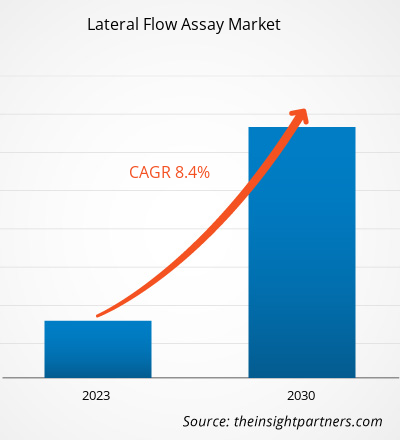

[Research Report] The lateral flow assay market size was valued at US$ 8,505.89 million in 2022 and is projected to reach US$ 16,106.13 million by 2030; it is estimated to record a CAGR of 8.4% from 2022 to 2030.

Market Insights and Analyst View:

Lateral flow immunoassay, also known as immunochromatographic assays or strip tests, is an easy-to-use diagnostic tool to determine whether a target analyte, such as pathogens or biomarkers in humans or animals, is present or absent. As lateral flow assays are easy to use, cost-effective, and can detect multiple markers in samples, they are becoming increasingly popular for therapeutic drug monitoring. Additionally, the growing prevalence of infectious diseases and increasing investments by major market players propel the growth of the lateral flow assay market. Furthermore, the growing availability of various diagnostic tests due to increasing demand for lateral flow assay kits, home, and POC testing fuels the growth of the market.

Growth Drivers:

Lateral flow assays (LFA) are paper-based tests designed for the detection of analytes (condition-specific biomolecules) in complex mixtures (biological samples), wherein samples are placed in a designated spot in a test device. These tests provide results within 5–30 minutes. Lateral flow assay kits exhibit stability over various environmental conditions and prolonged shelf life. Home tests based on later flow assays permit users to test self-collected samples and get results without the assistance of a trained medical professional. These tests are generally sold over the counter. A pregnancy test kit is one of the most common examples of home-based lateral flow assays. Further, these assays are designed for the diagnosis of infectious diseases, cardiovascular diseases, and stigmatized diseases such as HIV. Therefore, the rising prevalence of these diseases and the increasing adoption of lateral flow assay testing in home healthcare drive the lateral flow assay market growth. During the COVID-19 pandemic, many companies introduced at-home lateral flow assays for the diagnosis of SARS-CoV-2 infection due to people’s reluctance to visit hospitals or diagnostic labs for testing.

- In October 2020, Siemens Healthineers launched the CLINITEST Rapid COVID-19 Antigen Self-Test that helps detect the infection in 15 minutes so that the infected individuals can be isolated sooner to avoid the spread of COVID-19.

- In July 2020, BD Launched a portable, rapid point-of-care antigen test to detect SARS-CoV-2 infection in 15 minutes.

- In August 2020, the US Food and Drug Administration (FDA) issued an Emergency Use Authorization for Abbott BinaxNOW COVID-19 Ag Card, a rapid test to detect SARS-CoV-2. BinaxNOW uses Abbott’s proven lateral flow technology, making it a friendly and reliable method for frequent mass testing among healthcare providers.

- In September 2020, Roche launched a SARS-CoV-2 Rapid Antigen Test for markets accepting the CE Mark.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lateral Flow Assay Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lateral Flow Assay Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The lateral flow assay market is categorized on the basis of product type, technique, test type, application, end user, and geography. Based on product type, the lateral flow assay market is bifurcated into kits & reagents and lateral flow readers. Based on technique, the lateral flow assay market is classified into sandwich assay, competitive assays, and multiplex detection assay. Based on test type, the lateral flow assay market is bifurcated into lateral flow immunoassay and nucleic acid lateral flow assay. The lateral flow assay market, by application, is classified into clinical testing, veterinary diagnostics, food safety & environment testing, and drug development & quality testing. The lateral flow assay market, by end user, is categorized into hospitals and clinics, diagnostics laboratories, homecare, veterinary clinics, pharmaceutical & biotechnology companies, and others. The lateral flow assay market, based on geography, is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, Benelux, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and Rest of APAC), Middle East & Africa (Saudi Arabia, UAE, South Africa, Kuwait, Oman, Qatar, Egypt, and Rest of MEA), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The lateral flow assay market, by product type, is bifurcated into kits & reagents and lateral flow readers. The kits & reagents segment held a larger share of the market in 2022 and is expected to register a higher CAGR in the market during 2022–2030. The lateral flow assay market is anticipated to grow rapidly as the demand for kits & reagents is increasing significantly. Many regions have been experiencing a substantial rise in zoonotic and other animal diseases. Asia and Africa are among the hotspots for zoonoses—diseases transmitted from animals to humans. According to the World Health Organization (WHO), Africa has witnessed outbreaks of Marburg virus disease and several zoonotic diseases between 2012 and 2022. The region experienced a rise of 63% from 2012 to 2022, much higher than the previous decade. In addition, zoonotic disease represents ~32% of Africa’s infectious disease outbreaks reported during 2001–2022.

Thus, there is a rising need for diagnosing animal diseases across the globe. This is encouraging companies, such as Thermo Fisher Scientific Inc; Bio-Rad Laboratories, Inc; and F. Hoffmann-La Roche AG, to offer various reagents and kits, including FDA emergency use authorized RT-PCR detection kits, for sample collection, viral nucleic acid isolation, qualification, and quantification for reliable and accurate SARS-CoV-2 testing, antimicrobial susceptibility testing, rabies diagnosis testing, and qPCRs.

Based on technique, the lateral flow assay market is categorized into sandwich assay, competitive assay, and multiplex detection assay. The sandwich assay segment held the largest share of the market in 2022. However, the multiplex detection assay segment is projected to record the highest CAGR from 2022 to 2030.

The lateral flow assay market, by test type, is bifurcated into lateral flow immunoassay and nucleic acid lateral flow assay. The lateral flow immunoassay segment held a larger share of the market in 2022 and is expected to register a higher CAGR in the market from 2022 to 2030. Lateral flow immunoassay, also known as immunochromatographic assays or strip tests, is an easy-to-use diagnostic tool to determine whether a target analyte, such as pathogens or biomarkers in humans or animals, is present or absent. Lateral flow immunoassay tests have played a critical role in reducing the effects of the COVID-19 outbreak due to their ability to rapidly detect infected individuals and stop further transmission of SARS-CoV-2. The lateral flow immunoassay segment accounted for the largest share of the market in 2022. Lateral flow-based immunoassays are widely used to detect a wide variety of antibodies & antigens, both quantitatively and qualitatively, in hospitals, clinical laboratories, and clinics. It is a simple and cost-effective analytical method used to screen, monitor, and diagnose various diseases. As a result, the usefulness of lateral flow immunoassays is extremely high; these can be used by any health professional and/or patient at home.

In terms of application, the lateral flow assay market is categorized into clinical testing, veterinary diagnostics, drug development & quality testing, and food safety & environment testing. The clinical testing segment dominated with the largest share of the market in 2022. However, the drug development & quality testing segment is anticipated to register the highest CAGR during the forecast period.

Based on end user, the lateral flow assay market is categorized into hospitals and clinics, diagnostics laboratories, homecare, veterinary clinics, pharmaceutical & biotechnology companies, and others. Furthermore, the hospitals and clinics segment dominated with the largest market share in 2022. However, the pharmaceutical & biotechnology companies segment is anticipated to record the highest CAGR over the forecast period.

Regional Analysis:

The lateral flow assay market is primarily segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America held a major share of the market in 2022. In the same year, the US held the largest share of the market in the region. The market growth in North America is characterized by the growing prevalence of various diseases, government support for advanced diagnostics adoption, and increasing efforts in R&D and other activities undertaken by market players. In addition, technological advancements in the diagnosis industry are likely to be a major driver for the North American lateral flow assay market over the coming years.

The US Department of Health and Human Services report states that ~30–40% of people in the US suffer from H. Pylori infection. Similarly, according to a study published in PubMed Central (2020), the prevalence of H. pylori in Canada is estimated to be between 20% and 30%. To overcome the high prevalence of H. Pylori in the US, various top competitive players launched innovative products based on lateral flow immunoassay for qualitatively detecting H. pylori antigen. For example, Thermo Fisher Scientific's innovative "RAPID Hp StAR Lateral Flow Kit" helps detect H. pylori antigen directly from fecal samples.

Furthermore, the US has a high prevalence of hepatitis virus infection, which fuels the adoption of lateral flow assay-based testing kits. According to the 2020 Viral Hepatitis Surveillance Report, more than ten thousand people are infected with hepatitis annually in the US. Among these, the incidence rate of acute hepatitis C has increased by 124% in the past decade, and during 2020, it increased by 15% from 2019.

Moreover, various other technological advancements in the biotechnology industry in Canada have increased the demand for lateral flow assay-based tests. For instance, in February 2021, Canadian firm Laipac Technology Inc. partnered with YAS Pharmaceuticals LLC and Pure Health LLC, two UAE-based companies, to launch the first artificial intelligence (AI)-powered rapid COVID-19 antigen test. In April 2020, US-based Bio-Rad Laboratories launched a blood-based immunoassay kit to identify antibodies to SARS-CoV-2. Also, companies are distributing test kits intended for H. pylori bacteria in Canada. For instance, in June 2021, Biomerica Inc. announced a five-year agreement with a Canadian partner involved in distributing and marketing a new proprietary Helicobacter pylori test called Biomerica hp+ detect. The test was developed to identify and monitor H. pylori infection, a leading cause of duodenal and gastric ulcers, as well as a contributing risk factor associated with gastric cancer. Thus, the above-mentioned factors support the growth of the market in North America.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global lateral flow assay market are listed below:

- In March 2023, Roche announced that the FDA approved the Ventana PD-L1 (SP263) assay to detect patients with non-small cell lung cancer who are eligible for treatment with Libtayo, a PD-1 inhibitor therapy developed by Regeneron.

- In May 2022, Bio-Rad Laboratories launched the CFX Duet Real-Time PCR system to support researchers in developing singleplex and duplex quantitative PCR assays. The system offers the robust thermal performance and proprietary, accurate optical shuttle system of the company’s CFX Opus system.

- In April 2021, Hologic acquired Mobidiag Oy, a privately held Finnish-French developer of molecular diagnostic tests and instrumentation, for ~US$ 795 million. Hologic intends to invest in assay development in order to boost the adoption of the Novodiag platform. The Novodiag system combines real-time PCR and microarray capabilities.

- In April 2020, Hologic launched a new Aptima molecular assay that runs on the Panther system for the detection of SARS-CoV-2. The system is fully automated, with a high-throughput molecular diagnostic platform that has been installed in 60 countries and 50 states in the US. It can deliver initial results in three hours and can process over 1,000 COVID-19 tests a day.

Lateral Flow Assay Market Regional Insights

Lateral Flow Assay Market Regional Insights

The regional trends and factors influencing the Lateral Flow Assay Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Lateral Flow Assay Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Lateral Flow Assay Market

Lateral Flow Assay Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8.51 Billion |

| Market Size by 2030 | US$ 16.11 Billion |

| Global CAGR (2022 - 2030) | 8.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

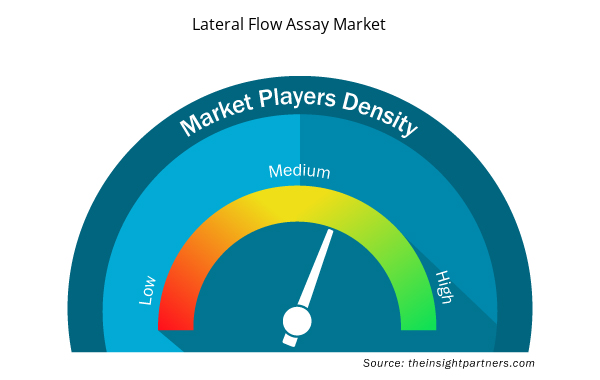

Lateral Flow Assay Market Players Density: Understanding Its Impact on Business Dynamics

The Lateral Flow Assay Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Lateral Flow Assay Market are:

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Lateral Flow Assay Market top key players overview

Competitive Landscape and Key Companies:

Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; bioMerieux SA; Quidel Corporation; PerkinElmer Inc.; Hologic Inc; Merck KGaA; Becton, Dickinson and Company; Siemens Healthineers AG; and QIAGEN are among the foremost players in the lateral flow assay market. These companies focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Technique, Test Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The factors driving the market include increasing use of home-based assay kits and rising popularity of point-of-care testing. However, inconsistent assay results due to procedural limitations hinder the market growth.

The global lateral flow assay market, by product type, is segmented into Kits & Reagents and Lateral Flow Readers. The Kits & Reagents is expected to dominate the market owing to it is substantial rise in zoonotic and other animal diseases. Asia and Africa are among the hotspots for zoonoses—diseases transmitted from animals to humans. Thus, to meet the rising demand for diagnosing animal diseases, companies, including Thermo Fisher Scientific Inc; Bio-Rad Laboratories, Inc; and F. Hoffmann-La Roche AG, among others, offers various reagents and kits for sample collection, viral nucleic acid isolation, qualification and quantification for reliable and accurate SARS-CoV-2 testing, antimicrobial susceptibility testing, rabies diagnosis testing, qPCRs, FDA emergency use authorized RT-PCR detection kits in the market.

Lateral flow assay is a type of diagnostic test that is used to detect the presence or absence of a target molecule in a sample. It is a simple and rapid testing method that does not require specialized equipment or technical expertise, making it suitable for point-of-care and home testing applications. Lateral flow assays are commonly used for various applications, including pregnancy tests, infectious disease diagnostics, food safety testing, and genetic testing. In genetic testing, lateral flow assays can be used to detect specific genetic mutations or sequences associated with various conditions or diseases.

The global lateral flow assay market majorly consists of the players such as Abbott Laboratories, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., bioMerieux SA, Quidel Corporation, Hologic Inc, PerkinElmer Inc., Merck KGaA, Becton Dickinson and Co, Siemens Healthineers AG, and QIAGEN.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Lateral Flow Assay Market

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- Quidel Corporation

- Hologic Inc

- PerkinElmer Inc.

- Merck KGaA

- Becton Dickinson and Co

- Siemens Healthineers AG

- QIAGEN

Get Free Sample For

Get Free Sample For