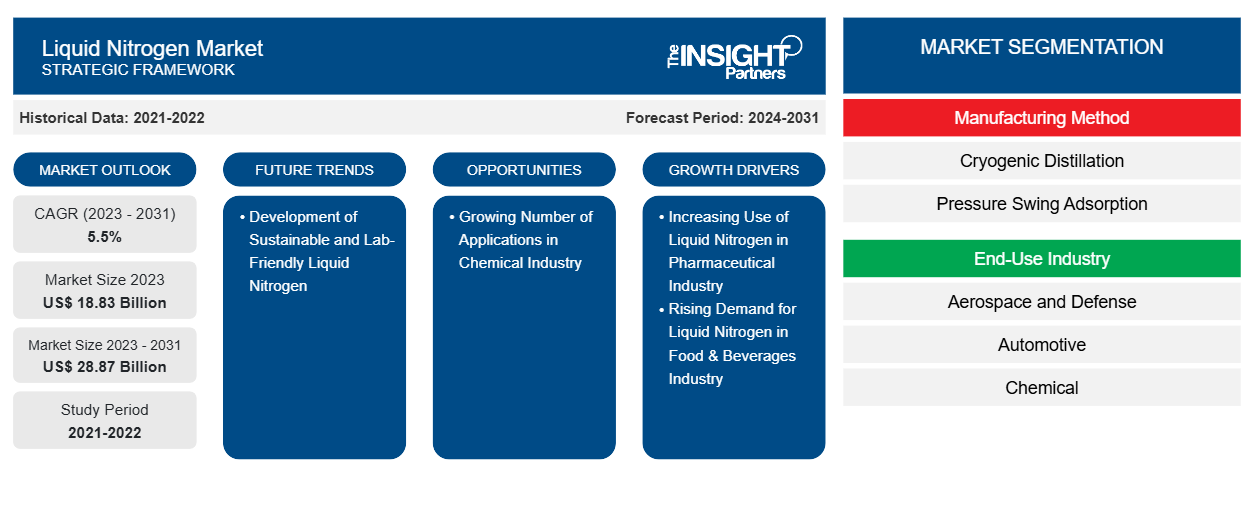

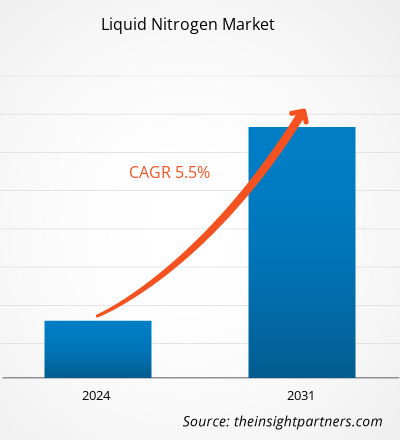

The liquid nitrogen market size is projected to reach US$ 28.87 billion by 2031 from US$ 18.83 billion in 2023; the market is expected to register a CAGR of 5.5% during 2023–2031. The development of sustainable and lab-friendly liquid nitrogen is likely to bring new trends into the market.

Liquid Nitrogen Market Analysis

Liquid nitrogen is extensively used in various pharmaceutical applications. It acts as an organic additive for the development of generics, therapeutic medicines, and an active pharmaceutical ingredient. Nitrogen is used in its pure form or mixtures for a wide range of quality control applications, medical and nonmedical analysis, as well as to preserve living tissues and cells at cryogenic temperatures. Also, it is used to store cells at low temperatures for lab work, promession (a way to dispose of human remains through freeze drying), and cryonic preservation. Liquid nitrogen acts as a coolant, becoming a commonly used anesthetic for minor surgical procedures. Thus, the widespread application of liquid nitrogen in the pharmaceutical industry is fueling the market growth.

Liquid Nitrogen Market Overview

Liquid nitrogen is a cryogenic liquid, inert, noncorrosive, colorless, odorless, nonflammable, and extremely cold. Although used more commonly in the gaseous state, nitrogen is stored and transported as a liquid, making it a more cost-effective way of providing product supply. Liquid nitrogen is widely used in a multitude of commercial and technical applications. It finds application in food freezing, plastic and rubber deflashing and grinding, cooling, metal treating, biological sample preservation, pulverization, and other temperature-related applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Liquid Nitrogen Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Liquid Nitrogen Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Liquid Nitrogen Market Drivers and Opportunities

Rising Demand for Liquid Nitrogen in Food & Beverages Industry

The growing food & beverages industry across various economies boosts the demand for liquid nitrogen. In the food & beverages sector, liquid nitrogen is majorly used to chill, freeze, cool, and preserve products. It is utilized in freezing baked goods, meat, poultry, fish, prepared foods, fruits, and vegetables while retaining their original color, scent, and flavor. Preservation involves cooling the food product or freezing it with the help of liquid nitrogen, thereby improving the product's shelf-life. It is also used for storage and transportation of perishable food products. Unlike traditional mechanical freezers, liquid nitrogen has minimal adverse environmental effects and requires limited initial equipment investment.

Moreover, the adoption of cryogenic freezing in the food & beverages industry is increasing due to growing concerns over the safety of food products. Cryogenic freezing does not affect the final product's quality and is more environmentally friendly and time efficient. Cryogenic freezing systems use liquid nitrogen as the refrigerant. Thus, the preference for liquid nitrogen among various food and beverage manufacturers is increasing owing to the rising adoption of cryogenic freezing.

Growing Number of Applications in the Chemical Industry

In the chemical industry, liquid nitrogen is often used in manufacturing, processing, handling, storage, and transportation. It is employed as a cryopreservation agent and serves as the raw material for cloning processes. Liquid nitrogen is used as a pressurizing gas, propelling liquids through pipelines. Also, it is used to shield oxygen-sensitive materials from the air as well as to remove volatile organic chemicals from process streams. In chemical analysis, liquid nitrogen is commonly used during sample preparation. It is used for maintaining concentration and reduction of the volume of liquid samples. Liquid nitrogen helps produce fertilizers, dyes, nitric acid, and explosives.

Further, specialty chemicals manufacturing companies are expanding their capacities to cater to surging demand from domestic and international markets. The chemical sector in Japan, India, European countries, and the US is significantly increasing. According to the India Brand Equity Foundation (IBEF), India became the sixth-largest producer of chemicals worldwide and ranked third in Asia; the chemical industry contributed 7% to the country's GDP in 2023. Thus, the growing liquid nitrogen usage in chemical applications across various economies is expected to create lucrative opportunities for the liquid nitrogen market growth during the forecast period.

Liquid Nitrogen Market Report Segmentation Analysis

Key segments that contributed to the derivation of the liquid nitrogen market analysis are the manufacturing method and end-use industry.

- Based on the manufacturing method, the liquid nitrogen market is divided into cryogenic distillation and pressure swing adsorption. The cryogenic distillation segment held a larger market share in 2023.

- By end-use industry, the market is segmented into aerospace & defense, automotive, chemical, food & beverages, metal fabrication, pharmaceutical, electronics & semiconductors, and others. The metal fabrication segment dominated the market in 2023.

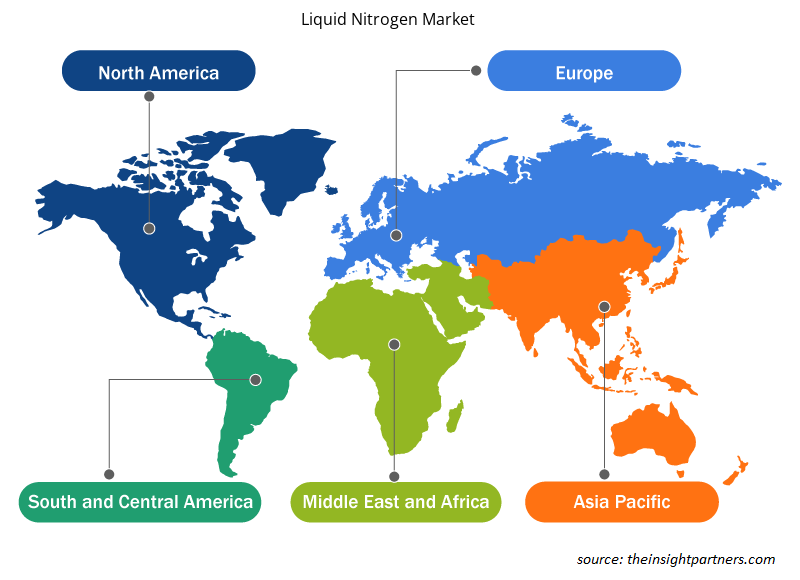

Liquid Nitrogen Market Share Analysis by Geography

The geographic scope of the liquid nitrogen market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific held the largest market share in 2023 and is expected to register the highest CAGR during the forecast period. North America held the second-largest liquid nitrogen market share in 2023. In terms of revenue, China held the largest share of the market in Asia Pacific in 2023. China is witnessing significant growth in the food & beverages industry owing to increased disposable income and a growing population. According to the US Department of Agriculture, in 2023, food production in China grew by 2.9%, which is 1.9% higher than the average industrial production growth rate. The country is also witnessing increased demand for processed food and packaged food products due to increased focus on convenience among consumers. Liquid nitrogen plays a crucial role in reducing food soilage, discoloration of food products, and giving strength to retail food packaging. Thus, the growing food & beverages industry fuels the demand for liquid nitrogen in China.

Liquid Nitrogen Market Regional Insights

The regional trends and factors influencing the Liquid Nitrogen Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Liquid Nitrogen Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Liquid Nitrogen Market

Liquid Nitrogen Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 18.83 Billion |

| Market Size by 2031 | US$ 28.87 Billion |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Manufacturing Method

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

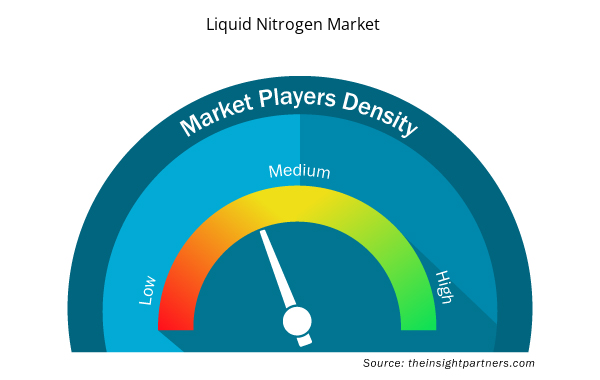

Liquid Nitrogen Market Players Density: Understanding Its Impact on Business Dynamics

The Liquid Nitrogen Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Liquid Nitrogen Market are:

- Linde Plc

- LAir Liquide SA

- Air Products and Chemicals Inc

- SOL SpA

- Praxair Technology Inc

- Nippon Sanso Holdings Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Liquid Nitrogen Market top key players overview

Liquid Nitrogen Market News and Recent Developments

The liquid nitrogen market is evaluated by gathering qualitative and quantitative data post post-primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the liquid nitrogen market are listed below:

- Linde announced the signing of a long-term agreement with H2 Green Steel for the supply of industrial gases to the world's first large-scale green steel production plant. (Linde PLC, Company website, May 2024)

- Safran announced that it entered into exclusive negotiations with Air Liquide to acquire the aeronautical oxygen and nitrogen activities of Air Liquide advanced Technologies, with the exception of the cryogenic activities related to naval applications. (Safran Group, Company Website, June 2023)

Liquid Nitrogen Market Report Coverage and Deliverables

The "Liquid Nitrogen Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Liquid nitrogen market size and forecast for all the key market segments covered under the scope

- Liquid nitrogen market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Liquid nitrogen market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the liquid nitrogen market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The increasing use of liquid nitrogen in the pharmaceutical industry and the rising demand for liquid nitrogen in the food & beverages industry are driving the market.

A few of the key players in the liquid nitrogen market include Linde Plc, L'Air Liquide SA, Air Products and Chemicals Inc, SOL SpA, Praxair Technology Inc, Nippon Sanso Holdings Corp, Ube Corporation, AIR WATER INC, Gulf Cryo LLC, Osaka Gas Co Ltd, Tokyo Gas Chemicals Co Ltd, Messer SE & Co KGaA, nexAir LLC, ADNOC Gas, and Matheson Tri-Gas Inc.

The market is expected to register a CAGR of 5.5% during 2023–2031.

The cryogenic distillation segment held the largest share of the global liquid nitrogen market in 2023. The principle of the cryogenic distillation method is based on a cryogenic distillation of liquefied air. The cryogenic distillation method is considered efficient and it is instrumental in generating high-purity nitrogen.

In 2023, Asia Pacific held the largest share of the global liquid nitrogen market. Asia Pacific is experiencing substantial growth in the metal fabrication industry. According to the World Steel Association AISBL, the region produced 1,367.2 metric tons of steel as of 2023. This growing steel production in the region boosts the demand for liquid nitrogen.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Liquid Nitrogen Market

- Linde Plc

- L’Air Liquide SA

- Air Products and Chemicals Inc

- SOL SpA

- Praxair Technology Inc

- Nippon Sanso Holdings Corp

- Ube Corporation

- AIR WATER INC

- Gulf Cryo LLC

- Osaka Gas Co Ltd

- Tokyo Gas Chemicals Co Ltd

- Messer SE & Co KGaA

- nexAir LLC

- ADNOC Gas

- Matheson Tri-Gas Inc.

Get Free Sample For

Get Free Sample For