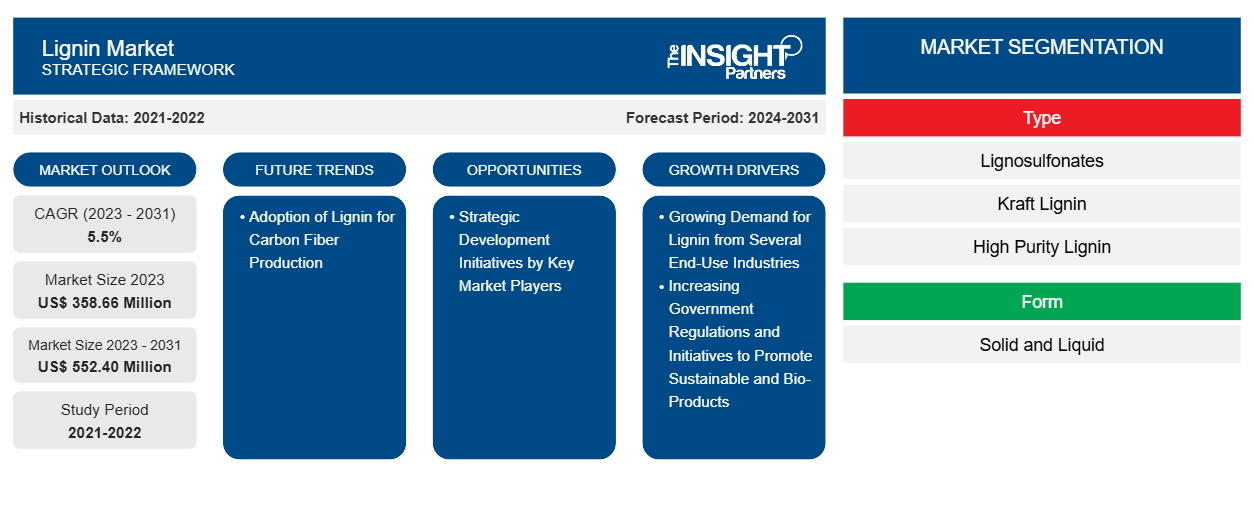

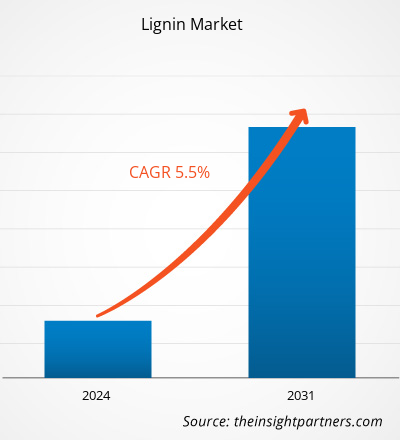

The lignin market size is projected to reach US$ 552.40 million by 2031 from US$ 358.66 million in 2023. The market is expected to register a CAGR of 5.5% during 2023–2031. The rising adoption of lignin for carbon fiber production is likely to bring new trends to the market.

Lignin Market Analysis

The increasing demand for sustainable products has prompted several manufacturers to produce bio-based products such as bio-based plastics, lignin-based resins, lignin-based binders, lignin-based composites, bio-asphalt, biofuels, and bio-coatings. For instance, in 2021, Lignin Industries AB commenced the production of Renol, a lignin-based material aimed at substituting and reducing fossil-based plastic utilization. Renol is used in ratios up to 50% in applications such as films, furniture, and automotive parts and as an infill material for artificial football pitches, replacing toxic and nondegradable rubber.

Major manufacturers are adopting creative strategies such as acquisition, expansion, and production capacity scaleup to serve their customers better and satisfy their growing demands. In January 2021, UPM Biochemicals expanded its lignin business with Domtar Paper Company LLC, the US-based pulp and paper producer, through a new supply agreement. Under this agreement, UPM is expected to boost its supply of kraft lignin by more than 20,000 metric tons annually. Therefore, strategic initiatives by manufacturers are expected to fuel the growth of the lignin market during the forecast period.

Lignin Market Overview

Selenium Lignin is one of the significant byproducts of the paper & pulp industry, which has a wide range of applications across various industries, including building and construction, automation, water treatment, biofuels, textile, paper & pulp, animal feed, and agriculture. Based on extraction processes, there are two main types of lignin: sulfur lignin and sulfur-free lignin. Sulfur lignin is a byproduct of commercial chemical pulping processes in the paper & pulp industry, giving kraft lignin and lignosulfonates. On the other hand, sulfur-free lignin includes soda lignin, alkaline lignin, hydrolysis lignin, and organosolv lignin produced by bioethanol production and sugar extraction processes. Lignin is used in the field of building materials in construction as a water-reducing admixture, set retarder, and grinding agent in cement production and cement replacement materials. Additionally, lignin is also used for pelletizing animal feed. In water treatment, lignin is used as an absorber; it can remove pollutants in water by physical adsorption. In animal feed, lignin improves the nutritional value and palatability of feed. The rising demand for lignin across various end-use industries is significantly driving market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lignin Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lignin Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lignin Market Drivers and Opportunities

Increasing Government Regulations and Initiatives to Promote Sustainable and Bio-Products

Governments of various European countries have imposed regulations on the use of chemicals to manufacture products in many processing industries, such as personal care, animal feed, and agriculture, to ensure better protection of human health and the environment. The European Union imposed stringent regulations on using fertilizers and other agricultural and water treatment chemicals due to their adverse environmental impacts. Moreover, these regulations are set to lessen greenhouse emissions and have compelled polymer manufacturing companies to increase investments in developing naturally derived raw materials. The rising awareness regarding greenhouse gas (GHG) emissions has surged the demand for bio-based polymer products. Lignin is used as an intermediate for manufacturing phenol, phenolic resins, and emulsifying agents. For instance, Lignin Industries AB received funding of US$ 1.38 million from the Swedish Energy Agency in 2020 for the development of lignin-based technology. The increasing importance of using biofuels globally, especially in North America and Europe, on account of regulatory support to reduce air pollution and GHG emissions is boosting the demand for lignin.

Rising Demand for Lignin for Biofuel Manufacturing

In recent years, lignin-derived fuels have gained popularity as a means of producing biofuels from biomass. There are two basic methods for converting lignin into fuel: thermochemical and catalytic. Fuels generated from lignin can reduce dependency on fossil fuels and, thus, can minimize greenhouse gas (GHG) emissions. Lignin can be converted into a range of fuels, including diesel, gasoline, and aviation fuel, which are more sustainable than conventionally available fossil fuels. Moreover, lignin is made from renewable plant materials and has a less carbon footprint than fossil fuels. Biofuels derived from lignin have the potential to be a strong fossil fuel substitute. Overall, lignin-derived biofuels can be promising; however, they are still in the early development stage, and more research and development are needed before they become a practical and economically viable option to fossil fuels. Lignin-based aviation fuels have shown positive results in laboratory tests and have significant implications for the future of aviation. Due to the increasing awareness regarding carbon emissions from air travel, Delta, JetBlue, and many airlines have earmarked funds to buy millions of gallons of jet biofuels. As lignin-based aviation fuel diminishes emissions and boosts aircraft performance, the demand for lignin-derived jet fuel is rising. The use of lignin helps boost fuel efficiency, and it could be used as an organic carbon substitute in everything, from batteries and biofuel to carbon fiber. The increasing importance of using biofuels across the globe on account of regulatory support to reduce air pollution and GHG emissions is boosting the demand for lignin.

Lignin Market Report Segmentation Analysis

Key segments that contributed to the derivation of the lignin market analysis are type, form, and application.

- Based on type, the lignin market is segmented into lignosulfonates, kraft lignin, high purity lignin, hydrolysis lignin, and others. In 2023, the lignosulfonates segment held the largest market share.

- Based on form, the market is bifurcated into solid and liquid. The solid segment led the market in 2023.

- Based on application, the market is segmented into concrete additives, plastics and polymers, animal feed, water treatment, dyes and pigments, activated carbon, agriculture, biofuels, and others. The biofuels segment is projected to register the fastest CAGR from 2023 to 2031.

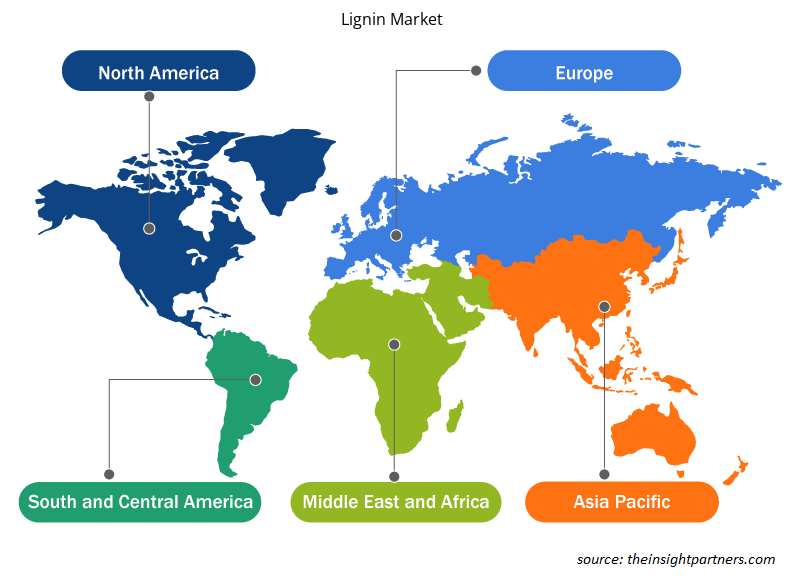

Lignin Market Share Analysis by Geography

The geographic scope of the lignin market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

Europe held a significant market share in 2023, followed by Asia Pacific and North America.

According to a report published by the International Energy Agency in 2022, China was the world's largest paper producer in 2020. In 2021, the country announced its plans to prioritize building a circular economy under its 14th Five-Year Plan (2021–2025) by attaining the capability of utilizing 66.1 million tons of waste paper by 2025. Moreover, the governments of China, Thailand, the Philippines, and India have introduced programs and taken initiatives to support wastewater treatment projects and a circular economy via statutory or legislative provisions.

Asia Pacific is home to several major construction companies. These include China State Construction Engineering Corp Ltd, Obayashi Corporation, China Railway Construction Corporation Group, Takamatsu Construction Group Co Ltd, Hindustan Construction Company Ltd, and McConnell Dowell South East Asia Pte Ltd. According to the United Nations Water, China received US$ 104 million in 2020 as official assistance for water- and sanitation-related developments, entailing water-related policies, water conservation, waste disposal and management, and agricultural water resources. As per a 2021 report of the Government of India, under the Swachh Bharat Mission (Urban) 2.0 initiative, the government issued US$ 1.93 billion to states/union territories for wastewater management in 2021, especially for the development of sludge treatment plants. Therefore, the growth of the construction and wastewater treatment industry favors the progress of the lignin market in Asia Pacific.

Lignin Market Regional Insights

The regional trends and factors influencing the Lignin Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Lignin Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Lignin Market

Lignin Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 358.66 Million |

| Market Size by 2031 | US$ 552.40 Million |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

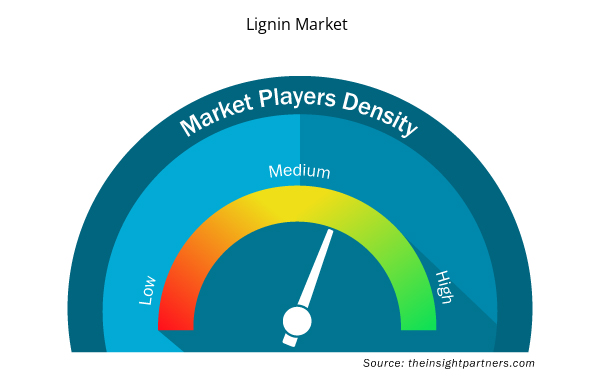

Lignin Market Players Density: Understanding Its Impact on Business Dynamics

The Lignin Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Lignin Market are:

- Nippon Paper Industries Co Ltd

- Borregaard ASA

- Burgo Group Spa

- Domsjo Fabriker AB

- Sappi Ltd

- Stora Enso Oyj

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Lignin Market top key players overview

Lignin Market News and Recent Developments

The lignin market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key recent developments in the lignin market are mentioned below:

- Stora Enso and Valmet collaborated on next-generation lignin product and process development to drive Stora Enso's lignin-based businesses. (Source: Stora Enso, Company Website, 2023)

- Suzano SA - Latin America's manufacturer, announced the construction of a new multi-billion dollar pulp plant with an annual production capacity of 2.3 million tons. (Suzano SA, Company Website, 2021)

Lignin Market Report Coverage and Deliverables

The "Lignin Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Lignin market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Lignin market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Lignin market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the lignin market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Green Hydrogen Market

- Fish Protein Hydrolysate Market

- Integrated Platform Management System Market

- Health Economics and Outcome Research (HEOR) Services Market

- Blood Collection Devices Market

- Machine Condition Monitoring Market

- Fertilizer Additives Market

- Organoids Market

- Fixed-Base Operator Market

- Hair Wig Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Form, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The growing demand for lignin from various end-use industries is one of the major factors contributing to the market growth.

The rising adoption of lignin for carbon fiber production is likely to emerge as a key trend in the market in the future.

Nippon Paper Industries Co Ltd, Borregaard ASA, Burgo Group SpA, Domsjo Fabriker AB, Sappi Ltd, Stora Enso Oyj, Suzano SA, The Dallas Group of America Inc, Tokyo Chemical Industry Co Ltd, and West Fraser Timber Co Ltd are a few of the key players operating in the market.

The market size is projected to reach US$ 552.40 million by 2031.

Europe accounted for the largest share of the market in 2023.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Lignin Market

- Nippon Paper Industries Co Ltd

- Borregaard ASA

- Burgo Group SpA

- Domsjo Fabriker AB

- Sappi Ltd

- Stora Enso Oyj

- Suzano SA

- The Dallas Group of America Inc

- Tokyo Chemical Industry Co Ltd

- West Fraser Timber Co Ltd

Get Free Sample For

Get Free Sample For