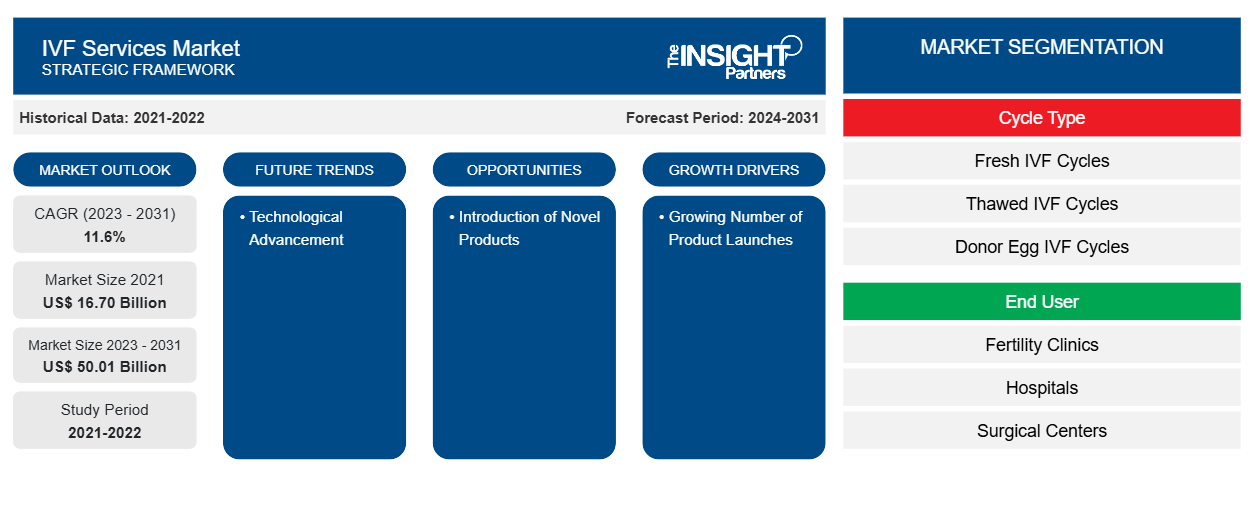

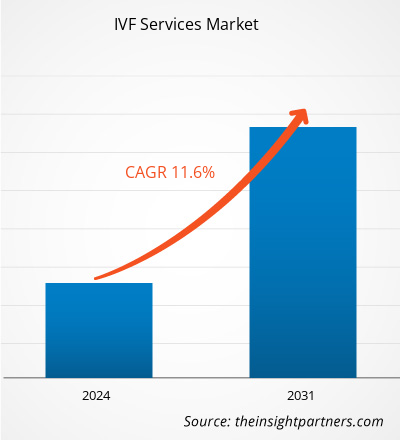

The IVF Services Market size was estimated to be US$ 16.70 billion in 2021 and US$ XX million in 2023 and is expected to reach US$ 50.01 billion by 2031. It is estimated to record a CAGR of 11.6% till 2031. Increasing incidences of infertility, rising number of fertility clinics and infertility services with government support, and integration of artificial intelligence in In vitro fertilization are likely to remain key IVF services market trends.

IVF Services Market Analysis

IVF, or in vitro fertilization, is a fertility therapy where eggs are retrieved from women's ovaries and fertilized with sperm outside the body. The step involves several steps and can be sought by couples or individuals suffering from fertility issues. Currently, various IVF clinics and centers provide IVF services worldwide.

The fertility rate is steadily dropping globally, owing to various factors, such as the growing inclination of late marriages and expanding age-related infertility. Global fertility rates are predicted to fall to 2.4 children per female by 2030 and 2.2 children per female by 2050. About 12% of women in the age group 15 to 44 years in the US faced difficulty getting pregnant or achieving pregnancy to term, regardless of marital status. Also, about 6.0% of married women aged 15 to 44 years in the US are incompetent of getting pregnant after one year of trying (infertility). Thus, the falling fertility rate leads to a substantial increase in demand for in vitro fertilization (IVF) services that influence the fertility window in males and females.

IVF Services Market Overview

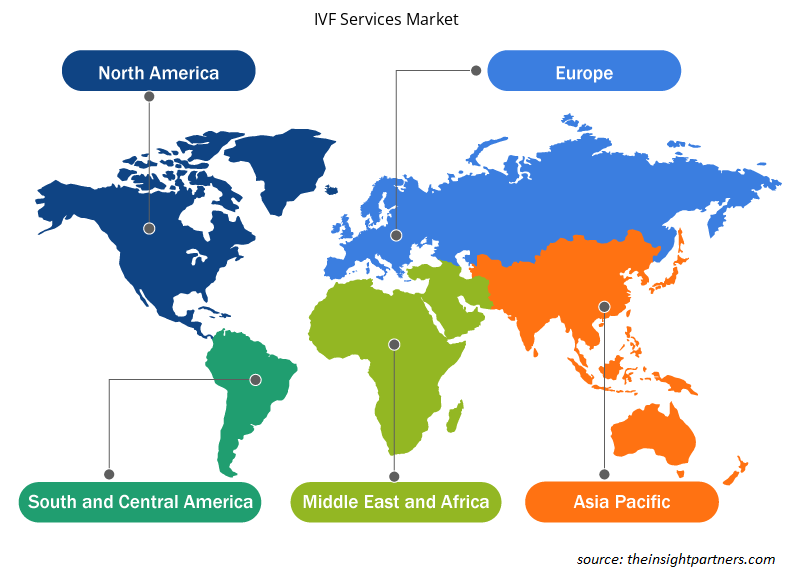

The increasing incidence of infertility, the rising figure of fertility clinics and infertility services with government support, and the growing number of product launches and developments. However, the high procedural cost of reproductive techniques and risks associated with infertility treatment hinder the market growth. Global IVF services market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The European region holds the largest market share, whereas the Asia Pacific region is the fastest-growing region. The factors such as an increase in infertility treatment by IVF and ART. The growing support from the government through various programs, the rising number of fertility centres in the countries, and the declining fertility rate among women are likely to increase the market growth in the region during the forecast years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IVF Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

IVF Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

IVF Services Market Drivers and Opportunities

Growing Number of Product Launches Development to Favor Market

Companies in the IVF services market is acting increasing research and development behaviour to introduce more innovative products. The new thawed IVF cycles, donor egg IVF cycles, micromanipulator systems, and incubators are enabling the adoption of advanced cell technologies, which are strengthening procedural outcomes. In Jan 2021, Royal Philips, a global leader in health technology, declared a multi-year partnership with Merck, a leading science and technology company, to develop clinical-grade digital solutions for highly personalized fertility treatment. An increasing number of product launches, mergers & acquisitions, and developments are projected to drive the IVF services market.

Conduction of Awareness Campaigns – An Opportunity in the IVF Services Market

The awareness campaigns are substantially contributing to increasing reach of IVF technologies and therapies among populations. Such campaigns also hold considerable potential for promoting new IVF centers, information exchange, and discussions. For instance, the first week of November 2022 was observed as the European Fertility Week 2022. The week was observed to invite policymakers across Europe to improve access and quality of existing infertility treatments. Also, organizations, such as Fertility Europe, are taking concrete steps to spread the correct information about infertility treatment. In 2022, the EFW will dedicate the whole week to bringing awareness to the patient's fertility journey and the difficulties they often have to deal with. Thus, conduction of appropriate awareness campaigns is expected to provide robust showcasing platforms for companies, thereby offering growth opportunities to propel revenues within the dynamic ecosystem.

IVF Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the IVF Services market analysis are cycle type, and end user.

- Based on cycle type, the IVF Services market is divided into IVF cycles, thawed IVF cycles, and donor egg IVF cycles. The fresh IVF cycles segment held the largest share of the market in 2023; also, the same segment is anticipated to register the highest CAGR % in the market during the forecast period.

- By End users, the market is segmented into hospitals, fertility clinics, surgical centers and clinical research institutes. The fertility centers segment held the largest share of the market in 2023; also, the segment is expected to register the highest CAGR in the market during 2023–2031.

IVF Services Market Share Analysis by Geography

The geographic scope of the IVF Services market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America has dominated the IVF Services market after Europe. There is an increase in the rate of infertility treatment across the country. Based on CDC’s 2018 Fertility Clinic Success Rates Report, there were 306,197* ART cycles performed at 456 reporting clinics in the United States during 2018, resulting in 73,831 live births (deliveries of one or more living infants) and 81,478 live-born infants. North America held the largest share in 2023. An inclination toward technically advanced products and the presence of global market players are factors contributing to the dominance of the North American IVF Services market. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

IVF Services Market Regional Insights

The regional trends and factors influencing the IVF Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses IVF Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for IVF Services Market

IVF Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 16.70 Billion |

| Market Size by 2031 | US$ 50.01 Billion |

| Global CAGR (2023 - 2031) | 11.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Cycle Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

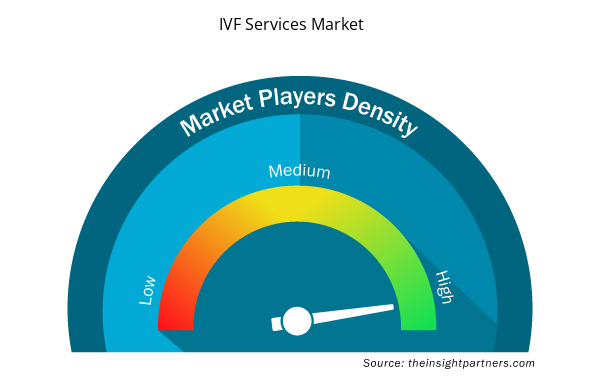

IVF Services Market Players Density: Understanding Its Impact on Business Dynamics

The IVF Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the IVF Services Market are:

- Max Healthcare,

- Bloom IVF,

- CCRM Fertility,

- OXFORD FERTILITY,

- Create Health (Create Fertility),

- Medicover,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the IVF Services Market top key players overview

IVF Services Market News and Recent Developments

The IVF Services Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for IVF Services and strategies:

- In April 2023, Cryoport, Inc. a leading global provider of innovative temperature-controlled supply chain solutions for the life sciences industry and a leader in supply chain solutions for the reproductive medicine markets, announced a multi-year agreement with Inception Fertility. Inception Fertility operates The Prelude Network® (Prelude), the largest and fastest-growing technology-led network of fertility centers in North America. (Source: Prelude Fertility, Press Release, 2024)

- In April 2023, The Prelude Network, a leading provider of comprehensive fertility services in North America, has announced an exclusive partnership with Future Family (FF), a national platform for family-building with flexible financial plans and concierge support services. The partnership aims to expand financial accessibility to premium fertility services, empowering patients with more financial options and a clear understanding of treatment costs. Source: (Prelude Fertility, Press Release, 2024)

IVF Services Market Report Coverage and Deliverables

The “IVF Services Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Cycle Type ; End User , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For