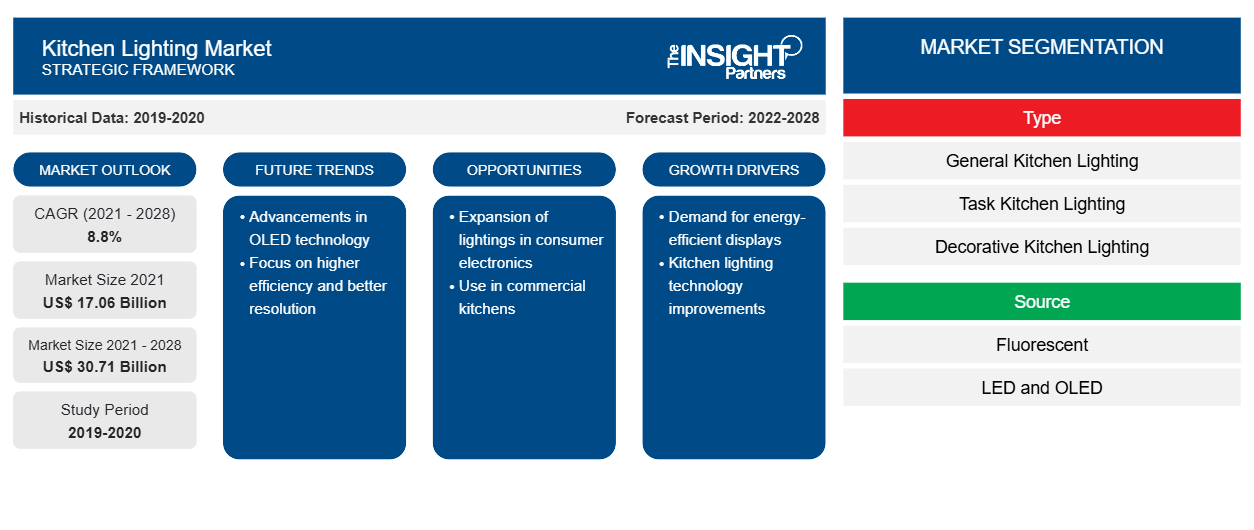

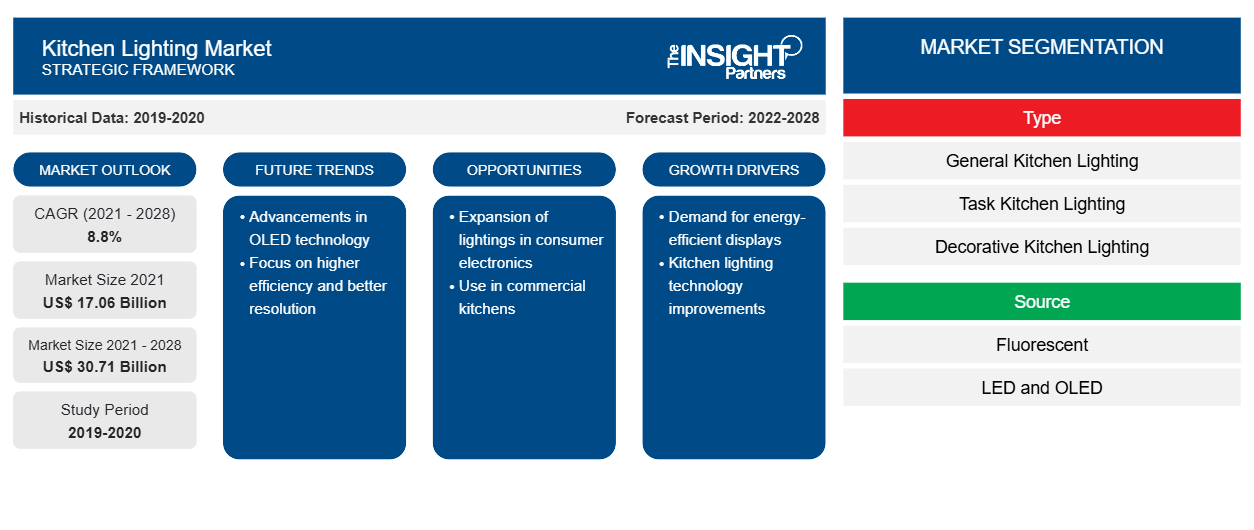

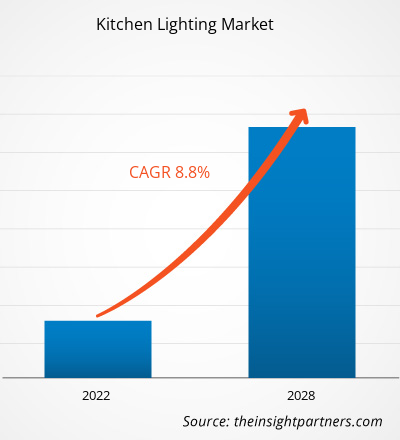

The kitchen lighting market is projected to reach US$ 30,707.36 million by 2028 from US$ 17,058.05 million in 2021; it is estimated to grow at a CAGR of 8.8% from 2021 to 2028.

The rising number of home repair and remodeling activities, particularly in North America and Europe, is supported by government policies. The significance and rising popularity of kitchen remodeling in renovation projects are creating a huge demand for kitchen lighting. For instance, according to The Hanover's 2021 Home Renovation report, more than half (54%) of homeowners in the US made home renovations during the pandemic. According to the report, the most popular home renovation projects during the pandemic were kitchen and bathroom, comprising around 68% of the total renovation projects. As per the National Kitchen and Bath Association (NKBA) data, lighting comprises 0.05% of the average budget for kitchen renovation in the US. Similarly, the launch of the EuroPACE project by the European Commission between 2018 and 2021 to make home renovation simple, affordable, and reliable for all Europeans through the combination of affordable financing and people-centric technical assistance accelerated the home renovation activities across Europe. Furthermore, LED and OLED lighting's growing popularity as energy-efficient alternatives to incandescent and CFL bulbs is creating demand for new lighting concepts and lighting designs in the region, such as the inclusion of nature-related elements in lighting. The factors mentioned above are driving the growth of the kitchen lighting market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Kitchen Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Kitchen Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Kitchen Lighting Market

The COVID-19 pandemic impact on the kitchen lighting market was briefly negative due to a halt in production and a disrupted supply chain. The restrictions on construction activities and the movement of workers led to a fall in demand for kitchen lighting worldwide. For instance, the lockdown imposed by the Irish government from April till May 2020 led to the shutdown of factory operations for Mullan Lighting. Further, production, supply chains, and demand for the kitchen lighting are improving with the successful implementation of vaccination drives and the restart of construction activities. This COVID-19 lockdown has encouraged residential customers and business owners to choose more energy-efficient kitchen lighting to reduce energy consumption. However, during 2021-2022, the kitchen lighting market is showing resilience due to increased residential building construction, increase in robustness of supply chain system, and government incentives and policy support. For example, the focus of E.U. member states on renovation measures as a part of crisis-recovery programs is helping the residential construction sector regain momentum and even exceed the pre-pandemic level by an estimated growth rate of 5.7% during 2021-2022.

Kitchen Lighting: Market Insights

Rising Penetration of E-Commerce Fuels Growth of Kitchen Lighting Market

Rising Penetration of E-Commerce Fuels Growth of Kitchen Lighting Market

As the Internet becomes more accessible in many regions of the world, the eCommerce industry is fast developing. Online product sales have been boosted by the rapid rise of e-commerce in the home appliance business. The United States has the most significant rate of e-commerce adoption. However, in Asia Pacific nations like India and China, e-commerce for lighting fixtures is fast expanding. Wholesalers control the majority of global e-commerce sales (for example, Rexel operates dozens of e-commerce sites throughout North America, Europe, and Asia-Pacific). E-tailers, which include worldwide e-commerce platforms (such as Amazon and Alibaba), specialized lighting websites (such as Lampenwelt), and furniture websites, are the fastest expanding sector (like Wayfair). Only a few manufacturers have their online stores. Manufacturers, distributors, and retailers are experimenting with new ways to sell online while maintaining a consistent and personalized client experience. Artificial intelligence, voice commerce, and mobile optimization have contributed significantly to eCommerce's expanding popularity. The Kitchen lighting industry's manufacturers, distributors, and retailers have understood the value of B2B eCommerce. They're using AI-powered eCommerce systems to figure out what customers want, forecast what they'll buy, and leverage transactional data as real-time insights to improve distribution and price. It also provides a customized experience based on recent purchases and searches, makes relevant product recommendations using AI and recommendation engine capabilities, and keeps consumers engaged by automating marketing efforts. Simplifies product administration by allowing users to manage product information via catalog or feature specifications and dynamic pricing and discounting. It also offers many payment choices and ensures a seamless return and exchange process. Thus, rapid growth in e-commerce industry will drive the demand for kitchen lighting market.

Kitchen Lighting

Market - Type-Based Insights

Based on type, the kitchen lighting market is segmented into general kitchen lighting, task kitchen lighting, and decorative kitchen lighting. The general kitchen lighting segment accounted for the largest share in kitchen lighting market in 2020. The majority of the population has limited concerns about kitchen lighting or is less aware of the importance of task lighting. Thus, the general lighting segment dominates the market.

Kitchen Lighting Market - Source-Based Insights

On the basis of source, the global kitchen lighting market is segmented into fluorescent, LED, and OLED. The LED and OLED segment accounted for the largest market share in 2020 due to the increasing demand for energy-efficient lighting globally. The importance of LED lighting has increased significantly in the past few years due to its cost saving benefits

Kitchen Lighting Market - Product-Based Insights

On the basis of product, the market is segmented into island lights, pendant lights, ceiling lights, chandeliers, track lighting, under cabinet lighting, and others. The ceiling lights segment accounted for the largest market share in 2020. . The ceiling lights dominate the market as they are the necessary lighting used in residential constructions. However, the rise in kitchen remodeling and decoration spending has significantly created a demand for under cabinet lighting and pendant lighting

Players operating in the Kitchen Lighting market adopt strategies such as mergers and acquisitions to maintain their positions in the market. A few developments by key players are listed below:

- In January 2022, Acuity Brands, Inc. has announced its partnership with Microsoft. The company is expanding collaboration with Microsoft. This partnership will be helpful for Acuity Brands in its smart lighting, lighting controls, and building automation solutions.

- In May 2020, Cree Lighting announced its collaboration with Lutron Electronics for expansion of the lighting solutions in the US. The collaboration will combine Cree lighting's indoor and outdoor lighting solutions with Lutron's wired and wireless digital fixture technologies.

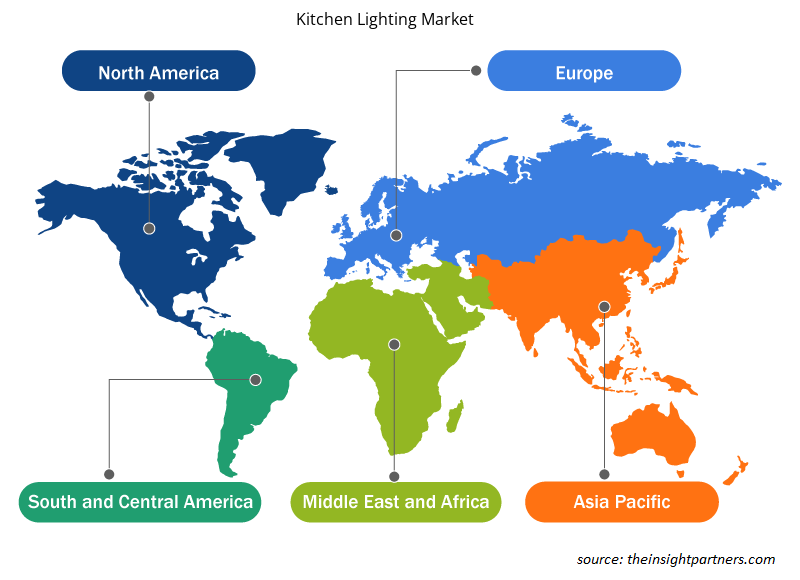

Kitchen Lighting Market Regional Insights

The regional trends and factors influencing the Kitchen Lighting Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Kitchen Lighting Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Kitchen Lighting Market

Kitchen Lighting Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 17.06 Billion |

| Market Size by 2028 | US$ 30.71 Billion |

| Global CAGR (2021 - 2028) | 8.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Kitchen Lighting Market Players Density: Understanding Its Impact on Business Dynamics

The Kitchen Lighting Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Kitchen Lighting Market are:

- ACUITY Brands Inc.

- Cree Lighting

- OSRAM Licht AG

- GE Lighting

- Panasonic Corportaion

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Kitchen Lighting Market top key players overview

The global kitchen lighting market is segmented on the basis of type, source, product, and geography. On the basis of type, the market is segmented into general kitchen lighting, task kitchen lighting, and decorative kitchen lighting. In 2020, the general kitchen lighting segment held the larger market share. On the basis of source, the kitchen lighting market is segmented as fluorescent, and LED and OLED. In 2020, the LED and OLED segment accounted for the largest market share. On the basis of product, the kitchen lighting market is segmented into island lights, pendant lights, ceiling lights, chandeliers, track lighting, under cabinet lighting, and others. In 2020, the ceiling lights segment accounted for the largest market share. Geographically, the kitchen lighting market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). In 2020, North America accounted for a significant share in the global kitchen lighting market.

ACUITY Brands Inc., Cree Lighting, OSRAM Licht AG, GE Lighting, Panasonic Corportaion, Signify Holding, Hubbell Incorporated, Kichler Lighting, Lutron Electronics, Hafele GmbH &Co, are among the major companies operating in the kitchen lighting market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Digital Language Learning Market

- Wind Turbine Composites Market

- Fixed-Base Operator Market

- Analog-to-Digital Converter Market

- Carbon Fiber Market

- Water Pipeline Leak Detection System Market

- Fill Finish Manufacturing Market

- Investor ESG Software Market

- Single Pair Ethernet Market

- Airline Ancillary Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Source, and Product

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Increasing proliferation of LED in Kitchen Lighting

Growing Number of Residential Construction Projects

With the continuously growing access to the internet in many regions, the e-commerce industry is flourishing rapidly. Although the US has the largest e-commerce business, the e-commerce for lighting fixtures is expanding at a high pace in India and China. Wholesalers control the majority of global e-commerce sales. Rexel operates dozens of e-commerce sites throughout North America, Europe, and Asia-Pacific. E-tailers, including the global e-commerce platforms such as Amazon and Alibaba; specialized lighting websites such as Lampenwelt; and furniture websites are the fastest expanding segments of the e-commerce business. Manufacturers, distributors, and retailers are experimenting with new ways for making online sales while maintaining a consistent and personalized client experience.

Layered Lighting, Smart Bulbs, Metallic Lights and Triple Pendant Lights, among others are latest trends that are expected in the kitchen lighting market in the coming years.

Key companies in the kitchen lighting market include Acuity Brands, Inc; Cree Inc.; Eaton Corporation; General Electric; Hubbell Lighting Inc; Kichler Lighting LLC; Lutron Electronics Co., Inc; Osram Licht AG; Panasonic Corporation; and Signify Holding.

Based on Type, the kitchen lighting market can be bifurcated into general kitchen lighting, task kitchen lighting, decorative kitchen lighting. The general kitchen lighting segment dominates the market as major adoption in developing and developed nations. The majority of the population has limited concerns about kitchen lighting or is less aware of the importance of task lighting. Thus, the general lighting segment dominates the market. However, with increasing disposable income and investment in kitchen remodeling, the task lighting and decorative lighting market are expected growth with a significant CAGR in coming years.

APAC held the largest market share in year 2020, along with the notable revenue generation opportunities in Europe and APAC.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Kitchen lighting Market

- ACUITY Brands Inc.

- Cree Lighting

- OSRAM Licht AG

- GE Lighting

- Panasonic Corportaion

- Signify Holding

- Hubbell Incorporated

- Kichler Lighting

- Lutron Electronics

- Hafele GmbH &Co

Get Free Sample For

Get Free Sample For