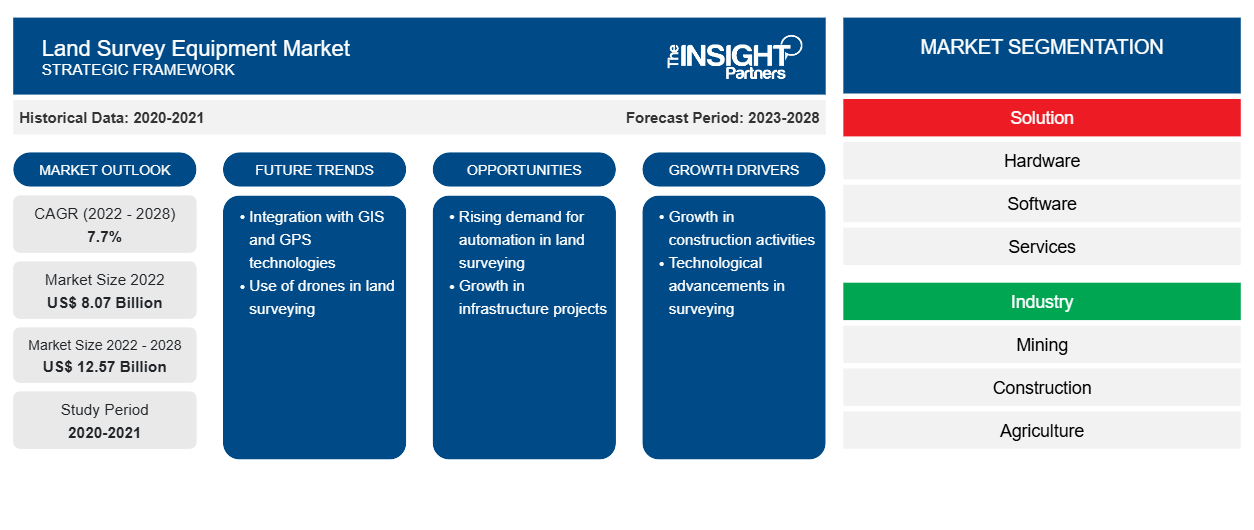

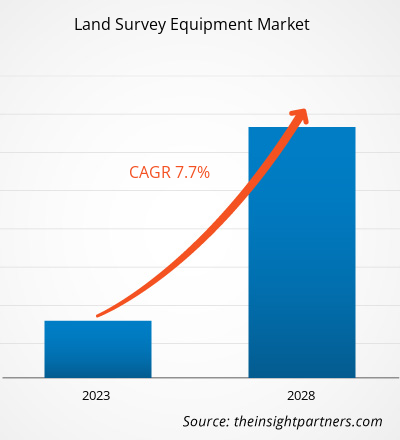

The land survey equipment market is expected to reach US$ 12,568.4 million by 2028; it is estimated to grow at a CAGR of 7.7% from 2022 to 2028.

Survey equipment includes the tools used for surveying, mapping, and land measurement by using specialized technologies and mathematics. These tools include surveying instrument tripods, levels, land surveying markers, marking machines, GPS equipment, surveying prisms, survey drones, land surveying rods, transits, stakes, grade rods, etc. Surveying contractors who work in the field use GPS, camera, and computation devices, along with different software solutions to process survey data and draft maps, plans, and survey reports. Land survey equipment is utilized in various applications, including volumetric calculation, inspection, layout points, and monitoring. The land survey equipment market is driven by the increasing demand for this equipment in the construction, renewable energy, mining, oil & gas, forestry, precision farming, disaster management, and transportation industries; scientific and geological research; and utilities.

The rising urbanization in developing countries is a key factor fueling the growth of the land survey equipment market. Governments of developing countries such as India, Peru, and China are planning different smart city projects, which would need surveying and inspection activities before the actual construction process. Further, major cities in the US, India, and China are rapidly expanding, and several new infrastructures are being constructed in different parts of these countries. Several plans for the development of smart cities are rolled out, and land survey equipment plays a critical role in surveying development sites in the planning stage.

Drones are increasingly being used for capturing images and videos, as they can provide real-time visual data without the need for human interference. Moreover, drones are easy to control using computers or smartphones, which drives their demand for surveying purposes. UAVs are also used in surveying and surveillance in the commercial & defense sectors. The videos and images captured by UAVs and drones are also used in research and planning operations. Moreover, land survey equipment helps save much time when it is in use in the field and provides accurate output using the data processing software.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Land Survey Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Land Survey Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Land Survey Equipment Market

The tremendous spread of SARS-CoV-2 urged governments of various countries to impose strict restrictions on vehicles and human movement in 2020. The subsequent travel restrictions, mass lockdowns, and business shutdowns affected economies and numerous industries in various countries. The lockdown imposition resulted in the lesser production of commodities, goods, and services. Manufacturing, automotive, food & beverages, oil & gas, textile, and other industries witnessed a decline in their operations due to the temporary suspension of production activities. The land survey equipment market players also experienced a slowdown because manufacturing facilities were operating with a limited workforce or were temporarily shut down in 2020.

Market Insights – Land Survey Equipment Market

The North America land survey equipment market is bifurcated into the US and Mexico. According to the US Census Bureau and the Department of Housing and Urban Development, in 2021, ~762,000 new homes were sold in the US, most of which were single-family houses. The land survey equipment market growth in North America depends on several factors, such as the growing real estate business in the US and Mexico, the usage of advanced construction software, the dependency on agriculture, and the development of automobiles that increased traffic and led to new road developments. For instance, according to a report published by World Highways in June 2022, a highway has been under construction in Mexico, which is expected to be completed by December 2022. This highway will connect Guadalupe y Calvo with Badiraguato and provide a link between Chihuahua State and Sinaloa State. Due to the presence of mountainous topography, the 140km highway construction was challenging and will cost ~US$ 117 million until its completion. Out of 140 km, ~13km of highway construction is still pending. Such infrastructure development requires land survey equipment to calculate area, route, location, site planning, etc.

Further, the US is one of the leading countries considered in the land survey equipment market study, due to the high consumption of land survey equipment that led to increased production by several leading market players such as Allenbuild Instruments. Moreover, rising technological advancements leading to increased production and research & development activities are a few factors supporting the land survey equipment market growth. With the growing demand for land survey equipment in North America, the land survey equipment market is expected to grow during the forecast period.

Hardware - Based Insights

Based on hardware, the land survey equipment market is segmented into GNSS systems, levels, 3D laser scanners, total stations, theodolites, unmanned aerial vehicles, machine control systems, machine guidance systems, and others. The others segment is further segmented into chains & tapes; compasses & clinometers; safety gear; prisms & reflectors; magnetic locators; and poles, tripods, and mounts. The GNSS systems segment held the largest land survey equipment market share in 2021. GNSS survey equipment is faster than traditional survey tools and provides more accurate results for large topographic surveys, which overshadows the cost factor. In August 2018, Trimble launched its GNSS receiver Trimble R 10 Model 2 GNSS System.

Hexagon AB; GUANGDONG KOLIDA INSTRUMENT CO., LTD.; Shanghai Huace Navigation Technology Ltd.; South Surveying & Mapping Technology CO., LTD.; Topcon Corporation; Trimble Inc.; Hi-Target; PENTAX Surveying; Suzhou FOIF Co., Ltd.; and Robert Bosch Tool Corporation are a few of the key players that are profiled during the land survey equipment market study. Moreover, the performances of several other essential players were analyzed to get a holistic view of the land survey equipment market report and its ecosystem.

In the land survey equipment market report, the players are majorly adopting strategic market initiatives, which involve the expansion of footprint globally and meeting the surge in customer demand. The land survey equipment market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.

Land Survey Equipment Market Regional Insights

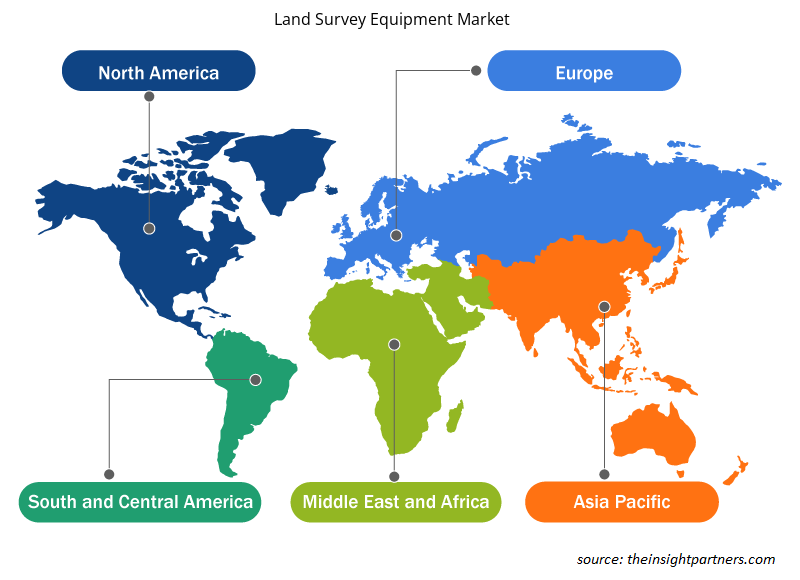

The regional trends and factors influencing the Land Survey Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Land Survey Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Land Survey Equipment Market

Land Survey Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8.07 Billion |

| Market Size by 2028 | US$ 12.57 Billion |

| Global CAGR (2022 - 2028) | 7.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

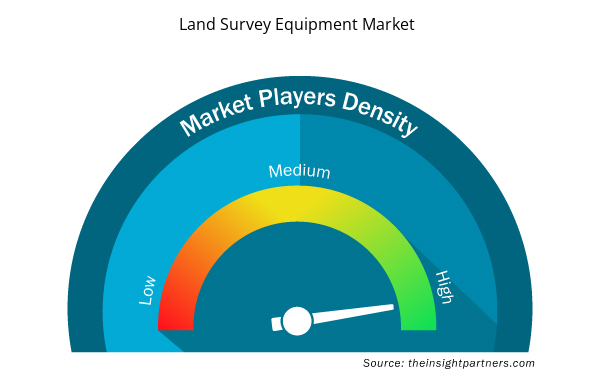

Land Survey Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Land Survey Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Land Survey Equipment Market are:

- Hexagon AB

- GUANGDONG KOLIDA INSTRUMENT CO. LTD.

- Shanghai Huace Navigation Technology Ltd.

- South Surveying & Mapping Technology CO., LTD.

- Topcon Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Land Survey Equipment Market top key players overview

- In 2022, South Surveying & Mapping Technology CO., LTD. announced that they had delivered another 200 sets of Total Station NTS-332RU to the Department of Lands Thailand. The 332RU provides a fast and powerful reflector with less EDM, easy connectivity, and clear feedback for its onboard software. Thus, the recognition by both government and private sections will help the company to attract more customers in the market.

- In 2021, Hi-Target announced that they had signed a Memorandum with AFLAG. Under this memorandum, the two parties will jointly establish a technology exchange center to carry out in-depth cooperation in the training of professional talents, the promotion and application of product technologies, and DDR.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Solution, Industry, Application, and Hardware

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Belgium, China, Egypt, France, Germany, India, Indonesia, Italy, Japan, Kazakhstan, Malaysia, Mauritius, Mexico, Peru, Philippines, Russian Federation, Saudi Arabia, Seychelles, Singapore, South Korea, Spain, Ukraine, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The US, China and India are registering a high growth rate during the forecast period.

Hardware segment held the largest share land survey equipment market. The constantly rising use of hardware for measurement and surveying at construction sites are the reason behind this segment’s growth.

China holds the major market share of land survey equipment market in 2022.

Hexagon AB, Trimble Inc., Topcon, South Surveying & Mapping Technology CO., LTD., and Hi-Target are the five key market players operating in the land survey equipment market.

The increasing trend of unmanned aerial vehicles and remote control drones are some of the major trends anticipated to propel the market growth during the forecast period.

Rising developments in real estate and increasing growth of industrial ad agriculture sectors are major driving factors contributing towards the growth of land survey equipment market.

The global land survey equipment market is expected to be valued at US$ 8,068.0 million in 2022.

By 2028, the global market size of land survey equipment market will be US$ 12,568.4 million.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Land Survey Equipment Market

- Hexagon AB

- GUANGDONG KOLIDA INSTRUMENT CO. LTD.

- Shanghai Huace Navigation Technology Ltd.

- South Surveying & Mapping Technology CO., LTD.

- Topcon Corporation

- Trimble Inc.

- Hi-Target

- PENTAX Surveying

- Suzhou FOIF Co., Ltd.

- Robert Bosch Tool Corporation

Get Free Sample For

Get Free Sample For