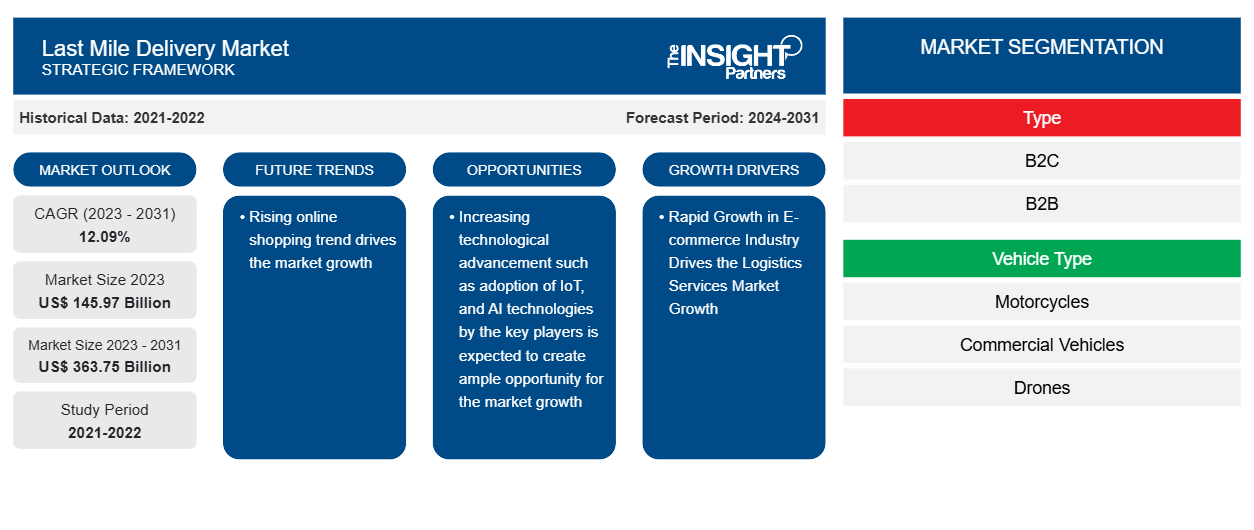

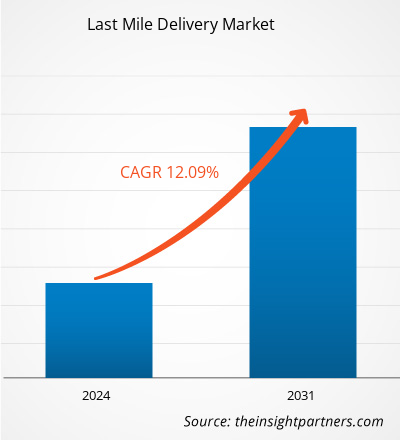

Last Mile Delivery market size is projected to reach US$ 363.75 billion by 2031 from US$ 145.97 billion in 2023. The market is expected to register a CAGR of 12.09% in 2023–2031. Last-mile delivery is the final step of the delivery process in which products are transferred from a transportation/warehouse center to their final destination, typically a personal residence or a business outlet. This is the most important phase in the delivery process, as the consumer's overall shopping experience and brand loyalty depend on it. One of the major factors driving the global last-mile delivery market is the increased penetration of the e-commerce sector across the globe. Online shopping across the globe is growing rapidly across developing countries such as India, Mexico, Brazil, and Argentina.

Last Mile Delivery Market Analysis

Last mile delivery providers transports more than 25 billion packages globally. The last-mile delivery is majorly done by third party logistic providers by roadways and air transport. Last-mile delivery is the final delivery process in which the parcel is delivered to the end customers. Last mile delivery includes a warehouse to the customer’s doorstep, which is known as the last mile delivery. Last-mile delivery is an expensive and time-consuming shipping process, but overall customer satisfaction is a major criterion for the key companies.

Last Mile Delivery Market Overview

Logistics companies then step in and use modern software to plan delivery routes based on criteria such as location, traffic, and delivery windows. To handle various metropolitan settings, goods are transported quickly using a broad fleet of vehicles ranging from basic trucks to cutting-edge drones and electric cars. The critical 'last mile' phase covers the final leg of delivery, where products are delivered directly to clients, which is frequently helped by real-time tracking technologies for transparency and convenience.

The last-mile delivery market constitutes a network of diverse stakeholders, technology integrations, logistical infrastructures, and evolving consumer behaviors. The primary stakeholders are e-commerce giants and retailers, and then logistics companies come into the picture. These organizations take help from technological companies that offer tools such as route optimization delivery management, among others. Apart from software companies, many drone manufacturers and service providers have come into the picture.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Last Mile Delivery Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Last Mile Delivery Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Last Mile Delivery Market Drivers and Opportunities

Increased E-commerce Industry Drives the Last Mile Delivery Market Growth

The e-commerce sector mostly depends on last-mile delivery to manage the parcel deliveries to the end customers. The increased demand for online shopping across the globe, along with the surge in internet penetration across the globe, is a major driving factor for the Last Mile Delivery market growth during the forecast period. The number of online shoppers is expected to grow in the coming years. This increment has directly affected the revenue generated. Total US e-commerce sales hit US$ 595.5 billion in 2019, an increase of 14.9% from US$ 518.5 billion in 2018. It is also one of the fastest rates of US e-commerce growth in seven years, trailing only 2017's 15.5% year-over-year gain

The rising adoption of unmanned delivery systems and rapid adoption of advanced technologies by logistic companies is expected to create ample opportunity for market growth.

In the future, US businesses have planned to deploy millions of unmanned delivery vehicles for parcel deliveries to meet the growing e-commerce sector requirements. Also, there has been increased demand for compact delivery cars and vehicles that are used in the on-demand e-commerce sector by retailers, merchants, restaurants, hotels, and grocery stores. The cars, such as full-size passenger vehicles, are designed to meet growing last-mile delivery requirements. Further, several key players in the market are developing and launching advanced technology-based solutions to meet customer's requirements for parcel or goods deliveries. For instance, in September 2023, Magna International developed and launched autonomous last-mile delivery solutions. The new solution was launched for metropolitan cities across North America.

Further, in March 2022, Magna also developed the robot to deliver a pizza business in the Detroit, US, area. Magna has consistently developed to improve the last-mile delivery service business. Such initiatives launched by the key players in the market are projected to create ample opportunities for the global last-mile delivery market during the forecast period.

Last Mile Delivery Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Last Mile Delivery market analysis are type, platform, application, and end-user.

- By type, the market is divided into B2C and B2B.

- Based on vehicle type, the market is divided into motorcycles, commercial vehicles, drones, autonomous ground vehicles, and others.

- Depending upon the end users, the market is segmented into groceries, home essentials/houseware and home furnishings, restaurant meals, clothing and apparel, consumer electronics, toys/hobbies/sporting goods, mass merchants, jewelry, specialty, automotive parts and accessories, and others.

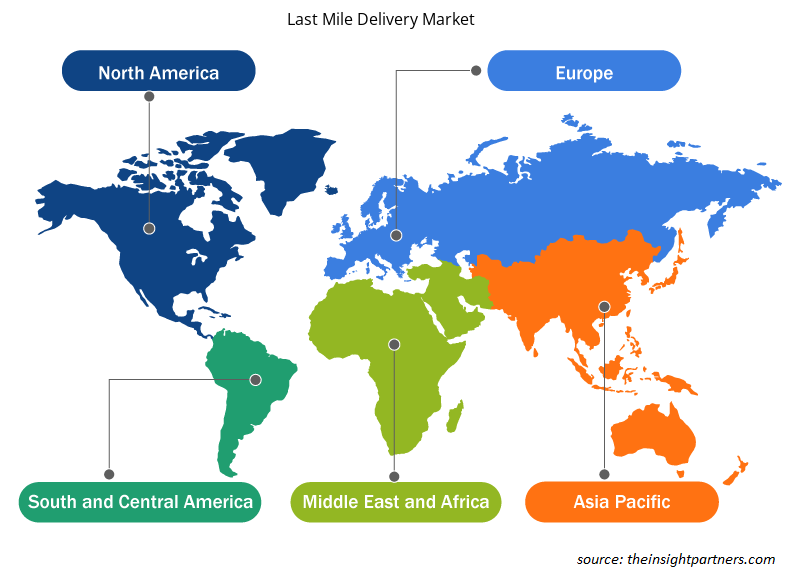

Last Mile Delivery Market Share Analysis by Geography

The geographic scope of the Last Mile Delivery market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North American last-mile delivery market is projected to have the largest share in Asia Pacific and is growing at the highest CAGR during the forecast period. North America’s market is driven by rapid growth in online shopping, with a surge in the e-commerce industry growth driving the global last-mile delivery market growth. In the US, there were more than 274.70 million people who shop goods online as of 2023. In the US, around 81% of the total US population is shopping the goods through online e-commerce websites. As of 2023, the total e-commerce sector revenue in the US reached US$ 1,137 billion. Such rapid growth in online shopping across North American countries has created massive growth for the last-mile delivery market.

Last Mile Delivery Market Regional Insights

Last Mile Delivery Market Regional Insights

The regional trends and factors influencing the Last Mile Delivery Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Last Mile Delivery Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Last Mile Delivery Market

Last Mile Delivery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 145.97 Billion |

| Market Size by 2031 | US$ 363.75 Billion |

| Global CAGR (2023 - 2031) | 12.09% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

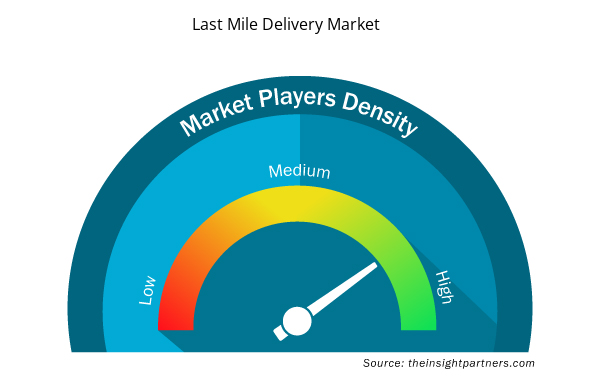

Last Mile Delivery Market Players Density: Understanding Its Impact on Business Dynamics

The Last Mile Delivery Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Last Mile Delivery Market are:

- C. H. Robinson

- DB SCHENKER Logistics

- United Parcel Service

- Nippon Express

- CEVA Logistics

- DSV Air & Sea

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Last Mile Delivery Market top key players overview

Last Mile Delivery Market News and Recent Developments

The Last Mile Delivery market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Last Mile Delivery market and strategies:

- In November 2023, Amazon.com Inc. launched the last-mile delivery fleet program in India that uses electric vehicles for its delivery service providers. Under this program, the company launched and adopted Mahindra Zor Grand's three-wheeler electric vehicle for offering Amazon's last-mile deliveries. (Source: DJI, Press Release/Company Website/Newsletter)

- In October 2023, Bringg, a Delivery Management Platform provider, launched the ROAD modular platform to optimize and dynamically manage internal fleets and automate last-mile delivery to create a seamless experience for drivers, dispatchers, and customers. (Source: Flyability, Press Release/Company Website/Newsletter)

Last Mile Delivery Market Report Coverage and Deliverables

The “Last Mile Delivery Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology ; Type ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For