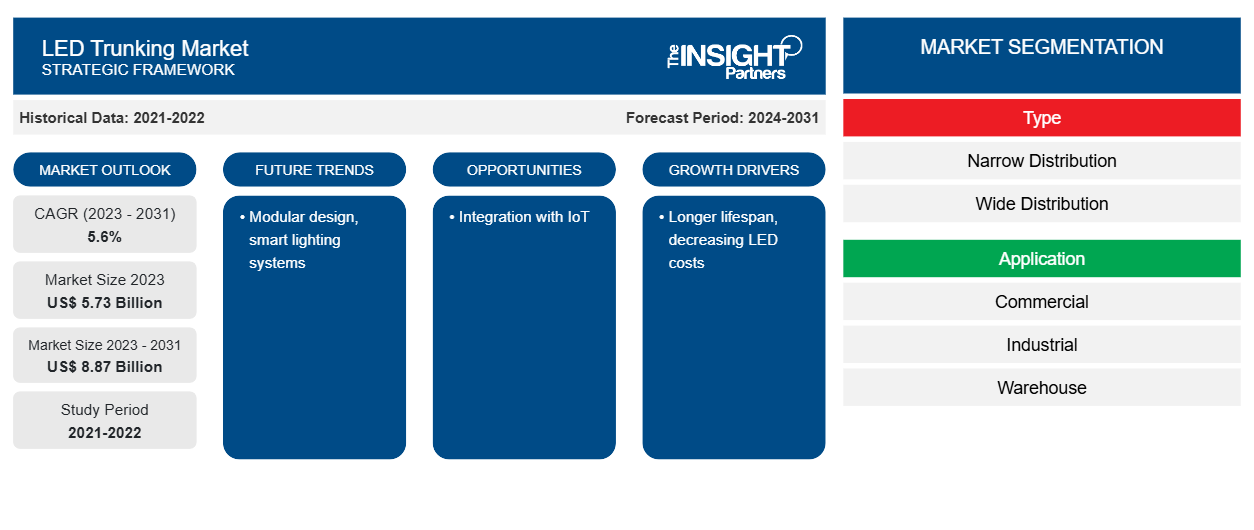

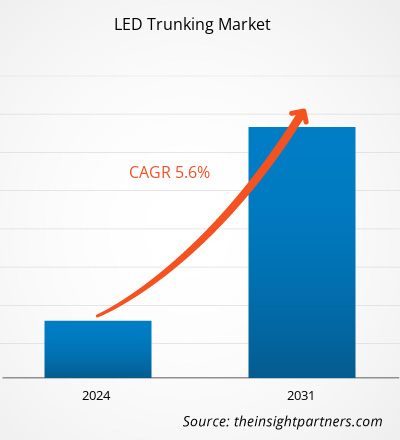

The LED Trunking Market size is projected to reach US$ 8.87 billion by 2031 from US$ 5.73 billion in 2023. The market is expected to register a CAGR of 5.6% in 2023–2031. Modular design and smart lighting are likely to remain key LED Trunking Market trends.

LED Trunking Market Analysis

LED linear trunking systems are continuous-row lighting assemblies that use trunking rails to connect individual lighting fixtures/subassemblies, such as LED light modules, power supplies, lighting controls, emergency battery packs, and/or other features. Flexible trunking systems can be built in a variety of ways to satisfy the demanding requirements for interior lighting in commercial and industrial buildings.

LED Trunking Market Overview

Many commercial buildings and industrial facilities are large and have sophisticated infrastructure, necessitating careful system integration and planning. Lighting design for these places is about more than just meeting quality, quantity, and operating standards. Interiors of large commercial buildings, such as supermarkets, hypermarkets, department stores, warehouses, distribution centers, trade centers, exhibition halls, office buildings, and so on, are more concerned with the networking and control capabilities of lighting devices, as well as the overall life-cycle costs of lighting. This is driving the demand for LED trunking products in the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

LED Trunking Market Drivers and Opportunities

Energy Efficiency to Favor Market

LED linear trunking systems are an energy-efficient, high-performance, and low-maintenance alternative to traditional linear fluorescent lighting systems that are ideal for open space, low-bay applications. LED lighting technology overcomes many of the disadvantages of fluorescent lighting by greatly improving energy conversion efficiency, strong controllability, high durability and dependability, longer lifespan, instant-on/rapid cycling, and compact form factors. When it comes to the advantages of LED linear trunking systems, their incredible design flexibility, unrivaled performance, ease of installation, and sophisticated digital control open up new horizons for innovative commercial lighting schemes that are not possible with traditional lighting technologies or other LED lighting systems.

Integration with IoT – An Opportunity in the LED Trunking Market

The LED trunking system can be enhanced with sensors that enable the integration of retail and warehouse technology, such as cameras, beacons, audio, and scanners, into a single system. In 2017, Philips Lighting today unveiled its new LED lighting trunking solution for retail and industrial environments, the Philips Maxos Fusion. This connected-ready system helps to future-proof buildings by combining high-quality LED lighting with the ability to change light effects and scale the system with other Internet of Things technologies. Auchan Hypermarket in Saint-Priest, France, was the first to install Philips Maxos Fusion and benefit from the ability to complement its shop layout with a configurable lighting design that provides future alternatives.

LED Trunking Market Report Segmentation Analysis

Key segments that contributed to the derivation of the LED Trunking market analysis are type and application.

- Based on the type, the LED Trunking market is divided into narrow distribution and wide distribution. The wide distribution segment held the largest share of the market in 2023.

- Based on the application, the LED Trunking market is divided into commercial, industrial, warehouse, and others.

LED Trunking Market Share Analysis by Geography

The geographic scope of the LED Trunking Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Asia Pacific has dominated the LED Trunking Market. The region has experienced rapid urbanization and industrialization in the past decade, which increases the need for energy-efficient lighting solutions to support sustainable infrastructure. Moreover, government regulation and initiatives to promote energy-efficient lighting in industrial and commercial settings are further to drive the growth of the market.

LED Trunking Market Regional Insights

LED Trunking Market Regional Insights

The regional trends and factors influencing the LED Trunking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses LED Trunking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for LED Trunking Market

LED Trunking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.73 Billion |

| Market Size by 2031 | US$ 8.87 Billion |

| Global CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

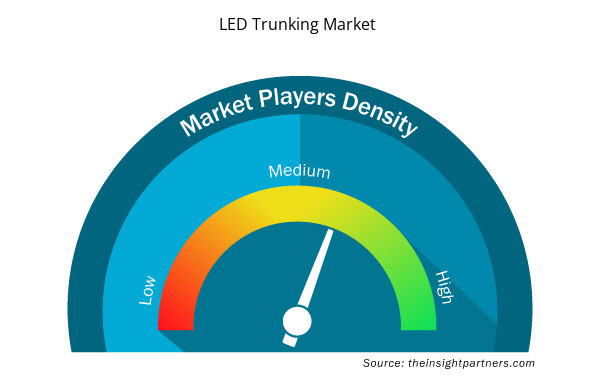

LED Trunking Market Players Density: Understanding Its Impact on Business Dynamics

The LED Trunking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the LED Trunking Market are:

- LEDYi Lighting

- Diodeled

- GE Lighting

- ED Linear

- SIRS-E LED

- NVC LED strips

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the LED Trunking Market top key players overview

LED Trunking Market News and Recent Developments

The LED Trunking Market is evaluated by gathering qualitative and quantitative data post-post-primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for LED Trunking Market and strategies:

- Osram developed a new industrial LED driver. OSRAM's new 300-watt LED driver broadens the power spectrum of the OTi DALI product line. It is an excellent solution for both linear industrial lighting, such as trunking systems, and high-bay luminaires. (Source: Osram, Press Release, 2021)

LED Trunking Market Report Coverage and Deliverables

The “LED Trunking Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

In terms of revenue, the wide distribution segment held the major market share in 2023.

The key players holding majority shares in the global LED Trunking market are LEDYi Lighting, Diodeled, GE Lighting, LED Linear, and SIRS-E LED.

Modular design and smart lighting are anticipated to bring new LED Trunking Market trends in the coming years.

Longer lifespan and decreasing LED costs are the major factors that propel the global LED Trunking Market growth.

The global LED Trunking Market was estimated to be US$ 5.73 billion in 2023 and is expected to grow at a CAGR of 5.6% during the forecast period 2024 - 2031.

Get Free Sample For

Get Free Sample For