaging methods, presents chances for IVD contract manufacturers to share their knowledge of developing state-of-the-art equipment.

Technology-Based Insights

Based on the technology, the global IVD contract manufacturing market is classified into immunoassay, molecular diagnostics, clinical chemistry, hematology, microbiology, urinalysis, and others. The immunoassay segment held a larger market share in 2022. Immunoassays can detect analytes in various ways, and contract manufacturing services are essential to meeting the demand for these diagnostic tests. The need for immunoassays in diagnosing and monitoring chronic diseases, such as diabetes, autoimmune conditions, and cardiovascular disorders, is driven by their rising prevalence. Consequently, there is a greater demand for contract manufacturing services. The need for these tests is rising due to the trend toward decentralized testing, which includes point-of-care immunoassays. Contract manufacturers are essential when creating quick and portable immunoassay instruments for use at the point of care.

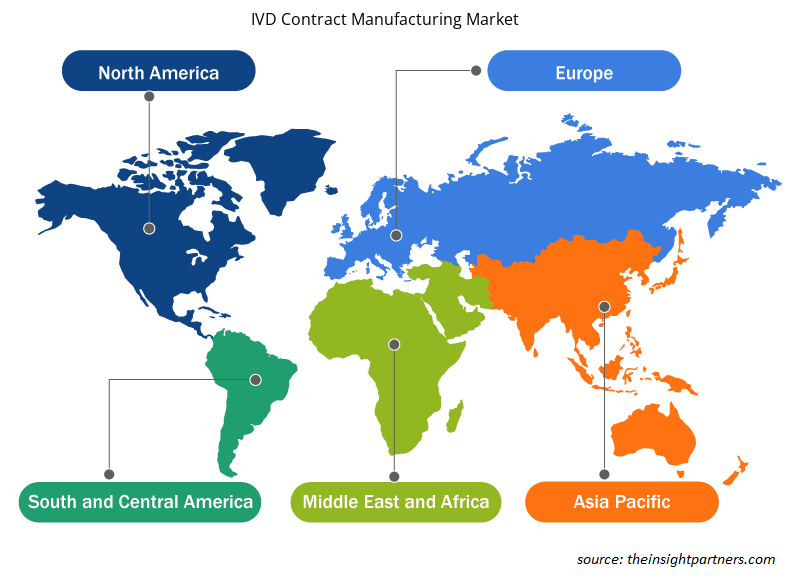

Regional Analysis

The North American IVD contract manufacturing market is segmented into the US, Canada, and Mexico. The IVD contract manufacturing market in North America has been steadily growing as people become more aware of the benefits of neuromonitoring in surgical procedures. North America has a noticeable trend toward decentralized testing, especially concerning point-of-care diagnostics.

The IVD contract manufacturing market in the U.S. has been experiencing steady growth due to the increasing demand for diagnostic tests, technological advancements, and the need for cost-effective manufacturing solutions. The rising prevalence of chronic diseases in the U.S., such as diabetes, cardiovascular diseases, and cancer, has contributed to the demand for diagnostic tests, fostering growth in the IVD contract manufacturing sector. Government programs and public health campaigns may affect the demand for particular diagnostic tests. For instance, initiatives aimed at disease prevention or screening might be the driving force behind the demand for particular IVD products.

Likewise, Asia Pacific will account for the highest CAGR for the IVD contract manufacturing market for the forecast period 2021-2031. The IVD contract manufacturing industry has grown significantly in the APAC region due to rising disease prevalence, healthcare costs, and growing awareness of diagnostic testing. Due to an aging population and rising healthcare costs, Asia-Pacific nations are seeing an increase in demand for diagnostic services, which is driving up the IVD market and contract manufacturing. Nations like South Korea, China, and India have become major players in the IVD market. These nations have a particularly high demand for contract manufacturing services because they invest heavily in healthcare infrastructure.

The report profiles leading players operating in the global IVD contract manufacturing market. These include Invetech, Zentech, Veracyte, Merck KGaA, Avioq, Inc, TCS Biosciences Ltd, Bio-Techne, SCIENION, Hochuen Medical, and SeaskyMedical.

In May 2023, Reagent IVD Resources Pvt. Ltd. (RIVDR), a Jaipur-based biotech start-up with a focus on diagnostics, and TechInvention Lifecare Pvt. Ltd., a Mumbai-based biotech start-up, partnered strategically to develop and produce an extensive range of diagnostics. RIVDR is a contract manufacturer that produces life science reagents and in-vitro diagnostics (IVD), providing creative manufacturing solutions for industry-upending shifts in diagnostics.

In May 2023, Biofortuna expanded its IVD service portfolio to emphasize immunoassay design, development, and manufacturing. The company has invested significantly in its manufacturing capabilities, which include plate coating, washing, drying, and quality control, resulting in an exceptional manufacturing suite for immunoassay kits.

In March 2021, a leading company in contract manufacturing, custom automation, and new product development, Invetech, announced that its in vitro diagnostics (IVD) manufacturing facility in Boxborough, Massachusetts, has received formal ISO 13485 certification. This accomplishment enhances the company's established manufacturing capabilities at its Melbourne, Australia facility and broadens its global IVD contract manufacturing footprint into the United States.

Company Profiles

- Invetech

- Zentech

- Veracyte

- Merck KGaA

- Avioq, Inc

- TCS Biosciences Ltd

- Bio-Techne

- SCIENION

- Hochuen Medical

- SeaskyMedical

IVD Contract Manufacturing Market Regional Insights

The regional trends and factors influencing the IVD Contract Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses IVD Contract Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for IVD Contract Manufacturing Market

IVD Contract Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 17.65 Billion |

| Market Size by 2031 | US$ 32.68 Billion |

| Global CAGR (2025 - 2031) | 9.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

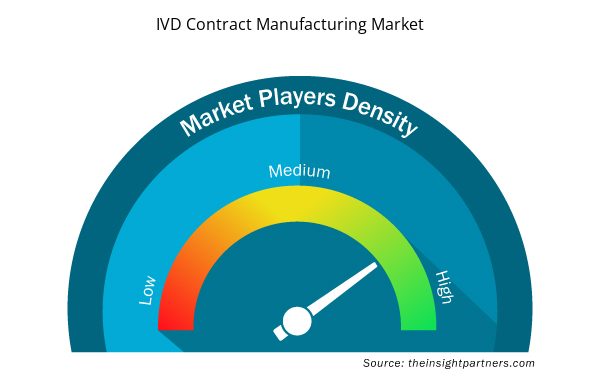

IVD Contract Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The IVD Contract Manufacturing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the IVD Contract Manufacturing Market are:

- Invetech

- Zentech

- Veracyte

- Merck KGaA

- Avioq, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the IVD Contract Manufacturing Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hair Wig Market

- Health Economics and Outcome Research (HEOR) Services Market

- Aircraft Wire and Cable Market

- Hydrogen Compressors Market

- Nuclear Waste Management System Market

- Biopharmaceutical Contract Manufacturing Market

- Automotive Fabric Market

- EMC Testing Market

- Extracellular Matrix Market

- Hair Extensions Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Invetech

- Zentech

- Veracyte

- Merck KGaA

- Avioq, Inc

- TCS Biosciences Ltd

- Bio-Techne

- SCIENION

- Hochuen Medical

- SeaskyMedical

Get Free Sample For

Get Free Sample For