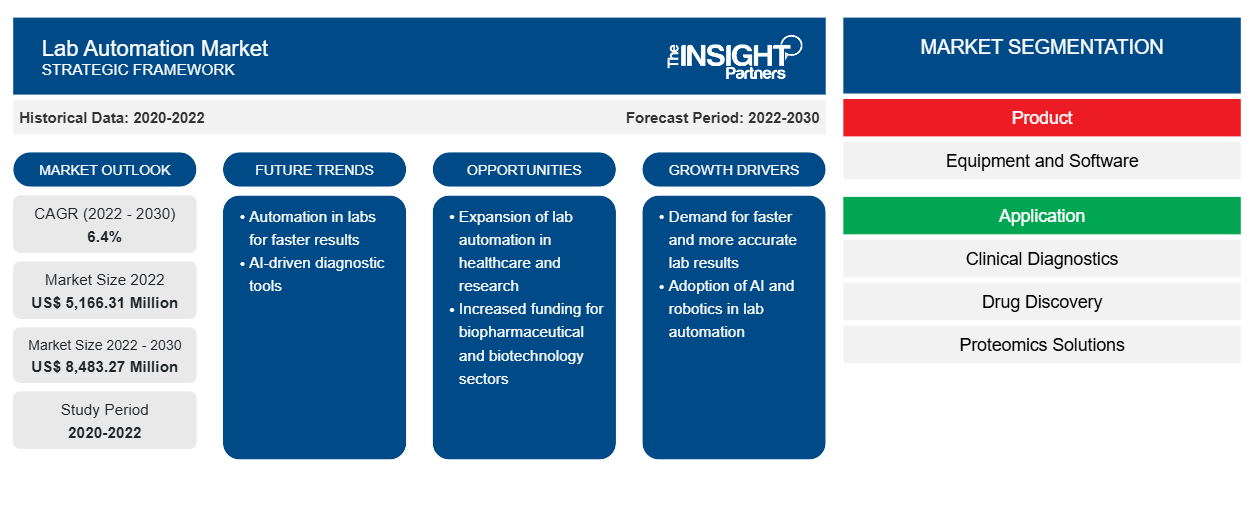

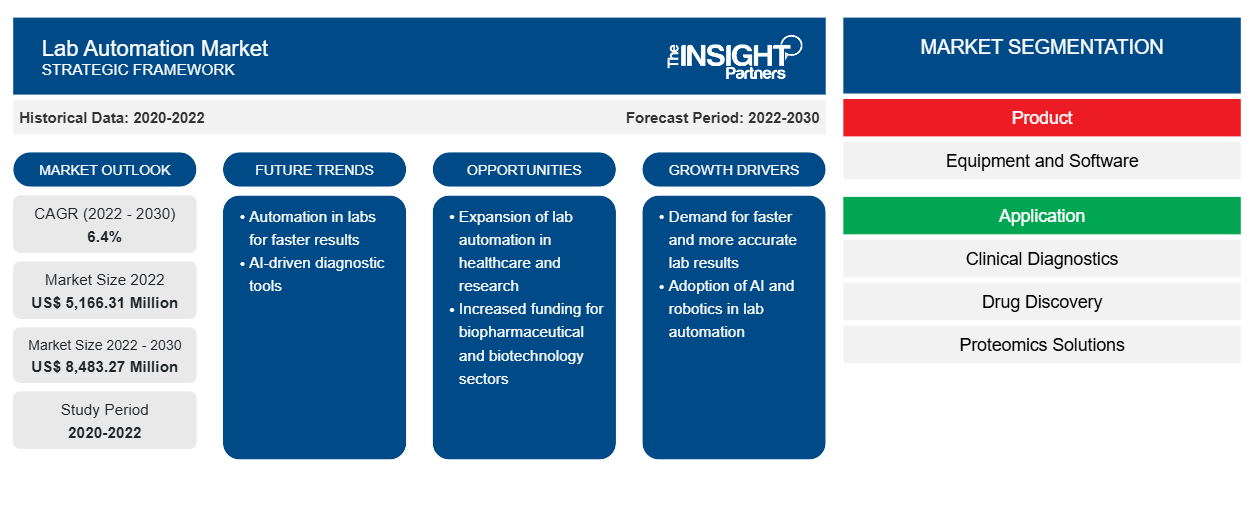

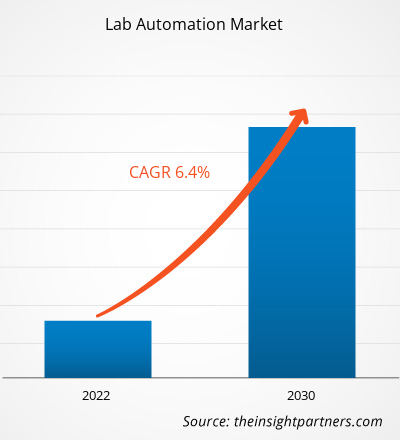

[Research Report] The lab automation market size is expected to grow from US$ 5,166.31 million in 2022 to US$ 8,483.27 million by 2030; it is anticipated to record a CAGR of 6.4% from 2022 to 2030.

Lab Automation Market Insights and Analyst View:

The integration of automation into laboratories to enable new and enhanced laboratory processes is known as laboratory automation. Laboratory robotics is the most well-known use of laboratory automation technology. In addition, laboratory automation encompasses a wide range of automated laboratory instruments, devices, software algorithms, and methodologies used to enable, accelerate, and improve the effectiveness of research in laboratories. Based on the lab automation market analysis, key factors driving the lab automation market are the rising applications and advantages offered by lab automation and the growing pharmaceutical industry. However, the limited adoption of lab automation due to high capital investment hinders the lab automation market growth.

Growth Drivers and Restraints:

Biotechnology, pharmaceuticals, clinical diagnostics, academic research, and environmental testing are among the major industries that have seen an increase in laboratory automation. The requirement for enhanced efficiency, precision, and throughput in laboratory procedures drives the demand for lab automation. The use of automation technology provides various benefits that can have a substantial impact on the productivity and quality of scientific research and development. Various key advantages and applications include high-throughput screening, sample preparation and handling, data management and integration, workflow optimization, flexibility and customization, quality control and assurance, resource optimization, long-term cost savings, reducing manual handling of hazardous chemicals or biological materials, and expansion of laboratories capacity and capabilities. Thus, laboratory automation has grown more and more advantageous, and this highlights how it might transform scientific research and development in various industries. It is anticipated that as technology develops, lab automation will increase, driving more efficiency and innovation in scientific initiatives.

However, various companies, notably in the biotechnology and pharmaceutical industries, experience significant problems adopting laboratory automation due to high capital expenditure. While laboratory automation provides various benefits, such as higher efficiency, accuracy, and throughput, the initial cost of deploying automation systems can be unaffordable for certain businesses. Various factors contribute to the high capital investment required for laboratory automation, such as equipment costs, infrastructure requirements, integration and customization, maintenance and support, high expertise requirements, and risk of technology obsolescence. For instance, according to Retisoft Inc., the price range for a small automated robot system is between US$ 100,000 and US$ 300,000. However, more complicated and large lab automation systems can often cost over US$ 1 million. Thus, the high capital investment required for laboratory automation can hinder the adoption of lab automation by many biotechnology and pharmaceutical companies, especially smaller or emerging organizations with limited financial resources. Thus, the abovementioned factors are likely to hamper the growth of the global lab automation market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lab Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lab Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global lab automation market report is segmented based on product, application, and end user. Based on product, the lab automation market is bifurcated into equipment and software. Based on equipment, the market is subsegmented into automated workstations, microplate readers, robotic systems, off-the-shelf automated work cells, automated storage and retrieval systems (ASRS), and others. Based on software, the market is subsegmented into laboratory execution systems (LES), laboratory information management systems (LIMS), electronic laboratory notebooks (ELN), and scientific data management systems (SDMS). Based on application, the lab automation market is differentiated into clinical diagnostics, drug discovery, proteomics solutions, genomics solutions, and others. Based on end user, the lab automation market is categorized into pharmaceutical companies, hospitals and diagnostic centers, educational and research institutions, and contract research organizations. The lab automation market report, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product, the lab automation market is bifurcated into equipment and software. The equipment segment held a larger share in lab automation market in 2022. However, based on the lab automation market forecast, the software segment is anticipated to register a higher CAGR during 2022–2030.

Based on equipment, the lab automation market is subsegmented into automated workstations, liquid handling systems, robotic systems, microplate readers, automated storage and retrieval systems (ASRS), and others

Based on application, the lab automation market is categorized into clinical diagnostics, drug discovery, proteomics solutions, genomics solutions, and others. The drug discovery segment held the largest share in lab automation market size in 2022. However, based on the lab automation market forecast, the clinical diagnostics segment is anticipated to register the highest CAGR from 2022 to 2030.

Based on end user, the lab automation market is segmented into pharmaceutical companies, hospitals and diagnostic centers, educational and research institutions, and contract research organizations. In 2022, the pharmaceutical companies segment held the largest share in lab automation market size. However, based on the lab automation market forecast, the hospitals and diagnostic centers segment is anticipated to register the highest CAGR during 2022–2030.

Regional Analysis:

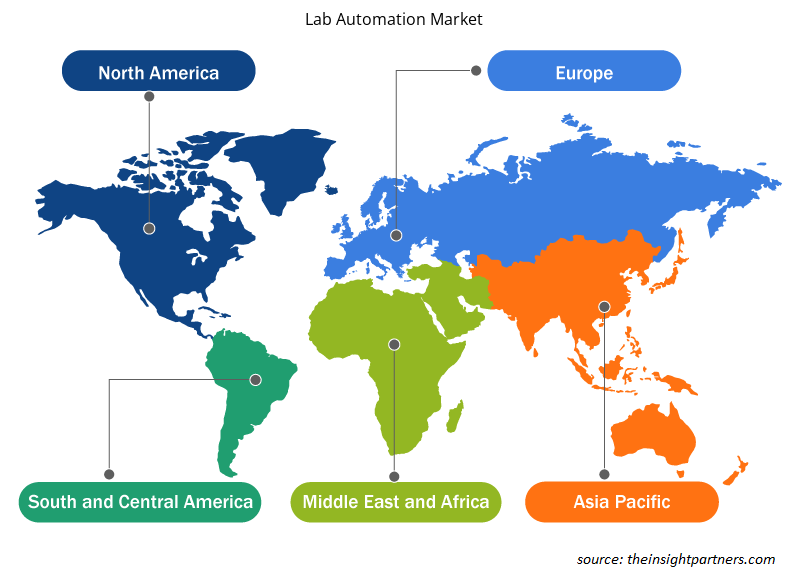

Based on geography, the global lab automation market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa.

In 2022, North America held the largest share of the global lab automation market size. The developments in medical infrastructure and the increasing expenditure on healthcare services across the United States are driving the lab automation market in the country. The use of laboratory automation in clinical trials, drug development, and biomedical research has had a substantial impact on lab automation market growth. These systems can also run for long periods of time with little supervision and direction, allowing researchers to focus on their primary work and spend less time on repetitive activities. Additionally, the Centers for Medicare & Medicaid Services (CMS) in the United States has adopted standards associated with human laboratory research under the Clinical Laboratory Improvement Amendments (CLIA), which has enhanced the lab automation market growth.

Lab Automation Market Regional Insights

The regional trends and factors influencing the Lab Automation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Lab Automation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Lab Automation Market

Lab Automation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,166.31 Million |

| Market Size by 2030 | US$ 8,483.27 Million |

| Global CAGR (2022 - 2030) | 6.4% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Lab Automation Market Players Density: Understanding Its Impact on Business Dynamics

The Lab Automation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Lab Automation Market are:

- Siemens Healthineers

- Thermo Fisher Scientific Inc

- Analytik Jena GmbH+Co. KG

- Labman Automation Ltd

- BD

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Lab Automation Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global lab automation market are listed below:

- In May 2023, Opentrons announced the launch of the Opentrons Flex robot, an innovative class of reasonably priced, easily programmable liquid-handling lab robots that will level the playing field for labs of all sizes and make advanced lab automation accessible to more researchers than ever. The Flex robot combines cutting-edge robotics with a vast open-source software ecosystem. It can be used with AI tools and has a nearly limitless capability for selecting new protocols.

- In March 2023, Brooks Automation US, LLC announced the acquisition of Aim Lab Automation Technologies Pty Ltd. Brooks's acquisition of Aim Lab aligns with the company's expansion plan to offer more solutions in the lab automation market. With its PreciseFlex product solutions, Brooks leads the life sciences collaborative automation market. Brooks' position in clinical diagnostics has increased beyond drug discovery with this acquisition. With PreciseFlex, Aim Lab will provide its clients with more capabilities, a global footprint, and opportunities to work together more closely.

- In February 2023, Automata launched LINQ, a new open, integrated laboratory automation platform. The LINQ platform includes an exclusive lab bench with built-in automation tools and strong, in-house lab orchestration software. As a result, labs may boost efficiency and accuracy while reducing the number of human touchpoints without adding more space for large, complicated equipment.

- In January 2023, BD (Becton, Dickinson and Company) launched a robotic track system for the BD Kiestra microbiology laboratory solution. This system automates lab specimen processing, potentially minimizing human labor and resulting in fewer wait times. With the new BD Kiestra 3rd Generation Total Lab Automation System, laboratories can link various BD Kiestra modules to build a unique and adaptable total lab automation configuration. It is also scalable to accommodate the changing needs of labs. By selecting from various track configurations and machines, labs can customize the automation system to match their unique workflow and physical lab space.

- In June 2022, Insilico Medicine launched an AI-run robotics lab. It is a real-world, interconnected expansion of Insilico's end-to-end AI-driven drug discovery platform. It will be remotely controlled by its AI system, with autonomous guided vehicles running experiments instead of human scientists. These robots will make cell culture, high throughput screening, next-generation sequencing, cell imaging, and genomics analysis and prediction.

- In May 2021, Beckman Coulter announced the global launch of the DxA 5000 Fit. The DxA 5000 Fit is a workflow automation system made to fit into medium-sized labs that perform fewer than 5,000 tests per day.

Competitive Landscape and Key Companies:

Siemens Healthineers, Thermo Fisher Scientific Inc, Analytik Jena GmbH+Co. KG, Labman Automation Ltd, BD, Brooks Automation Inc, bioMerieux SA, CrelioHealth Inc., Danaher Corporation, and F. Hoffmann-La Roche Ltd are among the prominent players operating in the lab automation market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Pharmacovigilance and Drug Safety Software Market

- Electronic Shelf Label Market

- Antibiotics Market

- Tortilla Market

- Online Recruitment Market

- Saudi Arabia Drywall Panels Market

- Compounding Pharmacies Market

- Nuclear Decommissioning Services Market

- Adaptive Traffic Control System Market

- Integrated Platform Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Lab Automation Market

- Siemens Healthineers

- Thermo Fisher Scientific Inc

- Analytik Jena GmbH+Co. KG

- Labman Automation Ltd

- BD

- Brooks Automation Inc

- bioMerieux SA

- CrelioHealth Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

Get Free Sample For

Get Free Sample For