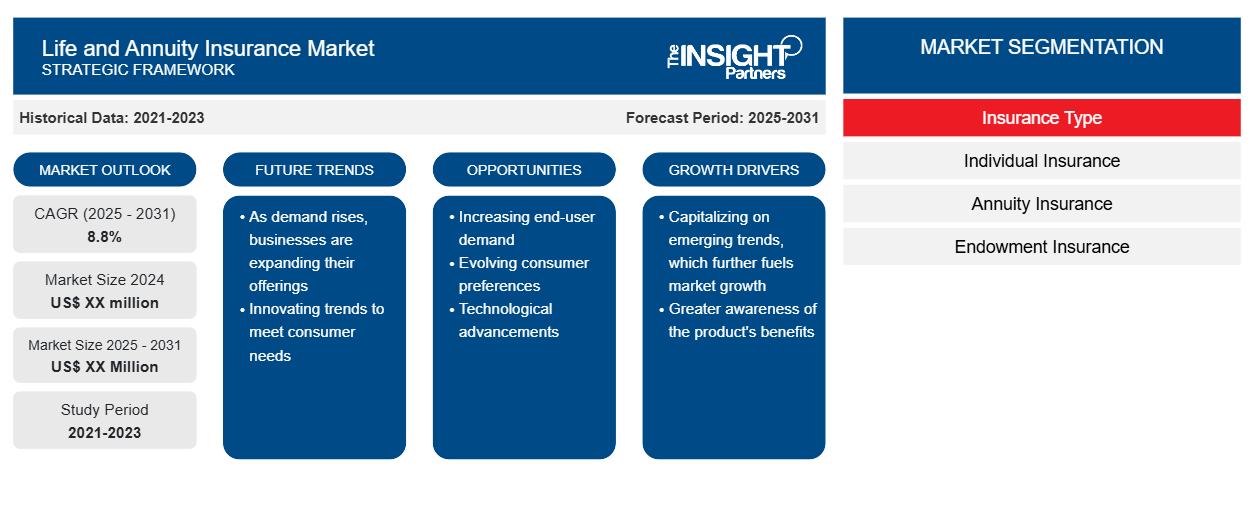

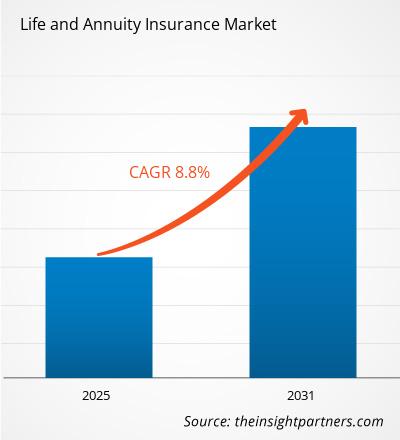

The Life and Annuity Insurance Market is anticipated to expand at a CAGR of 8.8% from 2025 to 2031. The rise in direct-to-consumer sales and the growing integration of advanced technologies will fuel the growth of the life and annuity insurance market in the forecasted period.

Life and Annuity Insurance Market Analysis

The report includes growth prospects owing to the current life and annuity insurance market trends and their foreseeable impact during the forecast period. As both life insurance and annuities help to delay taxes on earnings, it has become one of the major factors boosting the growth of the life and annuity insurance market. In addition, this insurance provides a guaranteed regular income to the policyholder in an exchange for a large payment made to the insurance company. Furthermore, the growing integration of technology and tailored messaging is creating an opportunity for the growth of the market in the forecasted period. Moreover, the focus of agency distribution is being shifted to the wealthy market, which is making room for both new and established insurance carriers in the individual market. Such a rise in direct-to-consumer sales is expected to propel the growth of the life and annuity insurance market.

Life and Annuity Insurance Market Overview

Life insurance is usually used to reimburse heirs after the insured passes away. Whereas an annuity develops users investments and provides income while they are still living. However, annuities can contain a death benefit payment, and many life insurance policies allow users to accumulate funds while they are still living. There are several types of life insurance coverage. Term life insurance only offers a death benefit. Permanent life insurance policies can provide coverage for the rest of the users life. In addition, permanent insurance accrues cash value that can be withdrawn over the lifetime. The interest rate paid by a whole life insurance policy is set. Additionally, a user can invest in subaccounts, such as mutual funds, with a variable life insurance policy; his growth is contingent upon the performance of his assets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Life and Annuity Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Life and Annuity Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Life and Annuity Insurance Market Driver

Growing Awareness Regarding the Benefits of Insurance To Drive the Life and Annuity Insurance Market Growth

Life insurance and annuities are two sorts of tax-advantaged financial instruments that can assist protect the insurer and his loved ones. Annuities provide a stream of income in exchange for a lump-sum payment, whereas life insurance offers a large sum in exchange for a continuous stream of premium payments. Generally, the death benefit is given to heirs tax-free. Estates that are liable to inheritance or estate tax are the primary exception. If life insurance proceeds are kept in an account for a while after the insured passes away, some of them may be subject to taxes. The interest received from the death benefit is taxable if it accrues interest prior to being disbursed to a beneficiary. Similarly, the popularity of certificates of deposit (CDs) can be attributed to their safety and guaranteed rate of return. But those rates of return might not be able to keep up with inflation during a period of low interest rates. According to Bankrate LLC, as of December 2023, CDs have an average rate of 1.73% for a one-year term, which is significantly lower than ordinary inflation rates, making interest rates on annuities more generous. Thus, all the above benefits of insurance are driving the life and annuity insurance market growth.

Life and Annuity Insurance Market Report Segmentation Analysis

- Based on insurance type, the life and annuity insurance market is segmented into individual insurance, annuity insurance, endowment insurance, whole life insurance, and others. The individual insurance segment is expected to hold a substantial life and annuity insurance market share in 2023.

- Individual life insurance is a policy that is purchased by one individual and protects only one person. In the case of the insured's passing, this insurance is meant to cover the surviving spouse's or family member's expenses.

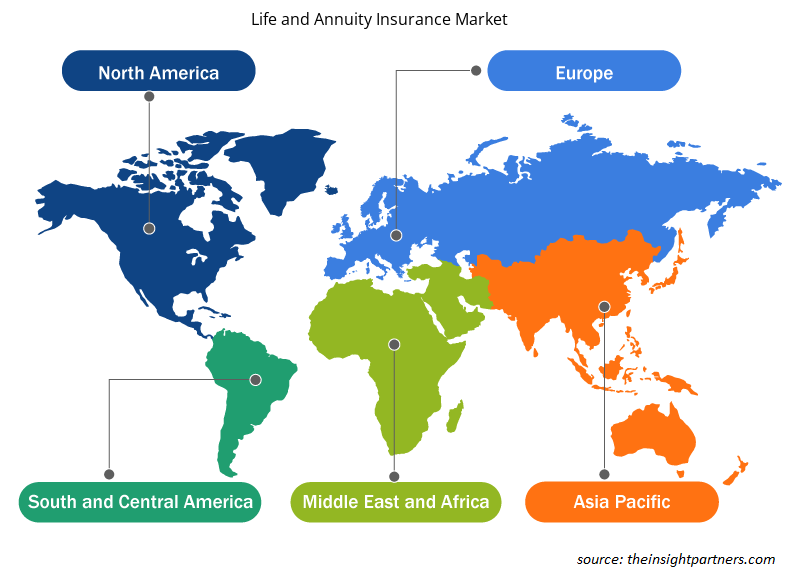

Life and Annuity Insurance Market Share Analysis By Geography

The scope of the Life and Annuity Insurance Market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant life and annuity insurance market share. The region's significant economic development, growing population, and increasing focus on financial inclusion across diverse economies have contributed to this growth. Furthermore, the growing awareness of individuals regarding the benefits of life and annuity insurance is fueling the market growth in the region. In addition, the growing adoption of technologies like data analytics, AI, and others is further creating an opportunity for the life and annuity insurance market growth in the region.

Life and Annuity Insurance Market Regional Insights

The regional trends and factors influencing the Life and Annuity Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Life and Annuity Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Life and Annuity Insurance Market

Life and Annuity Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 8.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insurance Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Life and Annuity Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Life and Annuity Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Life and Annuity Insurance Market are:

- The Northwestern Mutual Life Insurance Company

- MassMutual

- Allianz Life Insurance Company

- AXA SA

- MetLife Services and Solutions LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Life and Annuity Insurance Market top key players overview

The "Life and Annuity Insurance Market Analysis" was carried out based insurance type and geography. On the basis of insurance type, the market is segmented into individual insurance, annuity insurance, endowment insurance, whole life insurance, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Life and Annuity Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the life and annuity insurance market. A few recent key market developments are listed below:

- In September 2022, Northwestern Mutual announced the launch of Long-Term Advantage, a new offering designed to help people pay for long-term care needs – which, if ultimately not needed, will instead provide a life insurance benefit. The offering, which also has a guaranteed premium and will not be subject to rate increases, features a variety of key benefits, including long-term care benefits, death benefits, and accumulated value.

[Source: Northwestern Mutual, Company Website]

Life and Annuity Insurance Market Report Coverage & Deliverables

The Life and Annuity Insurance Market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Life and Annuity Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Insurance Type and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Growing awareness regarding the benefits of insurance is the major factors that propel the global life and annuity insurance market.

The Life and Annuity Insurance Market is anticipated to expand at a CAGR of 8.8% from 2023 to 2031.

The growing integration of advanced technologies is anticipated to play a significant role in the global life and annuity insurance market in the coming years.

The key players holding majority shares in the global life and annuity insurance market are The Northwestern Mutual Life Insurance Company, Allianz Life Insurance Company, AXA SA, Berkshire Hathaway Life, and American International Gro Inc.

The global life and annuity insurance market is expected to reach US$ 7248.31 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- The Northwestern Mutual Life Insurance Company

- MassMutual

- Allianz Life Insurance Company

- AXA SA

- MetLife Services and Solutions LLC

- Berkshire Hathaway Life

- American International Group Inc

- Chubb

- Prudential Financial Inc

- Zurich

Get Free Sample For

Get Free Sample For