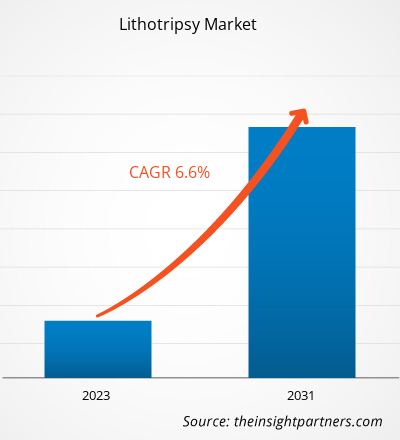

The lithotripsy market size is projected to reach US$ 2.3 billion by 2031 from US$ 1.4 billion in 2023. The market is expected to register a CAGR of 6.6% during 2023–2031. Preference for lithotripsy technique in coronary lesion treatment is likely to remain one of the key trends in the market.

Lithotripsy Market Analysis

The launch of innovative lithotripsy devices drives the lithotripsy market. In January 2022, Olympus announced the launch of its next-generation SOLTIVE Premium SuperPulsed Laser System (SOLTIVE Laser System). The product offers the potential for short procedure time, better patient outcomes, and low procedure cost as compared to standard Holmium: YAG lithotripsy device.

Lithotripsy Market Overview

In India, patients experienced lithotripsy procedures to be cost-beneficial. The ED Treatment India website states that the cost of lithotripsy in the country is approximately 40–70% lower than in the US and other developed nations. Additionally, the hospitals in India providing lithotripsy are highly competitive in terms of facilities and amenities and have experienced and skilled healthcare staff.

Comparison Table of International Cost of Lithotripsy Compared with India

Country |

Cost in US$ (Min–Max) |

|

India |

600–2,500 |

|

Canada |

4,500–12,400 |

|

US |

11,500–17,900 |

|

UK |

2,500–8,500 |

|

Turkey |

2,100–3,600 |

|

Australia |

5,000–6,500 |

|

Singapore |

10,000–20,000 |

|

UAE |

15,000–30,000 |

|

Colombia |

7,000–15,000 |

|

Indonesia |

3,000–5,000 |

|

Thailand |

4,000–8,000 |

|

Malaysia |

6,000–12,000 |

|

Kuwait |

10,000–20,000 |

|

Philippines |

2,000–4,000 |

|

Germany |

3,000–6,000 |

Source: HMSDESK, Website India

Therefore, the low cost of lithotripsy procedures in India is responsible for attracting patients across the globe for treatment under medical tourism, which drives the lithotripsy market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lithotripsy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lithotripsy Market Drivers and Opportunities

Medical Reimbursement/Coverage for Noninvasive Lithotripsy Procedure

Surgery is a traditional treatment option for patients suffering from kidney stones. These surgeries include nephrectomy and endoscopic treatment of the urethra. However, in the past few years, several new approaches have been developed such as noninvasive lithotripsy techniques for the treatment of upper urinary tract kidney stones. Patients are gradually shifting toward noninvasive procedures owing to increased awareness. According to the US Centers for Medicare & Medicaid Services, all traditional and noninvasive lithotripsy techniques are medically insured/reimbursed. These noninvasive lithotripsy techniques include extracorporeal shock wave lithotripsy, percutaneous lithotripsy, and transurethral ureteroscopic lithotripsy. Further, a report published by the European Med Tech and IVD Reimbursement Consulting Ltd. in October 2019 revealed that Med-Tech Reimbursement Consulting (MTRC) has released notification for medical reimbursement for lithotripsy procedures, such as extracorporeal shock wave therapy and intracorporeal (endoscopic) lithotripsy, in 11 European Union (EU) countries. These countries include Austria, Belgium, Denmark, England, Germany, Italy, the Netherlands, Norway, Sweden, and Switzerland. Furthermore, peripheral IVL is a new coronary lithotripsy technology that will be reimbursed in outpatient, ambulatory surgical centers (ASCs), and inpatient settings. Therefore, medical coverage/reimbursement for noninvasive lithotripsy procedures leads to an increase in patient visits to specialized lithotripsy centers and hospitals, which contributes to the lithotripsy market growth.

Rise in Mobile Lithotripsy Services

Mobile lithotripsy medical units, commercial tractor-trailers, and coaches are significantly beneficial to patients. These units offer patients a new healthcare service without any requirement to set up a specialized lithotripsy center or additional investment. Patients' experience with mobile lithotripsy services is significantly improving with technological advancements. For example, in June 2021, Mobile Medical announced launching its new state-of-the-art mobile lithotripsy unit. The lithotripter device was successfully removed from the existing lithotripsy center and installed in a cab/mobile truck. Similarly, The Oklahoma Mobile Lithotripsy Associates (OMLA), a subsidiary of Oklahoma Lithotripter Associates, has continued to provide extracorporeal shockwave lithotripsy (ESWL) services to area hospitals through a lithotripsy bus/trailer since 1995. The service began with a single Dornier unit. However, with a rise in technological advancements, the units are now transported to each location in small vans, making accessibility and scheduling noninvasive lithotripsy procedures much more accessible. Currently, mobile lithotripsy service is only available in developed countries, particularly in the US, and is anticipated to grow in other countries if awareness about mobile lithotripsy service is increased worldwide. Thus, the rise in mobile lithotripsy services is anticipated to create lucrative opportunities for the lithotripsy service providers in the coming years.

Lithotripsy Market Report Segmentation Analysis

Key segments that contributed to the derivation of the lithotripsy market analysis are product type, application, and end user.

- Based on product type, the lithotripsy market is bifurcated into extracorporeal shock wave lithotripsy devices , intracorporeal lithotripsy devices, and ureteroscopic. The extracorporeal shock wave lithotripsy devices segment held a larger market share in 2023.

- Based on intracorporeal lithotripsy devices, the lithotripsy market is bifurcated into Laser Lithotripsy Devices, Electrohydraulic Lithotripsy Devices, Ultrasonic Lithotripsy Devices, Mechanical Lithotripsy Devices. The Laser Lithotripsy Devices lithotripsy devices segment held a larger market share in 2023

- By application, the market is segmented into kidney stones, ureteral stones, pancreatic stones, bile duct stones, and bladder stones. The kidney stones segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, specialty clinics, and others. The hospitals segment dominated the market in 2023.

Lithotripsy Market Share Analysis by Geography

The geographic scope of the lithotripsy market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. Further, Asia Pacific is anticipated to record the highest CAGR in the coming years. In North America, the US accounted for the largest share of the lithotripsy market in 2023. According to the Korean Urological Association report, the prevalence of nephrolithiasis (kidney stone) is significantly high in the US. The BD company website reveals that kidney stones affect 1 in 11 people in the US annually, causing a considerable healthcare burden and high cost of treatment. The length of time from diagnosis to treatment takes approximately 18 days, with ~50% of the patients recommended to perform lithotripsy procedures [the majority are treated with extracorporeal shockwave lithotripsy (ESWL)] by physicians. Additionally, the most commonly recommended noninvasive procedure in the US is lithotripsy. The NewChoiceHealth.com website reveals that the average cost of lithotripsy in the US accounts for approximately US$ 12,800. In addition, as the lithotripsy procedure is an outpatient treatment for kidney stone removal, the prices might vary. The following table represents the Virginia State lithotripsy (outpatient cost vs licensed ambulatory surgical center cost) recorded in 2018.

Virginia State |

Hospital Outpatient (US$) |

Licensed Ambulatory Surgical Center (US$) |

|

Central |

8,710 |

5,385 |

|

Eastern |

6,273 |

4,547 |

|

Northern |

9,796 |

5,898 |

|

Northwestern |

9,983 |

7,133 |

|

Southwestern |

9,435 |

NA |

Source: Virginia Health Information

Patients undergoing lithotripsy noninvasive procedures can apply for medical reimbursement/coverage in the US, which benefits patients and leads to more lithotripsy procedures (in terms of volume). The New York Urology Specialists report website states that kidney stone treatment in the US is covered under health insurance. The insurance benefits the patients in blood testing, urologist (consultation fees), surgical cost of any chosen noninvasive as well as surgical procedure [lithotripsy, ureteroscopy, or percutaneous nephrolithotomy (PCNL), diagnostic imaging cost, and others]. Therefore, with rising incidences of kidney stones among the US population, demand for lithotripsy devices is also increasing, which boosts the volume of procedures in hospitals and specialized centers due to medical reimbursement/coverage benefits.

Lithotripsy Market Regional Insights

The regional trends and factors influencing the Lithotripsy Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Lithotripsy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Lithotripsy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.4 Billion |

| Market Size by 2031 | US$ 2.3 Billion |

| Global CAGR (2023 - 2031) | 6.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lithotripsy Market Players Density: Understanding Its Impact on Business Dynamics

The Lithotripsy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Lithotripsy Market top key players overview

Lithotripsy Market News and Recent Developments

The Lithotripsy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Lithotripsy market are listed below:

- Olympus announced the launch of an innovative solution—Soltive SuperPulsed Laser System (Soltive Laser System). The product uses thulium fiber laser technology designed for stone lithotripsy and soft tissue applications. This new product is cleared by the US FDA and CE Mark and approved by the responsible European Notified Body. It is available in the US, Canada, Europe, and the Middle East & Africa. (Source: Olympus, Company Website, June 2020)

Lithotripsy Market Report Coverage and Deliverables

The “Lithotripsy Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Lithotripsy market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Lithotripsy market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Lithotripsy market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the lithotripsy market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the lithotripsy market in 2023?

What are the driving factors impacting the lithotripsy market?

What are the future trends of the lithotripsy market?

What would be the estimated value of the lithotripsy market by 2031?

What is the expected CAGR of the lithotripsy market?

Which are the leading players operating in the lithotripsy market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For