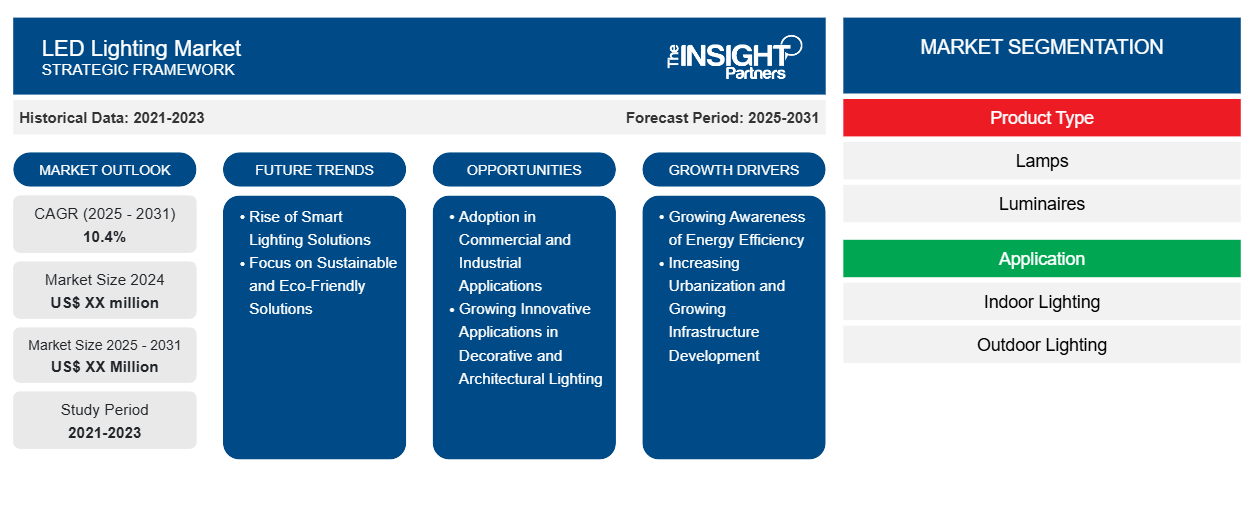

The LED Lighting Market is expected to register a CAGR of 10.4% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product Type (Lamps, Luminaires), Application (Indoor Lighting, Outdoor Lighting), End-user (Industrial, Commercial, Residential, Government Bodies). The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report LED Lighting Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

LED Lighting Market Segmentation

Product Type

- Lamps

- Luminaires

Application

- Indoor Lighting

- Outdoor Lighting

End-user

- Industrial

- Commercial

- Residential

- Government Bodies

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

LED Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

LED Lighting Market Growth Drivers

- Growing Awareness of Energy Efficiency: One of the primary drivers for the LED lighting market is the increasing awareness of energy efficiency among consumers and businesses alike. LED lights consume significantly less power compared to traditional incandescent or fluorescent bulbs, which translates to lower electricity bills and reduced environmental impact. As governments worldwide implement mandates and incentives to promote energy-efficient lighting solutions, consumers are becoming more inclined to switch to LED technology, driving growth in the market.

- Increasing Urbanization and Growing Infrastructure Development: As urbanization continues to rise globally, there is a heightened demand for efficient and reliable lighting solutions in urban infrastructure. Cities are investing in modern lighting systems to enhance public safety, improve aesthetics, and reduce energy consumption. LED lighting is particularly well-suited for urban environments due to its durability, low maintenance requirements, and ability to provide high-quality illumination. This trend towards urbanization and infrastructure development is driving the adoption of LED lighting solutions across cities worldwide.

LED Lighting Market Future Trends

- Rise of Smart Lighting Solutions: The trend towards smart lighting is gaining momentum in the LED lighting market. With the integration of IoT technology, smart LED lighting systems allow users to control their lighting remotely through smartphones or other devices. This functionality enables features like dimming, color changing, and scheduling, providing users with enhanced convenience and energy management. As consumers increasingly seek personalized and efficient lighting experiences, the demand for smart LED solutions is expected to continue to grow.

- Focus on Sustainable and Eco-Friendly Solutions: Sustainability is a significant trend influencing the LED lighting market, as consumers and businesses alike are prioritizing eco-friendly products. LEDs are free from hazardous materials like mercury, which is commonly found in traditional fluorescent lighting, and they have a much lower carbon footprint due to their energy-efficient nature. This growing focus on sustainable lighting solutions is driving manufacturers to innovate and promote the environmental benefits of LED technology, further propelling market growth.

LED Lighting Market Opportunities

- Adoption in Commercial and Industrial Applications: The commercial and industrial sectors present substantial opportunities for the LED lighting market. Businesses are increasingly recognizing the benefits of LED technology, including lower energy costs and reduced maintenance requirements. From office spaces to manufacturing facilities, the transition to LED lighting is becoming more prevalent as companies seek to enhance operational efficiency and sustainability. By targeting these sectors, manufacturers can capitalize on the growing demand for energy-efficient lighting solutions.

- Growing Innovative Applications in Decorative and Architectural Lighting: The versatility of LED technology opens up numerous opportunities in decorative and architectural lighting applications. With advancements in color mixing, dynamic lighting effects, and controllability, LEDs can be used creatively to enhance aesthetics in both residential and commercial spaces. This includes applications such as mood lighting, accent lighting, and even art installations. As consumers and designers increasingly seek unique and customizable lighting solutions, the demand for innovative LED products in decorative settings is likely to grow substantially.

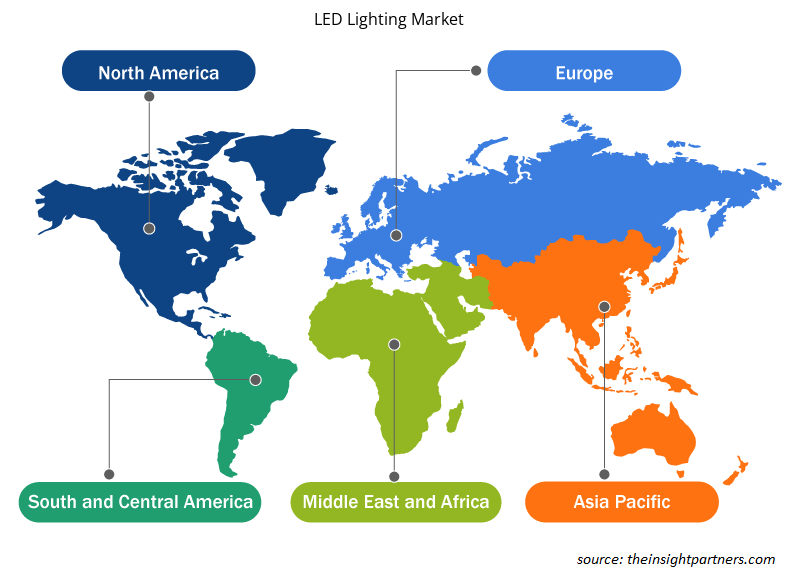

LED Lighting Market Regional Insights

The regional trends and factors influencing the LED Lighting Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses LED Lighting Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for LED Lighting Market

LED Lighting Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

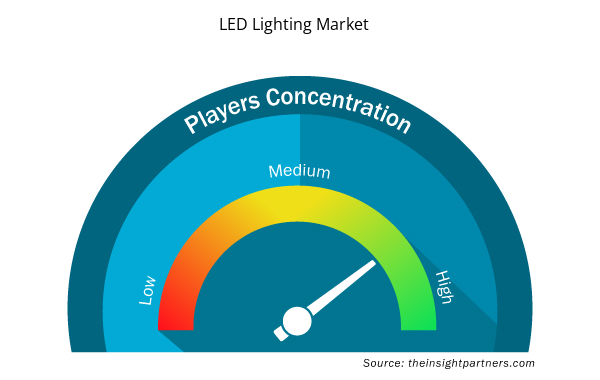

LED Lighting Market Players Density: Understanding Its Impact on Business Dynamics

The LED Lighting Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the LED Lighting Market are:

- Cree Lighting

- Dialight plc

- General Electric Lighting

- Nichia Corporation

- OSRAM Licht AG

- Signify N.V.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the LED Lighting Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the LED Lighting Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the LED Lighting Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Transdermal Drug Delivery System Market

- Formwork System Market

- Redistribution Layer Material Market

- Unit Heater Market

- Portable Power Station Market

- Biopharmaceutical Contract Manufacturing Market

- Europe Surety Market

- Analog-to-Digital Converter Market

- Grant Management Software Market

- Machine Condition Monitoring Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, End-user, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, UK, Canada, Germany, France, Italy, Australia, Russia, China, Japan, South Korea, Saudi Arabia, Brazil, Argentina

Frequently Asked Questions

Growing importance of sustainability and-friendly products is likely to remain a key trend in the market.

Key players in the LED lighting market include Philips Lighting, Sharp Electronics Corporation, Cree Inc., Nichia Corporation, General Electric Lighting, Samsung Electronics, OSRAM Licht AG, Panasonic Corporation, Cooper Industries, Inc., and Toshiba International Corporation

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The major factors driving the LED lighting market are:

1. Conscious lighting and other eco-friendly features.

2.High Lighting Perception is Key to New Developments in LED Luminaries

The LED Lighting Market is estimated to witness a CAGR of 10.4% from 2023 to 2031

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

1. Philips Lighting

2. Sharp Electronics Corporation.

3. Cree Inc.

4. Nichia Corporation

5. General Electric Lighting

6. Samsung Electronics

7. OSRAM Licht AG

8. Panasonic Corporation

9. Cooper Industries, Inc.

10. Toshiba International Corporation

Get Free Sample For

Get Free Sample For