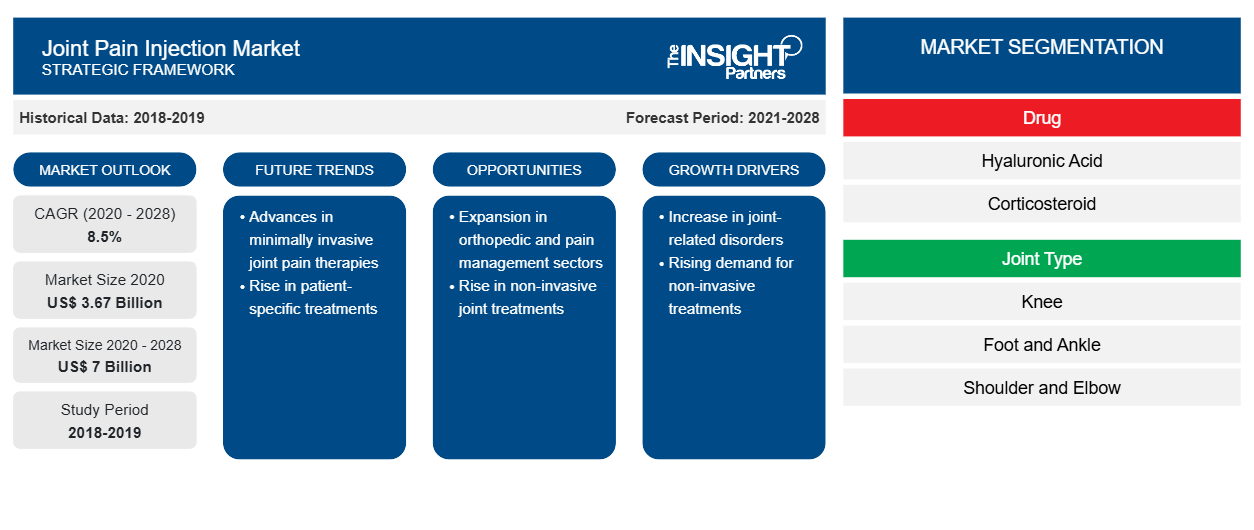

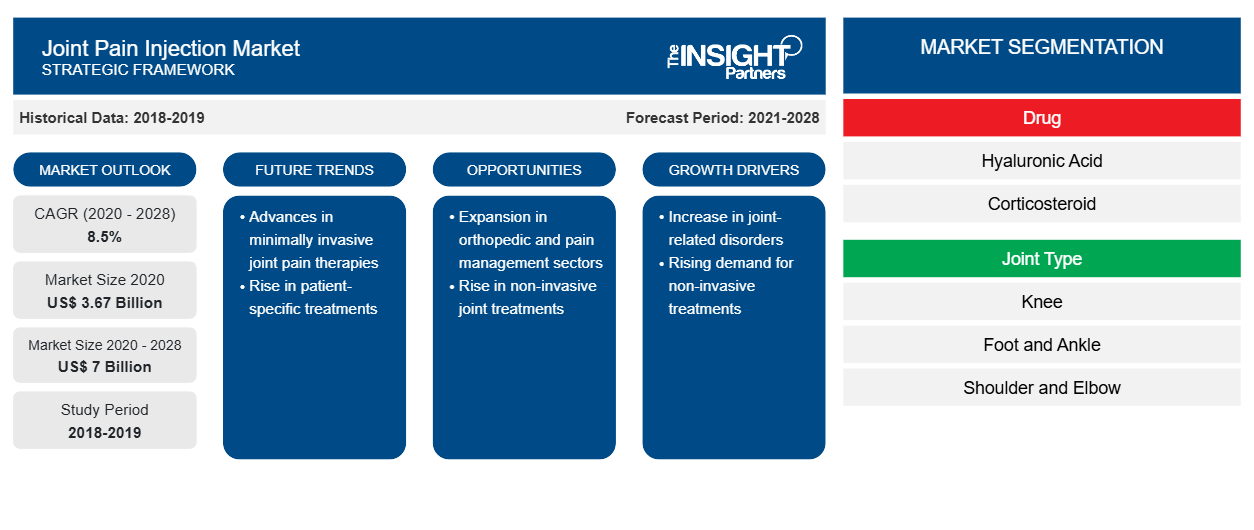

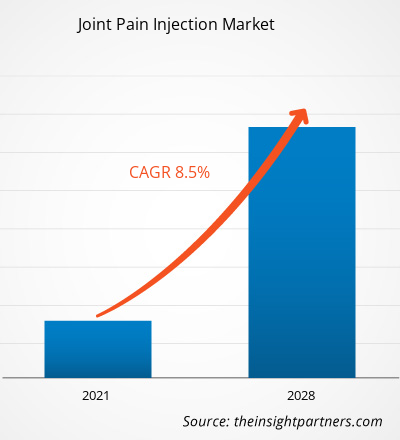

[Research Report] The joint pain injection market is expected to reach US$ 6,996.88 million by 2028 from US$ 3,667.45 million in 2020; it is estimated to grow at a CAGR of 8.5% during 2021–2028.

Joint pain injections provide faster relief from severe pain and reduce inflammation of joints. Several types of injections available in the market include corticosteroids injections, hyaluronic acid (HA) injections, platelet-rich plasma (PRP) injections, and placental tissue matrix (PTM) injections. The growth of the joint pain injection market is attributed to the factors such as high prevalence of musculoskeletal disorders and increasing number of sports injuries. However, high costs of joint repair therapies hinder the market growth

Market Insights

High Prevalence of Musculoskeletal Disorders

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Joint Pain Injection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Joint Pain Injection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Musculoskeletal disorders are medical conditions affecting muscles, bones, and joints of neck, shoulders, wrists, back, hips, legs, knees, and feet. These diseases include tendinitis, carpal tunnel syndrome, osteoarthritis, rheumatoid arthritis (RA), fibromyalgia, and bone fractures. As per the World Health Organization (WHO) factsheet updated in 2018, musculoskeletal conditions are the second-largest contributor to disability worldwide. According to the same, the prevalence and impact of musculoskeletal disorders is expected to rise with the increase in aging population and rise in the prevalence of risk factors of noncommunicable diseases (NCDs) worldwide. As per 2016 American Academy of Orthopedic Surgeons’ annual meeting data, ~1 in 2 adults is suffering from a musculoskeletal disorder in the US. Further, according to the Centers for Disease Control and Prevention (CDC), arthritis causes severe pain that affects millions of people in the US every year. Around one in four arthritis patients, i.e., ~15 million of total ~54 million patients, experiences severe arthritis-related joint pain.

Further, osteoarthritis (OA) is one of the most common joint disorders in the US, caused by the breakdown of joint cartilage between bones. It is also known as degenerative joint disease or “wear and tear” arthritis. As per the Centers for Disease Control and Prevention (CDC), more than 32.5 million adults in the US suffer from osteoarthritis. Similarly, as per the National Health Service (NHS), more than 10 million people in the UK have arthritis or other similar conditions that affect joints. As per the Bupa Health Insurance, osteoarthritis is the most common form of arthritis prevalent in the UK, it affects around the one-third of people aged 45 or more in the country, i.e., ~8.75 million people. Therefore, such high prevalence of musculoskeletal disorders in different countries is increasing the number of treatment procedures being carried out for the same, thereby driving the joint pain injection market growth.

Drugs-Based Insights

The joint pain injection market, by drug, is segmented into hyaluronic acid, corticosteroid, and others. The corticosteroid segment held the largest share of the market in 2020, and it is further anticipated to register the highest CAGR during the forecast period.

Joint Type-based Insights

Based on joint type, the joint pain injection market is segmented into knee, foot and ankle, shoulder and elbow, hips, and other applications. The knee segment held the largest market share in 2020 and is anticipated to register the highest CAGR in the market during the forecast period.

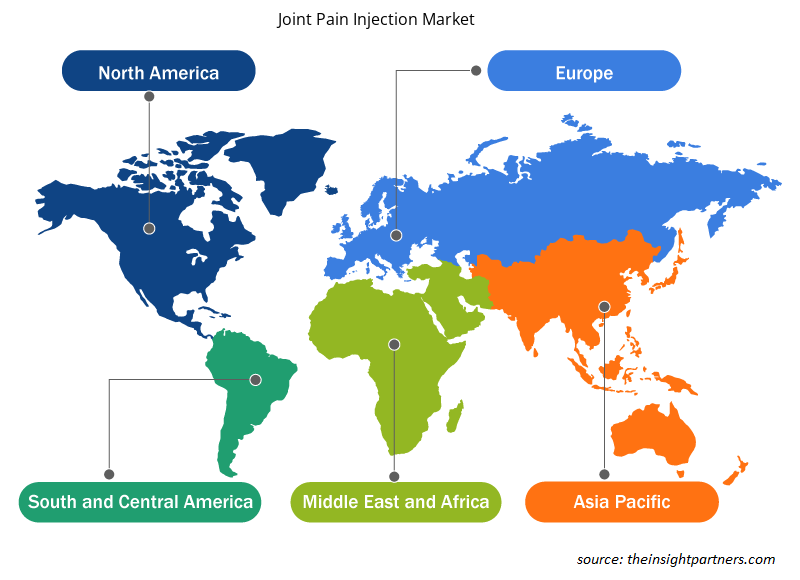

Joint Pain Injection Market Regional Insights

The regional trends and factors influencing the Joint Pain Injection Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Joint Pain Injection Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Joint Pain Injection Market

Joint Pain Injection Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 3.67 Billion |

| Market Size by 2028 | US$ 7 Billion |

| Global CAGR (2020 - 2028) | 8.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Drug

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

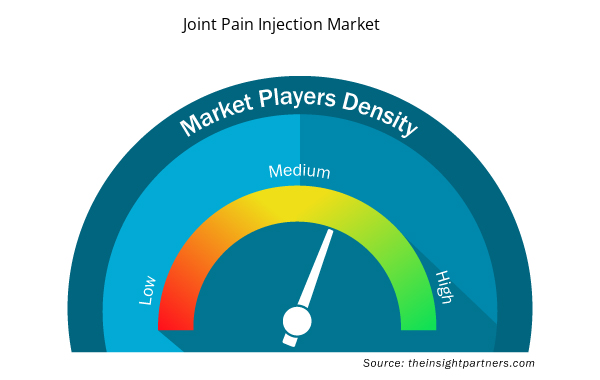

Joint Pain Injection Market Players Density: Understanding Its Impact on Business Dynamics

The Joint Pain Injection Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Joint Pain Injection Market are:

- Chugai Pharmaceutical Co., Ltd.

- Bioventus Inc.

- Fidia Pharma USA Inc.

- Flexion Therapeutics, Inc.

- SEIKAGAKU CORPORATION

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Joint Pain Injection Market top key players overview

Distribution Channel-based Insights

Based on distribution channel, the joint pain injection market is segmented into retail pharmacies, hospitals pharmacies, and others. The wound care segment held the largest market share in 2020, and the bone grafts segment is estimated to register the highest CAGR in the market during the forecast period.

Product launches and approvals are the commonly adopted strategies by companies to expand their global footprints and product portfolios. Moreover, the joint pain injection market players focus on the collaboration strategy to enlarge their clientele, which, in turn, permits them to maintain their brand name globally.

Joint Pain Injection Market – by Drug

- Hyaluronic Acid

- Corticosteroid

- Others

Joint Pain Injection Market – by Joint Type

- Knee

- Foot and Ankle

- Shoulder and Elbow

- Hip

- Others

Joint Pain Injection Market – by Distribution Channel

- Retail Pharmacies

- Hospitals Pharmacies

- Others

Joint Pain Injection Market – by Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of Asia Pacific

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

South and Central America (SCAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Chugai Pharmaceutical Co., Ltd.

- Bioventus Inc.

- Fidia Pharma USA Inc.

- Flexion Therapeutics, Inc.

- SEIKAGAKU CORPORATION

- Ferring B.V.

- Sanofi

- Anika Therapeutics, Inc.

- Teva Pharmaceutical

- OrthogenRx, Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Drug , Joint Type , and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The joint pain injection market majorly consists of the players such as Chugai Pharmaceutical Co., Ltd., Teva Pharmaceuticals, Bioventus Inc., Fidia Pharma USA Inc., Flexion Therapeutics, Inc., SEIKAGAKU CORPORATION, Ferring B.V., Sanofi, Anika Therapeutics, Inc., and OrthogenRx among others.

The global joint pain injection market growth is mainly attributed to factors such the high prevalence of musculoskeletal disorders and increasing number of sports injuries. However, the high costs of joint repair therapies hinder the market growth.

Joint pain injections are medicinal fluids inserted in the patient’s body to get faster relief from severe pain. The joint pain injections are used to reduce inflammation in the joints. There are several types of injections available in the market which are corticosteroids injections, hyaluronic acid (HA) injections, platelet-rich plasma (PRP) injections and placental tissue matrix (PTM) injections.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Joint Pain Injection Market

- Chugai Pharmaceutical Co., Ltd.

- Bioventus Inc.

- Fidia Pharma USA Inc.

- Flexion Therapeutics, Inc.

- SEIKAGAKU CORPORATION

- Ferring B.V.

- Sanofi

- Anika Therapeutics, Inc.

- Teva Pharmaceutical

- OrthogenRx, Inc.

Get Free Sample For

Get Free Sample For