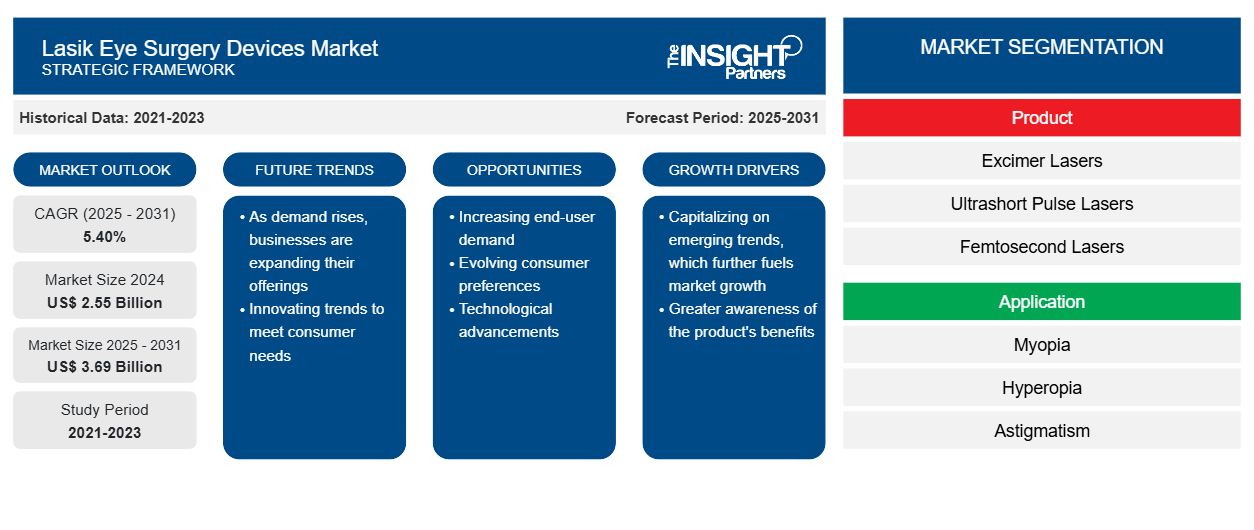

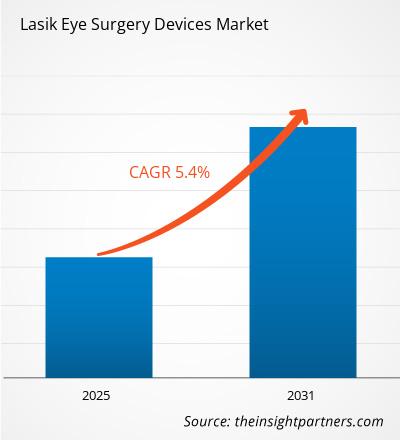

[Research Report] The Lasik eye surgery devices market size is expected to grow from US$ 2.3 billion in 2022 to US$ 3.6 billion by 2031; it is estimated to register a CAGR of 5.4% from 2022 to 2031.

Analyst’s ViewPoint

The Lasik eye surgery devices market analysis explains market drivers, such as the rising prevalence of vision and ophthalmic conditions, a standalone factor responsible for influential market growth. Further, technological advancement is expected to introduce new trends in the market during 2022–2031. Based on the product segment, the femtosecond lasers segment held a larger market share in 2022. Based on application, the global Lasik eye surgery devices market is segregated into myopia, hyperopia, and astigmatism. The myopia segment will account for a major share of the segment growth in 2022. Furthermore, based on end users, the global market is segmented into hospitals & clinics, ophthalmic centers & clinics, and others. The hospitals & clinics segment will account for the largest share.

Lasik eye surgery is the most commonly preferred laser refractive surgery to correct vision problems. The Lasik eye surgery is a special cutting laser used to change the shape of the cornea. As per the Cleveland Clinic 2023 report, about 99% of people have received corrected vision after Lasik surgery.

Market Insights

Rising Prevalence of Vision and Ophthalmic Conditions

According to the Centers for Disease Control and Prevention (CDC) report, approx. 12 million people over 40 years old in the US have vision impairment. Among these, 1 million people are blind, 3 million have vision impairment after correction, and 8 million have vision impairment due to uncorrected refractive error. Additionally, the Natural Institute for Occupational Safety and Health (NIOSH) report reveals that about 2,000 US workers suffer from job-related eye injuries every day and seek medical treatment. Therefore, rising vision problems worldwide accelerate demand for LASIK eye surgery devices.

Further, top medical device manufacturers are developing innovative product launches. Johnson & Johnson Vision's "ELITATM Platform" is one such example. For instance, in August 2023, Johnson & Johnson Vision, a pioneer in eye health, announced the launching of a next-generation laser correction solution, "ELITATM Platform," that enables surgeons to perform refractive correction of patients who have myopia with or without astigmatism using the Smooth Incision Lenticule Keratomileusis (SILK) procedure. The SILK procedure helps to correct myopia through a quick and minimally invasive process. Therefore, innovative product launches by medical device manufacturers and the rising prevalence of vision problems raise demand for Lasik eye surgery, ultimately responsible for the lasik eye surgery devices market growth during 2022-2031.

Future Trend

Technological Advancements

Both patients and surgeons welcome technological advancements in the field of laser eye surgery. Also, technological advancements make the surgery more precise, effective, and safer than previous practices. For example, technology-based LASIK has enhanced to get better, faster, and hassle-free results. The "Visumax Femtosecond Laser technology" is an example of the latest surgical advancements within the refractive surgical fields of ophthalmology. The technology is coupled with its predecessors' knowledge, experiences, and success, and the advancements represent the third generation of laser correction. Likewise, several advancements in the Lasik procedure for correcting eyesight are more readily available to patients dependent on corrective lenses. One of the biggest advancements in Lasik technology is the development of a blade-free system. This new blade-free system is a new wavefront technology that allows eye surgeons to use corneal mapping to treat patients with larger refractive errors. Such a combination of technological advancements gives doctors more control and accuracy during surgery, making it a safe option for patients. Therefore, technological advancements are a standalone factor driving Lasik eye surgery devices market growth during 2021-2031.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lasik Eye Surgery Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lasik Eye Surgery Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

Product-Based Insights

Based on product, the Lasik eye surgery devices market is segmented into excimer lasers, Ultrashort Pulse (USP) lasers, and femtosecond lasers. The femtosecond lasers segment held a larger Lasik eye surgery devices market share in 2022. The high adoption of lasers intended for ophthalmic procedures includes " Femtosecond lasers (FSL)." FSL belongs to the category of ultrafast lasers or ultrashort pulse lasers with a beam diameter of fewer than 8 microns. Also, FSL represents an innovative technology that stands as a new frontier in cataract surgery, providing advantages. These advantages include FSL incorporation to perform three important steps in cataract surgery: corneal incisions, capsulotomy, and lens fragmentation.

Further, the American Academy of Ophthalmology report reveals that more than 55% of all Lasik procedures are performed by FSL today. Also, advancements in technology, such as the "Lower Energy System," coupled with fast firing rates, will increase the versatility and precision of the laser system. The advancement in technology will reduce ancillary tissue damage and make the surgery safer, bringing down the cost of Lasik eye surgery equipment and making it less expensive. Therefore, FSL holds great promise, and its application will continue to evolve and expand in the ophthalmology field, thereby dominating the market growth from 2021 to 2031.

Application-Based Insights

Based on application, the global Lasik eye surgery devices market is segregated into myopia, hyperopia, and astigmatism. The Lasik surgery is indicated for correcting low, moderate, and high myopia with and without astigmatism. For the correction of low to moderate myopia of less than -6D and low to moderate astigmatism of less than 2D, Lasik is effective and predictable in obtaining good and excellent uncorrected visual acuity, proving safe in terms of minimal loss of visual acuity. Therefore, Lasik is an excellent procedure for most patients who have myopia and astigmatism, thereby dominating the market growth during 2021-2031.

End User-Based Insights

Based on end users, the global Lasik eye surgery devices market is segmented into hospitals & clinics, ophthalmic centers & clinics, and others. The hospitals & clinics segment will account for the largest Lasik eye surgery devices market share. The rising number of patients suffering from ophthalmic disorders contributes to the growing demand for Lasik eye surgery devices in hospitals. Additionally, technological advancements in Lasik eye surgery devices in acute care hospitals accelerate the utilization.

Further, the hospital & clinic segment's considerable growth is primarily attributed to the availability of several treatment options with modernizing technology to treat ophthalmic disorders. Therefore, hospitals providing an efficient and practical approach to treating eye disorders resulting in segment growth, ultimately driving the Lasik eye surgery devices market growth during 2021-2031.

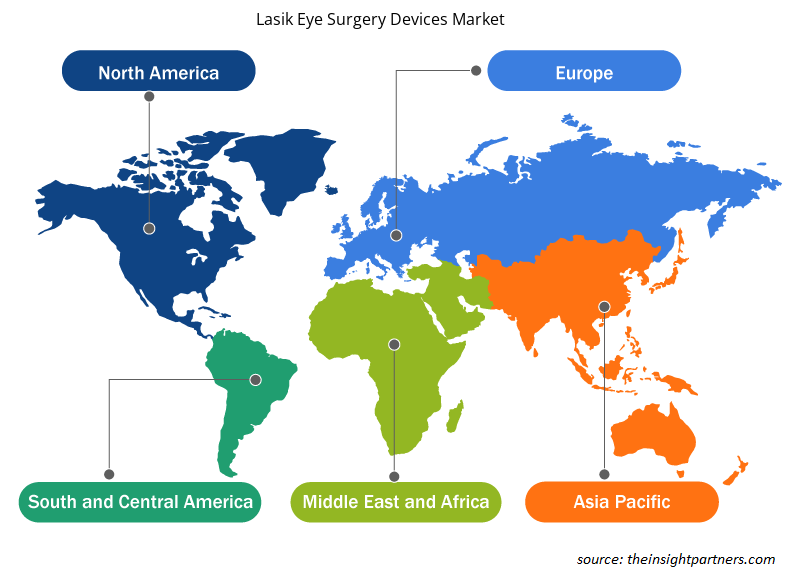

Regional Analysis

The North America Lasik eye surgery devices market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the new product launches by the top manufacturers as a standalone factor positively influencing the market's growth. Oculase's "Trans-PRK/LASEK" is one such example. The new product by Oculase is a no-touch technique intended for laser vision correction with no cutting, touching, or flaps. The surgery involves applying Trans-PRK directly to the cornea's surface for reshaping and creating no flap. Such advancements by the manufacturers for Trans-PRK in launching innovative products are standalone factors responsible for positive segment growth during 2021-2031.

Additionally, Alcon's "WaveLight Refractive Suite" is another example of providing surgeons and patients with a more comfortable and efficient Lasik experience. To deliver the fastest total refractive procedure in the US, a new platform offers a modernized user interface, ergonomic design, and expanded equipment color options. Also, the new suite enhancement will seamlessly integrate with Contoura Vision, offering surgeons true topography guidance and the unique ability to map each eye's corneal features and imperfections using 22,000 data points from the "Wavelength Topolyzer VARIO." Further, in a clinical trial, 92.6% of the eyes were treated with Contoura Vision, which achieved 20/20 vision or better. This is mainly due to new software updates enhancing the graphical user interface (GUI) of the Suite's "WaveNet Planning Station, EX500 Excimer Laser, and the FS200 Femtosecond Laser". This new software incorporation improves intuitiveness and workflow as surgeons use Contoura Vision to develop customized patient treatment plans. Such advancements in Lasik eye surgery devices and the launch of innovative products by US manufacturers are responsible for influential regional growth during 2021-2031.

Likewise, Asia Pacific will account for the highest CAGR for the Lasik eye surgery devices market for the forecast period 2022-2031. According to the AIER EYE HOSPITAL GROUP report, there is the highest prevalence of myopia in Asia Pacific, standing highest in Europe and the US. Among the Asia Pacific region, China has the highest prevalence of myopia, accounting for 48.5% among all age groups. There to address the prevalence of myopia, the Chinese government highly supports surgery through the influx of technological devices. Lasik surgery is the most commonly preferred refractive procedure performed to tackle myopia, accounting for 51.87% of all ophthalmic procedures as per the statistics revealed by the AIER HOSPITAL GROUP report. Therefore, rising myopia cases in China accelerate the demand for Lasik eye surgery among the Chinese population, dominating the Lasik eye surgery devices market growth from 2021 to 2031.

The report profiles leading players in the global Lasik eye surgery devices market. These include Johnson & Johnson Services Inc., NIDEK, SCHWIND Eye-Tech Solutions, Bausch Health, TECHNOLAS PERFECT VISION GmbH, Ziemer Ophthalmic Systems, Carl Zeiss, Nikon Corporation, LaserSight Technologies, Inc., Alcon Laboratories Inc., and other market participants. The companies in the Lasik eye surgery devices market are involved in new organic and inorganic developments, focusing on new product launches, mergers, and collaboration.

In December 2023, Carl Zeiss Meditec AG announced the acquisition of the Dutch Ophthalmic Research Center (International) B.V. (D.O.R.C.). The acquisition will enhance and complement ZEISS Medical Technology's broad ophthalmic portfolio and range of digitally connected workflow solutions to address several eye conditions, including eye disorders, cataracts, glaucoma, and refractive errors.

In July 2023, Bausch + Lomb announced the acquisition of Johnson & Johnson Vision's "Blink product portfolio." The over-the-counter Blink product line features eye and contact lens drops, Blink Tears Preservative Free Lubricating Eye Drops; Blink GelTears Lubricating Eye Drops; Blink Triple Care Lubricating Eye Drops; Blink Contacts Lubricating Eye Drops; and Blink-N-Clean Lens Drops.

In July 2023, Vantage Surgical Solutions announced the acquisition of Ophthalmic Surgical Solutions (OSS), specializing in ophthalmic surgical equipment and services. The acquisition combines the two companies' experience of providing ophthalmic surgery access to rural communities through partnerships with hospitals and ambulatory surgery centers.

Company Profiles

- Johnson & Johnson Services Inc.

- NIDEK

- SCHWIND Eye-Tech Solutions

- Bausch Health

- TECHNOLAS PERFECT VISION GmbH

- Ziemer Ophthalmic Systems

- Carl Zeiss

- Nikon Corporation

- LaserSight Technologies, Inc.

- Alcon Laboratories Inc.

Lasik Eye Surgery Devices Market Regional Insights

The regional trends and factors influencing the Lasik Eye Surgery Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Lasik Eye Surgery Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Lasik Eye Surgery Devices Market

Lasik Eye Surgery Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.55 Billion |

| Market Size by 2031 | US$ 3.69 Billion |

| Global CAGR (2025 - 2031) | 5.40% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Lasik Eye Surgery Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Lasik Eye Surgery Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Lasik Eye Surgery Devices Market are:

- Johnson & Johnson Services Inc.

- NIDEK

- SCHWIND Eye-Tech Solutions

- Bausch Health

- TECHNOLAS PERFECT VISION GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Lasik Eye Surgery Devices Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Johnson & Johnson Services Inc.

- NIDEK

- SCHWIND Eye-Tech Solutions

- Bausch Health

- TECHNOLAS PERFECT VISION GmbH

- Ziemer Ophthalmic Systems

- Carl Zeiss

- Nikon Corporation

- LaserSight Technologies, Inc.

- Alcon Laboratories Inc.

Get Free Sample For

Get Free Sample For