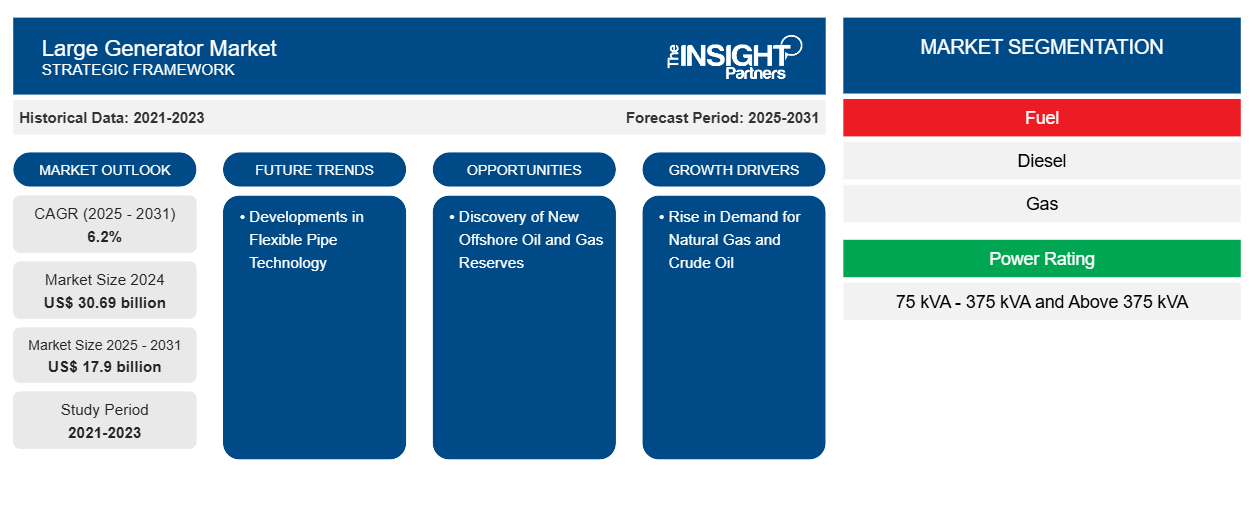

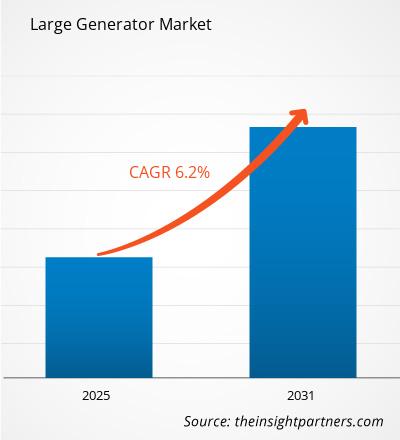

The large generator market size is projected to reach US$ 17.9 billion by 2031 from US$ 28.9 billion in 2023. The market is expected to register a CAGR of 6.2% in 2023–2031. Increasing power consumption, technological advancement of large generators, and rapid growth of energy transition are among the key factors driving the large generator market.

Large Generator Market Analysis

The large generator market is expected to experience considerable growth during the analyzed timeframe owing to the rising number of power generation projects as well as the rise in demand for portable power generators, particularly in remote locations. Additionally, the rise in investment toward the replacement or upgradation of power infrastructure across the globe is projected to propel the demand for large generators. Moreover, the rapid industrialization across the developing regions is further projected to boost the large generator market growth in the coming years.

Large Generator Market Overview

With the mounting population and industrialization, the demand for energy is also rising at the global level. The rise in energy consumption also boosted the need for power generator infrastructure in developing and developed economies. This has resulted in driving the demand for large generators across the globe. In addition, the Large population, high per capita income, and rapid industrialization are driving the construction, manufacturing, and telecom industries in the Asia Pacific. Further, highly industrialized countries in the Asia Pacific, such as China, India, South Korea, and Japan, are reporting increasing overall energy consumption. These countries are increasing their focus on boosting electricity production through various sources such as oil & gas, geothermal, nuclear, and others, which in turn is supporting the large generator market growth in Asia Pacific.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Large Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Large Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Large Generator Market Drivers and Opportunities

Rise in demand for Power Generation Across the Developing Region

Declining electricity consumption in advanced economies slowed the growth of global electricity demand in 2023. Global electricity demand grew by 2.2% in 2023, as compared to 2.4% growth registered in 2022. While developing countries, including China, India, and other countries in Southeast Asia, experienced significant growth in electricity demand in 2023, advanced economies experienced significant declines due to a weak macroeconomic environment and high inflation, which led to a decline in manufacturing and industrial output. Global electricity demand is expected to increase faster over the next three years, growing by an average of 3.4% per year through 2031. The increases will be driven by an improving economic outlook, which will contribute to faster growth in electricity demand in both developed and emerging markets. Hence, the rise in demand for power generation in the developing region is projected to fuel market growth in the coming years.

Adoption of Diesel Generators in Backup Power and Peak Shaving Applications

Connecting rural communities to national power grids in developing countries is not economically viable. Network infrastructure in developing countries could be improved at best. Diesel generators offer an ideal solution. They can be used individually or as part of a combined power system in conjunction with wind and solar energy. For instance, agriculture generally makes up large parts of developing countries. India's rural irrigation network is estimated to be powered by around 4 million small diesel generators. Diesel generators are low-tech, long-lasting, portable energy sources and provide important energy solutions in developing countries. As developing countries struggle with increasing infrastructure demands, demand for electricity continues to outstrip supply. This leads to peak power deficits, blackouts, and brownouts.

Diesel generators can ensure the security of the power supply in the case of a grid failure. Compared to alternatives such as solar and wind energy, diesel generators represent the most cost-effective solution in terms of initial investment costs for developing countries. Due to the limited budgets of developing countries, diesel generators remain the best solution for primary and emergency power generation. As developing countries continue to industrialize and populations continue to grow, energy demand will increase. Diesel generators represent an important source of energy in developing countries. This trend is expected to continue for the foreseeable future. Hence, the adoption of diesel generators in backup power and peak shaving applications is projected to boost the market growth from 2025 to 2031.

Large Generator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the large generator market analysis are fuel, power rating, and application.

- Based on fuel, the large generator market has been divided into diesel, gas, and others. The diesel segment held a larger market share in 2023.

- Based on the power rating, the large generator market has been divided into 75 kVA – 375 kVA and Above 375 kVA. The above 375 kVA segment held a larger market share in 2023.

- On the basis of application, the market has been segmented into standby, continuous, and peak shaving. The continuous segment dominated the market in 2023.

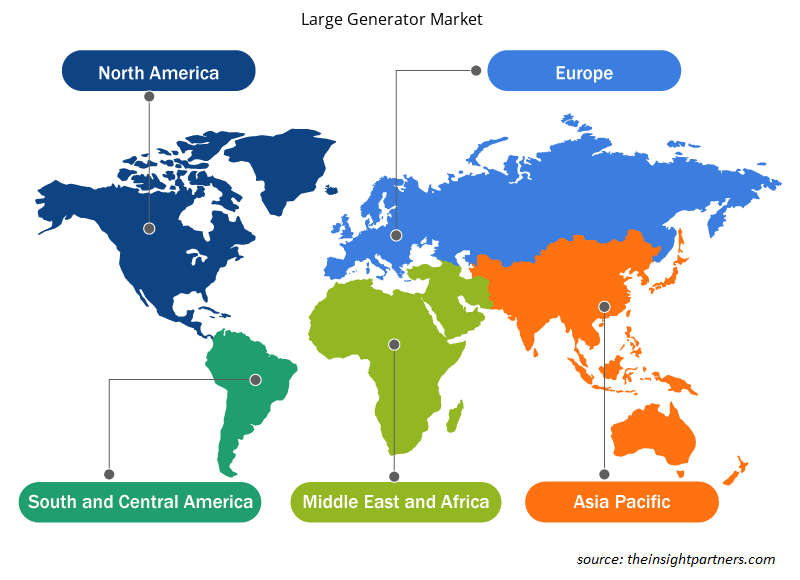

Large Generator Market Share Analysis by Geography

The geographic scope of the large generator market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Asia Pacific dominated the large generator market in 2023. The Asia Pacific region includes Australia, China, Japan, India, South Korea, & the Rest of Asia Pacific. Rapid industrialization and a rise in investment toward the expansion of oil and gas, chemicals, power generation, water treatment, and other industries are expected to drive the growth of the market in this region. In addition, the rise in chemical production across the emerging markets in Asia, including China, India, and others, is anticipated to fuel the demand for large generators, which in turn is expected to drive the market growth from 2025 to 2031.

Large Generator Market Regional Insights

Large Generator Market Regional Insights

The regional trends and factors influencing the Large Generator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Large Generator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Large Generator Market

Large Generator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 30.69 billion |

| Market Size by 2031 | US$ 17.9 billion |

| Global CAGR (2025 - 2031) | 6.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Fuel

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

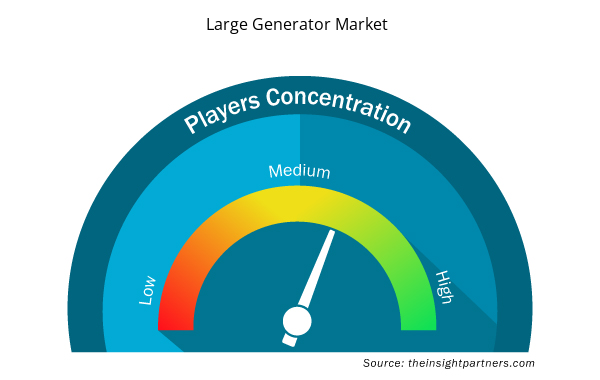

Large Generator Market Players Density: Understanding Its Impact on Business Dynamics

The Large Generator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Large Generator Market are:

- Caterpillar Inc

- Cummins Inc

- Weichai Holding Group Ltd

- Kohler Co

- Mitsubishi Heavy Industries

- Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Large Generator Market top key players overview

Large Generator Market News and Recent Developments

The large generator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for large generators market and strategies:

- In August 2023, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. launched MGS3100R, A New 3,000 kVA Class generator set. This new product launch strengthened the product portfolio of the company.

- In February 2023, EODev announced the commercialization of high-capacity hydrogen power generators with capacity ranging from 10 kVA to 1,750 kVA for commercial and industrial applications.

Large Generator Market Report Coverage and Deliverables

The “Large Generator Market Size and Forecast (2021–2031)” report provides a detailed market analysis of the covering below areas:

- Market size and forecast at global, regional, & country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fuel Type, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For